Non-residents can submit e-file Form 10F without PAN

Page Contents

Non-residents may electronically submit Income Tax Form 10F without needing a Permanent Account Number if they are not required to have one.

- The CBDT required electronic filing of Form 10F in a notification dated July 16, 2022. From October 1st, 2023, non-residents who did not have a permanent account number or were exempt from having one were required to submit Form 10F electronically. Permanent Account Number was necessary for non-residents to register on the Income Tax Portal in order to submit Income Tax Form 10F electronically, as this registration was not possible without it.

- The Central Board of Direct Taxes has made it possible to file Income Tax Form 10F without obtaining a Permanent Account Number in order to assist those non-residents who are exempt from the requirement to obtain one in India. Following is the procedure:

- Non-resident can select on the ‘Register‘ option on Income Tax e-filing portal.

- Under ‘others’ category, there is an option to choose ‘non-residents not having a Permanent Account Number & not needed to have a Permanent Account Number‘.

- Certain basic details will need to be entered, like date of incorporation, status, name, country of residence, & Tax Identification No.

- Non-resident will then have to provide the details of the key person, i.e., date of birth, name etc.

- The next step is to provide contact details, i.e., mobile No & E-mail address which will be verified via an one-time password.

- Lastly, Non-resident will need to upload certain documents like its Tax residency certificate, address proof, identification proof, and any other document if required.

- Finally, when registration is complete, NRI or Foreign residence must digitally sign the form using Digital Signature Certificate.

3.The previously mentioned window is only available to “non-residents not having a Permanent Account Number and not required to have a Permanent Account Number,” it should be emphasised.

Therefore, non-residents who choose to register must carefully assess their situation and make sure they are not obliged to obtain a Permanent Account Number.

What is Consequences in case PAN becomes Inoperative due to Non Linking of PAN-Aadhaar?

Inoperative Permanent Account Number:

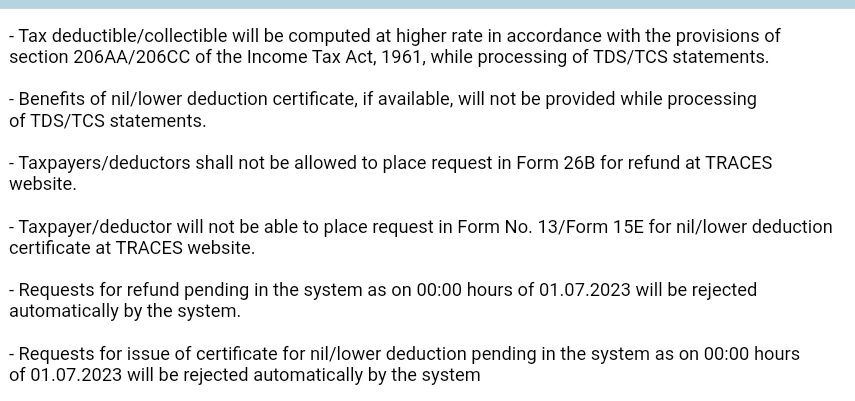

- Permanent Account Numbers of NRIs who applied for Permanent Account Numbers under resident status & have not updated/corrected their residential status & have not submitted income tax returns in any of the last 3 FY have been deemed inoperative Permanent Account Numbers.

Why Non-Residents Must Now Treat Tax Reconciliation as Asset Protection

Introduction

Clause 422 of the Income-tax Bill, 2025, expressly empowers the tax authorities to recover outstanding tax demands from any assets of a non-resident located in India. This includes bank accounts, rental income and receivables, securities, and immovable property.

While Clause 422 is technically a re-codification of Section 173 of the Income-tax Act, 1961, its placement, language, and emphasis in the new act have brought renewed focus on the exposure of NRI assets to tax recovery proceedings. The law has not changed dramatically, but the risk landscape has.

Clause 422: What It Really Does

Scope of Applicability

- Clause 422 applies to non-residents who have income accruing or arising in India, or Income deemed to accrue or arise in India. Physical presence is irrelevant. Asset presence is enough.

- Recovery Mechanism: The tax department may recover tax arrears by attaching any asset of the non-resident situated in India & proceeding against assets that may come into India in the future. This includes Bank balances (NRO/other accounts), Rent receivables, sale proceeds of property & securities, and other movable assets

- “Any Asset”: A Deliberately Broad Net: The phrase “any assets” is intentionally expansive and covers movable and immovable property, tangible and intangible assets, and present and future inflows. There is no statutory prioritisation or ring-fencing.

- The Real Concern: Procedural Asymmetry: What makes Clause 422 particularly sensitive for non-residents is not its existence but its procedural silence. No minimum demand threshold is prescribed. No express cooling-off period before recovery, no distinction between substantive tax evasion and clerical mismatches. In practice, this means even small mismatches in TDS, AIS, or reporting can mature into enforceable demands capable of triggering asset attachment.

- Why Tax Reconciliation Is Now Asset Protection: For non-residents, tax compliance is no longer just about avoiding penalties or claiming refunds. It is about protecting Indian-based assets from enforcement risk.

Practical Advisory for Non-Residents

- Continuous Reconciliation Is Non-Negotiable : Periodic reconciliation of Form 26AS, AIS, and TIS is essential. Continuous reconciliation ensures TDS credits are correctly reflected, income is properly classified, & no silent or unattended demand exists. Dormant demands are the most dangerous ones.

- DTAA Documentation Is a Defensive Shield: Maintain complete and updated treaty documentation, Tax Residency Certificate (TRC), Form 10F & correct treaty article application. Proper DTAA compliance Prevents excess TDS, Reduces refund-driven mismatches & Avoids system-generated demands that later escalate into recovery actions

- The Larger Shift: Clause 422 reflects a broader enforcement philosophy under the new law. Tax recovery is no longer an end-stage consequence. It is an active, asset-centric process. For non-residents, compliance lapses translate directly into asset risk.

The Income-tax Bill, 2025, does not merely restate recovery powers. It repositions them. For NRIs and other non-residents, tax reconciliation is no longer an accounting hygiene exercise, and it is a front-line asset protection strategy. Ignore mismatches, and your assets, not just your returns, are at stake.