How to Change the Name of a Company-ROC

Page Contents

How to Change the Name of a Company-ROC

A company’s name is the title by which it is recognized across the world. A company’s name might be altered over time to meet the demands of the firm. As per requirements of the Companies Act, 2013, which have been covered fully in this blog.

Since the Memorandum of Association and Articles of Association must be changed, changing the business name is a substantial change. A business may change its name under Section 13 of the Companies Act 2013 by passing a special resolution at general meeting and gaining permission from the Central Government.

REQUIREMENTS FOR A CHANGE IN THE COMPANY’S NAME THAT MUST BE COMPLETED

- If a company wishes to change its name, it must file the required Annual Returns or Financial Statements with the Registrar.

- A change of name is permitted on the submission of required papers or the payment or repayment of maturing debentures, deposits or interest thereon, as applicable. [Companies (Incorporation) Rule, 2014, Rule 29]

What doesn’t get affected When You Change name of the company?

- Any rights/obligations of the firm will be unaffected by the change of name, as well as any legal procedures brought against/by the company under its previous name.

- However, when the ROC has registered the new name, any new legal procedures brought against the corporation in its old name are invalid. The firm should be regarded as if it never existed under its previous name. However, by modifying the plea, the new name can be substituted.

- The company’s legal processes that were started under its previous name can be resumed under the new name. Despite the name change, the corporation remains the same entity.

How to Change the Name of the Company with MCA

The conditions for getting prior approval in the process of changing the company’s name are as follows.

- The Board of Directors’ approval

- Approval of more than 75% of the stockholders

- The ROC’s approval (MGT-14)

- Central Government’s Approval (INC-24)

Legal Provision: Any firm, new or old, is eligible to obtain for a name change. However, if the firm has not filed its ROC Annual Return, Financial Statement, or any other report/documents to ROC on time, Section 13 (2) of the Companies Act, 2013, read with Rule 29(2) of the Companies (Incorporation) Rules, 2014, does not allow for a name change.

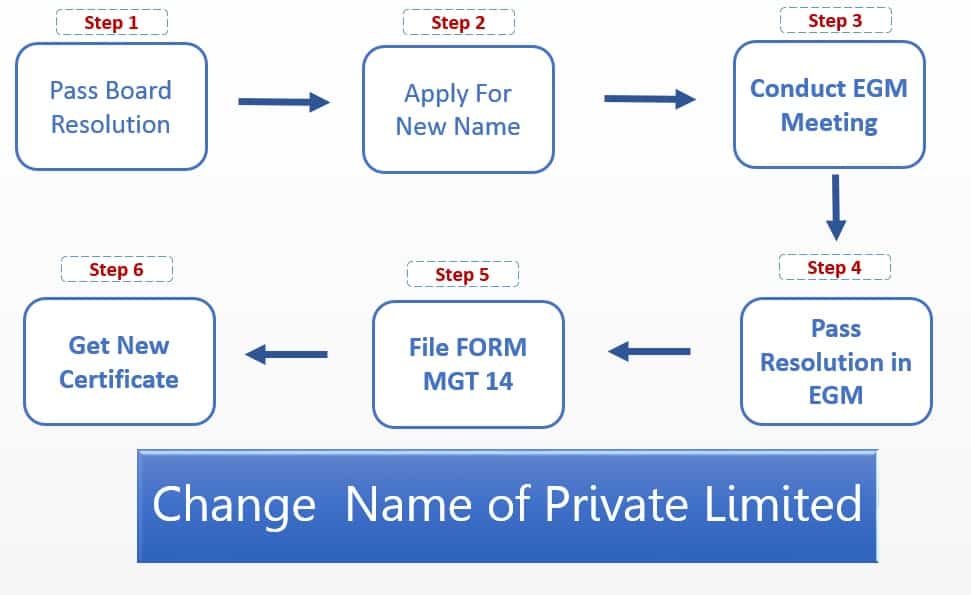

Step-by-step guide to alter the name of a private limited company:

-

A change in the company’s name involves a change in the Memorandum of Association.

- A memorandum of association (MOA) is a charter document that contains everything from the name clause to the object clause in the formation of a corporation.

- A change in a company’s name prompts a change in the name clause in the MOA. As a result, the firm must follow procedure for changing the MOA outlined in Section 13 of the Companies Act, 2013.

- According to this section, the company’s name can be changed by adopting a special resolution with the consent of the Central Government.

2. Things to look for when changing a company’s name

Before asking for a name change for an established business, be sure that it has:

- Needed to filed its annual returns; or

- We needed to filed its financial statements due to the Registrar; or

- Interest on matured deposits or debentures has been paid or returned.

If any of the above elements are not met, the corporation must first correct the default before proceeding to alter the name. [Companies (Incorporation) Rules, 2014, Rule 29].

-

Conducting a board meeting to discuss the company’s name change.

A board meeting must be called in accordance with the provisions of section 173 of the Companies Act, 2013 and Secretarial Standard -1 in order to consider the company’s new name. The Board of Directors must:

- debate the grounds for the company’s name change; and

- recommend two new names. (New names should not be similar to existing companies or be considered undesirable by the Central Government.)

- make a declaration on the filing of annual reports or financial statements, as well as the payment or repayment of maturing deposits, debentures, or interest on them.

- allow one of the company’s Directors or the CS to file a name change application with the Registrar of Companies (ROC).

-

Request for new name availability and name reservation

- On behalf of the firm, an authorized person will submit an RUN-e online form to the MCA portal, together with two recommended names and the required cost of Rs 1,000. A copy of the board resolution must also be attached to the form.

- ROC will accept the name if all relevant papers are submitted and the name is available; if there are any objections, the applicant will be given one resubmission opportunity to apply for two more names during a 15-day period.

Consider the following:

- The proposed names should be original and distinct from existing corporate names or registered trademarks.

- When using the RUN online service for the first time, you can apply for up to two names of your choice. If the names are not available, you will have one more chance to submit and apply for two additional names.

- Once ROC approves a name, it is held for a maximum of 20 days before being revoked and you must reapply.

The approved name will be reserved for 20 days at first, and with the payment of further costs, it can be extended as per the deadlines listed below in rule 9A of the Companies Incorporation Rules, 2014:

- 40 days from the date of approval if fees of INR 1,000 are paid before the expiration of the 20-day period.

- 60 days from the date of approval if fees of INR 2,000 are paid before the expiration of the 40-day period.

- 60 days from the date of approval if fees of INR 3,000 are paid before the expiration of the 20-day grace period.

- Obtaining shareholder approval is number five.

-

Obtaining the consent of the shareholders

- After reserving the name, the corporation should seek shareholder approval as well as Central Government permission. An extraordinary general meeting will be held for the purpose of shareholder approval by issuing notice to all interested parties and marking the attendance of a minimum number of shareholders (quorum).

- Following that, shareholders’ approval will be sought through the passage of a special resolution, which will be subject to the approval of the Central Government.

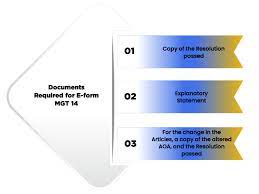

- Within 30 days after the resolution is passed, a special resolution will be filed with the Registrar. Form MGT-14 will be submitted with it, along with attachments such as a certified copy of the special resolution, an EGM notice, an explanatory statement to the EGM, a changed memorandum of association, and a changed articles of association.

Registrar’s Application

Within 30 days of the resolution’s passage, a special resolution will be lodged with the ROC. It will also be accompanied with Form MGT-14, which provides information on special resolution. MGT-14 is accompanied by the following documents:

- Special Resolution certified copy,

- EGM explanation statement,

- Altered Memorandum of Association,

- EGM notice,

- Altered Articles of Association

Following the filing of MGT-14, the firm must file INC-24 with the RoC, together with the required fee, to obtain central government permission for a name change.

Form MGT-14 attachments:

- Certified true copies of the Special Resolutions, together with an explanation;

- Changes to the MOA and AOA.

- Shorter Notice Consent, if applicable

- Certified true copies of the Special Resolutions, together with an explanation;

- Shorter Notice Consent, if applicable

As INC-24 expressly requests the SRN of MGT-14 submitted with RoC, it will be filed after MGT-14 has been filed with the ROC. INC-1’s SRN must also be stated in INC-24. INC-24 must be accompanied by a copy of the minutes of the EGM at which the special resolution was passed.

Attachments to form INC-24:

- Notice and Explanatory Statements are attached to form INC-24.

- A true copy of the Special Resolution that has been certified.

- Changes to the Memorandum and Articles of Association.

