NBFC fundamental analysis, Key Ratios & Concern

Page Contents

NBFC Type, fundamental analysis, key ratios & basic Concern

Kind of NBFC Classification on the basis of its activities.

INVESTMENT ACTIVITIES

-

Lending Activities

-

Activities Related To Lending

-

Investment Co.

-

Non-Operative Financial Holding Co.

-

Core Investment Co.

Lending activities and activities related to lending:

-

1.Asset Finance Co.

-

Infrastructure debt co.

-

Micro finance co.

-

loan co.

-

infrastructure finance co.

-

Factors

OTHER ACTIVITIES

- P2P(Peer to peer) lending platform

- Mortage gurantee company

- Account aggregator

What are the documents needed to acquire NBFC License in India

MANDATORY DOCUMENTS NEEEDED FOR OBTAINING NBFC LICENCE IN INDIA

Following is the list of documents that are required to be submitted with RBI to procure

- Substantiate facsimile of Commencement Certificate of Business and Certificate of Incorporation of the company.

- Director details filled and signed by every director of the company.

- Certificate of the directors from NBFCs showing experience where the directors worked earlier.

- Substantiate facsimile of Articles of Association (AOA) ad Memorandum of Association (MOA) of the company

- The CIBIL Data of directors of the company.

- Substantiate facsimile of the Board Resolution under Fair Practices Code.

- Board Resolution in particular to prove the submission of the application and authorizing signatory.

- Substantiate facsimile of Permanent account number and company identification Number of the company.

- Board Resolution to prove that the company is not holding any deposits and has not accepted any public deposits.

- Also, it shall also state that it will not accept any deposits in the near future without obtaining an approval from Reserve Bank of India.

- Board resolution to prove that the company does not own any unregistered NBFC

- Proof that No business activities are being done without getting it registered with RBI.

- Financial Statements pertaining to past 2 years of Unincorporated Bodies.

- A list including the Authorized Share Capital and the new shareholding of the enterprise

- Net owned funds must also be mentioned with fixed deposit receipt and bank statement.

- The details of Profit & Loss account and Audited Balance Sheet pertaining to three years along with directors & auditors report.

- All the details of bank accounts and postal address of the bank, loan/credit facilities.

- Bank Statement and Income Tax returns Self-attested by company.

- The business plan of the firm for next three years which must include essential details about the business, balance sheet, market segment etc.

NBFC Registration Process to obtain NBFC License in India

The registration process contains certain steps that must be followed to obtain NBFC License. A license is crucial for the smooth establishment of the company. The NBFC License plays a essential role and it must be acquired after following the below mentioned NBFC Registration process –

- Getting the company registered before filing for application: The first step in acquiring NBFC License is company registration. The company must be registered as per the Companies Act 2013 or Companies Act 1956.

- Ownership of Net Owned Funds: A minimum Net Owned Funds (NOFs) must be held by the company. The amount must be Rs2 crore or more.

- Presence of Directors: There must be at least one director in the company.

- CIBIL Score: Maintaining a Good CIBIL score is essential as it is an important aspect that is considered and it fulfills the eligibility requirements to register as an NBFC.

- File the Application form: The next step in the process is to file an application form on the website of RBI.

- Submission of important documents: Next, the applicant must Submission of all the required documents along with the application form.

- Obtaining CARN Number: After the submission of the application form and the documents, a CARN number will be provided to the applicant.

- Submission of the application form: Hard copy of the application must be submitted to the regional branch of RBI.

- Arrival of NBFC License: After the application is approved and verified, the License will be provided to the company

NBFC fundamental analysis and key ratios

- Non-banking financial companies (NBFCs) are businesses that offer banking services at a lower cost. They are in the lending and advance industry, as well as the acquisition of shares, stocks, bonds, debentures, government securities, and other marketable securities of leasing and insurance. It is necessary for firms to obtain an NBFC licence in order to create an NBFC.

- The fundamental analysis is basically an evaluation to understand a company’s financial position. The various aspects that are evaluated are cash flows, projected earnings, debt/equity ratio, Return on Earnings, Return on Investment etc.

Steps to conduct a Fundamental Analysis of a company

- Understand the nature of the business

- Understand the scope of growth of the company

- Identify the products or services of the company and recognize if it has the capacity to expand and grow further.

- Carry out an analysis and evaluate of factors that states the company’s financial position. Annual reports are a great way to identify where the company stands financially. Conduct an assessment of the crucial statements such as Profit and Loss Statement, Balance Sheet, Cash Flow Statement etc.

- Carry out an evaluation process and understand the debt ratios

- Identify company’s competitors

Framework on how to fundamental analysis of the NBFCs

Net interest margin: To explain more articulately Net interest margin is the variance between interest paid and interest received.

Formula to calculate NIM = Net Interest Margin investment return – interest expense/ average earning asset.

Net profit Margin: it shows how much profit is earned as a percentage of total revenue.

Formula to calculate npm= net profit/ sales

Return on Assets= It shows how much profit is generated from the assets. Its one of the profitabilty ratios that is helpful to check the working of an NBFC.

Return on Asset formula = Net profit/average total assets

Return on Equity= this amounts to the return that is earned by the shareholders of the company

Financial Ratios

- Current Ratio: CR = Current Assets / Current Liabilities

- Return on Equity:ROE = Net Income/Shareholder’s Equity

- Debt to Equity Ratio: DE =Total Liabilities / Shareholders Equity

- Return on Equity:ROE = Net Income/Shareholder’s Equity

- Quick Ratio: QR = (Current Assets – Inventories)/ Current Liabilities

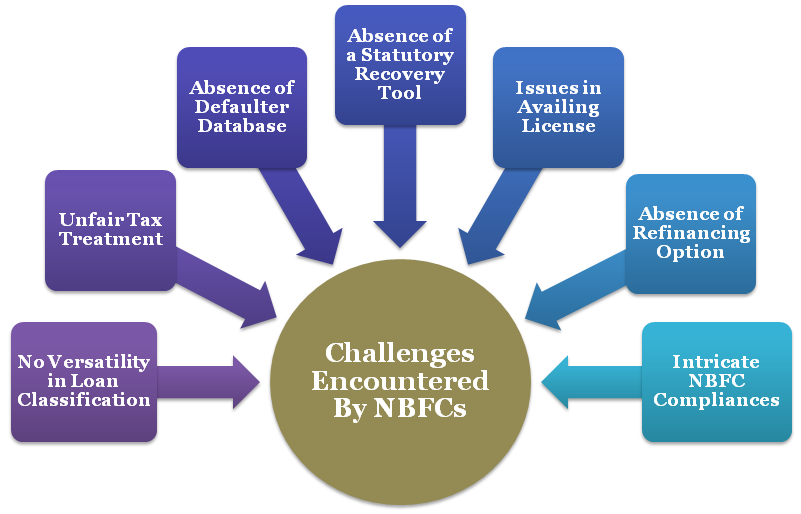

Basic issues/troubles for Non banking financial institutions sector

NBFC sector faces various issues and challenges in their functioning. There are some major concerns of the NBFC Sector such as; the NBFC has to register itself with all four CICs like any other Credit Institution like a Bank and if it does not become a member, it becomes a cause of concern. Also, we will see how they can avoid any disruptions in their working by following the prescribed guidelines. Furthermore, in this blog, we are going to see some common concerns of the NBFC sector and what are the guidelines set by the concerned regulatory bodies.

Common issues/Concerns of the NBFC Sector : Following are Few concerns of the NBFC sector in India.

- There are 4 CICs and the concern is that the NBFC is not registered with all 4 of them.

- It has been made mandatory for all the credit institutions including NBFC to become a member of 4 CICs via credit information bureau limited by the RBI.

The rules are:

- The RBI gave 3 months period for all credit institutes to become member of CICs. CICs to keep record of credit informtion update it on monthly basis.

- No registration of CKYCR

- CKYCR is a repository of KYC details of customers. The objective is to reduce the process and the burden of producing KYC documents and to verify it time to time wirh every new customer signing with the financial sector.

The norms are:

- The compulsion for NBFC to register with CKYCR. Regulated enitites like the NBFCs are under mandatory regulation to follow kyc norms. Non banking financial institutions and all payment system providers are some of the other regulated entites.

3.No prior approval from RBI by NBFC to change the name.

- The Reserve bank of India has observed that many NBFCs were adamant on changing their names without intimating the banks. The use of InfoTech at the end of the name of the NBFC was used by many to take unfair advantage.

Norms are:

- RBI advised and also made mandatory to intimate regulatory bodies in the case of NBFC name change due any reason. It becomes necessary for any NBFC for taking permission prior from RBI for making changes in the names to avoid misuses which could be associated with it.

- NBFCs which are not complying with the same are liable for punishment in the form of cancellation of the certificate of registration in case it is already registered or on rejection of the application for registration, if not registered.

- Sources of NBFCs need to be shown.

- The sources of NBFCs funding unlike banks do not rely on current account saving as source of income. Alternative sources of fundings are supposed to seek.

Norms are:

- There are some business activities permitted by NBFCs by the RBI are loans advances insurances of shares bonds etc.

- It is mandatory for NBFC to report to RBI for its source of funding.

- Not complying with KYC guidelines

- KNOW YOUR CUSTOMER (KYC) is basically an international benchmark used to frame anti money laundering rules and also used to combat terrorism funding by regulatory bodies.

Norms are:

- All NBFCs are said to perform some practices according to the guidelines and ensure the forming of the KYC and anti-money laundering measures within the organisation by the proper approval from its board.

- No following of Credit Exposure limits

- Credit exposure limit is basically when a lender makes available some amount of credit to borrower by lender called as credit exposure limit. It shows that to what extent lender can be exposed to the risk of loss in case of defaulting borrower.

Norms are:

- RBI guidelines suggests that the single borrower limits should be set to 15%.It used to be 10% for NBFCs not financing infrastructure strands.

- No sticking to the leverage limit

- Leverage limit is the total putside liabilities of net owned funds by RBI. It was set by the said institute to 7 stating any NBFC must not exceed this limit. W.e.f 31 march 2015.

- Inability to produce record on demand due to poor record keeping.

- Poor record keeping can be an agenda for loss of any company. It causes loss of time, Inefficency, And unnecessary stress.

Norms are:

- New Indian Accounting norms as per 2018 say that all NBFCs include housing finance companies have to set aside some amount as provisions to which impact is felt at bottom line. Expected credit loss is a system on which loan loss provisioning norms should be built.

- Aggressive Marketing tactics with use of low quality manpower.

RBI laid out some rules regarding the advertisement of NBFC. It is used to promote the business of NBFCs or to seek different services.

Norms are:

RBI has set all advertisements by NBFC must contain following:

- Mode of repayment of deposit

- All terms and conditions related to deposit renewal

- Mention of deposits are not insured

- any other feature related to terms and conditions of acceptance of deposits.

Some other concerns

- In case of change of management then RBI’s prior approval is not needed, within 30 days

- NBFC doesn’t intimate about change of statutory auditor

- The NBFC not taking prior approval in a change of control and management

- In case there is change of management there is no intimation where no prior approval of RBI is needed

- NBFC not providing a copy of Loan agreement to the borrower, interest rates not mentioned in the annualized form, no display of grievance redressal matrix in branches and official website

- Correspondence email id of company should be same as registered with the MCA

- The NBFC sector not Present at registered address

- Submission of incomplete documents while applying for prior approval

- NBFC delayed reply on correspondence sent by RBI

Popular blog:-