TAX BENEFIT ON INVESTMENT IN STARTUPS U/S 54GB

Page Contents

INCOME TAX BENEFIT ON INVESTMENT IN STARTUPS U/S 54GB

Section 54GB of the Income Tax Act exemptions on capital gains from the sale of residential property if the proceeds are invested in startup firm equity shares. This exemption was created to provide assistance to an individual or HUF that want to establish or start a business by selling a residential property.

- Said Income tax provisions under this section 54GB will not applicable to any transfer of residential property made after the 31st March, 22 as amended by Central Board of Direct Taxes

Note – If the amount is not used within one year of subscription, it will be charged as assesse (Individual/HUF) income in the preceding year in which the one-year period expires, and the firm will be allowed to remove the amount from the deposit plan.

- Within five years after the date of acquisition, the individual/HUF or the company, as the case may be, should not sell or otherwise transfer the company’s equity shares or any new asset acquired by the firm. If exempt capital gain is transferred within 5 years, it will be taxable in the PY of the transfer of equity shares or new assets in the hands of the assesse.

Note: A 3 restriction applies to computers and computer software acquired by qualifying start-ups.

- The terms of this section will not apply to any residential property transfers made after March 31, 2022, as amended by the CBDT.

CONDITIONS APPLICABLE FOR CLAIMING EXEMPTION UNDER SECTION 54GB

- It only applies to capital gains in the hands of individuals or Hindu undivided families (HUF)

- It must be a long-term capital gain on the sale of a primary residence (a house or a plot of land)

- The net consideration should be used for subscriptions in equity shares of an eligible firm before the due date for filing a return of income under section 139(1).

- Within one year of the date of subscription in the equity shares, the amount of subscription must be used by the qualified company to purchase a new asset.

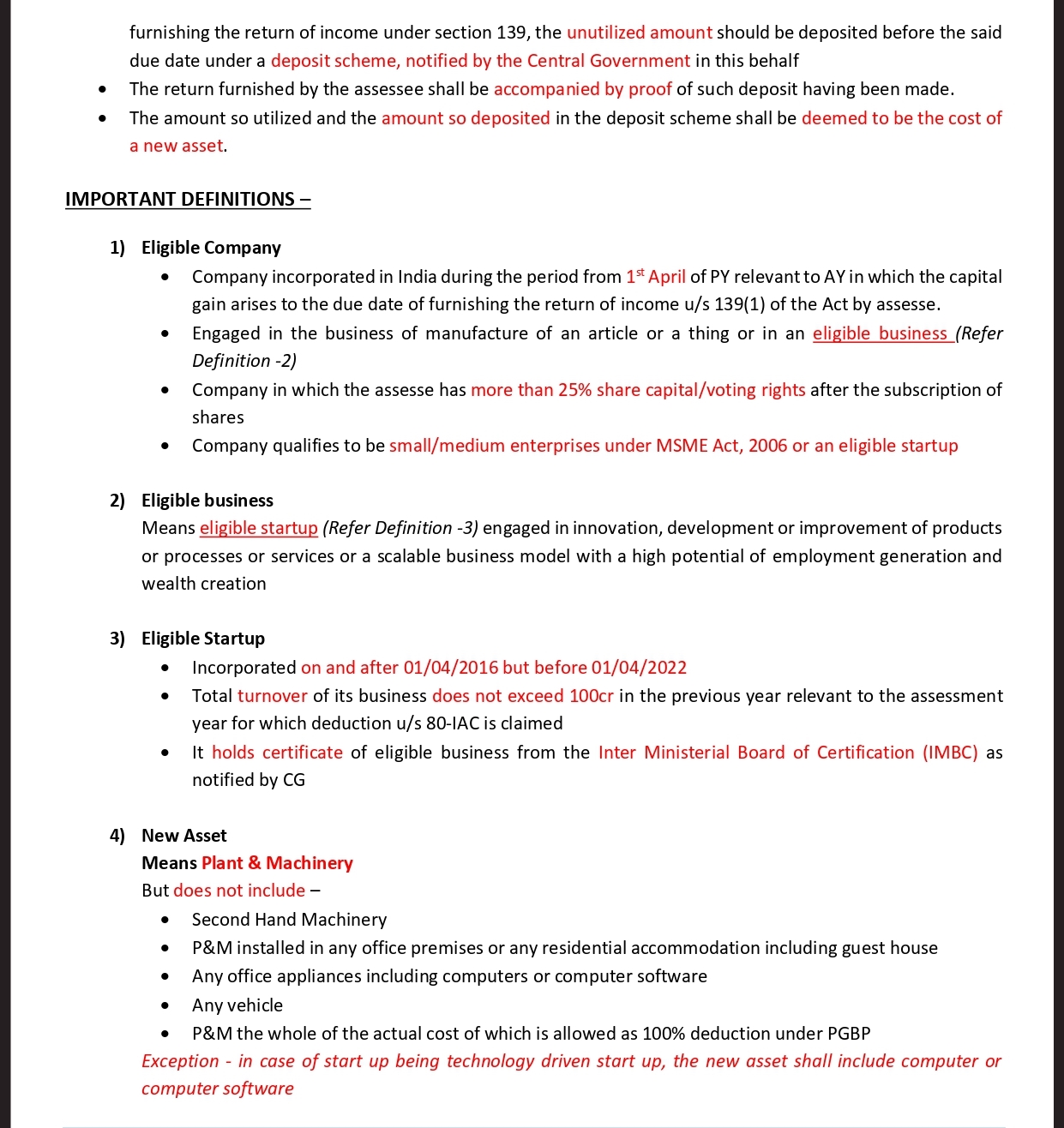

EXEMPTION AMOUNT UNDER SECTION 54GB OF THE INCOME TAX ACT

| Conditions of Claiming Exemption | EXEMPTION AMOUNT |

| If Net consideration > Cost of New Asset | Cost of new asset * Capital Gain/Net Consideration |

| If Net consideration <= Cost of New Asset | Capital Gain |