Overview on ROC Annual Fillings Under the XBRL

Page Contents

ROC Annual e-Fillings Under the XBRL MCA

- XBRL (eXtensible Business Reporting Language) is a data-rich dialect of XML (Extensible Markup Language), the universally preferred language for the transmission of information over the Internet.

- It was explicitly designed to communicate information between businesses and other users of financial information, such as analysts, investors, and regulators. eXtensible Business Reporting Language is a standardized communication language in the electronic form to express, report/file financial statements by a Co.

- XBRL is a widely accepted, electronic format for corporate reporting. It does not change what has been reported. This only changes the way it is confirmed.

- MCA (Ministry of Corporate Affairs) is the regulatory authority for company law and related matters in India. All companies registered with MCA are required to submit their financial statements to MCA.

When the Statutory requirements for Application of XBRL Submission with ROC/ MCA:

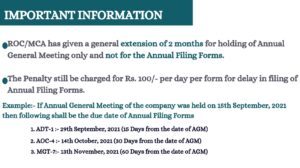

The Below class of corporations shall File their respective financial statements & other papers as per section 137 of the Companies Act 2013 to the Registrar in electronic form AOC-4 XBRL:

- All public companies listed on the Indian stock exchange and their Indian subsidiaries.

- All companies with a turnover of INR 100 CR or more

- companies with paid-up capital of INR 5 CR or more

(other than banking companies, insurance companies, power companies and NBFCs), Visual Representation below for better understanding.

Document required to Filing of Financial Statements in XBRL mode:

The XBRL instance document must be organised as per the MCA Taxonomy (I-GAAP/IND-AS). As per MCA Taxonomy, the comprehensive list of annual reports must be filed in XBRL format. For consolidated and stand-alone reports, separate instance documents are to be prepared. The main aspects of the annual report are listed below:

- BS

- P& L

- Details Schedules and Notes to BS & P & L Statement

- Main Significant Accounting Policies

- Cash Flow Statement

- Schedule of Statement of Change in Equity

- Board Report & Director with annexures thereto

- Statutory Audit Report

in addition to above, there are various other details/documents which are required for XBRL filing. You can contact us for a checklist for XBRL filing.

Financial statements have been prepared in the XBRL system for submitting with the Registrar:

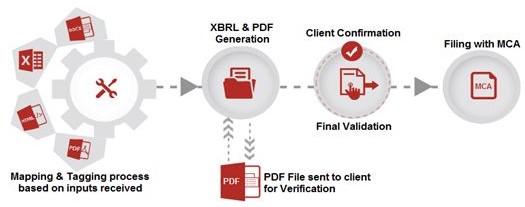

The process of developing and submitting financial statements in XBRL mode is as follows:

Step 1: Creation of an instance document for XBRL

Step 2: Download the XBRL validation tool on the MCA portal.

Step 3: Use this tool to validate an instance report

Step 4: Execute a pre-scrutiny of a validated instance document using a tool.

Step 5: Attach the instance document to the AOC-4 XBRL form

Step 6: Submission Form AOC-4 XBRL to the MCA portal

When your requirement for XBRL filing?

- As per the Companies Act 2013, the below regulation is applicable for XBRL filing the financial statements with the MCA/ ROC Registrar:

| The situation in the case of Company | XBRL Filing of financial statement MCA/ ROC-Registrar: |

| Financial statement adopted at the AGM along with the consolidated financial statements & documents which are attached to the financial statements | Within Thirty days of the AGM along with fees/additional fees as given in regulation |

| In case of an adjourned meeting | Within Thirty Days of the adjourned annual general meeting along with fees/additional fees as given in regulation |

| If financial statements are unadopted | Within Thirty days of the AGM. |

| If an annual general meeting is not held | Within thirty days from the date when the annual general meeting should have been held along with fees/additional fees as given in the regulation. |

