Last date to pay advance tax ends today

Page Contents

All about the Advance Tax under Income Tax law

The month of March has its own significance in many ways. Be it in terms of being considered the last month for making tax-saving investments or return filing or discharging taxes due for the year and so on. Amongst these, this month also stands out as crucial for those who must pay taxes in advance or what is called ‘advance taxes’.

Advance taxes are, as the name suggests, advance tax is simply a tax paid in advance. In general, tax return for income earned in the financial year i.e., 12 month period starting on April 1st and ending on 31st March will be filed in the next financial year. However, the government has designed a mechanism to collect taxes at regular intervals to ensure cash inflow throughout the year. This helps the government meet expenses on time.

And avoids collection of taxes after the year-end in one lump sum. Tax paid for income earned in the financial year in the same financial year before filing return of income, at specified intervals, is advance tax. Further, the advance tax must be paid if you still have a tax payable of Rs 10,000 or more after considering the TDS, which has already been deducted. To explain this further, the salaried class generally would not have to pay advance tax unless they have income other than salary, because TDS is already made by their employer. However, if they have incomes such as rental or interest income on which TDS has not been deducted, the advance tax would apply.

Advance tax payment

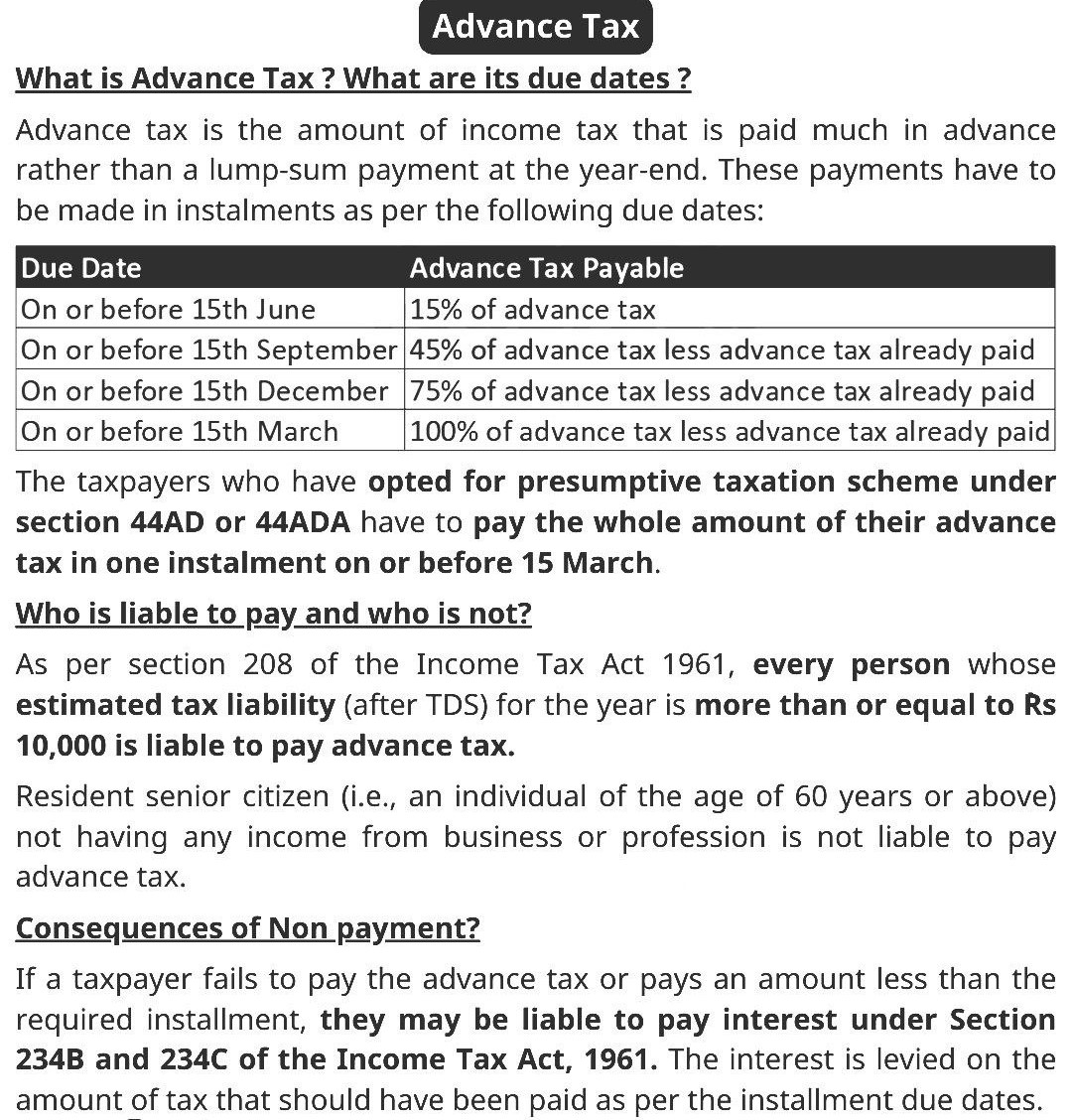

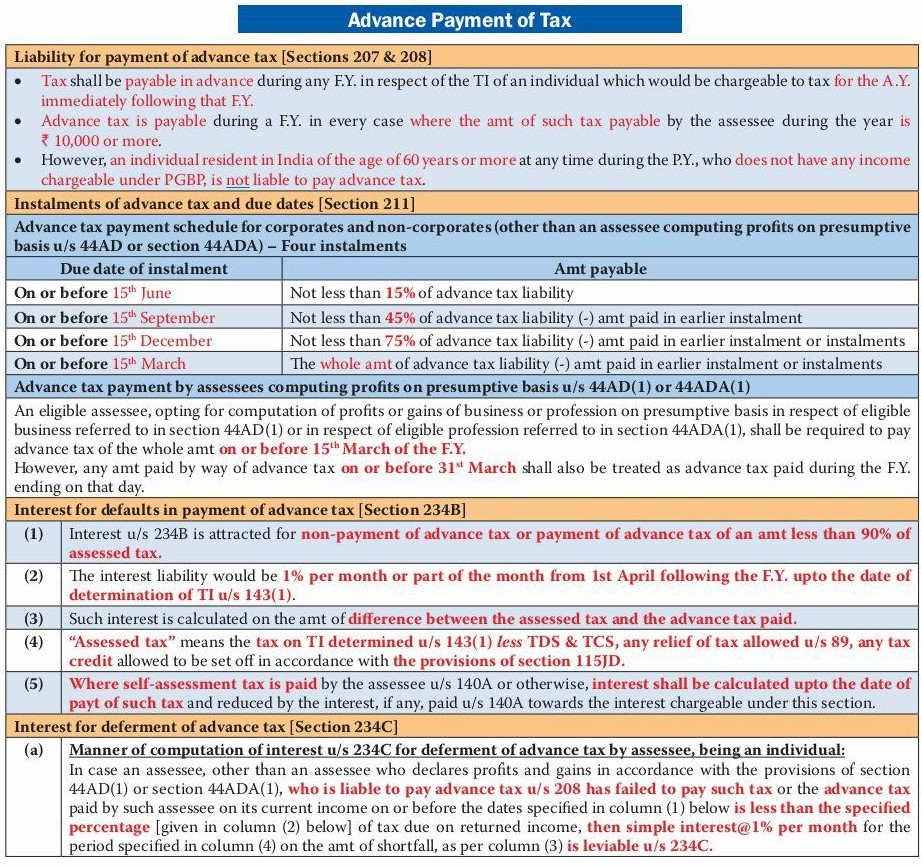

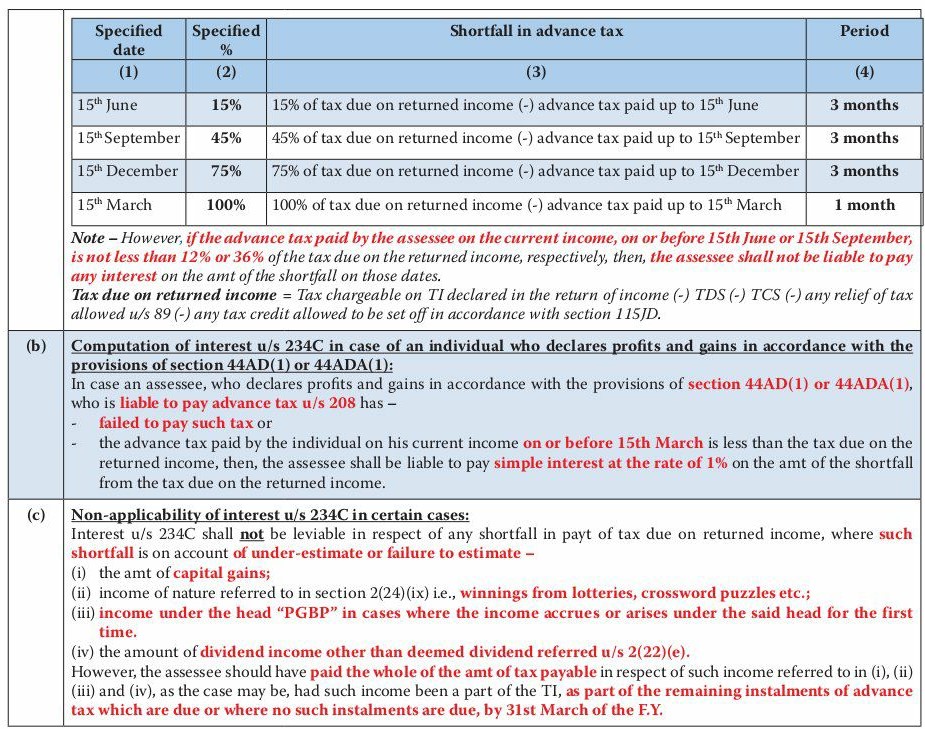

The income tax laws specify that a certain percentage of advance taxes be discharged on certain specific dates during the year. The below table discusses these details:- Due date of installment Advance tax payable On or before 15 June 15% of total tax liability On or before 15 September 45% of total tax liability On or before 15 December 75% of total tax liability On or before 15 March 100% of total tax liability

Any amount paid on or before 31st March would be treated as advance tax.

- Also to note that if you are a senior citizen aged 60 years or more not having any income from a business or profession, you don’t have to pay advance taxes.

- Further, another exception to the rule of applicability of advance taxes is for those who opt for the presumptive taxation scheme under Section 44AD or 44ADA who can pay the entire advance tax on or before 15th March of the financial year at once.

- Any default /delay in paying advance tax would attract interest under Sections 234B and 234C. At the same time, any excess payment for any quarter can be adjusted against the liability of other quarters of the year or claimed as a refund as the case may be.

Steps to pay advance tax

As 15 March 20X1 which is the due date for payment of the last installment of advance taxes for individuals, one needs to know how to go about paying the same.

- The steps involved in payment of advance taxes have been discussed in the ensuing paras.

- Advance tax can be paid either online or offline through any of the authorised bank branches. However, any individual covered under tax audit can only pay tax electronically. Concerned challan for the payment of advance tax is ITNS 280. Authorized bank branch details can be found using the link ‘https://www.tin-nsdl.com’ and navigate to the following path:

Services > OLTAS > Bank Branch . Then select State and location.

Online mode –

In order to pay taxes using the electronic mode, the taxpayer should have net banking enabled account in any of the authorized banks. E-payment of tax can also be made by using a debit card, however, only 5 banks are authorized for this purpose (ICICI, HDFC, Indian bank, Punjab National, and SBI).

In case the taxpayer does not have net banking enabled account or debit card of the above banks, payment of tax can be made in the taxpayer’s names by any other person having net banking enabled account or debit card of an authorized bank.

More read: