HSN & SAC codes alongwith gst rate

Page Contents

HSN & SAC CODES ALONGWITH GST RATE

- HSN codes: Basically HSN stands for a harmonized system of nomenclature. This harmonized system of the nomenclature coding system is developed by the World Customs Organization.

- Now This is a global standard of the Nomenclature of normal trading goods in foreign trade.

- The harmonized system of nomenclature is the codification of all tradable commodities into twenty broad sections with each and every chapter containing commodities of the same kind of nature.

- Its normal vision of classifying goods from all worldwide in a systematic & logical way. It is a 6th digit uniform code that classifies more than 5k products & is accepted globally.

- This HSN code is a set of defined regulations used for GST taxation objective in identifying the GST Rate of tax apply to a product in a Nation.

HSN codes of goods along with the rate of IGST, CGST, SGST mention in the below link

What is a harmonized system of nomenclature (HSN) classification?

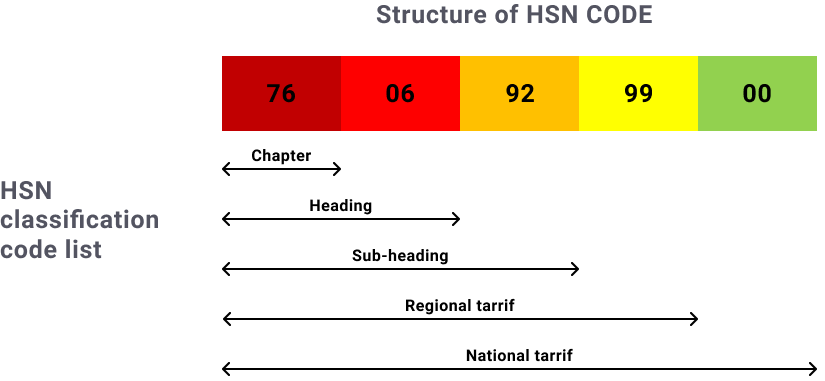

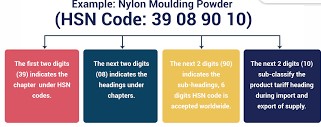

HSN(harmonized system of nomenclature) have twenty-one sections, ninety-nine chapters, 1,244 headings, & 5,224 subheadings. Sections & chapters are arranged in order of a product’s degree of manufacture/ in terms of its technological complexity.

Natural products like animals & vegetables appear in earlier sections; man-made/technologically advanced products like machinery appear later.

Chapters have a similar structure. Take cotton, for example – Chapter 52. Cotton that has not been carded or combed appears earlier in the chapter; cotton as a woven fabric appears later.

- Each Section is a collection of various chapters. Sections represent a broader class of goods, and chapters represent a particular class of goods.

- Each chapter is further divided into various headings depending upon different types of goods belonging to the same class.

- Each heading contains products, which are ultimately assigned an HSN code.

- For better identification of goods, India and a few other countries use eight-digit codes for deeper classification.

- few HSN codes also use dashes. A single dash (-) at the beginning of a description denotes an article that belongs to a group covered under a heading.

- A double dash (–) indicates that the article is a sub-classification of the preceding article that has a single dash. Similarly, a triple dash (—) or a quadruple dash (—-) indicates the article is a sub-classification of the preceding article that has a double dash or triple dash.

Harmonized system of nomenclature (HSN) in Goods and Services Tax

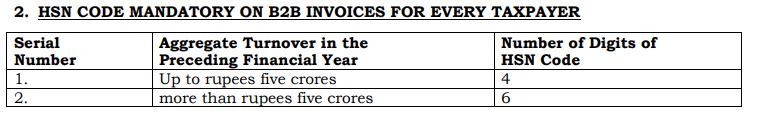

HSN CODE IS REQUIRED ON ALL B2B INVOICES FOR EVERY TAXPAYER.

HSN codes to be declared under the GST in present circumstances

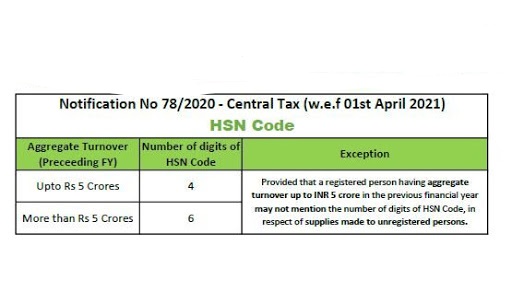

Note: A registered person with a cumulative turnover of up to 5 crores rupees in the past financial year is not required to include the number of digits of the HSN Code in a tax invoice issued in respect of supplies made to unregistered persons.

| Turnover/ Sales | Number of digits of HSN to be declared in Return or invoices |

| Up to 1.5 crore | 4 |

| 1.5 crore- 5 crore | 4 |

| More than 5 crore | 6 |

- Registered persons with a turnover of more than Rs 5 crores will be given an HSN code with up to 6 digits (it was previously 4 digits).

