ESSENTIALS OF GST REGISTRATION & PROCESS IN INDIA

PROCESS FOR NEW BUSINESS REGISTRATIONS & DOCUMENTS REQUIREMENT FOR GST REGISTRATION IN DELHI/INDIA.

WHO ARE LIABLE TO BE REGISTERED?

Following categories of suppliers shall mandatory required to get registered under this Act irrespective of the threshold limit:*

- Persons making any inter-State taxable supply.

- Casual taxable persons.

- Persons who are required to pay tax under reverse charge.

- Persons registered to pay existing taxes that will be subsumed under GST

- Voluntary Registration below threshold

- Unique-id for specific class of persons

- Non-resident taxable persons.

- Persons who are required to deduct tax under section 37.

- Persons who supply goods and/or services on behalf of other registered taxable persons whether as an agent or otherwise.

- Input service distributor.

Persons who supply goods and/or services, other than branded services, through electronic commerce operator.

- Every electronic commerce operator.

- An aggregator who supplies services under his brand name or his trade name.

- Such other person or class of persons as may be notified by the Central Government or a State Government on the recommendations of the Council.

LIABILITY FOR REGISTRATION IN GST

| Region | Aggregate Turnover |

| North East India + Sikkim, J&K, Himachal Pradesh and Uttarakhand | Rs 10 Lakhs |

| Rest of India | Rs 20 Lakhs |

GST REGISTRATION FORMS FOR OTHER STAKEHOLDERS

| Form No. | Form Type |

| Form GST REG-07 | Application for Registration as Tax Deductor or Tax Collector at Source |

| Form GST REG-08 | Order of Cancellation of Application for Registration as Tax Deductor or Tax Collector at Source |

| Form GST REG-09 | Application for Allotment of Unique ID to UN Bodies/Embassies |

| Form GST REG-10 | Application for Registration for Non Resident Taxable Person |

GST REGISTRATION PROCESS IN INDIA

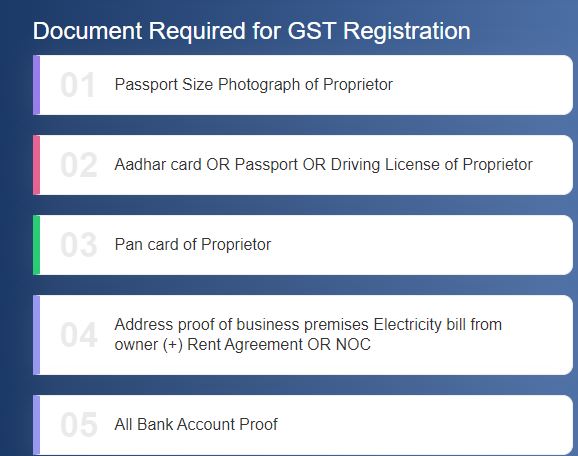

GST REGISTRATION IN DELHI: GST registration is on for DVAT Dealers from 16 December to 31st December 2016. Documents Required For GST Registration:

- PAN Card of business entity

- Proof of constitution

3. Proof of place of business.

4. Bank statement

5. Authorized signatory details

6. Photograph of the Authorized sign

7. Copy of registration certificates

All documents to be scanned and uploaded at www.gst.gov.in in the format.

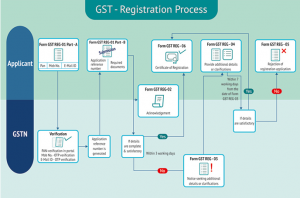

If you are a regular dealer or a composite tax payer, you need to do the following for GST registration:

- Fill Part-A of Form GST REG-01. Provide your PAN, mobile number, and E-mail ID, and submit the form.

- The PAN is verified on the GST Portal. Mobile number, and E-mail ID are verified with a one-time password (OTP).

- You will receive an application reference number on your mobile and via E-mail.

- Fill Part- B of Form GST REG-01 and specify the application reference number you received. Attach other required documents and submit the form. Following is the list of documents to be uploaded –

- Photographs: Photographs of proprietor, partners, managing trustee, committee etc. and authorized signatory

- Constitution of taxpayer : Partnership deed, registration certificate or other proof of constitution

- Proof of principal / additional place of business :

- For own premises – Any document in support of the ownership of the premises like latest property tax receipt or Municipal Khata copy or copy of electricity bill.

- For rented or leased premises – copy of rent / lease agreement along with owner’s (landlord) documents like latest property tax receipt or Municipal Khata copy or copy of electricity bill.

- Bank account related proof : Scanned copy of the first page of bank pass book or bank statement

- Authorization forms: For each authorized signatory, upload authorization copy or a copy of resolution of managing committee or board of directors in the prescribed format.

- If additional information is required, Form GST REG-03 will be issued to you. You need to respond in Form GST REG-04 with required information within 7 working days from the date of receipt of Form GST REG-03.

- If you have provided all required information via Form GST REG-01 or Form GST REG-04, a certificate of registration in Form GST REG-06 will be issued within 3 days from date of receipt of Form GST REG-01 or Form GST REG-04.

If the details submitted are not satisfactory, the registration application is rejected using Form GST REG-05.

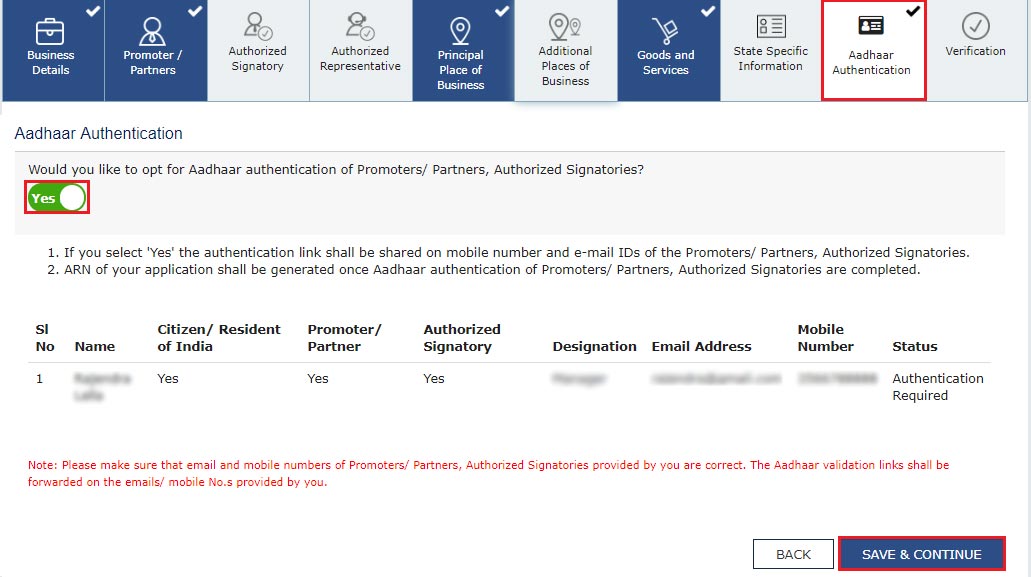

Aadhaar Authentication & E-signature process New GST Registration

You must all observe the Aadhar Authentication text verification code as and when you log in to your GST Profile. Here’s what needs to be done;

Functionality for Aadhaar Authentication and e-KYC where Aadhaar is not obtainable has been deployed to GST Common Portal w.e.f. 6 January 2021 for existing taxpayers. All taxpayers registered as Regular Taxpayers (such as Casual Taxable Person, SEZ Units/Developers), ISD and Composition Taxpayers may submit their Aadhaar Authentication or e-KYC to the GST Portal. This shall not apply to government departments, public sector, local authorities and statutory authorities.

What is Aadhaar Authentication or an e-KYC?

If Aadhaar is available, the mainly Authorized signatory and one person who is Managing Partner/Director / Karta of the entity registered/ Proprietor/Partner can go for the Aadhaar Authentication.

Lack of availability of Aadhaar, You can submit any of the below documents to undergo e-KYC:

- KYC Form

- Passport

- Certificate issued by Competent Authority

- Aadhaar Enrolment Number

- Voter ID Card

- Others

How to make e-KYC on Portal/ Aadhar Authentication

- If a present registered assesses would login first, a pop-up with Question will be shown “Would you like to authenticate Aadhaar of the Promotor/ Partner & Primary Authorized Signatory “with the 2 options “Yes, navigate to My Profile” & “Remind us later stage”.

- When assesses clicks on “Remind us later” pop up will be finished and closed, thereafter user can navigate anywhere on the GST website.

- If the assesse clicks on “Yes, Navigate to My Profile”, GST system will navigate to My Profile. In MY PROFILE, a new tab “Aadhaar Authentication status” has been shown from where link for Aadhaar Authentication to the Primary Authorized Signatory & one of partners/ promoters as selected by him will be sent.

Note: in case the same person is Primary Authorized Signatory & Promoter/ Partner, Aadhaar authentication is only needed to be done for that person.

- On the My profile page, in addition, to send aadhar Authentication Link, the UPLOAD E-KYC documents option will also be displayed to taxpayers from where they can file the e-KYC documents on Portal. In such a case, the process of e-KYC authentication will be subject to the approval of submitted e-KYC documents by the Tax Official.

You would refer below link of the tutorial in case any further clarification is needed;

https://tutorial.gst.gov.in/userguide/registration/index.htm#t=manual_aadhaar.htm

Recommendation/Comments

As per section 25(6A) as per income tax act 1961, which deals with Aadhaar Authentication of existing registered persons states that the Aadhaar Authentication will be done in such form & manner, within such time as may be specified. But, No corresponding amendment/ notification in rules has been carried out. The Govt has straightaway gone to implement the same through the GSTN portal.

However, it is recommended that we needed to undertake the Aadhaar Authentication.

We look forward for your valuable comments. www.carajput.com

We look forward for your valuable comments. www.carajput.com

FOR FURTHER QUERIES CONTACT US:

W: www.carajput.com E: singh@carajput.com T: 9-555-555-460