Govt extends few Direct Tax Timelines due to COVID -19

Page Contents

Govt extends few Direct Tax Timelines due to COVID -19 pandemic

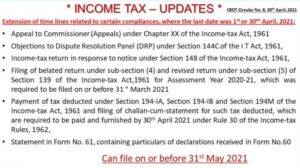

Because of demands from taxpayers, tax experts, professionals, and other stakeholders to further extend various Direct Tax due dates in the light of the COVID-19 pandemic spreading unabated across the world, the Central Govt has agreed to increase specified timelines vide On April 24, 2021, via a press release was issued.

As a result, the Central Govt has granted the time limits to June 30, 2021, in the below cases where the time limit was previously extended to April 30, 2021, through various notifications provided under the Taxation and Other Laws (Relaxation) & Amendment of Certain Provisions Act, 2020, namely:

- The time limit for issuing a notice under section 148 of the income tax Act for restarting assessment where income has escaped assessment;

- The time

- limit for issuing any order for assessment/reassessment under the income tax Act;

- A time limit for issuing an order under the guidance of the DRP under section 144C of the income tax Act;

- Central Govt has also further extended the timeline for having to pay the amount due under the Direct Tax Vivad se Vishwas Act, 2020, without interest, until June 30, 2021.

- Deadline for submitting the Equalisation Levy intimation of processing u/s. 168 of the Finance Act 2016.

Govt has extended the Individuals ITR deadline till September 30 for FY21.

- The CBDT said in a circular that it is extending time restrictions for some tax compliances “to provide relief to taxpayers in light of the severe pandemic.”

Extended due date Summary of as below:

| Particulars | Extended date |

| Vivad se Vishwas Scheme | 31st Jan 2021 |

| ITR Audit Cases | 15th Feb 2021 |

| FY 19-20 GSTR 9 and GSTR 9C | 28th Feb 2021 |

| Individual ITRs | 10th Jan 2021 |

| Tax Audit and other audits | 15th Jan 2021 |

Penalty for late e-filing of income tax returns

The Central Board of Direct Taxes (CBDT) charges a penalty if you fail to file your ITR by the deadline. For late efiling, the maximum penalty is Rs.10,000. The penalty is imposed under section 234F of the Criminal Code.

Popular blog:-

Taxation on Income from Equity and Mutual Fund