- HSN Code was required for every B2B transaction by every taxpayer, but it was exempt for taxpayers with a turnover of up to Rs 1.5 crore.

- Only B2C sales by taxpayers with a turnover of up to Rs 5 crore are exempt.

Why is HSN essential for the GST?

- The motive of HSN codes is to ensure that GST is systematically and globally established. HSN codes will eliminate the need to upload detailed information about the goods. It will save time and make filing simpler as GST returns are automated.

- The dealer or service provider should provide HSN/SAC with a wise conclusion of sales in its GSTR-1 if its turnover falls within the above slabs.

What are the Rules & nature for Classifying goods under the HSN(harmonized system of nomenclature) code?

- In formatting a classification for a specific item, GST Dealers shall apply the General Interpretative Rules (GIR) in a systematic sequential approach. when a classification is done, there is no need to continue applying the remainder of the rules.

- Further Shifting towards the next rule is only essential if the full categorization does not occur from the application of the previous rule. Classification is finally carried out when there is no uncertainty or confusion.

- For the purposes of classification, every other word should take its meaning or be interpreted in its general sense, and not in a technical or strict sense.

Basis of Rule 1

- Titles of sections, chapters, and sub-chapters are provided for ease of reference only.

- For legal purposes, refer to headings and sub-headings to drive classification.

Basis of Rule 2a

- If the goods are incomplete/unfinished and have the characteristics of the finished product, classification is the same as that of the finished product.

- The heading shall also include removed/unassembled or disassembled parts.

Basis of Rule 2b

- Any reference to a material or substance includes a reference to mixtures or combinations of that material or substance with other materials or substances.

- The classification of goods consisting of more than one material or substance shall take place as per Rule 3.

Basis of Rule 3a

- Choosing a specific heading is preferred over a general heading.

Basis of Rule 3b

- Mixtures/composite goods should be classified per the material or substance that gives them their essential character.

Basis of Rule 3c

- If two headings are equally suited to the item, choose the heading that appears last in numerical order.

Basis of Rule 4

- If goods cannot be classified per the above rules, they are to be classified according to the goods to which they are most akin.

Basis of Rule 5

- Containers specifically designed for the article and suitable for long-term use will be classified along with that article, if such articles are normally sold along with such cases. For example, a camera case would fall under cameras.

- Packing materials and containers are also to be classified with the related goods except when the packing is for repetitive use.

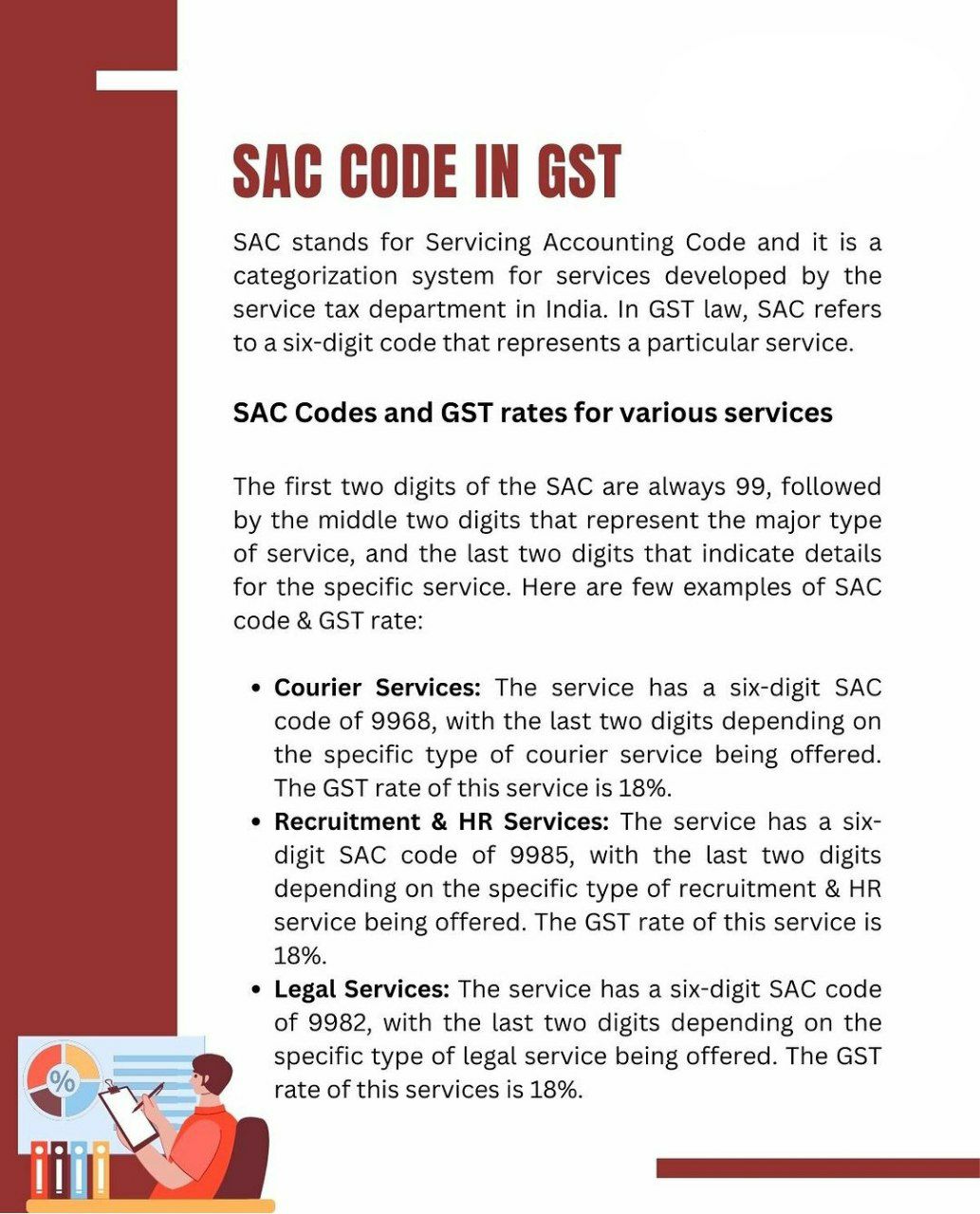

SAC codes(Services Accounting Code):

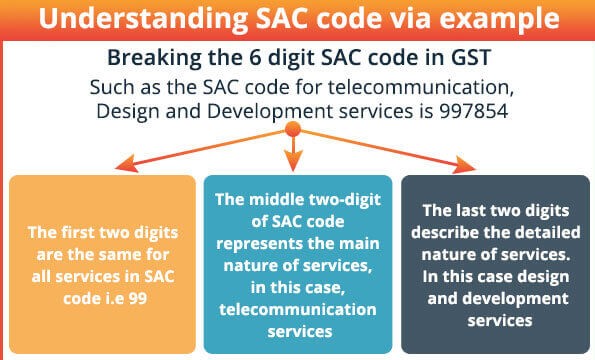

- Services will be classified as per the Services Accounting Code (SAC). In the case of services, each type of service provided is given a unified code for recognition, measurement, & taxation.

- These are commonly known as Services Accounting Code. It is formulated by the CBEC.

- These codes are a combination of numbers to identify the service type and the rate at which it is to be taxed. SAC Code has been in existence to define proper levy of service tax & each kind/type of service under the GST law.

SAC codes Services Accounting Code for services along with the rate of IGST, CGST, SGAT are mention in the below Link

HSN(harmonized system of nomenclature) and SAC codes (Services Accounting Code) in Goods and Services Tax

- Under GST, all goods and services supplied in India have been classified – Goods are classified under the HSN Code(harmonized system of nomenclature) and Services are classified under the SAC Code(Services Accounting Code).

- Based on the HSN or SAC code (Services Accounting Code), GST rates have been fixed in 5 kinds of slabs, like 0%, 5%, 12%, 18%, and 28%.

In the Goods and Services Tax regime, each invoice will have to mention the HSN code (harmonized system of nomenclature) for all goods which are sold and SAC code(Services Accounting Code) for all services which are provided.

Businesses will need to be aware of the HSN code list and SAC code (Services Accounting Code) list for all Goods and Services Tax applicable supplies they are dealing in.

Under Goods and Services Tax, the majority of the dealers will need to adopt two, four, or eight-digit HSN codes (harmonized system of nomenclature) for their commodities, depending on their turn-over the previous year. The following are the detailed requirements:

- Enterprises/ Corporate with sales of less than INR 1.5 crores – will not be required to use HSN codes(harmonized system of nomenclature)

- The Enterprises/ Corporate with sales between INR 1.5 crores and INR 5 crores – will be required to use 2-digit HSN codes(harmonized system of nomenclature)

- Enterprises/ Corporate with sales equal to INR 5 crores and above – will be required to use 4-digit HSN codes(harmonized system of nomenclature)

- Imports / Exports -8-digit HSN codes(harmonized system of nomenclature)

- Services -5-digit SAC codes (Services Accounting Code)

Points to Note

- Usually, Small dealers under the composition scheme will not be required to mention HSN/SAC codes in their invoices.

- The above codes will be required to be mentioned in the invoice & mentioned in the GSTR Returns details, which will be submitted on the GSTN website portal.

- Only During the registration process of the GST, it will be appropriate to note the HSN/SAC supply codes of the business activities.

- You can check GST Rate, HSN Code & SAC Code under the GST Regime

what is UQC?

- UQC stands for Unique Quantity Code. In simple terms, it is a unit of measurement such as 1 kilogramme of wheat, 1 litre of oil etc.

What is UQC in GST?

- As per central goods and Services Tax (CGST) Rules, 2017, any tax invoice, credit note, a debit note must have UQC or quantity unit description.

Read About the Advisory on HSN and GSTR-1 Filing

- As per Notification No. 78/2020 – Taxpayers must declare the Harmonized System of Nomenclature (HSN) Code of Goods and Services supplied by them on raising tax invoices, with effect from 1st April 2021, on the lines below, according to Central Tax, dated October 15, 2020.

| S.No | Particular of Aggregate Turnover in FY | No of Digits of HSN Code to be reported in GSTR-1 |

| 1 | Aggregate Turnover in FY Upto Rs. 5 crores | Four |

| 2 | Aggregate Turnover in FY Above Rs. 5 crores | Six |

- Few taxpayers have reported that the HSN they used for GSTR-1 reporting is not available in the table 12 HSN drop-down. They further said that they are experiencing issues entering the necessary HSN details in table -12 and filing the July 2021 statement of outward supply in form GSTR-1. Furthermore, the HSN field is blank in some JSON files generated by the offline tool, along with other issues as stated below: –

- Click here to view a full advice on what taxpayers should do to remedy the above issues:

CBIC Clarifications Concerning GST Rates.

- CBIC was issued by the CBIC to clarify ambiguities about the tax rates that should be levied in respect of the supplies listed in the circular. (Circular No.163/19/2021-GST, dated 6.10.2021,)

- CBIC issued clarification in order to offer clarity to the tax rates applicable to particular supplies. The same aims to clear up any ambiguity regarding the tax rates that should be applied to the suppliers indicated in the circular. (via Circular No.163/19/2021-GST on 6.10.2021)

Key Analysis of Circular No.163/19/2021-GS has been given for clear understanding objective.

| S. No. | Particulars | Rate | Remarks |

| 1 | Solar PV Power Projects | It was provided that w.e.f. 1.1.2019, goods and services tax will be paid in the ratio of 70:30 for goods and services in respect of specified Renewable energy projects.

Now, even for the period prior to 1.1.2019, the same mechanism will be adopted. The value of goods purchased will be considered to be 70percentage of the gross consideration paid. |

|

| 2 | Copra | 5 percentage | Copra is the dried flesh of coconut used for extracting oil. It separates from the shell skin. Dried or fresh coconuts, with or without shells are exempted.

Copra is distinguished under goods and services tax from dried & fresh coconuts. Hence, it attracts goods and services tax at 5 percentage. |

| 3 | Pure Henna Powder & leaves | 5 percentage | It has been clarified that Henna powder & leaves fall under the Heading 1404 since the heading includes raw vegetable materials primarily used for the purpose of dyeing or tanning, regardless of whether it is used directly or in preparation of dyeing/ tanning extracts. The same goods and services tax rate is applicable for mehndi cones. |

| 4 | Fibre Drums | 18 percentage | Earlier corrugated boxes and cartons would attract goods and services tax at 12 percentage while the rest would attract the rate of 18 percentage. In the case of fiber drums that are partially corrugated,

there used to be a dispute about the rate applicable. To absolve from such dilemma, w.e.f. 1.10.2021 a uniform goods and services tax rate has been prescribed at 18 percentage. Prior to the aforementioned date, even if 12 percentage was charged, it would be considered as fully goods and services tax being paid. No refund will be available if 18percentage was charged prior to 1.10.2021. |

| 5 | Fresh & Dried fruit and nuts | Exempt/5 percentage/12 percentage | Fresh fruit & nuts are supplied as plucked. They continue to be called fresh even if chilled. If fresh fruit & nuts are cooked or otherwise, they cannot be considered fresh.

