Guide on How to file ITR on the Income Tax Portal

Page Contents

How to file an Income tax return:

- The tax return is a form filed to report the taxpayer’s yearly income. In the absence of income, there may be various reasons for filing the income tax return.

- A taxpayer may wish to file his or her income tax return for the reporting of his or her income for the financial year, to bear losses, to claim income tax refunds, to claim tax deductions, etc.

- The income tax return is a form that enables a taxpayer to report income, expenses, tax deductions, investments, taxes, etc. under Income Tax Act, 1961,

- it is Compulsory for a taxpayer to file an ITR under different scenarios.

- The Tax Department shall provide an electronic filing (e-filing) facility for the income tax return.

- Until discussing the steps involved in the e-filing of the ITR, it is crucial for the taxpayer to keep the computation and reporting documents in the income tax return.

-

Computation of taxable income and tax therein?

-

- The assesses will be needed to calculate his/her income in accordance with the provisions of the income tax law applicable to him/her. The calculation should take into account income from all sources, such as salary, freelance and interest income.

- A taxpayer may claim deductions such as tax-saving investment under section 80C and so on. The taxpayer also should take into account the credit for TDS, TCS or any advance tax paid by them.

-

TDS Certificates and along with Form 26AS

-

- The taxpayer must table his TDS amount on the TDS certificates received by him for all four quarters of the financial year. Form 26AS helps the taxpayer with the TDS brief and the tax paid during the financial year.

-

Just choose a valid income tax form

-

- The taxpayer must determine the income tax form/ITR form applicable to the filing of his income tax return.

- Once the income tax form has been determined, the taxpayer can proceed with the filing of the income tax return.

- There are 2 modes available for filing—online and offline.

- The online mode from the taxpayer’s login is only available for ITR 1 and ITR 4; it is not available for forms of other categories of individual taxpayers.

- Offline mode (generating and uploading XML) is available for all types of income tax forms.

-

Required to Download Income tax return utility from Govt Income Tax Website

-

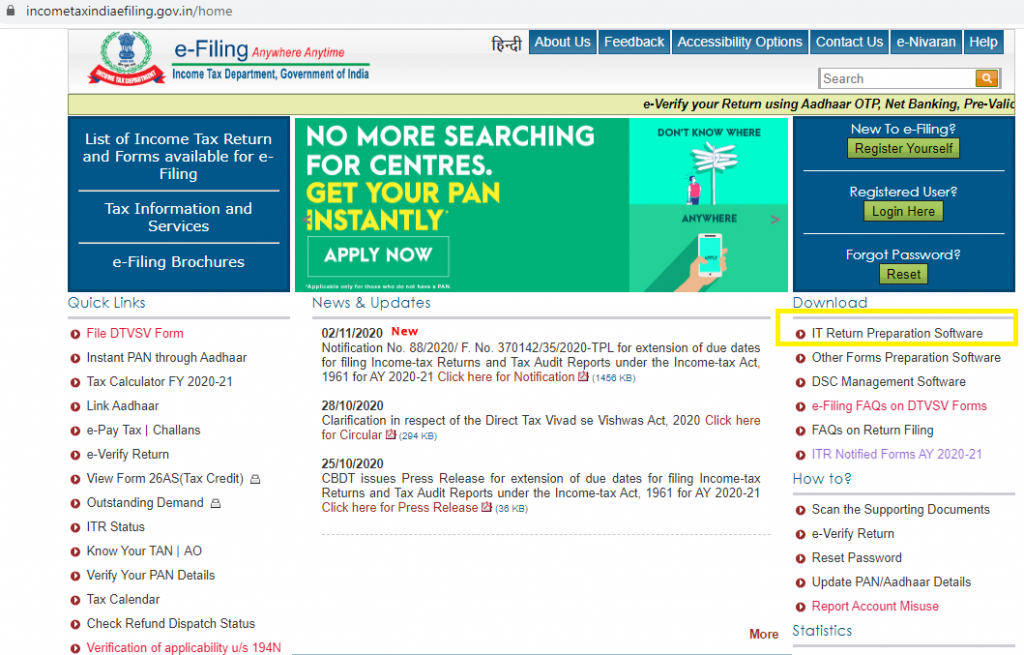

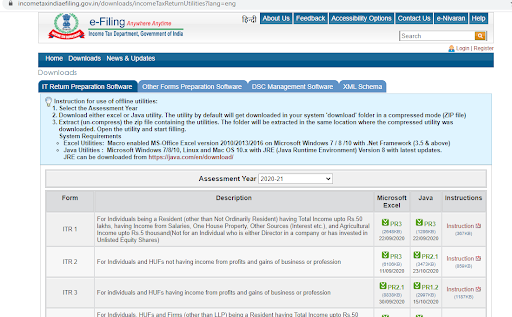

- Needed to Visit the website www.incometaxindiaefiling.gov.in and click the ‘IT Return Preparation Software’ choice on the right menu.

- Option the AY & download the offline utility software, i.e. MS office Excel or Java utility based on your preference.

-

Fill in the Downloaded File for your information

-

- Upon downloading the offline utility, please fill in the relevant details of your income and check the tax payable or refund receivable as per the utility calculations.

- Details of the income tax challenges can be found in the downloaded form.

