OVERVIEW OF EQUALISATION LEVY/GOOGLE TAX

Page Contents

Equalisation Levy -Relevance & Background

Information Technology has undergone an increasing growth phase in India and internationally in the last decade. This has resulted in an increase in the supply and purchasing of online services. As a result, this has given rise to a number of business models, where there is a heavy dependence on online and telecommunications networks.

Over the last decade, Information Technology has gone through an expansion phase in India and globally. Consequently, this has given rise to various new business models, where there is a heavy reliance on digital and telecommunication networks.

As a result, the new business models have come with a set of new tax challenges in terms of nexus, characterization, and valuation of data and user contribution. The combination of the inadequacy of physical presence based nexus rules in the existing tax treaties and the possibility of taxing such payments as royalty or fee for technical services creates a fertile ground for tax disputes.

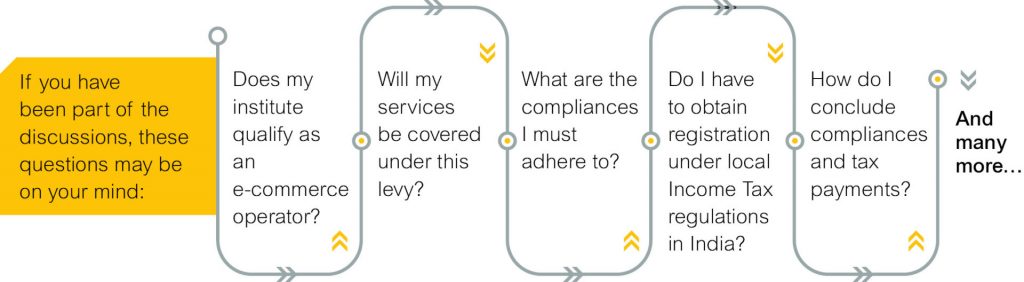

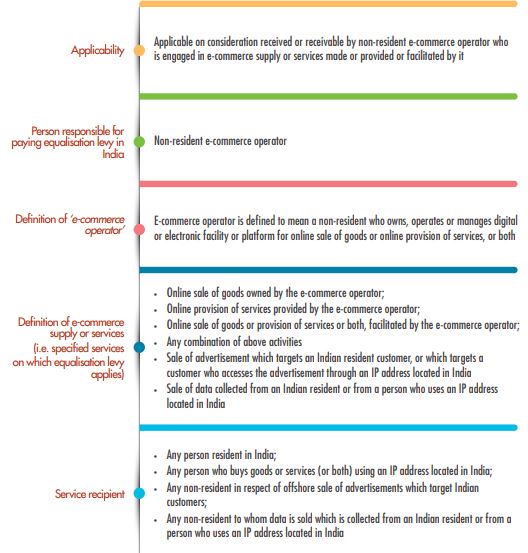

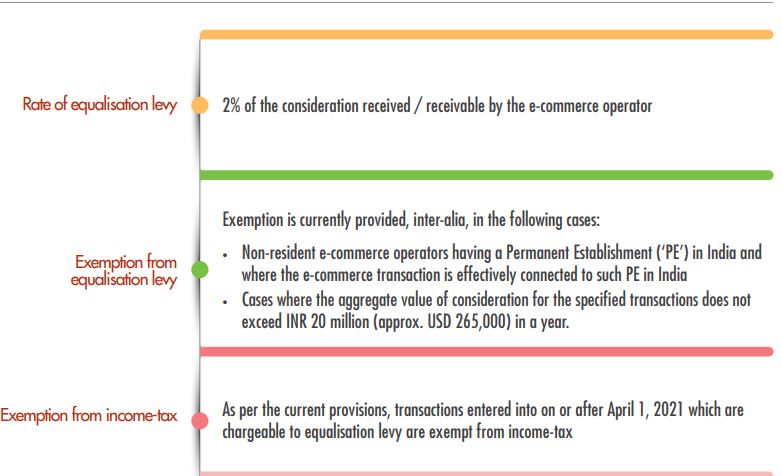

A new chapter (viii) titled ‘Equalisation levy’ is inserted in the finance bill which will take effect from 1st of June 2016 to provide for an equalisation levy of 6%/2% of the amount of consideration for specified services received or receivable by a non-resident not having a permanent establishment (‘PE’) in India, from a resident in India who carries out business or profession, or from a non-resident having a permanent establishment in India.

With the introduction of the equalisation levy, the Govt. has been indirectly able to tax the global advertising companies and has set the more services may be added in the list of specified services in the future.

New business models have come up with a set of proposed tax challenges in terms of nexus, data characterization & valuation, and customer contribution. The combination of the inadequacy of physical presence depending on the nexus rules in current tax bilateral agreements and the likelihood of taxing such payments as royalties or fees for technical services provides a collaborative ground for tax disputes.

To make more clarification, the Govt will introduce through the Budget 2016 equalisation levy to give effect to one of the guidance of the BEPS (Base Erosion and Profit Shifting) Action Plan.

More read for related blogs: Legal Compliance Audit service in India

Reason for Introduction of Equalization Levy: –

Many companies who are providing services in the whole world register themselves in a country wherein the Tax rates are very low and pay very low taxes on their global income.

Like in India revenue of Google in FY 2014-15 was 4,108 Crores, hence the introduction of Equalisation levy would help the Government to collect a lot of money which till now was not Taxed that’s why many people are calling Equalisation levy as Google Tax. Because a major share of online ads spent goes to Google.

The Salient Features of Equalisation Levy are as Under: –

- It is to tax the e-commerce transaction/digital business which is conducted without regard to national boundaries.

- The equalization levy would be 6% of the amount of consideration for specified services received or receivable by a non-resident not having the permanent establishment (‘PE’) in India, from a resident in India who carries out business or profession, or from a non-resident having the permanent establishment in India.

- Specified services mean online advertisement, any provision for digital advertising space or any other facility or service for the purpose of online advertisement and includes any other service as may be notified by the Central Government.

Equalization Levy Applicability in India

Equalization Levy is an Indian direct tax retained at the time of payment by the beneficiary of the service. The two parameters to be met are subject to an equalisation levy:

- When payment shall be made to a non-resident service provider;

- When annual payment made to service provider more than INR 12 Cr in one FY. No levy if the aggregate amount of consideration does not exceed Rs.2 Cr in any previous year.

Services covered under equalisation levy

Equalization tax returns are applicable if online sales of goods or services have been made available; Resident of India

- In addition, under certain conditions, a non-resident

- In addition, an equalisation levy on online advertising is feasible if it is directed at Indian consumers or if anyone consumes an ad via an IP address in India.

- In addition, an equalisation fee return is required if data is sold and the data is of an Indian resident or collected from someone whose IP address is in India.

- Every other individual who buys e-commerce services or goods via an Indian IP address.

At present, not all services are covered by an equalisation levy. The following activities were covered under equalisation levy:

- Online advertising;

- Any requirement for digital advertising space or facilities/services for the purposes of online advertising;

- And furthermore, when all other service providers are notified, they will be included in the aforementioned services.

Equalization Tax Returns are not needed- Equalization Levy will not be Charged:

- If the Equalization Levy is referred to in Section 165.- If service provider being a non-resident having Permanent Establishment in India.

- Service provider is a resident in India.

- Furthermore, if the e-commerce operator owns a permanent venture in India & the sale of Services & Goods is linked to this enterprise.

- In contrast, if the Annual turnover of e-commerce sales of any kind falls below Rs 2 Cr.

Applicability and Manner of Deduction of Equalization Levy: Tax Rate Applicable on Equalisation Levy

Presently, the tax rate in force is 6% of the gross amount to be paid. This levy of equalization would be in the same manner as TDS, like the person making the payment for advertisement will require to deduct Equalization levy @ 6% on the total amount of consideration and deposit the same to the account of Central Govt.

In case of failure to do so, these expenditures will not be allowed to claim for Income Tax Purpose.

What is the process of deposit the Equalization levy?

- Each e-commerce operator must prepare & present a financial statement to the Assessing Officer involved before the deadline.

- In addition, the declaration must contain information on the nature and details of all e-commerce goods, services and services sold.

- When such a financial statement has been obtained, the Board or Authority shall measure the cost of the equalisation levy needed.

- Once all the corrections and verifications have been formed, the organisation will give a copy of the total amount to the e-commerce operator.

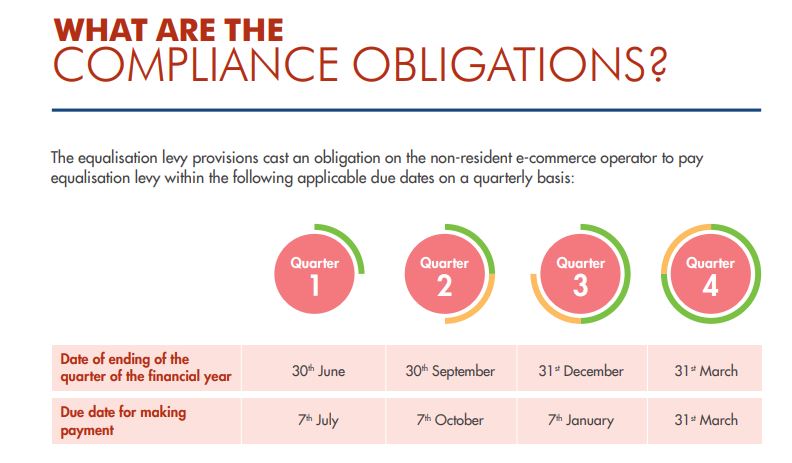

Due Compliance Dates- Due Date of Depositing Equalization Levy

Due Date of Furnishing Equalization Levy Statement (Form-1)

Due Date of Furnishing Equalization levy Statement is on or before 30th June of Financial Year ended. (after the end of Financial Year Assesse has to submit Form-1 on or before 30th June or within the prescribed time as the case may be.). Due Date of depositing Equalization levy to the account of Central Govt by the 7th day of the Month immediately following the said calendar Month.

This is the annual return/statement has deadline date of Equalization Levy Statement (Form-1) is due on or before end of 30 June of the FY. In order to comply with the compliance with laws referred to in Equalization Levy Section 165A, a levy payment has to be made within the time limits explicitly mentioned.

| Sl No | Period of Compliance | Deadline Date for Equalisation Levy Payment |

| 1 | April – June | 7th July |

| 2 | July – September | 7th October |

| 3 | October – December | 7th January |

| 4 | January – March | 31st March |

| 5 | Annual Statement | 30th June |

For Example

- Let us presume from the above example that Rohan made the payment on 15 February 2019.

- The Equalization Levy shall be deposited with the income tax authorities by 7 March 2019 and the declaration (i.e. Form-1) shall be filed on or before 30 June 2019.

The revision or Late Submission of Form-1

If assesse failed to furnish the statement within time or had furnished wrong and now want to revise the same he can upload belated return or revise return at any time before the expiry of two years from the end of the financial year in which specified services were provided.

You can also read : Income tax Chart 2020 with covering latest Covid Relaxations & Alternative Tax Regime

Impact & Consequences of Delayed Payments on Equalization levy

| in the below Situation | Penalty (in addition to paying equalisation levy and interest) |

| Failure to deduct equalisation levy (wholly or partly) | A penalty equal to the amount of equalisation levy |

| Failure to deposit with the government | Rs. 1000 for each day of default (not to exceed the amount of equalisation levy) |

| Failure to furnish a statement | Rs. 100 for each day of default |

Interest on Default: –

If the amount of levy is not deposited within a specified time, then the assessee shall have to pay 1% Interest on such levy for every month or part of the month by which such credit of the Tax or any part of Tax delayed.

Failed to deduct levy: –

the penalty amount will be equal to the amount of Equalization levy that Assessee failed to deduct.

Levy has been deducted but not deposited then the Penalty amount will be Rs. 1,000 per Day till default continues but the total of a penalty shall not exceed the amount of equalisation levy.

Penalty for Default in Furnishing Statement: –

If Assessee failed to furnish the Equalization levy statement within the prescribed time, he has to pay a penalty of Rs. 100 Per day till the default continues

Prosecutor’s Office

If a false statement has been filed, a person may be subject to a term of imprisonment of up to three years & fine.

Also read our blog : CBDT Extend the Due date of Income tax E filling form Due dates