Dried fruit & nuts include the ones that are evaporated or dehydrated. Dried fruit & nuts even if partially rehydrated, will retain their identity. |

| 6 | BSG, DDGS, and other such residues | 5 percentage | These are classifiable under Heading 2303 and attract goods and services tax at 5percentage. |

| 7 | Sweet Supari and flavored & coated illaichi | 18 percentage | Flavored and coated illaichi consists of cardamom seeds, saffron, artificial sweeteners, and other ingredients.

It is considered a value-added item and hence, not treated at par with cardamom which falls under heading 0908. Sweet and flavored illaichi falls under the heading 2106 just like scented sweet supari. The goods and services tax rate applicable is 18percentage. |

| 8 | Laboratory Reagents and other goods falling under Heading 3822 | 12 percentage | It has been clarified that the goods and services tax rate of 12 percentage will be applicable to all goods falling under heading 3822 whether they happen to be diagnostic or laboratory reagents. |

| 9 | Inverter/ UPS sold along with external batteries | 18 percentage and 28 percentage, respectively | If the price of the Inverter/ UPS, as well as the price of external batteries, is given in the same invoice but separately, then different goods and services tax rates for each will be charged. |

| 11 | Pharmaceutical goods falling under the Heading 3006 | 12 percentage | S. No. 65 of Schedule II mentions an illustrative list. It has been clarified that the goods finding mention under Heading 3006 but not given in entry 65 specifically will also be covered by this entry and attract goods and services tax at 12 percentage. |

| 12 | Tamarind Seeds | Nil rate/ 5 percentage | Nil rate is used where the tamarind seeds are for the purpose of sowing and falling under Heading 1209. W.e.f. 1.10.2021,

these seeds if falling under the same heading and not used for sowing, will be liable to goods and services tax at 5 percentage. |

CBIC advisory on Revamped Search HSN Code Functionality in GST : A revamped & enhanced version of Search HSN Functionality has been launched on the GST Portal. For Complete Details CBIC advisory click here

Summarizing

- Alongside India’s move to GST, begins to move to an online tax system and HSN codes to categorize goods for taxation purposes.

- It’s all designed to bring more homogenous taxation and ease of biz. HSN codes will now be used for filing returns, invoices, etc., rather than written descriptions.

- They will all necessitate a few other prep work from professionals as well as taxpayers, but automated GST compliance remedies are available to assist smooth the transition.

For more details you may refer to Hand Book on Classification under GST Act

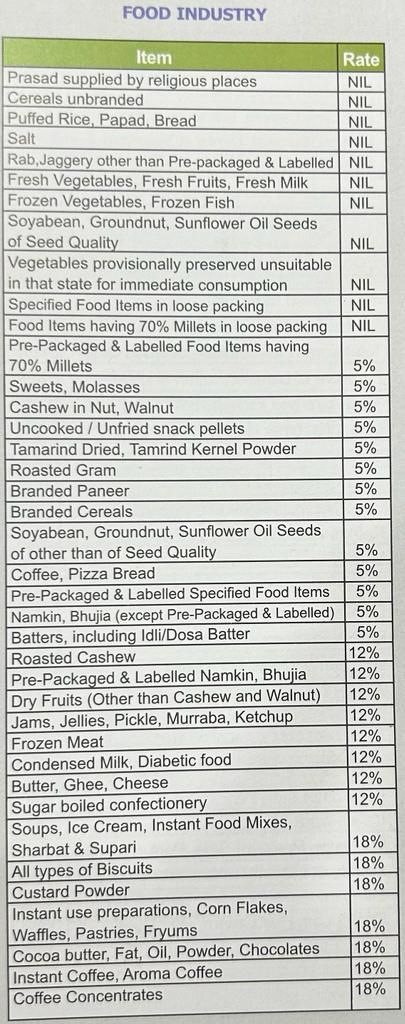

Various Food Industry GST Rates

CBIC notifies GST Rate hike from 5% to 12% on Fabrics, Apparel, Footwear w.e.f. 1st January 2022

- Central Board of Indirect Taxes and Customs Notified the hike in GST rate from 5% to 12% on Fabrics, Apparel, and Footwear w.e.f. January 2022 Vide Notification No. 14/2021-Central Tax (Rate) dated 18th Nov 2021

Popular Blog:-

All about Provisional Attachment of Property GST

Key GST Compliance Calendar for the 2022