Revised MCA additional fee for delay filing go upto 18 time

Page Contents

Brief history:

The MCA had previously issue the Companies (Registration Offices and Fees) Rules. 2014 (“the Companies Rules, 2014”) by the Notification No. G.S.R. 268(E) dated 31, March 2014, in order to prescribe certain rules relating to fees & forms for registration under Companies Act, 2013.

New Notification on applicable revised fee:

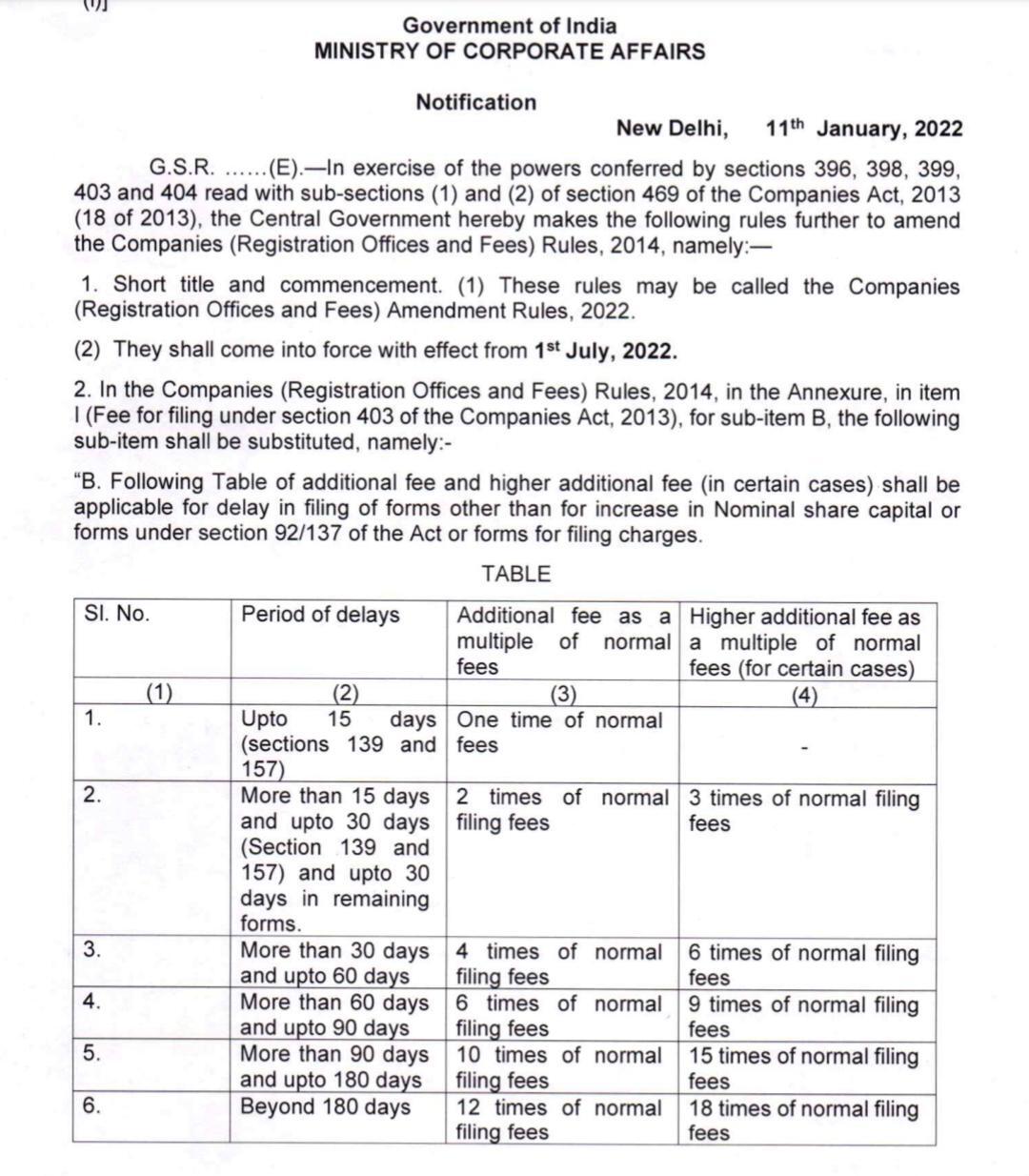

MCA revised additional fees for delay filings under notification of Companies (Registration Offices and Fees) Amendment Rules, 2022, now it will go upto 18 times (other than annual filings) w.e.f. 1st July 2022. this Amendment is made in Section 403 of the Companies Act, 2013.

- Additional fees on forms will be raised to 18 times the standard rates, up from the current 12 times. In addition, where a greater additional fee is due, no additional fee will be levied.

- If there is a delay in filing e-form INC-22 or e-form PAS-3 on two or more occasions within a period of 365 days from the date of filing the last such belated e-form for which an additional fee or higher additional fee was charged, higher additional fees will be payable.

- For late filing of forms other than for raises in nominal share capital, forms under Section 92 or Section 137 of the Companies Act, or forms for filing charges, an additional fee and a higher additional fee will be charged in the prescribed sequence:

| Serial Number. | delays Period | The Additional fee as a multiple of normal fees | New applicable Higher additional fee as a multiple of normal fees (for specified cases) |

| 1 | upto Fifteen days (section 139 and section 157 of the Companies Act) | 1 time | – |

| 2 | For applicable Sections 139 & 157 of the Companies Act fee if More than Fifteen days and thirty days and upto Similarly thirty days in remaining forms. | Two times of normal filing fees | Three times of applicable normal filing fees |

| 3 | More than thirty days and upto Sixty days | Four times of normal filing fees | Six times of applicable normal filing fees |

| 4 | More than Sixty days and upto Ninety days | Six times of normal filing fees | Nine times of applicable normal filing fees |

| 5 | More than Ninety days and upto One eighty days | Ten times of normal filing fees | Fifteen times of applicable normal filing fees |

| 6 | Beyond One eighty days | Twelve times of normal filing

fees |

Eighteen times of applicable normal filing fees |

Popular Articles :

- Re-Appointment & Rotation of statutory Auditors

- Form dir-5 for cancellation or surrender of din

- Relaxation provided by MCA on filling Forms

- All About Key Managerial Personnel under Co Act 2013

- Form no. Inc 22A