export promotion on capital goods

Page Contents

EXPORT PROMOTION ON CAPITAL GOODS

Export promotion on capital goods is a scheme provided by Director General of Foreign Trade (DGFT), which provides a concession on custom duty on import of Capital Goods in order to promote Exports.

This is a policy under which many schemes are available for different kinds of Industrial units under which the company needs to apply for the license to avail benefits under the scheme the company wants to opt for

ZERO DUTY EPCG SCHEME:

This scheme allows the import of capital goods for pre-production, production, post-production purposes at Zero customs duty subject to an export obligation of 6 times duty saved over imports for 6 years.

This is available to a variety of industries such as textiles, plastics, handicrafts, chemicals, ceramic products etc.

But this scheme is not available to such exporters who are already covered under Technology Upgradation Fund Scheme (TUFS), Status Holder Incentive Scheme (SHIS), which are other schemes provided by DGFT.

But if the business line under different schemes is different from the one covered under EPCG, such benefits can be availed.

CONCESSIONAL 3% DUTY EPCG SCHEME:

This scheme allows import of capital goods for pre-production, production, post-production purposes on payment of 3% of Basic custom duty subject to an export obligation of 8 times duty saved over imports for 8 years.

Export Obligation of 6 times of duty saved for the Export Obligation Period of 12 years is available to Agri units and Cottage Sectors and EO of 6 times and EoP of 8 years is available to SSI units whose investment does not exceed Rs.50 Lakhs

Also, Motor cars can also be imported but such provision is available only to Hotels, Tourism industry and Tour Operators subject to the conditions such as:

- Total earnings from such Hotel and tourism industry in current and preceding three years should exceed Rs. 1.5 Crores

- Duty saved should not exceed 50% of average foreign exchange earnings from such hotel and tourism industry.

- Vehicle imported should be registered for tourism purpose only and a copy of registration should be submitted concerned Regional Authority (RA).

- However, vehicle parts cannot be imported under this scheme.

Second-Hand capital goods can also be imported under this scheme and can avail benefits of same.

Spares, molds, Dies, Jigs, Fixtures, and Tools can also be imported under this scheme. Also, the same cane imported for existing machinery subject to an export obligation of 4 times duty saved in case of Concessional 3% duty scheme and 3 times of duty saved in case of Zero Duty scheme.

Note: If any Countervailing Duty is paid in cash, that would not be taken into the computation of net duty saved.

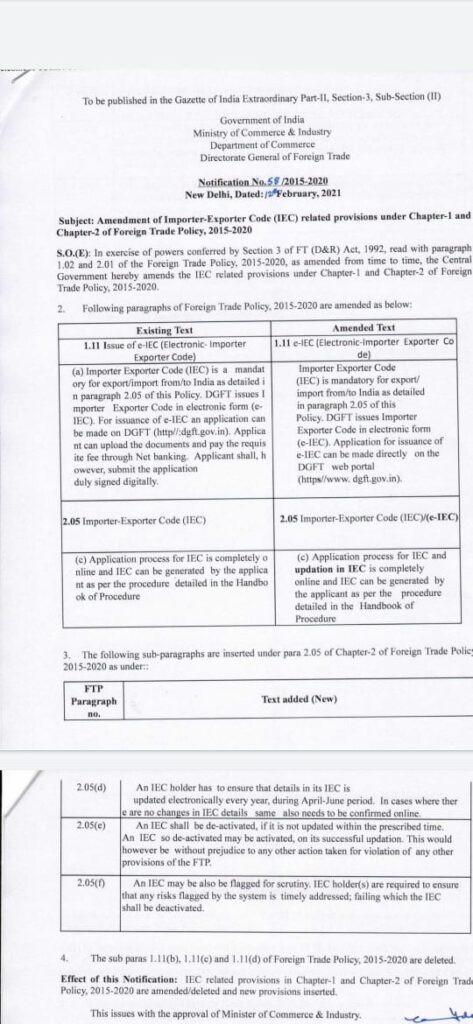

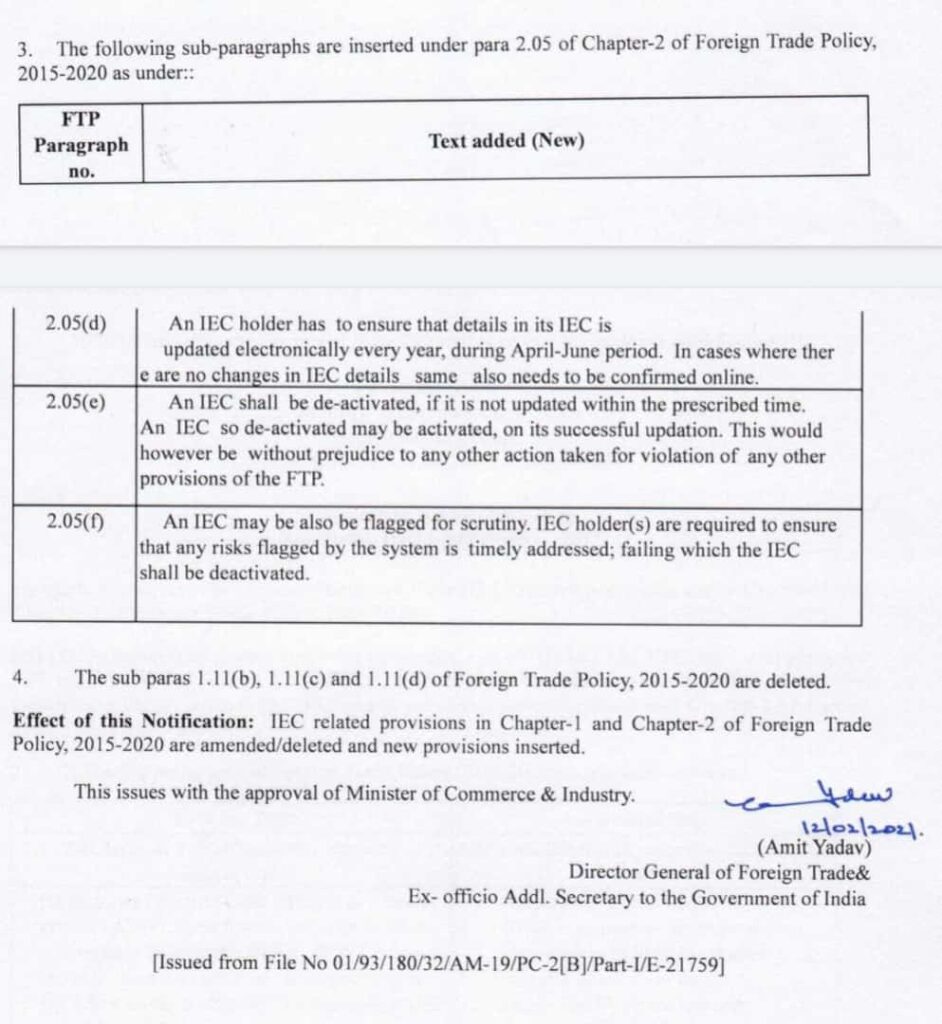

CURRENT CHANGES RELATED TO IEC CODE PROVISIONS IN FTP

Your IMPORT EXPORT CODE required to be UPDATE. BEFORE 30 JUNE 2021 , Otherwise, your upcoming SHIPMENT HOLD will be hold, GOVERNMENT NOTIFICATION – NO 58/ 2015-220 DATE 12FEB 2021

All IMPORT EXPORT CODE holders are required to update and validate their IMPORT EXPORT CODE details, Even without any modifications from April to June each year via online systems, which does not allow their IEC to be deactivated and no activity for import or export.

An IMPORT EXPORT CODE holder shall ensure that the IMPORT EXPORT CODE details are updated every year, during the period April-June, by electronic means.

If IMPORT EXPORT CODE details have not been modified, the required details must also be confirmed online.

If not updated within the prescribed time, an IMPORT EXPORT CODE shall be deactivated. On successful updating, IMPORT EXPORT CODE can therefore be deactivated.

However, this would be without prejudice to any other measures taken to violate any other FTP provisions.

IEC application and update processes in IMPORT EXPORT CODE are fully online, and the applicant can produce the IMPORT EXPORT CODE in accordance with the procedure detailed in the Procedure Manual.

For query or help, contact:singh@carajput.com or call at 9555555480