ALL ABOUT FOREIGN INWARD REMITTANCE CERTIFICATE

Page Contents

FOREIGN INWARD REMITTANCE CERTIFICATE

BRIEF INTRODUCTION

As a merchant or service exporter who receives international payments from customers, a FIRC is a vital document to possess. This guide is meant to assist global eCommerce sellers comprehend the FIRC process. Read on to be told more on what you wish to grasp about getting paid in India and receiving a FIRC.

FIRC: in keeping with the banking company of India (RBI) and also the exchange Dealers Association in India (FEDAI), a FIRC (Foreign Inward Remittance Certificate) may be a document that acts as proof of foreign transfers to India. Many authorities use this document as evidence that a personal or business has received a payment in a very foreign currency from abroad.

In India, sellers and repair exporters are required to FIRC, which may typically take over six months to urge. additionally, customers have to provide paper applications to their banks for each single transaction made and that they would should follow up with banks further. Also, it is commonly seen that banks tends to charge higher fees for processing FIRC requests.

A DOCUMENT AS PROOF OF AN OVERSEAS TRANSFER TO INDIA

According to guidelines from the depository financial institution of India (RBI) and letters circulated by FEDAI (Foreign Exchange Dealers Association in India), the subsequent 2 documents are often issued by A.D (Authorized Dealer) Category I banks in India as proof of foreign transfers to India.

- Physical Foreign Inward Remittance Certificate (FIRC)

A physical FIRC could also be issued just for inward remittances covering Foreign Direct Investment (FDI) / Foreign Institutional Investment (FII). Payments for these purposes are only allowed through banking channels as per RBI guidelines. this implies we can’t complete transfers for FDI/FII on your behalf, so a FIRC can’t be issued.

- Electronic FIRC (e-FIRC)

As per the regulations provided by the RBI, the AD Category I banks is required to report all the money transfers made to India, to Export and Data Monitoring Systems (EDPMS). This includes any advances or outstanding transfers they’ve received for the export of products or software. Banks that receive these styles of transfers will issue an electronic FIRC to EDPMS when the exporter asks them to.

If your transfer falls into this category, it’ll be subject to EDPMS reporting. So please ensure you’re in line with RBI regulations. you’ll check this along with your bank (the one that received the transfer) and so apply for an e-FIRC with one in every of our partner banks (the one that processed your transfer). There are more details on a way to try this below.

