CBDT Allowed HRA who pay rent to their parent, spouse/family

Page Contents

CBDT : Allowed HRA Exemption who pay rent to their parents, spouses/ family Members

For individuals that pay rent and live in rented housing, the Income Tax Act of 1961 provides the House Rent Allowance (HRA) as a way to reduce taxes. This clause also applies for individuals who rent to their parents, spouses, or other family members. However, these situations frequently have unique requirements and complications.

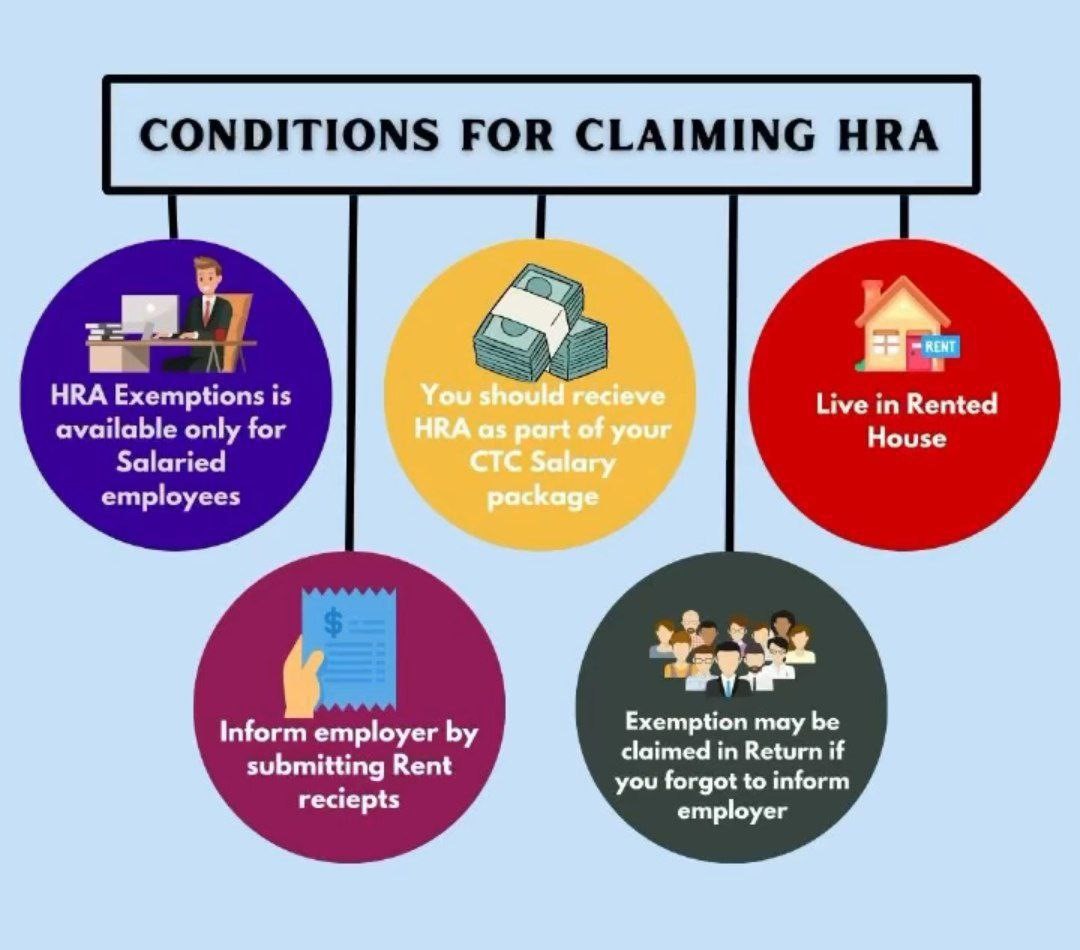

Conditions for Claiming HRA Deduction:

It’s important to fulfill all the conditions mentioned under Section 10(13A) to claim the deduction. Any misrepresentation or failure to meet these conditions might lead to tax scrutiny or penalties.

-

- The individual must be a salaried employee.

- HRA must be a part of their salary package.

- The individual must actually incur expenses on rent for the house they reside in.

- The house should not be owned by the employee himself/herself.

Amount of Deduction: The amount deductible is the least of the following:

-

-

- Actual HRA received.

- 50% of salary (for employees living in metro cities) or 40% of salary (for employees living in non-metro cities).

- Rent paid minus 10% of salary.

-

The basic provision of House Rent Allowance specified for exemption under section 10(13A) of the Income Tax Act 1961. Tax Law allows salaried individuals to claim deduction for HRA under section 10 (13A). Said of House Rent Allowance deduction available is the least of the following amounts:

- Actual House Rent Allowance received

- 50% of [basic salary + Dearness allowance] for those living in metro cities (Mumbai, Delhi, Kolkata or Chennai)

- 40% of [basic salary + Dearness allowance] for those living in non-metros

- Actual rent paid (-) 10% of basic salary + Dearness allowance

As of last update in the Income Tax Act of 1961, the eligibility to claim HRA depends on various factors, including your relationship with the property owner and the actual payment of rent. House Rent Allowance is typically claimed by individuals who are living in rented accommodation and receiving a specific allowance for the same from their employer.

Important Point to be taken care while claiming HRA Exemption

In case Taxpayer is living with his own parents or spouse & paying them rent, He may still be eligible to claim House Rent Allowance, but there are certain conditions that need to be met specified to be fulfilling Under Section10(13A) the Income Tax Act of 1961.

- Actual Payment of Rent: You should actually make the rent payments to your parents or spouse. The arrangement should not be just on paper; there should be a real transfer of funds.

- Ownership by Parents/Spouse: The property should be owned by your parents or spouse. If you are paying rent to them for a property they own, you may be eligible for House Rent Allowance.

- Genuine Rental Agreement: There should be a valid and genuine rental agreement between you and your parents or spouse. This agreement should specify the amount of rent to be paid, the duration of the rental, and other relevant details.

- CBDT Circular 01/2019: As per CBDT (Central Board of Direct Taxes) Circular 01/2019, If rent paid exceeds INR 1,00,000/- per annum, it is compulsory for the salary employee to report Permanent account number of the landlord to the employer along with the following details as per income tax specified Form 12BB:-

o Actual Rent paid to owner / landlord.

o landlord Name

o Address of landlord.

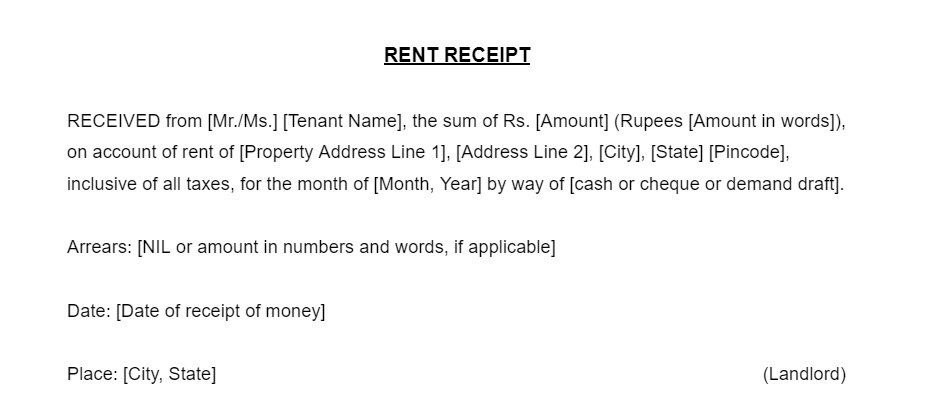

Rent Receipt Format- Rent Receipts are useful when you claim HRA deduction :

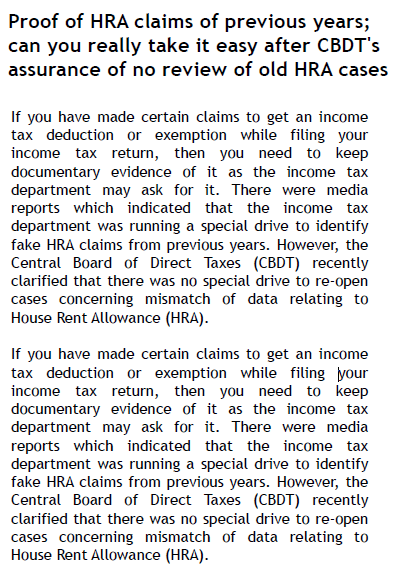

Other Point to be taken care while claiming HRA :

Few other points to be noted while claiming deduction & fulfilling conditions mention U/s 10(13A) the Income Tax Act of 1961:

o The employee must be a salaried individual & Salary employees must be paying rent for the residential accommodation.

o The employee must not own any residential accommodation in the place where they are currently residing.

o Salary Employees must have proof of rent payment, such as rent receipts or a rental agreement.

o HRA deduction can only be claimed for the current FY.

o Income Tax deduction cannot be claimed if the employee is also claiming a deduction for rent U/s 80GG.

Question: HRA Exemption Query : The client received an income tax notice. He failed to deduct tax on rent paid by him, which is more than Rs 50,000/- per month and on the basis of HRA exemption claimed, the same suggestion has been given by the ITD to file ITR-U. The employee claimed HRA exemption under Section 10(13A). Rent paid exceeded ₹50,000/month, thus triggering TDS obligation u/s 194-IB (1). No TDS was deducted or deposited, even though bank transactions may reflect rent payments. The Income Tax Department has detected this likely through data triangulation: Like HRA claims in ITR, No TDS reported in TDS returns (Form 26Q), possibly thelandlord’s ITR disclosure under “Income from House Property.”

Ans.: Responding to HRA Exemption Query :

While HRA was claimed without TDS deduction, it does not automatically render the claim invalid, provided the rent was actually paid and appropriate documentation exists (e.g., rent agreement, landlord PAN, payment proof). Two options are available:

Option A: Retain HRA Exemption (if claim is genuine)

-

File Form 26QC and deposit TDS now.

-

Maintain supporting documents: rent receipts, rent agreement, landlord’s PAN,

-

Respond to the notice through e-proceedings or grievance redressal (if applicable),

-

No need to file ITR-U if TDS compliance is regularized and claim is valid.

Option B: File Updated Return (ITR-U)

-

If supporting documents are unavailable or incomplete, or if the taxpayer prefers to avoid potential scrutiny, File ITR-U and withdraw the HRA claim voluntarily, accepting additional tax liability and applicable penalty.

Landlord Disclosure & Risk of TDS Default : As rightly pointed out, the landlord is also expected to report rental income under “Income from House Property” in their ITR. This strengthens the department’s ability to triangulate data. Even if the HRA exemption is withdrawn by filing ITR-U, the department may still issue a TDS default notice under:

-

Section 201(1) (failure to deduct),

-

Section 201(1A) (interest for late deduction/deposit),

…based on:

-

Rent payments visible through bank records,

-

High-value transaction alerts,

-

Landlord’s disclosure,

-

HRA exemption previously claimed.

Hence, non-compliance with TDS requirements is not a viable long-term option.

Recommended Course of Action :

Accordingly, the following steps are advised: We advices advised Taxpayer to deposit TDS immediately. Interest may be deposited later when the demand is raised. Moreover, the landlord is also obligated to report the tenant’s details in their ITR u/h Income from House Property. Given that the tax department has triangulated the transaction, non-compliance with TDS requirements appears improbable.

-

Immediately deposit TDS using Form 26QC for each applicable year.

-

Preserve all rent-related documentation: rent agreement, receipts, landlord PAN.

-

Retain the HRA claim, if the rent payment is genuine and supported.

-

File ITR-U only if the client lacks documentary proof or prefers to preempt scrutiny.

-

Wait for any demand notice for interest under Section 201(1A) and pay accordingly.

-

Ensure the landlord reports rental income properly to avoid mismatch in department records.