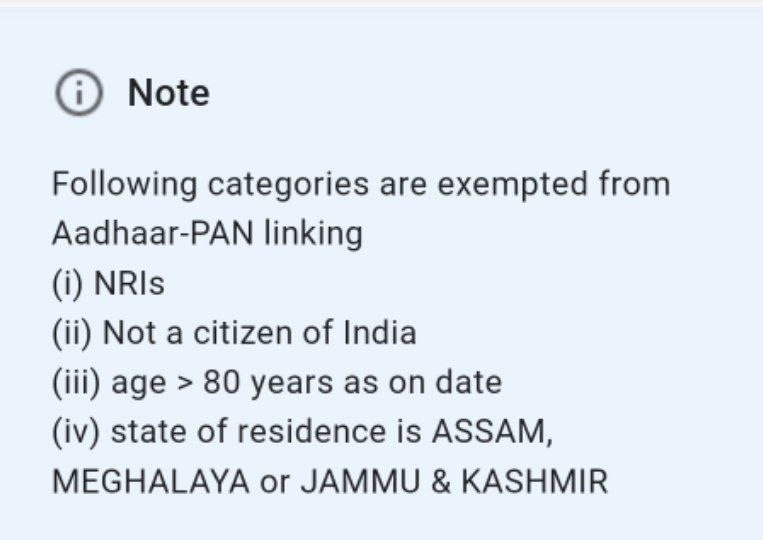

PERSON NOT REQUIRE TO LINK AADHAR – PAN CARD

Page Contents

PERSON NOT REQUIRE TO LINK AADHAR – PAN CARD

General terms of Aadhar card

- It is a 12-digit unique number issued to citizens of India by the Unique Identification Authority of India (UIDAI) after finishing an individual’s verification process.

- Regardless of age and gender, anyone who wants to obtain a uniform identification across the country can apply for it.

- Individuals can only enroll once to maintain the uniqueness of the Aadhaar card.

- Demographic Information: Name, DOB, Gender, Address, Email ID, Contact Number, etc.

- Biometric Information: Fingerprints, Two Iris Scans, and Facial Photograph.

-

- A aadhaar card prevents the use of duplicate & false identities and is used as an essential identifier.

- Aadhaar card has the power to modify the Indian service distribution system. For example, it will make the government’s social security programmers for the poor, more crystalline and thus reduce the pressure on them due to a reduction in identity duplicity.

Characteristics of Aadhar card

- Singularity: As it is focused on demographic & biometric authentication it is unique in itself for each individual.

- Flexibility: It offers the national portability facility as it can be validated electronically and individually.

- Scalable Infrastructure Architecture: A centralized data management system is given, and authentication from anywhere in the nation can be performed electronically.

- Singular number: It is a random number dependent on the demographics, along with an individual’s biometric attributes. It does not even monitor an individual’s class, culture, earnings, etc.

- Offline Confirmation: Offline Confirmation process will be as regulations stated by UIDAI.

- Penalty: UIDAI can impose penalties against a person for failure to (i) comply with the rules/regulations in the act or UIDAI guidance (ii) provide the necessary details. Penalties can be as large as 1 crore.

Perks of Aadhar Card

- For Government: There are many social security programs in place that concentrate on the socially deprived classes / vulnerable communities to raise them. Through using the Aadhaar card as a tool to recognize these individuals, the service delivery system will definitely be improved and the pressure on the exchequer will also be minimized.

- For Individuals: In offline/online mode, provides a common source of identity verification across the country. If a person has an aadhaar card they can use it several times to check their identity.

Basic Requirement for Aadhar card

- Indian resident

- Children under the age of 5 years- Baal aadhaar card

- NRI /Foreigners remain in India for more than 12 years

Essential Document for Enrolment of Aadhar card

List of Identity and Address Proof;

- Driving Licenses

- Voter ID Card

- Passport

- Ration Card

- Insurance Policy

- Account Statement of Bank/ Passbook

- Statement of Credit Card (not more then 3 month)

- Account Statement of Post Office /Passbook

- Electricity bill (not more then 3 months)

- Water bill (not more then 3 months)

- Telephone Bill (not more then 3 months)

- photo ID card/ Service ID card Issued by PSU

- Property Tax Receipt (not more than 1 year)

Process of Enrolment for Aadhar Card

- Enrollment is free of charge.

- Aadhaar Card Enrolment Centre: Visit with your identification & address proof to your nearest approved Aadhaar Enrolment Centre.

- Supporting documents for proof of address & identity are specified above

- If you do not have either of the above photo ID evidence then a Photo Identification certificate issued by a gazetted official would be valid as POI / POA.

- If someone does not have a validated document, if his / her name appears in the family eligibility list, he/she will still enroll for Aadhar.

- Even if no records are available for the same reason, the resident may take advantage of introducers at the aadhaar card enrollment center.

There are 3 Ways for Aadhaar Card enrolment:

- Depending upon the head of the family: Relationship proof (POR) must be formed by documentation with the family members.

- Document Depending upon: Submit correct Identity Proof (POI) & Address Proof (POA);

- Depending upon Introducers: An Introducer is an approved person with a valid Aadhaar number appointed by the registrar.

UIDAI or Office of the Registrar General of India (RGI) makes registration in all states / UT.