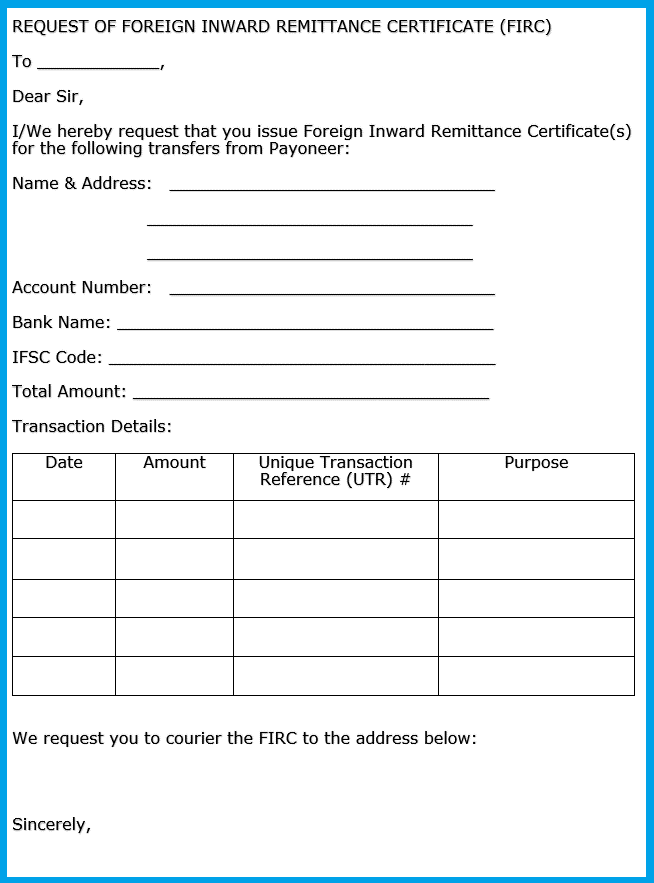

FIRC Request Format

DETAILS PROVIDED IN FIRC DOCUMENT

- Beneficiary’s name

- Indication of whether the quantity is paid by cash or to the person’s checking account

- Name and address of the one that sent the cash

- Name and address of the primary bank who processed the foreign transaction

- Demand Draft (DD) or Telegraphic Transfer (TT) number or Cheque number

- The amount denominated therein foreign currency

- Any equivalent amount as determined in the denomination of rupees (both in words as well as in numbers)

- Name of the recipient of the funds

- The rate of exchange that was applied to the transaction

- The purpose of the remittance

FIRC TEMPLATE

TYPES OF FIRC

- Physical FIRC

Formally discontinued as of 2016, from 2016 onwards remitter banks issue another document called an advice, a press release or a NOC for your home bank to complete the e-FIRC process.

- E-FIRC

This process is completed by your home bank after they receive an advice, statement or NOC from the remitter bank and after they collect additional required documents as explained below. Typically, the house bank, when satisfied with the documents, generate an Inward Remittance (IRM) on the govt. export portal (EDPMS), and also the IRM number is brought up further as e-FIRC number.

PROCEDURE FOR REQUESTING A FIRC OR AN ADVICE

- If your transaction falls under the reporting of EDPMS, your transaction is eligible for an e-FIRC. you’d must follow RBI regulations and also the bank in India where the remittance was received.

- In other cases, to request a FIRC, a letter to the bank will must be sent with the subsequent details of the transaction:

-

- UTR number

- Account number

- Amount of the transfer

- Date of the transfer

- Purpose of the transfer

- Name of recipient

The recipient will then have to pay money for the issuance of the FIRC which can be delivered either physically or electronically.

- Foreign Inward Remittance Advice – If your transfer doesn’t fall in either of those 2 categories above, you’ll apply for an overseas Inward Remittance Advice (certificate of inward remittance) from the partner bank that processed your transfer. Advice is barely available for businesses.

PROCEDURE TO APPLY FOR ADVICE FROM WISE’S PARTNER BANKS

To apply for advice, please contact the banking partner that processed your transfer. we’ve got 2 banking partners in India, Yes Bank and HDFC. you’ll tell which banking partner we used for your transfer by staring at your PDF receipt.

Transfers received via HDFC can issue an e-FIRC if your recipient’s checking account is additionally with HDFC.

You can request an E-FIRC by emailing both vostro@hdfcbank.com and indialink.helpdesk@hdfcbank.com — ensure to connect the transfer receipt.

If your recipient’s bank isn’t with HDFC, you will need to achieve dead set their bank to urge the E-FIRC instead.

If you wish credit advice from HDFC, rather than an E-FIRC, you’ll be able to request this by emailing both vostro@hdfcbank.com and indialink.helpdesk@hdfcbank.com. One important thing to keep in mind, is that the charges for getting credit advice from HDFC depends as follows –

- If the transfer is a smaller amount than a year old — 177 INR

- If the transfer is quite a year old — 354 INR

More read:

- Key characteristics for Auto-population of e-invoice

- Overview of Invoice Furnishing Facility (IFF) Under QRMP Scheme

TRANSFERS RECEIVED VIA BANK

For transfers received via Yes Bank, you’ll request an e-FIRC. to try and do this:

- Pay YES BANK 354 INR for FIRC issuance charges. There are 2 options to pay:

- Transferring the money using NEFT to the account using the following details – Account number: 105051718 IFSC: YESB0000001

- Or by demand draft to YES BANK Ltd, using this address: YES BANK Ltd Inward Remittance Team, 5th floor, Tower 2, India-bulls Finance Centre, Prabhadevi (West), Mumbai – 400013

Keep note of the reference number, as you’ll must send it to YES BANK.

- Send an email to singh@carajput.com with the topic “Request for FIRC advice.”

In the e-mail, you’ll have to include the Inward Remittance Transaction details, a sound purpose code for the transaction, an NOC from the beneficiary bank (unless the payment is thru YES BANK), and therefore the transaction reference number for the FIRC issuance charges you paid. You’ll also must attach the Wise receipt to your email.

- BANK will then verify the small print and send the beneficiary the FIRC advice.

- It takes approximately 7–10 days for completing the steps mentioned above. If you don’t follow the steps exactly, there may be delays in getting the FIRC advice.

- Please don’t courier documents to BANK offices or visit their branches nose to nose to create a FIRC request.

- All the transfers in respect of Export, import, trade, and business related, made to India are regulated as per the guidelines of RBI and FEDAI. Please review these guidelines closely to raised understand whether a FIRC will be issued for your transfer.

- Remember that FDI transfers aren’t allowed under RDA. So, please don’t submit FIRC requests about FDI transfers employing a different purpose code.

ISSUANCE OF E-FIRC

When the export proceeds for an export of products and services is received by a bank apart from the bank through which documents are submitted, the recipient bank issues an e-FIRC to attach the 2. Typically, when the house bank is satisfied with the documents will generate an Inward remittance (IRM) on the govt export portal (EDPMS), and also the IRM number is mentioned further as e-FIRC number.

FAQS ON FIRC

- Who requires a FIRC?

Indian sellers or service providers receiving international payments require a FIRC. Some examples are as follows –

- A salaried individual getting compensation in foreign currency.

- A freelancer getting compensation in foreign currency.

- An E-commerce seller having customers making payment in foreign currency

So, how are you able to obtain a FIRC certificate? Well, before we go on thereto section, we want to brush au fait some related concepts.

- What is Export processing and Monitoring System (EDPMS)?

- RBI launched the Export processing and Monitoring System (EDPMS) portal, an internet software in 2014. It helps digitize export transactions. it’s helped improve foreign trade operations and facilitated the convenience of doing business in India.

- With the introduction of EDPMS, the concept of FIRS (Foreign Inward Remittance Statement) came into play.

- For the realization of export proceeds, FIRS is nearly as good as a FIRC.

- What is IRM (Inward Remittance Message)?

- Inward remittance is any amount of cash transferred in an account.

- However, foreign inward remittance specifically refers to money sent into an account from someone outside the country.

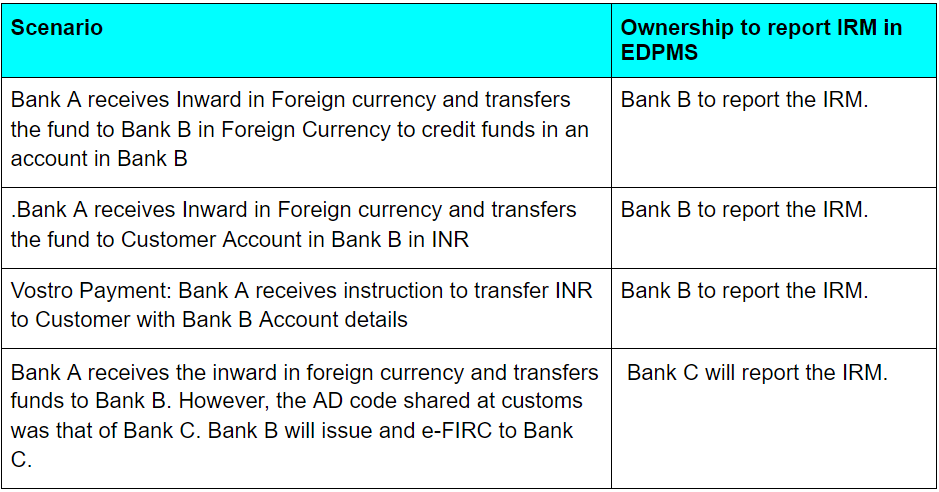

- After the funds are completely credited to the beneficiary account, the bank reports IRM in EDPMS. this can be possible through NOSTRO, VOSTRO or RTGS/NEFT. After that, the house bank uses the IRM to shut the EDPMS entry if they’re satisfied with the bonafides of transactions. Before reporting IRM in EDPMS, the house bank also ensures that there’s no KYC / AML concern.

- What is AD? is that the beneficiary bank the identical because the bank that issues the AD?

- AD stands for ‘Authorized Dealer’ Bank. As outlined in (Foreign Exchange Management Act) FEMA guidelines, banks function AD Category I Banks who are authorized parties to conduct money exchange.

- When an exporter ships his product abroad, it’s to taste Indian customs.

- Here, the exporter needs to submit the IEC code (import-export code) and AD (Authorized Dealer) code against which the shipment is finished.

- Can a person undertake import/export business without having the Import Export Code (IEC)?

On the opposite hand, the Authorized Dealer Code (AD Code) may be a 14-digit numerical code. it’s provided by the bank where the exporter encompasses an accounting. One requires the AD code at every port for custom clearance of the products.

In most cases, the bank that issues the AD code and therefore the beneficiary bank (that received the credit) is that the same. during this case, RJA banking partner will provide the e-FIRS copy to the exporter. The e-FIRS copy is nearly as good because the FIRC itself.

However, just in case the beneficiary bank is different from the AD Bank (whose code is shared at customs), the recipient bank will issue the e-FIRC to the AD bank.

Let us assume that Bank ABC receives the foreign remittance of services and goods.

However, Bank XYZ’s code is submitted at the time of shipment.

So here, Bank ABC will issue an e-FIRC to Bank XYZ. Bank XYZ will pass the IRM to shut the EDPMS entry.

- How do I purchase my digital FIRC?

You will receive your digital FIRC on to your Pioneer account. you’ll be able to then download your digital FIRC within 7-15 days of receiving a payment. Please note: Some outstanding FIRC requests may take longer to process.

- What are the fees related to the digital FIRC?

For a limited time only, your digital FIRC are freed from charge. we are going to notify you beforehand when this offer expires.

- How do I access my digital FIRC?

To access your digital FIRC, please see the section above under How does it work and follow the steps written.

However, you’ll be able to only be eligible for e-FIRC if your transaction falls under the reporting of EDPMS.

- How am I able to get a FIRC in India?

- First of all, a request is to be made in respect of Foreign Inward Remittance Statement or Advice

- Let’s assume you’re a business that has credited a payout to an Indian beneficiary. Once you’ve got credited the payout, your beneficiary would require a FIRS certificate. this can be also called as Foreign Inward Remittance Advice (FIRA) or Advice. The FIRS has got to be requested from the bank that processed the foreign transaction.

It is important to notice that e-FIRS is pretty much as good because the FIRC. you simply have to specifically get the FIRC if the beneficiary bank is different from the bank issued the AD code.

- What is the format of FIRC certificate / FIRC request letter?

To request a FIRC, your beneficiary should draft a letter to their bank. The letter should include these following details:

-

- Beneficiary Details i.e., beneficiary in India

- Buyer Details to spot the overseas buyer

- Details related to the payment or the amount realized in foreign currency, and the same be reported in terms of Indian Rupees.

- The Unique Transaction Number (UTR)

- Purpose Code to spot the character of the cross-border transaction. This will help in identifying the source as well as the destination of funds remitted. it’s extremely important to say the aim of remittance honestly. this can be because banks usually kindle proof of the aim listed by people.

