Pre-Requisites for NBFC Registration

Page Contents

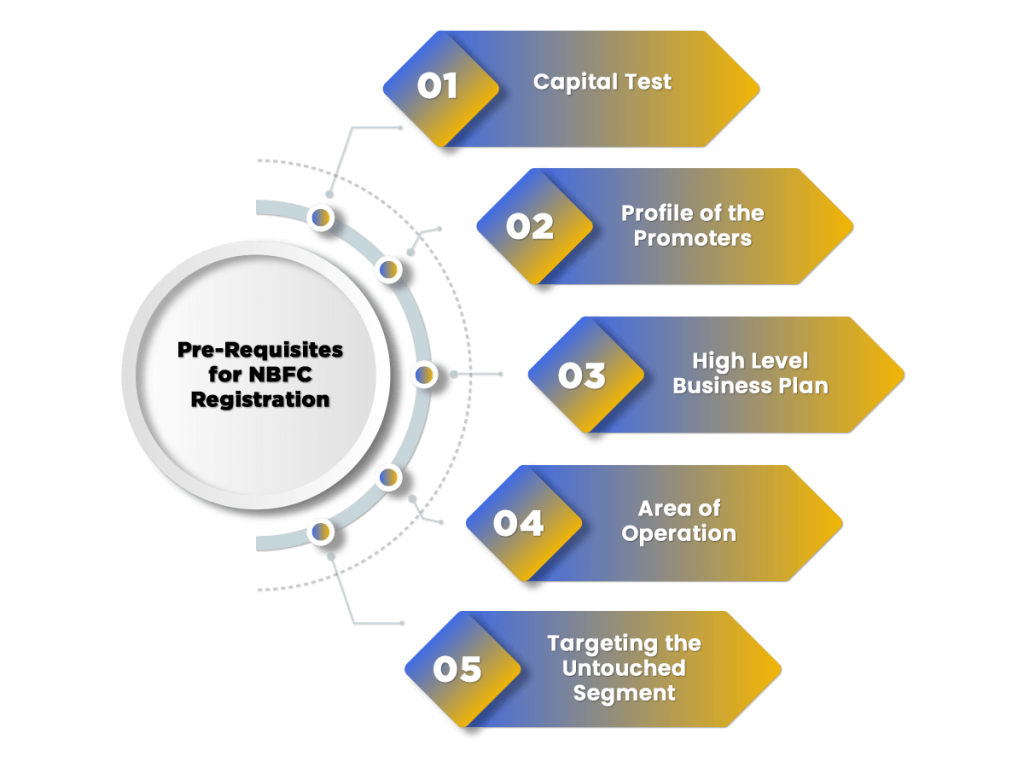

Pre-Requisites for NBFC Registration

Basic Pre-Requisites for NBFC registration are as below:

- Targeting the Untouched Segment

- High-Level Business Plan

- Capital Test

- Profile of the Promoters

- Area of Operation

Functions & Role of an NBFC

- The function and mechanisms of the NBFC in India can be summed up as:

- Developing sectors such as infrastructure, education and small and medium-sized enterprises;

- It facilitates the creation of wealth;

- To generate significant employment;

- Provide financial assistance to the economically weakest segment of society;

- In contributing to the economic growth of the nation;

- Make a contribution to the State Exchequer;

- This provides specialized credit;

- In case of lead to the growth of the financial market.

Focus areas of NBFC

NBFCs have expanded dramatically, as indicated by their structure of asset development over the past:

- Customized Loan Products: the needs of one customer are different from the needs of another customer and the funding requirements are as follows;

- Flexible interest rate: In line with banking channels, NBFCs are committed to serving competitive interest rates to customers;

- Quick disbursement of funds;

- Minimum documentation requirement;

- Going to serve the underprivileged section;

- An effective mechanism for recovery.