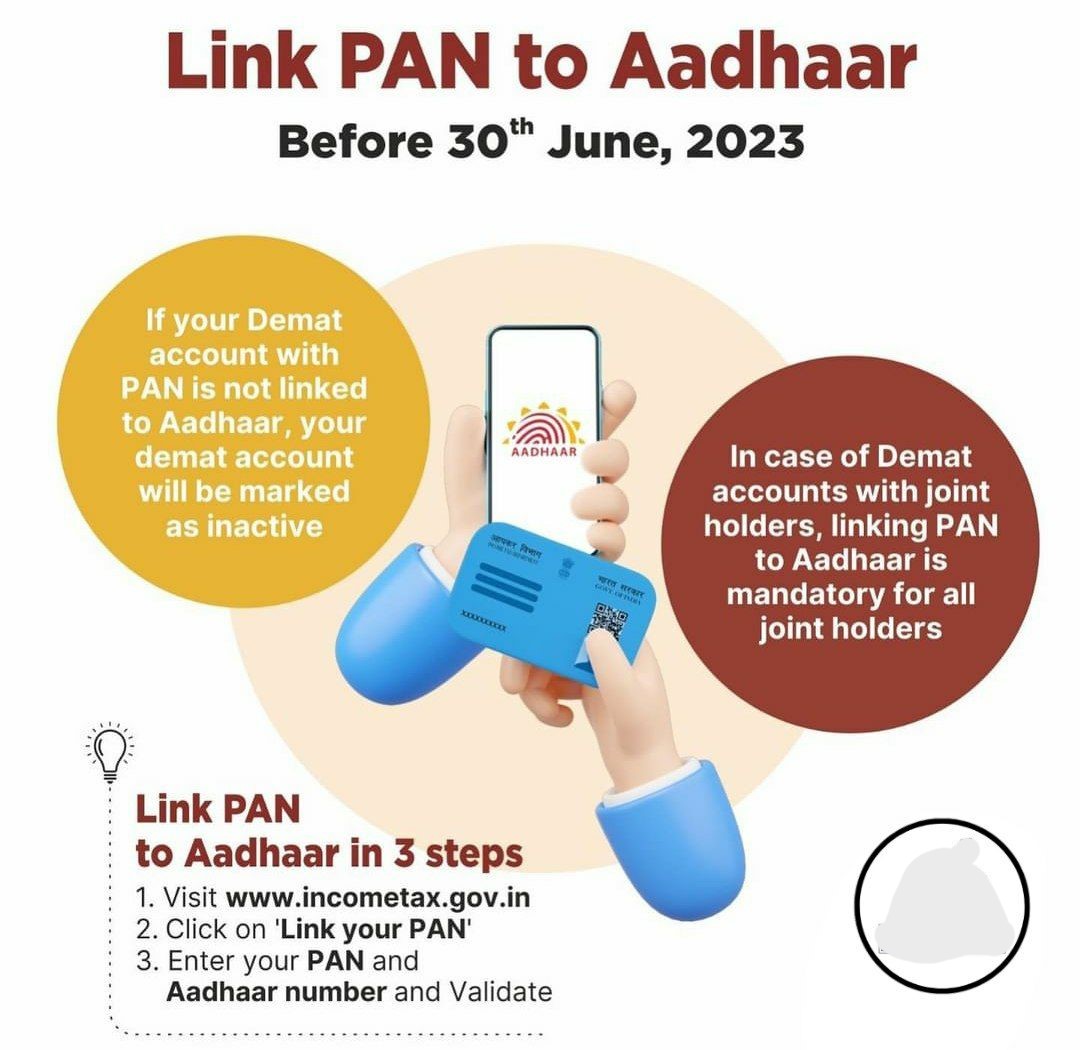

What are the Consequences of not linking Aadhar Card with Permanent Account Number ?

For all those who come under under Income tax, & failing to link their Permanent Account Number & Aadhar Card has following negative effects, including:

- The Income tax Taxpayer will only be able to make Permanent Account Number operative after linking with the Aadhar & paying a penalty or fee of up to INR 1k. (According to Income tax U/s 2734H)

- Income tax Taxpayers will not be able to file their Income tax returns; Penalty of up to INR 10,000/- u/s 234F : (According to Income tax u/s 234A, 234B, 234C)

- It is Compulsory to provide Permanent Account Number for specific financial transactions as per sec 139A. If Permanent Account Number is not linked, it will become invalid or inoperative & this will may result in non-compliance as per Sec 139A that may attract a penalty up to INR 10k. (According to Income tax under Section 272B):

- Tax Collected at Source would be collected at a higher rate (According to Income tax under section 206CC) : : Income tax under section

- Tax Deduction at Source will be deducted at a higher rate (According to Income tax under section 206AA)

Update on permanent account number linked with Aadhar :

- Before deducting Tax Deducted at Source, ensure that the person whose Tax Deducted at Source you are deducting has got his/her permanent account number linked with Aadhar by virtue of change to Rule 114 AAA w.e.f. April 1st, 2023. If permanent account number is not linked with Aadhar, deduct Tax Deducted at Source at higher rate as per section 206AA read with Rule 114AAA(3)(iii) which could be @ 20 percentage & Tax collection at source under section 206CC read with Rule 114AAA(3)(iv).

- The Income Tax dept has started creating income tax demand for the difference. To check the status of permanent account number linked with Aadhar, you may Login to TRACES at https://www.tdscpc.gov.in/app/login.xhtml and navigate to Dashboard to locate permanent account number Verification” in the Quick Links menu.