Process to add Additional Trade Name under same GST No

Page Contents

What is Process to add Additional Trade Name under same GST No?

- The Goods and Services Tax Network recently implemented a new feature that allows you to add a “Additional Trade Name” (not the same as the ordinary trade name) to the same Goods and Services Tax Number.

- Having various trade names under the same legal name or the same Goods and Services Tax Number will be advantageous to a company. The facility is open to both new and existing taxpayers. Existing taxpayers can apply for this functionality by filing an amendment application under the core field.

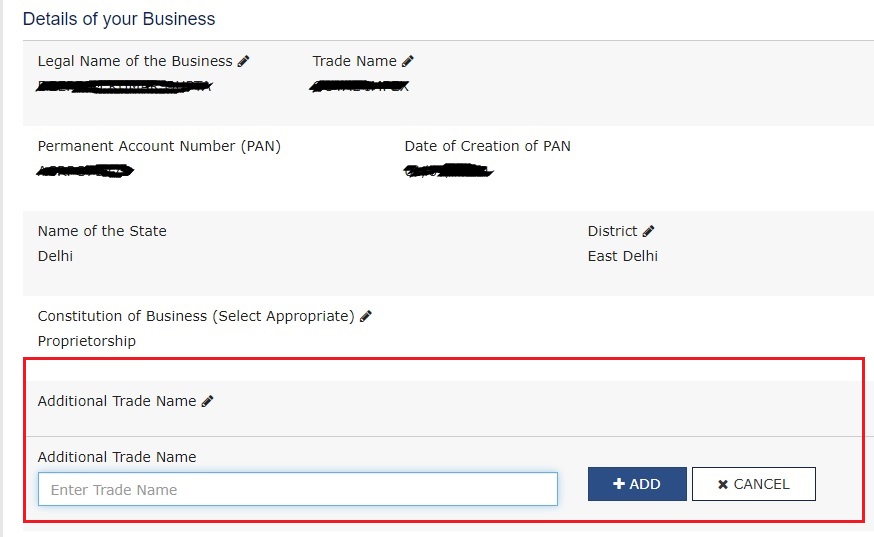

- We needed to Login to the Goods and Services Tax portal & select the option “Amendment of Registration Non – Core Fields” from the GST Registration tab.

GST Dashboard => Services => Registration => Amendment

But New taxpayers, can use this option when completing out a new registration form.

Can a new business with a different trade name can be add in Existing GST registration?

- YES, If a GST Taxpayer wants to operate 2 different businesses under the 2 different trade names in the same state, Then they may obtain more than 1 registration there with the same PAN.

- The possibility of obtaining a separate registration for a distinct business vertical within the same state or UT, however, this restriction was previously present and same has been eliminated via THE CENTRAL GOODS AND SERVICES TAX (Amendment) Act, 2018 with effect from 01 Feb 2019.

In Summary

- So, we can add more than one GST registration in same underline state or union territories for 2 or more different-2 places of business,

- it may be possible that these places of business are involved in various goods or services supplying.

Popular Articles: