Documents & Step-by-step process for NBFC Registration

Page Contents

Non-Banking Financial Company (NBFC)

- Non – banking financial companies are companies registered under the companies act,2013, doing the business of loans and advances buying of shares, debentures, securities, hire–purchase, insurance business, and chit business.

- It plays a very important role in access to the financial market, increasing competition, and diversification of the financial sector.

- Simple procedure, customer satisfaction, attractive rate of return on deposit are some of the features that increase the value of non-banking financial companies.

- This is a financial institution that provides financial services to both individuals and business entities.

- Such financial services are similar to those of the banks, but do not require a banking license, but are owned by NBFC License.

- Act as an alternative to banks, providing financial solutions to the unorganized part of the society.

- Documents and Step-by-step process for NBFC registration.

REGISTRATION OF NBFC WITH RBI

NBFC can not start its business as a non-banking financial company unless

- without obtaining the certificate of registration from the bank

- without having a net worth of RS 2 Cr.

A certain category of NBFCs are exempted from registration

- Venture capital fund

- Insurance company a valid certificate of registration issued by IRDA

- Nidhi companies as notified by the companies act

- Chit companies defined in clause b of section 2 of chit funds act, 1982

- Housing finance companies

- A stock exchange or a mutual benefit company.

List of Document & Basic Process for online A Non-Banking Financial Company (NBFC) Registration in India?

- A Non-Banking Financial Company (NBFC) generally refers to financial institutions that do not have a banking license or are not supervised by any national or international regulatory authority.

- Although these organizations provide banking services, but just don’t hold any license and do not accept any kind of deposits from the general public.

Enterprises are not NBFCs in India:

The NBFC doesn’t include the corporations with the main business In India, as follows:

- Purchase & sell of all goods;

- The activity of agriculture;

- Purchase or Sale or Construction of a Property.

- Industrial activities;

Documents required for A Non-Banking Financial Company (NBFC) Registration:

Below is the list of documents required for the registration of an NBFC.

- Copy of MOA and AOA.

- Certificate of company incorporation.

- Information about the management along with the brochure of the company.

- List of directors’ profile duly signed by each director.

- CIBIL/credit reports of the Directors of the Company.

- Address proof supporting office location.

- A board resolution on the ‘Fair Practices Code’ is to be passed and the same copy should be attached along with the documents.

- It is issued by the auditor stating that the company does not hold the public deposit and does not accept it as well.

- A scan copy of the board resolution certifying that the company has not carried out or abruptly stopped any NBFC activity and will not carry any until the registration from RBI is granted.

- Information regarding the bank account, balances, loans, credits, etc. of the directors.

- The Certificate specifies owned funds as on the date of the application from the Statutory Auditor.

- Audited balance sheet and profit and loss statement along with the directors and auditors report of the preceding three years.

- Self-certified copy of the bank statement and Income Tax Returns.

- Information specifying the company’s future plan, generally for the next 3 years, along with the projection of balance sheets, cash flow statement and income statement.

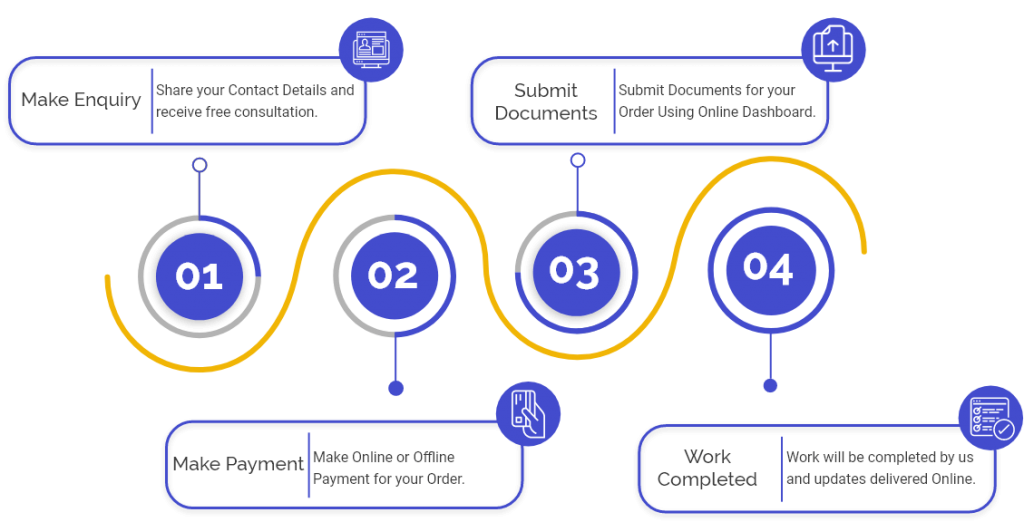

The step-by-step process for NBFC registration.

For any company to be registered as an NBFC a step-by-step process is explained below in detail.

- Register the company under the Companies Act 2013 or the old Companies Act 1956.

- The Net worth of the Funds owned by the Company should be INR 2 CR or more.

- At Least 1 director in the company should be from the same background.

- To register as NBFC a good CIBIL score is required.

- For filling out the application form, visit RBI’s website and completely fill all the required fields.

- Once they submit all the documents along with the application form.

- After the submission of the application form, a CARN number will be generated.

- Then needed to Send the hard copy of the application to the regional branch of RBI.

- After the application is checked and verified, the License will be given to the company.

