How to reduce your Loan burden smartly?

Page Contents

How to reduce your Loan burden smartly?

As the name suggests, a top-up credit is advantageous to the applicant well above the previously existing debt. The tenure period for such advancement usually varies from 5 to 10 Yrs. Banks include borrowers who have a current home loan or personal loan with this kind of advance. Well, it is easy to use these loans, but banks have certain conditions for accepting this form of loan.

If your bank does not offer top-up loans, you can select a payment method with a lender that also provides a top-up loan. You need to be consistent for your current loan payments to get accepted for the same kind of top-up loans and you can do so with a unique amount of Equated Monthly Installments.

For those that have current loans and are searching for monetary assistance at the same time, top-up loans are best. It will satisfy all of your criteria for personal and short-term business. It’s cheaper than most loans for corporate use.

Characteristic of a top-up loan

- The credit amount authorized for your top-up loan will be decided by your pending home loan / personal loan.

- Your debt experience plays a great part in your top-up loan acceptance for the current loan and your CIBIL.

- Top-up loans are normally available at the same interest rate as you have your existing loan.

- The duration can vary from five to ten years if it’s a home loan top-up, and if it’s a personal loan top-up, the duration can go up to two years.

- Only if you have a current home loan or personal credit facilities from the same provider then you can qualify for a top-up loan.

Home loan tops are normally only given for housing construction, repair, purchasing, etc., while a personal loan top-up may be used for multiple criteria, including-

- When you are searching for a short-term finance solution for your business needs.

- When you are searching for low-interest rates with long-duration resources.

- To cover your wedding costs, holidays, etc.

- When you need immediate funds to deal with your personal requirements.

- A loan with limited paperwork is required.

Various factors and advantages of a top-up loan

- It may be used for a number of professional or personal purposes.

- The reasonable interest rate in comparison with other commercial loans.

- The easy option for repayment.

- Minimum paperwork and fast loan processing are expected as you already have an existing link with the lender they previously have your information.

- Longer-term of loans

Way out of reducing your burden of loan efficiently

Loans are, without a doubt, one of the most essential elements of life. Many of us have taken advantage of this to solve the financial crisis we face from time to time. Loans, however, may also prove to be a liability since they need to be repaid within a defined time period and with interest. With careful management, though, one can easily reduce the load pressure and lead a life that is essentially stress-free. Go through the write-up and learn for yourself some of the ways to smartly reduce your loan load.

1. Loan modification offers a great choice

Loan modification or the transfer of the balance will not only decrease interest but will also greatly minimize the loan burden. It implies that for a new loan that can be used by the same lender or some other one, one can pay off the current loan.

In situations where the borrower has an existing loan that he has used at a high-interest rate, unwanted terms, etc., refinancing will prove to be beneficial because various lenders offer the same loan in improved conditions.

The creditor would have to file for a balance transfer with the new lender and choose for a loan modification, who would refund the money back to the former leader, who will then close his loan account when accessing his new account with the new lender.

2. In order to minimize loans, existing resources should also be used

Borrowers may use bonds to redeem their debt against savings such as Public Provident Fund, life insurance premiums, etc. It is worth noting here that the Public Provident Fund requires the lender to take advantage of the loan from the investment’s third financial year, which will then be repaid over the next three years.

Up to 25% of the balance can be the maximum amount that may be taken as a loan from the Public Provident Fund. The interest charged on loans is 2 percent more than the existing Public Provident Fund interest rate.

If one accepts the above points, so there would be no shadow of evidence that he will be able to repay his loan amount without any trouble, every time and in his life, there will be nothing like the loan burden.

3. Anytime appropriate, opt for pre-payment or part-payment

Pre-payment and part-payment allow the borrower to pay off the balance of the loan and the interest before the deadline stated. The pre-payment of the loan reduces the remaining principal balance, which reduces the EMIs in exchange. But on the other side, there are times that the applicant has a surplus number.

He will then take this option to pay in half for the home loan. The principal balance is decreased by these conditional installments on the home loan and the EMIs and interest paid on it are reduced.

The financial pressure on the applicant is minimized by both non- and part-payments. At the very beginning, it is necessary to explain whether the lender provides pre-and part-payment facilities or not.

4. Choose for reasonable cost Equated Monthly Installment

If the lender fails to the repayment of the regular EMI, his credit score gets a beating that destroys his record and adversely affects his potential borrowing opportunities. Thus it is important for him to choose for a reasonable cost Equated Monthly Installment that can be quickly repaid.

One should obtain the aid of the online EMI calculator to know about the EMI that he will have to spend on the loan he plans to take. This will allow the creditor to consider the Equated Monthly Installment he would have to spend and whether he would be able to afford it.

5. Rising the amount of repayment with a rise in your earnings

If you’re earnings increase, then it is suggested that you should also raise your monthly EMI amount. Doing that will make sure that the loan is clear before the specific timeframe and that you are free to take care of more essential items in life. If one needs to clear more than one debt, so he can first aim to clear the highest interest debt. On the other side, if one has established credit card debt as well, then he can make it known that the first.

https://carajput.com/learn/basic-impact-after-implication-of-gst-on-the-personal-loan.html

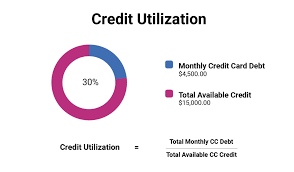

What is Credit Utilization Ratio?

For each credit bureau, the procedure of determining the credit score is different, but basically, the variables remain the same. Your payment background is the most significant aspect that decides your credit score. A lower credit score will result from any defaults on your EMI and credit card payments. The Credit Utilization Ratio is the second most relevant aspect taken into consideration when determining the credit score. Let’s see what makes this ratio so important and how we can keep it under control—

How to calculate the credit utilization Ratios?

The credit utilization ratio is the ratio, as a proportion, of the total balance you used on your credit card and the overall credit balance you were given. In a way, this calculation indicates the amount of credit you use, hence the term, the calculation of credit utilization Ratio.

What is the perfect Credit Utilization Ratio?

An optimal ratio of credit utilization will be Zero. However, since not having a credit card is not ideal for your credit score, you need to use your credit card from time to time, which means that a credit utilization ratio of 0 is not feasible. It is also prudent to try to keep the credit utilization ratio as low as possible and to manage it. Anywhere below 30 percent is a good credit utilization ratio. If you use less than 30 percent of your credit cap, possible investors will deem you a prudent borrower.

How to get lower credit Utilization ration

It is no rocket science to decrease and retain your credit utilization ratio. You just have to take a close look at the new credit management plans and, appropriately, make the required adjustments. Here are a couple of guidelines to support you do it—

-

Increase in credit card limit

This one is rational sufficient. If you expect the ratio to decline, raise the fraction denominator. Your credit usage ratio will decline immediately as you increase your credit cap. In order to get notifications on the changes or improvements available on your credit card, call your credit card company. Invite them to lift the credit cap. If you have got a pay increase lately, etc., you will use it to get a higher credit cap.

-

Get multiple cards

It benefits you in several ways to have many credit cards, but it goes with a key difference that you must be very alert about them. Only because you can, do not engage in overspending. When you plan to have many credit cards, distribute your payments among them so that your credit usage percentage can be reduced. To retain a decent credit score, make sure you pay the dues on all credit cards on time. Bonus: you should synchronize the billing times in order to take full advantage of the credit card grace periods.

-

Decrease the use of credit card

This is pure mathematics. If you want to decrease the ratio, lower the numerator. Decrease the amount of money you use on your credit card if you can. Try to control your payroll payments and just use your credit card when you really use it or only to keep it in use. For some time, at least, before your ratio increases and your credit score finally increases.

So, that now you understand why this ratio is an important element in your credit score estimation, make sure you measure your credit score.

Read our articles: