Compulsory HSN and SAC code in Goods and Services Tax

Page Contents

HSN(harmonized system of nomenclature) and SAC codes (Services Accounting Code) in Goods and Services Tax

- Under GST, all goods and services supplied in India have been classified – Goods are classified under the HSN Code(harmonized system of nomenclature) and Services are classified under the SAC Code(Services Accounting Code).

- Based on the HSN or SAC code (Services Accounting Code), GST rates have been fixed in 5 kinds of slabs, like 0%, 5%, 12%, 18%, and 28%.

In the Goods and Services Tax regime, each invoice will have to mention the HSN code (harmonized system of nomenclature) for all goods which are sold and SAC code(Services Accounting Code) for all services which are provided.

Businesses will need to be aware of the HSN code list and SAC code (Services Accounting Code) list for all Goods and Services Tax applicable supplies they are dealing in.

Under Goods and Services Tax, the majority of the dealers will need to adopt two, four, or eight-digit HSN codes (harmonized system of nomenclature) for their commodities, depending on their turn-over the previous year. The following are the detailed requirements:

- Enterprises/ Corporate with sales of less than INR 1.5 crores – will not be required to use HSN codes(harmonized system of nomenclature)

- The Enterprises/ Corporate with sales between INR 1.5 crores and INR 5 crores – will be required to use 2-digit HSN codes(harmonized system of nomenclature)

- Enterprises/ Corporate with sales equal to INR 5 crores and above – will be required to use 4-digit HSN codes(harmonized system of nomenclature)

- Imports / Exports -8-digit HSN codes(harmonized system of nomenclature)

- Services -5-digit SAC codes (Services Accounting Code)

Points to Note

- Usually, Small dealers under the composition scheme will not be required to mention HSN/SAC codes in their invoices.

- The above codes will be required to be mentioned in the invoice & mentioned in the GSTR Returns details, which will be submitted on the GSTN website portal.

- Only During the registration process of the GST, it will be appropriate to note the HSN/SAC supply codes of the business activities.

- You can check GST Rate, HSN Code & SAC Code under the GST Regime

what is UQC?

- UQC stands for Unique Quantity Code. In simple terms, it is a unit of measurement such as 1 kilogramme of wheat, 1 litre of oil etc.

What is UQC in GST?

- As per central goods and Services Tax (CGST) Rules, 2017, any tax invoice, credit note, a debit note must have UQC or quantity unit description.

Read About the Advisory on HSN and GSTR-1 Filing

- As per Notification No. 78/2020 – Taxpayers must declare the Harmonized System of Nomenclature (HSN) Code of Goods and Services supplied by them on raising tax invoices, with effect from 1st April 2021, on the lines below, according to Central Tax, dated October 15, 2020.

| S.No | Particular of Aggregate Turnover in FY | No of Digits of HSN Code to be reported in GSTR-1 |

| 1 | Aggregate Turnover in FY Upto Rs. 5 crores | Four |

| 2 | Aggregate Turnover in FY Above Rs. 5 crores | Six |

- Few taxpayers have reported that the HSN they used for GSTR-1 reporting is not available in the table 12 HSN drop-down. They further said that they are experiencing issues entering the necessary HSN details in table -12 and filing the July 2021 statement of outward supply in form GSTR-1. Furthermore, the HSN field is blank in some JSON files generated by the offline tool, along with other issues as stated below: –

- Click here to view a full advice on what taxpayers should do to remedy the above issues:

CBIC Clarifications Concerning GST Rates.

- CBIC was issued by the CBIC to clarify ambiguities about the tax rates that should be levied in respect of the supplies listed in the circular. (Circular No.163/19/2021-GST, dated 6.10.2021,)

- CBIC issued clarification in order to offer clarity to the tax rates applicable to particular supplies. The same aims to clear up any ambiguity regarding the tax rates that should be applied to the suppliers indicated in the circular. (via Circular No.163/19/2021-GST on 6.10.2021)

Key Analysis of Circular No.163/19/2021-GS has been given for clear understanding objective.

| S. No. | Particulars | Rate | Remarks |

| 1 | Solar PV Power Projects | It was provided that w.e.f. 1.1.2019, goods and services tax will be paid in the ratio of 70:30 for goods and services in respect of specified Renewable energy projects.

Now, even for the period prior to 1.1.2019, the same mechanism will be adopted. The value of goods purchased will be considered to be 70percentage of the gross consideration paid. |

|

| 2 | Copra | 5 percentage | Copra is the dried flesh of coconut used for extracting oil. It separates from the shell skin. Dried or fresh coconuts, with or without shells are exempted.

Copra is distinguished under goods and services tax from dried & fresh coconuts. Hence, it attracts goods and services tax at 5 percentage. |

| 3 | Pure Henna Powder & leaves | 5 percentage | It has been clarified that Henna powder & leaves fall under the Heading 1404 since the heading includes raw vegetable materials primarily used for the purpose of dyeing or tanning, regardless of whether it is used directly or in preparation of dyeing/ tanning extracts. The same goods and services tax rate is applicable for mehndi cones. |

| 4 | Fibre Drums | 18 percentage | Earlier corrugated boxes and cartons would attract goods and services tax at 12 percentage while the rest would attract the rate of 18 percentage. In the case of fiber drums that are partially corrugated,

there used to be a dispute about the rate applicable. To absolve from such dilemma, w.e.f. 1.10.2021 a uniform goods and services tax rate has been prescribed at 18 percentage. Prior to the aforementioned date, even if 12 percentage was charged, it would be considered as fully goods and services tax being paid. No refund will be available if 18percentage was charged prior to 1.10.2021. |

| 5 | Fresh & Dried fruit and nuts | Exempt/5 percentage/12 percentage | Fresh fruit & nuts are supplied as plucked. They continue to be called fresh even if chilled. If fresh fruit & nuts are cooked or otherwise, they cannot be considered fresh.

Dried fruit & nuts include the ones that are evaporated or dehydrated. Dried fruit & nuts even if partially rehydrated, will retain their identity. |

| 6 | BSG, DDGS, and other such residues | 5 percentage | These are classifiable under Heading 2303 and attract goods and services tax at 5percentage. |

| 7 | Sweet Supari and flavored & coated illaichi | 18 percentage | Flavored and coated illaichi consists of cardamom seeds, saffron, artificial sweeteners, and other ingredients.

It is considered a value-added item and hence, not treated at par with cardamom which falls under heading 0908. Sweet and flavored illaichi falls under the heading 2106 just like scented sweet supari. The goods and services tax rate applicable is 18percentage. |

| 8 | Laboratory Reagents and other goods falling under Heading 3822 | 12 percentage | It has been clarified that the goods and services tax rate of 12 percentage will be applicable to all goods falling under heading 3822 whether they happen to be diagnostic or laboratory reagents. |

| 9 | Inverter/ UPS sold along with external batteries | 18 percentage and 28 percentage, respectively | If the price of the Inverter/ UPS, as well as the price of external batteries, is given in the same invoice but separately, then different goods and services tax rates for each will be charged. |

| 11 | Pharmaceutical goods falling under the Heading 3006 | 12 percentage | S. No. 65 of Schedule II mentions an illustrative list. It has been clarified that the goods finding mention under Heading 3006 but not given in entry 65 specifically will also be covered by this entry and attract goods and services tax at 12 percentage. |

| 12 | Tamarind Seeds | Nil rate/ 5 percentage | Nil rate is used where the tamarind seeds are for the purpose of sowing and falling under Heading 1209. W.e.f. 1.10.2021,

these seeds if falling under the same heading and not used for sowing, will be liable to goods and services tax at 5 percentage. |

CBIC advisory on Revamped Search HSN Code Functionality in GST : A revamped & enhanced version of Search HSN Functionality has been launched on the GST Portal. For Complete Details CBIC advisory click here

Summarizing

- Alongside India’s move to GST, begins to move to an online tax system and HSN codes to categorize goods for taxation purposes.

- It’s all designed to bring more homogenous taxation and ease of biz. HSN codes will now be used for filing returns, invoices, etc., rather than written descriptions.

- They will all necessitate a few other prep work from professionals as well as taxpayers, but automated GST compliance remedies are available to assist smooth the transition.

For more details you may refer to Hand Book on Classification under GST Act

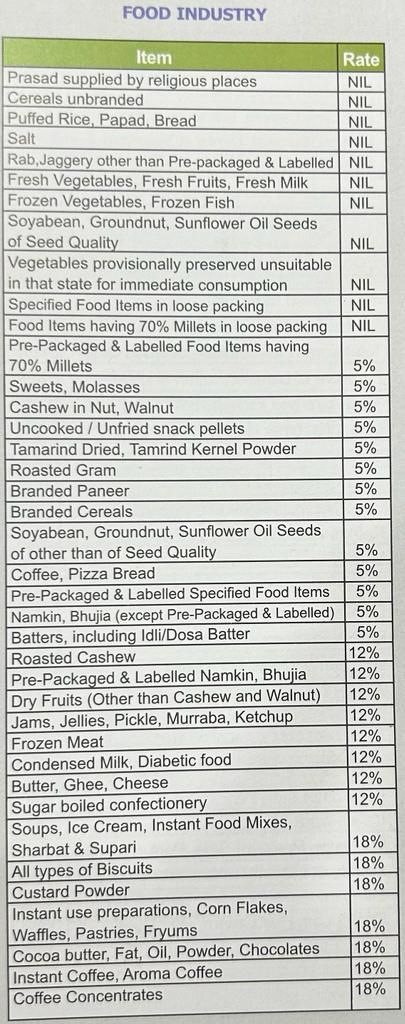

Various Food Industry GST Rates

Pharmaceutical Products – GST Rate

| Particular | % of GST Rates |

| Human Blood and its components | NIL |

| Animal or Human Blood Vaccines | 5% |

| All types of contraceptives | NIL |

| Ostomy appliances including pouch or flange, stoma adhesive paste, barrier cream, irrigator kit, sleeves, belt, micro-pore tapes | 5% |

| Pharmaceutical goods specified in Note 4 to this Chapter [i.e. Sterile surgical catgut, similar sterile suture materials (including sterile absorbable surgical or dental yarns) and sterile tissue adhesives for surgical wound closure; sterile laminaria and sterile laminaria tents; sterile absorbable surgical or dental haemostatics; sterile surgical or dental adhesion barriers, whether or not absorbable; Waste pharmaceuticals] [other than contraceptives] and Ostomy appliances | 12% |

| Insulin | 5% |

| Diagnostic kits for detection of all types of hepatitis | 5% |

| Desferrioxamine injection or deferiprone | 5% |

| Cyclosporin | 5% |

| Medicaments (including veterinary medicaments) used in bio-chemic systems and not bearing a brand name | 5% |

| Oral re-hydration salts | 5% |

| Drugs or medicines including their salts and esters and diagnostic test kits, specified in List 1 appended to this Schedule | 5% |

| Formulations manufactured from the bulk drugs specified in List 2 appended to this Schedule | 5% |

| Medicaments (including those used in Ayurvedic, Unani,Siddha, Homeopathic or Bio-chemic systems)) | 5% |

| Following goods namely:- a. Menthol and menthol crystals, b. Peppermint (Mentha Oil), c. Fractionated / deterpenated mentha oil (DTMO), d. Dementholised oil (DMO), e. Spearmint oil, f. Mentha piperita oil | 12% |

| Glands and other organs for organo-therapeutic uses, dried, whether or not powdered; extracts of glands or other organs or of their secretions for organo-therapeutic uses; heparin and its salts; other human or animal substances prepared for therapeutic or prophylactic uses, not elsewhere specified or included | 12% |

| Animal blood prepared for therapeutic, prophylactic or diagnostic uses; antisera and other blood fractions and modified immunological products, whether or not obtained by means of biotechnological processes; toxins, cultures of microorganisms (excluding yeasts) and similar products | 12% |

| Medicaments (excluding goods of heading 30.02, 30.05 or 30.06) consisting of two or more constituents which have been mixed together for therapeutic or prophylactic uses, not put up in measured doses or in forms or packings for retail sale, including Ayurvedic, Unani, Siddha, homeopathy and Biochemic systems medicaments | 12% |

| Medicaments (excluding goods of heading 30.02, 30.05 or 30.06) consisting of mixed or unmixed products for therapeutic or prophylactic uses, put up in measured doses (including those in the form of transdermal administration systems) or in forms or packings for retail sale, including Ayurvedic, Unani, homeopathy siddha or Biochemic systems medicaments, put up for retail sale | 12% |

| Wadding, gauze, bandages and similar articles (for example, dressings, adhesive plasters, poultices), impregnated or coated with pharmaceutical substances or put up in forms or packings for retail sale for medical, surgical, dental or veterinary purposes | 12% |

CBIC notifies GST Rate hike from 5% to 12% on Fabrics, Apparel, Footwear w.e.f. 1st January 2022

- Central Board of Indirect Taxes and Customs Notified the hike in GST rate from 5% to 12% on Fabrics, Apparel, and Footwear w.e.f. January 2022 Vide Notification No. 14/2021-Central Tax (Rate) dated 18th Nov 2021

Popular Blog:-

All about Provisional Attachment of Property GST

Key GST Compliance Calendar for the 2022