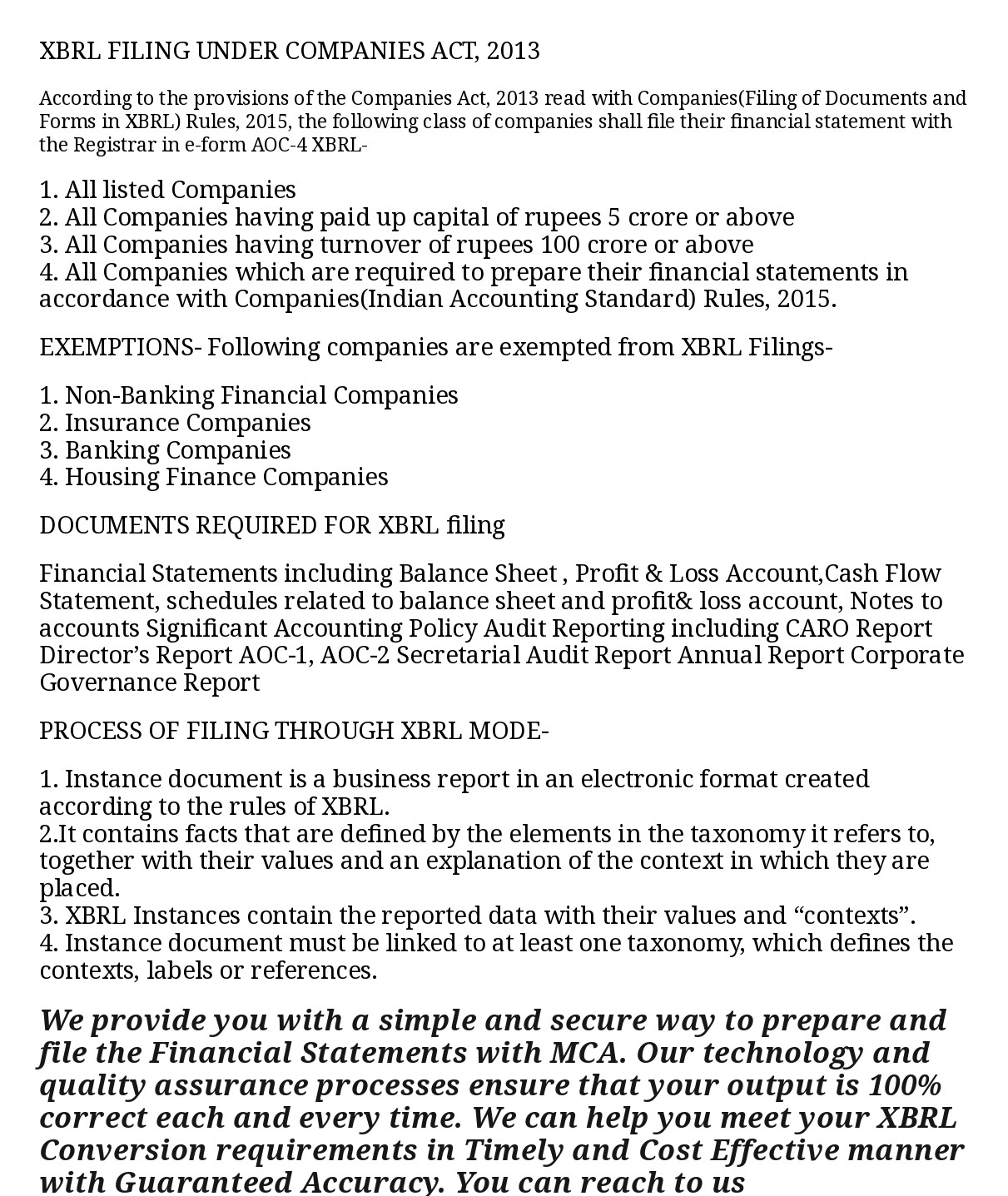

In case event of a delay in filing a financial statement with MCA, the below additional fees shall apply:

| Delay Time period | Applicable Additional fee |

| Delay Time period beyond the period provided U/s 137(1) of the Company Act 2013 – Due dates to file AOC-4 (within 30n days of the date of AGM) | INR 100 perday |

Non-filing form AOC-4 – Penalty:

| Defaulting in the case | Applicable Penalty |

| Company | INR 1k for every day of default subject to maximum of INR 10,00,000/- |

| CFO/MD or In case of the absence of the MD/CFO – Any other Director who the Board assigns the responsibility or In case of the absence of any such Director – All directors of the company | INR 1,00,000/- + INR 100 per day for continuing default subject to maximum of INR 5,00,000/- |

Updated MCA XBRL Validation Tool version and business rules CSR reporting Business Rules related to the XBRL C&I taxonomy 2016 have been revised. Stakeholders are advised to make a note of the changes and use new version of MCA XBRL Validation Tool V3.0.6 while filing AOC-4 XBRL.

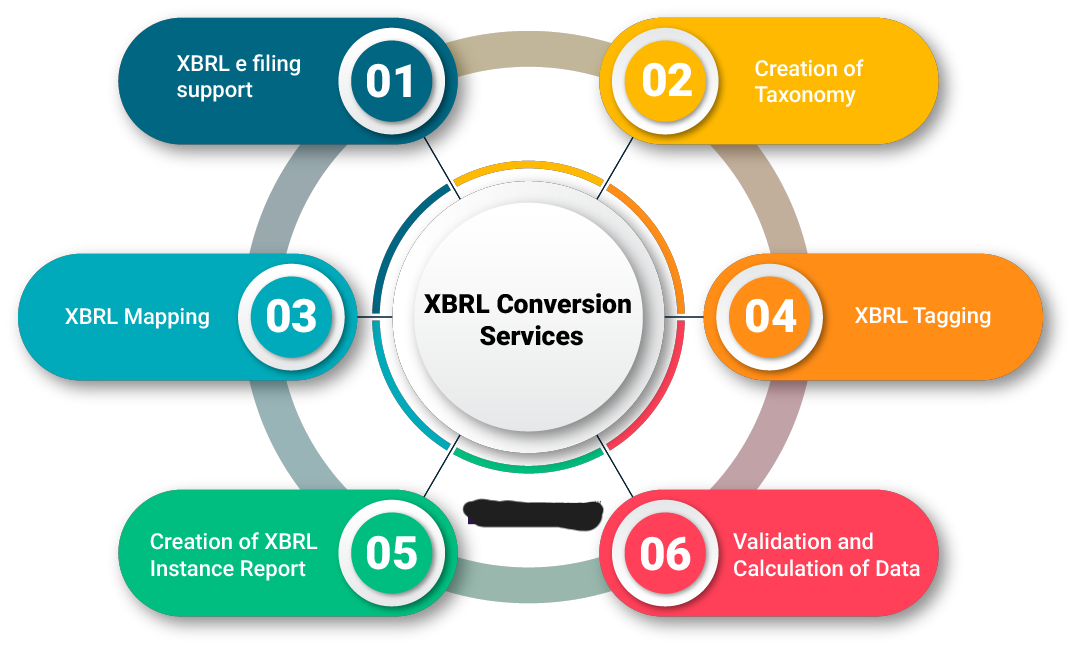

About the Professionals/experts in XBRL:

XBRL Professionals will give you lots a simple and secure way of preparing and file financial statements with MCA. Our technology and quality assurance system ensure that your output is 100% accurate every time. We can help you to meet your XBRL conversion needs in a timely and cost-effective way with Assured Validity. You can reach us at singh@carajput.com.

What we are delivering to clients under ROC Annual Fillings Under the XBRL

- Accuracy: Detailed tagging as per MCA guidelines, no shortcuts;

- Presentation: Tables and texts are formatted to make them readable and notes are given for clubbing of figures;

- Personalized Services with Seamless Communication;

- Full Attention to every Client;

- Timely and Cost Effective;

- Full Confidentiality of Information received.

- We look forward to your valuable comment www.carajput.com

FOR FURTHER QUERIES CONTACT US:

W: www.carajput.com E: singh@carajput.com T: 9-555-555-480