-

Validate the information you entered

-

- You can see a few buttons on the right side of the downloaded form. Click the ‘Validate’ button to ensure that all necessary information is filled in.

-

Transform the file to an XML format file

-

- Upon successful validation, click the ‘Generate XML’ button on the right side of the file to convert the file to an XML file format.

-

Upload the XML file to the Taxation Portal.

-

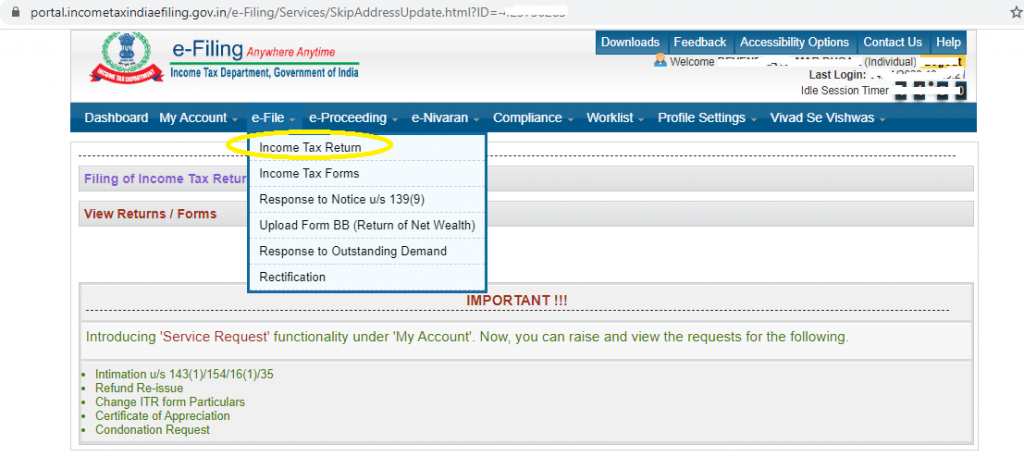

- Just log in to the income tax e-filing platform and click the ‘e-file’ tab to select the ‘Income Tax Return’ choice.

- Also provide the required information, such as PAN, assessment year, ITR form number, and mode of submission. Remember to choose

- the option ‘Upload XML’ from the drop-down corresponding to the field name ‘Submission Mode’ as shown in the picture below.

- Presently, attach the XML file to your computer and click the ‘Submit’ button. Get one of the obtainable verification modes—Aadhaar OTP, electronic verification code (EVC), or send a manual process signed copy of ITR-V to CPC, Bengaluru.

BE AWARE OF SEC-234F (FEES) OF ITR

- Under this section, the fee (penalty) is levied if the Income-tax return is not filed within the due date. It is likely to be increased from 1st April 2018 onward as per Section 234F of the Income Tax Act.

- Provisions of Section 234F of the Income Tax Act are as follows.

Section 234F:

- New penalty for late filing of Income Tax Return under section 234F is introduced in Budget 2017. This penalty is applicable for the assessment year commencing from 1st Day of April 2018.

- If a person who is compulsorily required to file Income Tax Return (ITR) under section 139, doesn’t file a return on time then he is liable to a penalty as follows

| Total Income | Return filed | Fee (Penalty) |

| Exceeds Rs. 5 Lakh | On or before 31st December of Assessment Year but after due date | Rs. 5,000/- |

| In any other case | Rs. 10,000/- | |

| Upto Rs. 5 Lakh | After due date | Rs. 1,000/- |

Let us discuss the above provision below:-

AMOUNT OF PENALTY

For a person with a Total Income of more than Rs. 5,00,000. The penalty amount would be as follows:-

-

- If ITR is filed on or before 31st December following the last date – Rs. 5,000

- In case ITR is filed after 31st December – Rs. 10,000

For a person with a Total Income of up to Rs. 5,00,000 – Rs. 1,000

Before 1st April 2018 – The penalty for Late Filing would be as follows-

- Up to FY 2016-17, taxpayers who do not file their income tax returns in the stipulated time period are liable to a fine (penalty) of Rs. 5,000.

- Further noted that liability to pay the penalty of Rs.5,000 is arises when an Income Tax Officer issues a notice for a late filing of income tax return.

- It is worthwhile to note that the penalty for late filing of income tax return is based on the conclusion of the assessing officer.

If you required any Assistance in Tax return E-filing? RJA is here to help

You can Need an expert to Compute your tax & your e-file your Income-tax return on your behalf

| Details required for Your Tax filling | In the case of Salary Income | Income from House property / Multiple form-16 | Income from Capital gains income | A resident with Global income/NRI |

| One form 16 | ||||

| Donation Given | ||||

| In case various Form 16 ( Same FY) | ||||

| Income from House Property | ||||

| Details of PF Withdrawal | ||||

| If any Income Save A/c, Dividends, Exempt interest | ||||

| Details of any NRE A/c, NRO A/c | ||||

| Interest Received from Fixed Assets | ||||

| Brought Forward Losses | ||||

| Income from Capital Gain | ||||

| Income from Foreign Income received | ||||

| Lottery/Gaming Income |

Also read Prevent popular errors while filing an income tax return

For query or help, contact: singh@carajput.com or call at 9555-555-480