Process for NBFC Business Commencement:

Pre Loan Disbursement Prerequisites: Before the newly licenced NBFC enters into operation, registrations from all of the following must be required:

- Registration by the Anti-Money Laundering Act;

- Adoption of the Code of Fair Practice.

- Credit rating agencies like CIBIL, ICRA, Equifax and Experian;

- Central-CYC

- FIU-ND:

- A Registration of CERSAI

In addition, all contracts and policies concerning all types of lending and lending procedures, organisational structure, recovery measures, etc. must be in place.

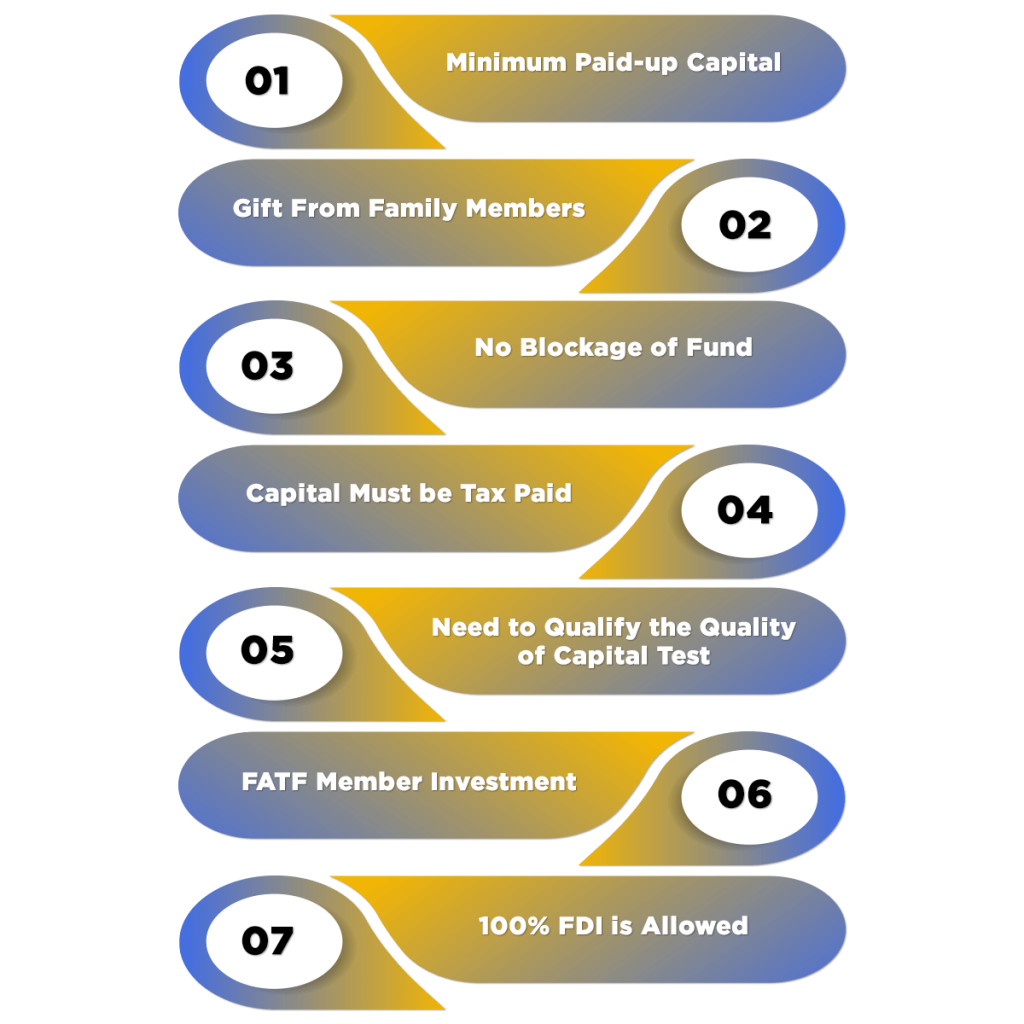

Minimum Capital Requirement for NBFC License Registration

The Minimum Capital needed for Non-Banking Financial Company license registration are as follows:

- 100% of foreign direct investment is Allowed

In Non-Banking Financial Company Sector 100% foreign direct investment is allowed from FATF member countries and under autoroute.

- No Fund Blockage

It shall mandatorily hold Net owned funds of Rs. 2 Cr at the time of registration and at all times thereafter. But you can use the minimum capital for the lending or investment purpose.

- Capital Must be Tax Paid

The Applicant will require to produce the Proof of tax payment against the capital invested in the Non-Banking Financial Company.

- The Minimum Paid-up Capital

Net owned fund of NBFC-ICC (Investment Credit Company) must be more than INR 2 Cr over the life of the Non-Banking Financial Company’s unless otherwise prescribed the RBI.

-

Gift From Family Members

Shareholders should introduce own INR 2 Cr as share capital, However, shareholders can give or take gifts from Close relatives or Spouse

- Required to Qualify the Quality of Capital Test

A Reserve bank of India Conducts quality of capital test and ensure that Capital invested by the shareholders are free from any possible defects or non-compliance with Indian or international laws.

- FATF Member Investment

In Reserve bank of India Only recognize and Approves Non-Banking Financial Company’s Registration or takeover from FATF Member Country Investment in India

FOR FURTHER QUERIES CONTACT US:

W: www.carajput.com E: singh@carajput.com T: 9-555-555-480