ITR Filing compliance by LLP– In the filling of ITR 5

Page Contents

Income Tax Return Filing compliance by LLP– In the filling of ITR 5

Every LLP Registered shall file ITR Return filling in ITR-5 within the below prescribed time limit:

| PARTICULARS REQUIRED TO BE MADE | DUE DATE OF Limited Liability Partnership |

| All Registered Limited Liability Partnership which yearly Turnover of less than Rs. 40,00,000/- in the previous FY or LLP where the partner’s obligation of contribution is less than Rs. 25,00,000/- (not required to get their accounts audited) | Required to file ITR on or before 31st July. |

| LLP having a turnover of Exceed Rs. forty lakhs and/or partner’s capital contribution of exceeding Rs. 25,00,000/- (required to get their accounts audited) | Need to file ITR on or before 30th September. |

Also Read CBDT Notification :

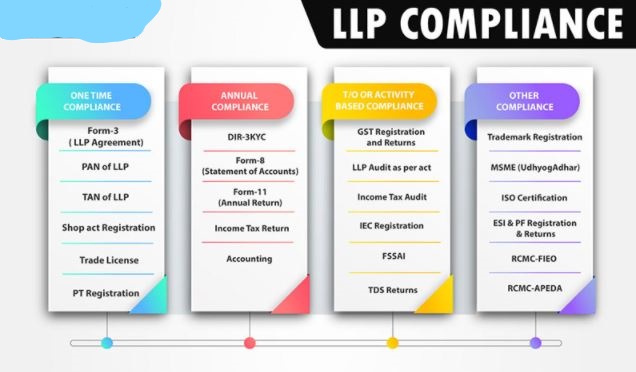

What are the Basic Event Based Compliances for LLP?

| S. No. | Event | Compliance |

| 1. | Resignation/Appointment of Partner/Designated Partner | Required to be file Form 3 and Form 4 (As linked Forms) |

| 2. | In the case of Change in Name of LLP | Required to be file Form 5 |

| 3. | Registered Office address Change | need to be file Form 15 |

| 4. | Changes in LLP agreement | Required to be file Form 3 |

| 5. | While Strike off name of the LLP | Need to be file Form 24 |

| 6. | In case DIN Application | Required to file DIR-3 |

| 7. | In case the change in particulars of Director | Need to file DIR-6 |

Limited Liability Partnership – Annual Compliances

| Head | Section | Compliance | Penalty for Non-Compliance |

| Statement of Accounts & Solvency | 34(2) | LLP shall within a period of 6 months from the end of every financial year prepare and file a Statement of Account and Solvency with the ROC in E-Form no. 8. | LLP shall be punishable with a fine minimum of Rs. 25,000 and maximum Rs 5,00,000 and every designated partner of such Limited Liability Partnership shall be punishable with a fine minimum of Rs10,000 & maximum Rs 1,00,000 |

Annual Return |

35(1) | Limited Liability Partnership to file Annual Return compliance to the ROC within 60 days of closure of the financial year in E-Form no. 11. | Limited Liability Partnership shall be punishable with a fine of a minimum of Rs 25,000 & maximum of Rs 5,00,000 and every designated partner of such Limited Liability Partnership shall be punishable with a fine of a minimum of Rs 10,000 & maximum of Rs 1,00,000 |

Notes:

1) Every Limited Liability Partnership has to file E-Form no.11 within 60 days from the date of closure of the financial year without any additional fee and later additional fees ofRs. 100/- per day of delay.

2) Financial year in relation to Limited Liability Partnership means the period from the 1st April to 31st March of the following financial year. Provided that in case of Limited Liability Partnership incorporated after the 30th day of September of a year, the financial year may end on the 31st March of the next following yea

Limited Liability Partnership – Event Based Compliances

| Particular | Under Section | MCA Compliance | Penalty for Non-Compliance under Company Act |

| Procuring Designated Partners Identification No | 7(6) | Every Designated Partner should obtain a DPIN from the Central Government | Every partner shall be punishable with fine which may extend to INR 5000 and where the contravention is continuing one, with further fine, which may extend to INR 500 for every day during which the default continues. |

| Consent and Particulars of Partner/assigned Partner | 7(3) & 7(4) | Filing of the consent of Partner/ Designated Partner to act as such with the ROC in E-Form no.4 within 30 days of the appointment as the designated partner | The Limited Liability Partnership and it’s every partner shall be punishable with a fine which shall not be less than Rs. 10,000 & maybe extend to Rs. 1,00,000 |

Vacancy of Designated Partner |

9 | Filing of a vacancy in Designated Partner within 30 days of vacancy and intimation of same to Registrar in E-Form no.4 and in case if no designated partner being appointed then each partner shall be deemed to be the designated partner | LLPs every partner shall be punishable with fine which shall not be less than Rs. 10,000 but which may be extend to Rs. 1,00,000. |

| Change of Registered Office | 13(3) | File the notice of any change in the registered office with the Registrar of Companies in E-Form no. 15 and any such change shall take effect only upon such filing. | The Limited Liability Partnership and it’s every partner shall be punishable with fine which shall not be less than Rs. 10,000 but which may be extended to Rs. 1,00,000. |

| Change of Name | 1 | Limited Liability Partnership may change its name registered with the Registrar by filing with the Registrar notice of such change in E-Form no. 5. | A person guilty of an offense shall be punishable with a minimum of Rs.5000 to Rs.500000 and with a further fine which may extend to Rs 50 for every day after the first day after which the default continues |

| Name of LLP on Invoice and official Correspondence | 21(1) | All invoices and official correspondence of the LLP shall include its name, address and registration number and a statement that it is registered with Limited Liability | The Limited Liability Partnership shall be punishable with a fine which shall not be less than INR 2000 but which may extend to INR 25,000. |

| LLP Agreement & Changes therein | 23(2) | LLP Agreement and any changes made therein shall be filed with the Registrar in E-Form no. 3. | A person guilty of an offense shall be punishable with a minimum of Rs 5,000 & maximums 5,00,000 and with a further fine which may extend to Rs 50 for every day after the first day after which the default continues. |

| Change in Partners | 25(2) | Where a person becomes or ceases to be a partner or where there is any change in the name or address of a partner, notice of the same signed by the designated partner and to be filed within 30 days to the Registrar in E-Form no. 4. | The LLP and every designated partner of the LLP shall be punishable with a fine minimum of INR 2000 & a Maximum of INR 25,000. |

| Books of Accounts | 34(1) | Limited Liability Partnership shall maintain proper Books of Accounts for each year on a cash basis or on an accrual basis and according to the Double Entry System of Accounting at its registered office and shall get them audited in accordance with the rules as may be prescribed | LLP shall be punishable with fine minimum of INR 25,000 and maximum INR 5,00,000 and every designated partner of such Limited Liability Partnership shall be punishable with fine minimum Rs 10,000 & maximum 1,00,000 |