Indian Bank generates the IRM

Once the bank is satisfied with all the documents, it generates an Inward Remittance Message (IRM) on the govt export portal called EDPMS. Thereafter, this IRM number is named the FIRC number.

FIRC is issued

Once the payment is made, the beneficiary bank shall issue the FIRC electronically or physically to the concerned person.

- What is the process of getting the e-FIRS?

The process of getting the FIRC are often a small amount tedious. But there’s the simplest way to chop through this hassle.

If you’re a RJA merchant, the beneficiary email ID is shared with the bank at the time of transfer and our bank partners will issue the e-FIRS on to your beneficiary’s email address. In fact, it’ll be sent on the identical day your payout is processed.

- What is e-FIRC?

e FIRC is that the electronic version of FIRC. Since June 20, 2016, banks have stopped issuing physical FIRC. Now, people use the terms FIRC and e-FIRC interchangeably.

- What is the difference between Physical FIRC and e-FIRC?

- Before the introduction of EDPMS, banks used to issue a physical Foreign Inward Remittance Certificate against every transaction. However, the govt discontinued the physical FIRC in 2016.

- Nowadays, a physical FIRC is simply issued just in case of FDI and FII.

- For all other foreign remittances and transactions, banks issue an e-FIRC.

- Moreover, post the introduction of EDPMS, FIRS is employed today for the realization of export proceeds.

- How does the FIRC and BRC differ from each other?

Often, the difference between the BRC (Bank Realization Certificate) and FIRC (Foreign Inward Remittance Certificate) isn’t very clear.

-

- In case of initial transactions, the beneficiary’s Authorized Dealer Banks will issue both BRC and Foreign Inward Remittance certificates to customers for receiving amounts from foreign countries.

- However, here is what differentiates them: A bank issues the Foreign Inward Remittance Certificate in reference to any receipt of an amount from foreign countries. Now, this amount is often remuneration or advance payment on exports, air freight or ocean.

- The beneficiary’s bank issues the Bank Realization Certificate specifically in respect to the export of products. In fact, bank issue the BRC on each shipment of export proceeds.

- Let us assume you’re an exporter. chances are high that you would like to avail the financial assistance or duty exemptions provided by the Government/ bureau.

- However, these agencies require proof of your exports to say those benefits.

- BRC acts as proof of your export activities and helps you avail those exemptions. RJA banking partner issue the FIRS. On its basis, the beneficiary bank issue the BRC / FIRC.

- Who will issue the FIRC?

The FIRC is issued by the beneficiary bank and its quite lengthy process. However, if you’re a RJA customer, this process is made simpler. Our banking partner would issue an e-FIRS (Foreign Inward Remittance Statement) against every transaction to the beneficiary email address. In fact, our banking partners will issue the e-FIRS on to the beneficiary on the identical day your payout is processed.

- How can your seller/service provider gain instant access to e-FIRS?

- While initiating a transfer request with RJA, please make sure that you include the proper ‘Email ID’ cherish your seller/service provider.

- But understanding a way to get a FIRC certificate is simply half the work done. it’s also important to grasp why.

- What is the utilization of FIRC?

So, why is that the Foreign Inward Remittance Certificate important for your beneficiaries in India? Have a glance It is legal proof

-

- FIRC is evidence for receiving international payments in India. Without it, your beneficiaries may be at risk of legal troubles which might reach your own organization.

- The FIRC & BRC are crucial documents required by DGFT (Directorate General of Foreign Trade), Central Board of Indirect Taxes and Customs to say any export-related incentives.

- In fact, they’re equally crucial to say custom duty exemptions, refunds on service tax or the other financial assistance.

Proof of shares purchased

-

- Let’s take another situation where the FIRC can prove itself indispensable. Assume you issue shares within the name of a person/ company that exists outside a rustic. Here, it acts because the proof of cash received by that person/company in lieu of share application.

- Alternatively, let’s assume that a resident Indian sells or transfers his shares to some non-resident Indian or foreign identity. Here, the FIRC certificate is proof that the resident seller possesses the consideration for the share purchase.

- Moreover, it’s an awfully crucial document which is submitted to DGFT (Director General of Foreign Trade) just in case of EPCG (Export Promotion Capital Goods) and Advance License.

- Export Promotion Capital Goods (EPCG) may be a scheme by DGFT to facilitate import of capital goods. This Scheme allows import of capital goods at zero duty.

- Furthermore, an Advance License is issued to permit duty-free import of inputs that are incorporated within the export product.

To prove no GST on services

-

- If services are exported, no GST is levied. In such cases, FIRC acts as a crucial proof of export of services and remittances which are received in lieu of them.

- What to try to do if the FIRS isn’t received?

Write an email to singh@carajput.com and that we shall facilitate you with a replica copy.

- What is FIRC in export?

FIRC in export could be a certificate issued by banks as proof of international payments. This certificate mentions all the small print of remittance. Exporters may show this certificate to numerous government authorities if they apply for financial assistance and other government support.

- Which bank will report IRM in EDPMS?

- Do freelancers require a FIRC?

If you’re a freelancer and receiving foreign remittances, you may require a FIRC as proof. In fact, this goes for freelance bloggers, artists and sellers similarly.

- What is a Purpose Code?

Reserve Bank of India (RBI) issues the aim Code which may be a unique code to specify the sort of foreign currency transactions. This code is important because RBI prohibits certain kinds of payments. This helps RBI curb illegal transactions.

Hence, the FIRC request letter must have the aim code attached.

- What are the most recent FIRC RBI guidelines?

- You can confer with the most recent version of RBI guidelines on Export of products and Services, as of October 19, 2020.

- Well, that was quite a lot of data.

- We hope this blog helped you understand the ins and outs of the Foreign Inward Remittance Certificate and therefore the process of obtaining it.

- What are the provisions in respect of Inward Remittances?

Inward Remittance is employed for remittance from Overseas Bank to Domestic Bank. Inward Remittance is against Export of Goods/ Services, Investment purpose, Donations, Gifts, etc.

Procedure of Inward Remittance

- Remitter Side:

At the primary stage the Sender of cash (Remitter) goes to his checking account and submit the request for payment into receiver’s (Remittee) account.

For remittance the data required by Remitter bank of Remittee are:

-

- Remittee Name and Address

- Bank Account number

- Bank Branch details

- Swift Code of Bank

- Nationality of Bank

After completion of the transaction Remitter Bank provide an acknowledgement of transfer which the Remitter has got to provide to the Remittee.

- Remittee Side:

After completion of the transfer the Remittee bank holds the number for Procedural completion and compliance check. The Remittee must contact his bank and supply all the relevant documents asked by the Bank.

Generally, documents required by the Bank are:

-

- Invoice against which payment is created

- Contract

- Purpose Code list that the payment is received (Bank Share this list),

- Details of the remittance, invloing the amount in Foreign currency along with the remitter’s name.

- Bank Generally take 1-2 working days to complete the transaction. For First time inward remittance the Bank usually take 3-4 working days.

Other things to be kept in Mind associated with Inward Remittances

-

- The Remittee is required to stay all the records for future reference. Remittee is additionally required to stay a replica of FIRC (Foreign Inward Remittance Certificate) within the records. FIRC will be taken from the Remittee’s Bank.

- For Inward Remittance RBI approval is additionally required in some cases. However, your bank takes care of that almost all of the time.

Bank Charges for Inward Remittances - Generally, no amount is charged by the Bank in respect of inward remittances. However, the Bank charges GST on their fees. So, the GST is payable to the Bank

- Other thing is that there’s difference in rate and also the rate at which the bank clears your funds. Generally, it falls from 50 paise-70 paise per dollar.

- So, overall, your deduction in inward remittance fall to around Rs 1 per dollar.