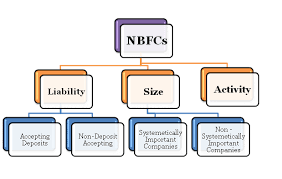

Different Categories of RBI NBFC Registration

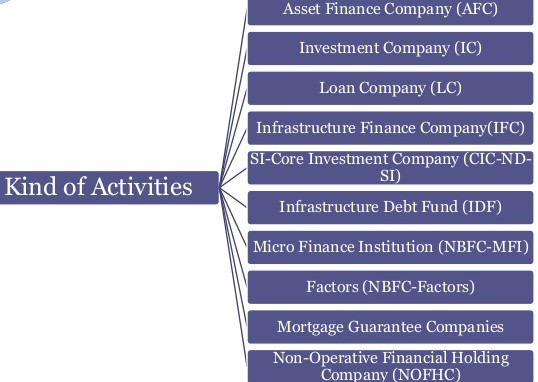

NBFCS NEED COMPULSORY REGISTRATION

- ASSET FINANCE COMPANY

- INVESTMENT COMPANY

- LOAN COMPANY

- INFRASTRUCTURE FINANCE COMPANY

- CORE INVESTMENT COMPANY

- INFRASTRUCTURE DEBT FUND NON-BANKING FINANCIAL COMPANY

- NON-BANKING FINANCIAL COMPANY – MICROFINANCE INSTITUTION

- MORTGAGE GUARANTEE COMPANIES

- NON–BANKING FINANCIAL COMPANY – FACTORS

- NBFC NON–OPERATING FINANCIAL HOLDING COMPANY ( NOFHC ).

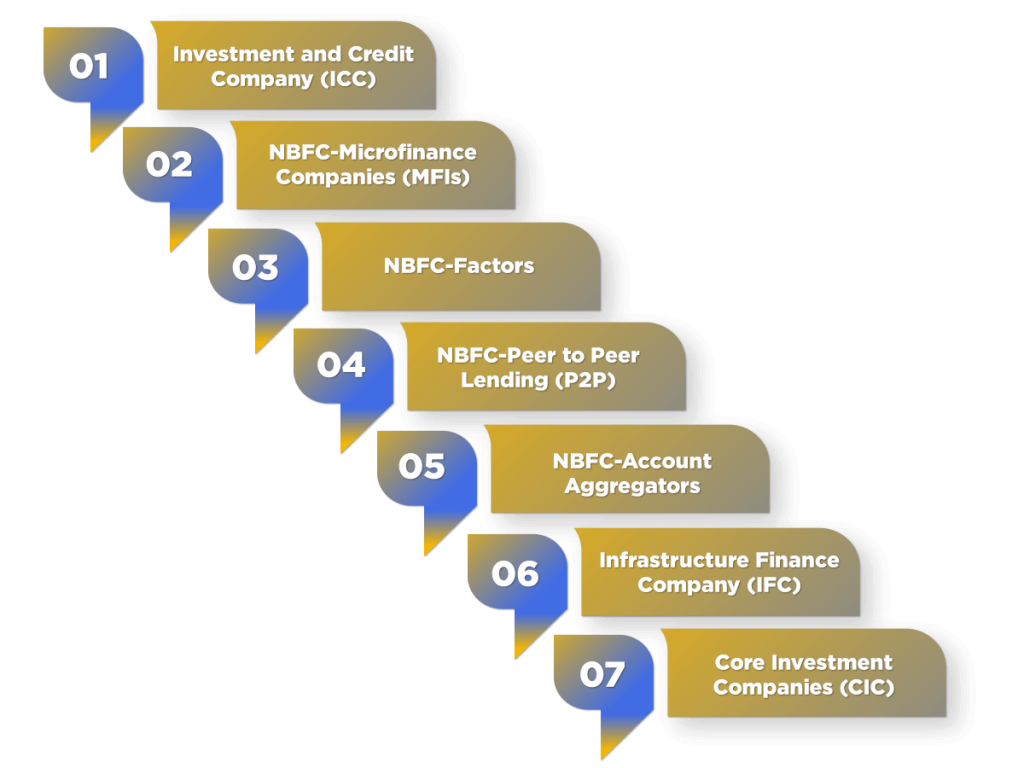

Various kind of RBI NBFC registration are as below:

- NBFC-Peer to Peer Lending (P2P)

- Core Investment Companies (CIC)

- NBFC-Account Aggregators

- Investment and Credit Company (ICC)

- NBFC-Microfinance Companies (MFIs)

- NBFC-Factors

- Infrastructure Finance Company (IFC)

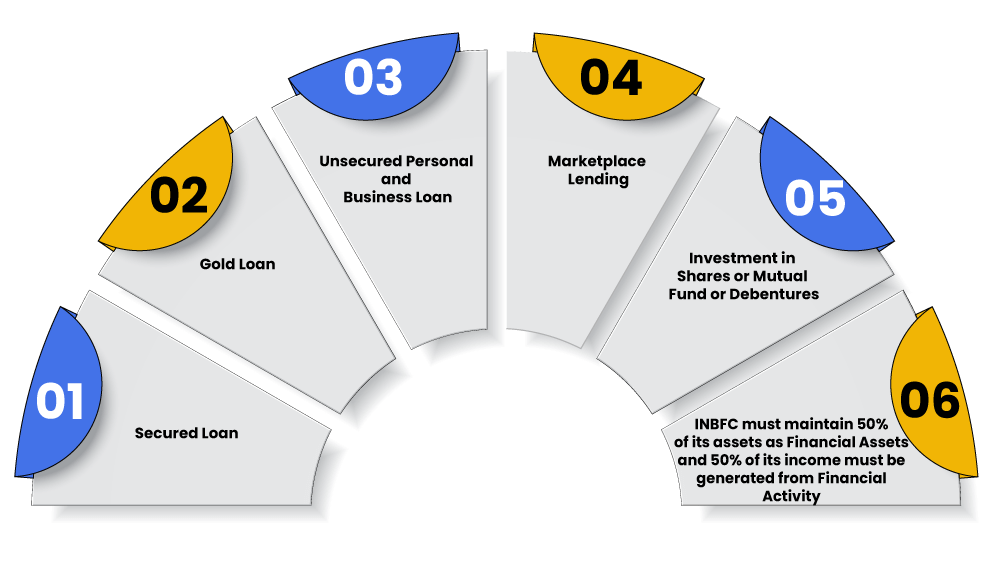

Basic Principal Business of an A Non-Banking Financial Company (NBFC) in India

- Marketplace Lending (Digital Lending );

- Gold Loan;

- NBFC must maintain 50% of its assets as Financial Assets and 50% of its income must be generated from Financial Activity.

- Investment in Shares or Mutual Fund or Debentures;

- Secured Loan (LAP);

- Unsecured Personal & Business Loan;

Powers of RBI to Non-Banking Financial Company(NBFCs):

The powers of the RBI to Non-Banking Financial Company in India, can be summed up as:

- Inspects and exercises surveillance over Non-Banking Financial Company’s to verify whether or not they comply with the terms of the RBI Act, 1935;

- It helps to regulate the registration process for Non-Banking Financial Companies;

- The sets out the directions for the police and issues Non-Banking Financial Companies;

- This penalizes Non-Banking Financial Company’s for violating rules of the RBI Act, which may also outcome in the cancellation or suspension of the Non-Banking Financial Company

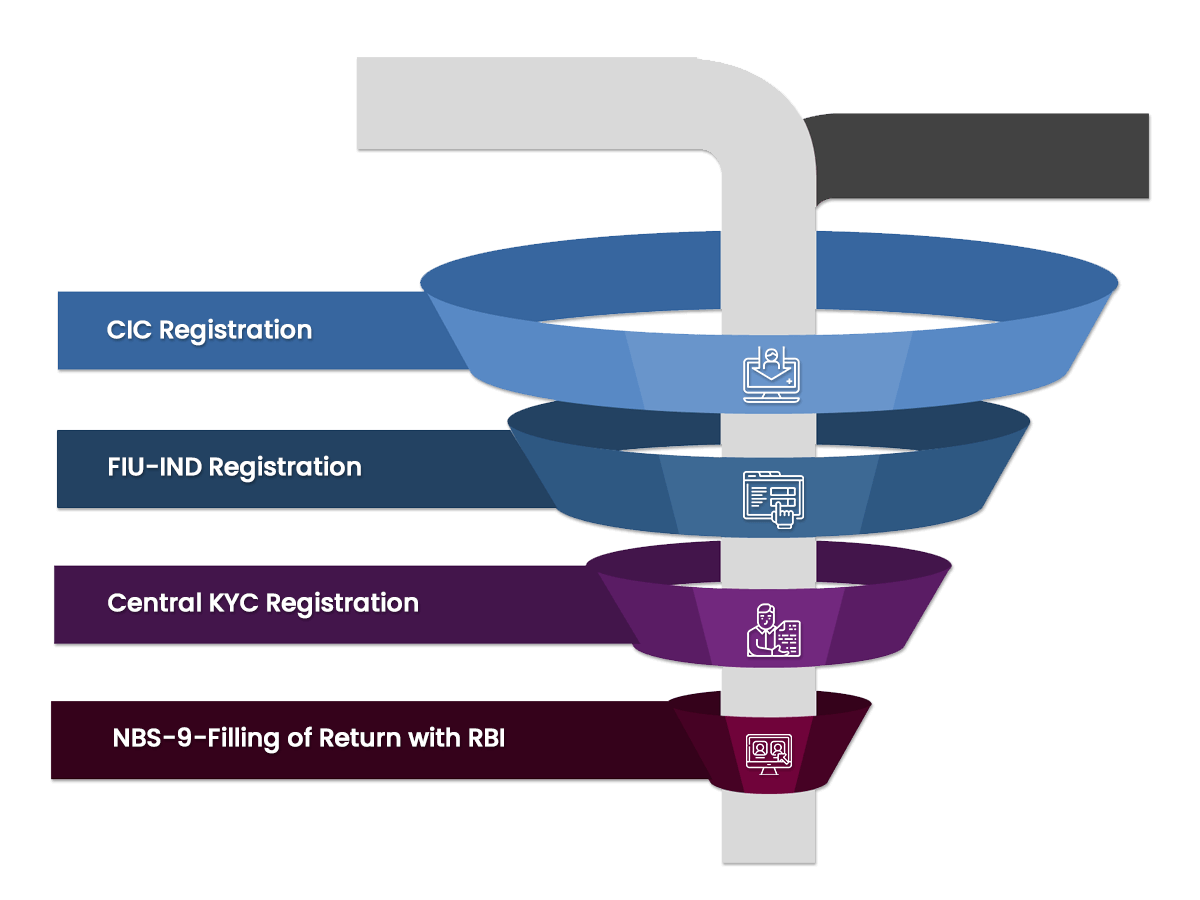

Compliances under Non-Banking Financial Company after RBI Approval:

After the one-time Non-Banking Financial Company Registrations, all the non-deposit accepting Non-Banking Financial Company’s shall be responsible for maintaining certain annual compliances as below:

- Income Tax Returns and GST Returns;

- Maintenance of proper accounts;

- All such compliances as may occur from time to time.

- Needed to Filing of NBS-9 on online RBI portal i.e. COSMOS;

- Timely compliance & meet, with maintaining 50:50 PBC Criteria

- ROC Filings such as Annual Returns, Balance Sheets, Profit and Loss Accounts, etc;

- Appointment of Statutory Auditor;

- Adopt Fair Practice code as prescribed the RBI and Also Adopt NBFC Prudential norms as prescribed the RBI.

Registration for an NBFC should be as per the guidelines prescribed by the auditor. For professional help and trained expertise, contact the professionals at www.carajput.com

COMPLIANCES OF NON-BANKING FINANCIAL COMPANIES:-

NBFC – ANNUAL COMPLAINTS

S. No. |

Particular of Compliance |

100 crore or more |

More than 50 crores less than 100 crore |

Less than 50 crore |

Due date |

| 1. |

Auditor certificate |

Applicable | Applicable | applicable | Within 30 days of the annual general meeting |

| 2. |

Net owned fund |

Applicable | Applicable | applicable | Within 30 days of the annual general meeting |

| 3. |

Asset/income pattern |

Applicable | Applicable | applicable | Within 30 days of the annual general meeting |

| 4. |

The balance sheet to RBI |

applicable | Applicable | applicable | Within 30 days of the annual general meeting |

NBFC – HALF-YEARLY COMPLIANCES:

S. No. |

Particular of Compliance |

100 crore or more |

More than 50 crores less than 100 crore |

Less than 50 crore |

Due date |

| 1. |

ALM – 2 |

applicable | Not applicable | Not applicable | 20th April 20th October |

| 2. |

ALM – 3 |

applicable | Not applicable | Not applicable | 20th April 20th October |

| 3. |

NBFC – FDI certificate |

applicable | applicable | applicable | Within 30 days of the annual general meeting |

NBFC – QUARTERLY COMPLIANCES:

S. No. |

Particular of Compliance |

100 crore or more |

More than 50 crores less than 100 crore |

Less than 50 crore |

Due date |

| 1. |

NBS – 7 |

applicable | Not applicable | Not applicable | 15th April

15th July 15th October 15th January |

| 2. |

Special quarterly returns |

Not applicable | applicable | Not applicable | 15th April

15th July 15th October 15th January |

| 3. |

NBFC having FDI quarterly |

applicable | applicable | Applicable | 15th April

15th July 15th October 15th January |

NBFC – MONTHLY COMPLIANCE:

S. No. |

Particular of Compliance |

100 crore or more |

More than 50 crores less than 100 crore |

Less than 50 crore |

Due date |

| 1. |

ALM – 1 |

applicable | Not applicable | Not applicable | 10th day of the next month |

| 2. |

100 crore NBFC – ND – SI |

applicable | Not applicable | Not applicable | 7th day of the next month |

RBI UPDATES:-

- RBI on Thursday directed credit information companies (CIC) to provide free credit reports in full to individuals whose credit score is maintained with the agency, effective January 1.

- This came up with a discussion paper on peer-to-peer lending (P2P), seeking to regulate the fast-emerging crowdfunding platforms as the new financing model has assumed importance too significant to be ignored.

- All peer-to-peer lending (P2P) platforms will be regulated by the Reserve Bank of India (RBI), according to a government of India notification released on Wednesday.

- The gazette notification stated that all the P2P loan platforms will be treated as non-banking financial companies (NBFCs) and will be brought under the ambit of the banking regulator..

FAQ ON COMPLIANCES OF NON- BANKING FINANCIAL COMPANIES :

Q1- what is the limit of nonbanking financial companies’ net worth to start a business?

Ans- to start a business the limit of nonbanking financial companies’ net worth is Rs. 2 Cr.

Q2- to whom NFBC need to report the complaints of NFBC?

Ans.- NBFC needs to report to RBI the compliances.

Q3-is all the NBFC need registration to commence a business?

Ans.- no, certain companies do not need to get registered.

Our NBFC Registration Package

Package includes: –

- Setting up Company for NBFC registration purpose.

- Top/ High-level NBFC Business Plan

- Application preparation & Review

- Reviewable of Application for CoR by Expert

- Incudes Advisory about Latest FinTech Models

- End to end Support & response of RBI Query

- Legal Consultancy for Securing Approval From authority.

We look forward to your valuable comment www.carajput.com,