- General Meeting Minutes

- Directors’ affidavits

INC-24 also includes information on the grounds for the name change, the number of members who attended the EGM, the number of members voting in favor/against the resolution, and the percentage of shareholding.

Fee for ROC

- RUN FORM: INR 1000/- for a request to reserve a new company name.

- MGT-14: INR 300-600 based on the company’s capital (Refer below Table).

- INC-24: From INR 1,000 to INR 20,000, depending on the type of business and capital (Refer below Table)

| Fee Table for Filing MGT-14 | ||||

| No | Authorized Capital | ROC Fee Payable | ||

| 1 | Less than Rs. 1,00,000/- | Rs. 200/- | ||

| 2 | Rs. 1,00,000/- to 4,99,999/- | INR 300/- | ||

| 3 | INR 5,00,000/- to 24,99,999/- | Rs. 400/- | ||

| 4 | Rs. 25,00,000/- to 99,99,999/- | INR 500/- | ||

| 5 | INR 100,00,000 or More | Rs. 600/- | ||

| Fee Table for Filing INC-24 | ||||

| No | Authorized Capital | OPC & Small Companies | Other than OPC & Small Company | |

| 1 | Upto Rs 25,00,000/- | Rs. 1,000/- | Rs. 2,000/- | |

| 2 | Rs 25,00,001 to Rs 50,00,000/- | Rs. 2,500/- | Rs. 5,000/- | |

| 3 | Above Rs. 50 Lakh to 5 Crores | – | Rs. 10,000/- | |

| 4 | Above Rs. 5 Crores to 10 Crores | – | Rs. 15,000/- | |

| 5 | Above Rs 10 Crores | – | Rs. 20,000/- | |

-

Obtaining Central Government permission

As previously indicated, suggested names should not be confusingly similar to current companies or otherwise undesirable in the eyes of the federal government. A company shall not be registered with a name that contains—

(a) each and every word or expression that is likely to give the impression that the company is in any way connected with, or has the patronage of, the Central Government, any State Government, or any local authority, corporation, or body constituted by the Central Government or any State Government under any law currently in force; or

(b) Any word or expression that may be stipulated in Companies (Incorporation) Rules, 2014, rules 8 to 8B.

unless the use of any such phrase or expression has received prior clearance from the Central Government.

Any change in a company’s name, according to section 13(2) of the Companies Act, 2013, is subject to the provisions of subsections (2) and (3) of section 4 and will not take effect until the Central Government approves it in writing. As a result, every name change must be approved by the Central Government, unless the name change is simply the addition or deletion of the term “private” for turning a public business to a private company or a private company to a public company.

Once Form MGT-14 is filed, Form INC-24 must be filed with the Registrar to gain Central Government approval. The following papers must be added to the INC-24 form:

- Include a note with an explanation.

- An accurate copy of the special resolution that has been certified.

- Changes to the MOA and AOA.

- General Meeting Minutes

- Directors’ affidavits

-

Issuing a certificate of incorporation after registering a new business name

- The Registrar of Companies will issue a new certificate of incorporation if the papers are satisfactory; the company name change procedure will not be complete until the ROC issues the new certificate of incorporation.

- After verifying the form and documentation, the Registrar must be satisfied that all requirements have been completed and then register a new name for the business and issue a new certificate of incorporation in Form INC-25.

-

Requirements after a name change

The business name must be inserted in all copies of MOA and AOA once the new certificate of incorporation is obtained from ROC. The corporation must alter its name in the following papers and locations after the new name has been registered:

(a) paint or affix its name in legible letters on the outside of every office or place where its business is conducted, in a prominent location, and if the characters used are not those of the language or one of the languages in general use in that locality, also in the characters of that language or one of those languages;

(b) If it has one, have its name carved in readable characters on its seal:

(c) Have its name written on all of its business letters, billheads, letter sheets, notifications, and other official documents; and

(d) Have it’s name printed on hundies, promissory notes, bills of exchange, and other specified instruments.

(e) Submit an amendment application as required by the following statutes.

- The Goods and Services Act

- EPF

- The Shops and Establishments Act

- Private Security Agency Act

- The Factories Act; and

- Industry Specific Laws;

- Inter-State Migrant workmen Ac

- ESI

- The Foreign Exchange Management Act.

- Other Labor Laws

Popular Articles: