Significance of Aadhar Card, Process PAN Linking

Page Contents

Basic of Significance of Aadhar Card, Process PAN Linking

Importance’s and Process of PAN & Aadhaar linking

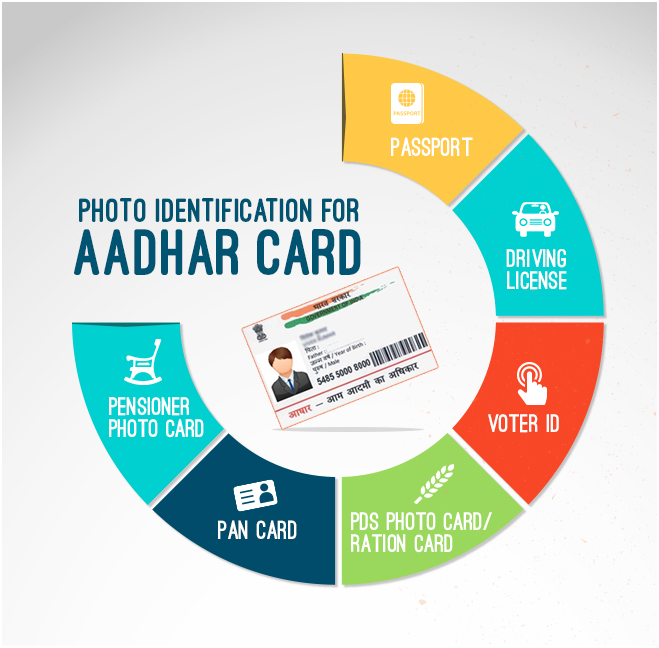

Aadhaar Card is a verifiable 12-digit identification number issued by India’s Unique Authority for Identification (UIDAI). It acts as evidence of identity and as proof of residence.

PAN or Permanent Account Number is an alphanumeric identifier of ten characters issued by the Income Tax Department under the supervision of the Central Direct Tax Board (CBDT). It is necessary for income tax filings and also acts as proof of identity.

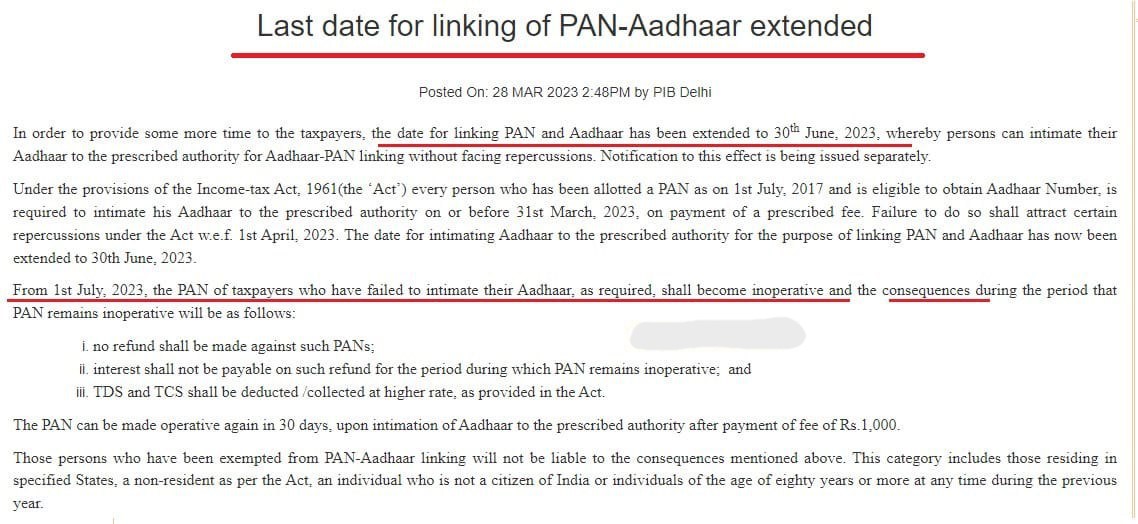

There are about a few days left to end PAN-Aadhaar linking completion date. Within the next few days, if PAN not linked to Aadhaar it becomes useless from next month. Moreover, there is no need to worry about those who have already linked their PAN to Aadhaar. The Ministry of Finance’s (CBDT) issued a notice clarifying the time limit for PAN-Aadhaar.

The CBDT statement said, “In some media sections it has been reported that certain PANs that are not linked to the Aadhaar number may be nullified. The central government has considered the matter and now the cut-off date for notifying the Aadhaar number and linking PAN with Aadhaar is —– unless formally exempted.

The Supreme Court claimed that quoting Aadhaar Card is necessary for the filing of income tax returns and the implementation of a new PAN. Section 139 AA(2) of the Income Tax Act states that as of 1 July 2017, every person with PAN who is qualified to obtain Aadhaar must notify tax authorities of his Aadhaar number.

The Income Tax Department has listed various ways for income tax assesses to link their Aadhaar to PAN on its website – incometaxindia.gov.in.

What are the benefits of linking PAN and Aadhaar card :

PAN and Aadhaar are both considered proof of identity for resident Indians. The benefits of linking a PAN card to an Aadhaar Card are:

–In the case of Individuals

- Linking the Aadhaar to the PAN would make the process of income tax filing simpler and much more convenient. It’ll also help an individual avoid the physical signature and digital signature process while filing income tax.

- It also helps an individual open a bank account electronically without any further documents being provided.

- The individual is given the option of verifying their tax filings with their own Aadhaar card.

- It will allow the individuals to display all transactions by log in to Income Tax.

`In the case of Government

- The multiple tax evasion PAN card dilemmas will be solved as Aadhaar is linked to unique biometric identification. It will also help the government identify all transactions, thus reducing tax avoidance and increasing the government’s direct tax.

- The Black-money issue must be curbed.

- Tax evasion is a thing of the past. The huge taxpayer base would allow the government to lower the tax rate, as it will be compensated by higher wages.

Mistakes that may lead to Trouble for us.

The link can be easily made on the website of the income tax department, or even via SMS.

However, a number of PAN card holders have trouble making the link simply because the records of either the Income Tax Department or India’s Unique Identity Authority (UIDAI) have a mismatch. The I-T department issues PAN cards while Aadhaar cards are issued by the UIDAI

There may be at least three types of cases where linking between PAN-Aadhaar is expected to fail.

Earlier, the UIDAI had a provision to permit linking in case of minor name differences but with effect from December 2017, the provision was deleted. Around the time, Aadhaar authentication was possible by using an OTP-based verification if the cardholder’s name had a minor change.

“It is hereby accepted to discontinue the provision of partial matching in demographic authentication in order to remove any chance of wrongful identity verification using demographic authentication,” a UIDAI memorandum said.

PAN cardholders have been asked also by the Income Tax department to ensure that the Aadhaar number and the name as per Aadhaar are exactly the same in the PAN card.

Income Tax PAN Forms

Part- 1: Application for allotment of PAN and TAN

| Sr. No | Form Number | Description |

| 1. | FORM NO. 49A | Application For Allotment of Permanent account number

[In the case of Indian citizens/Indian Companies/Entities incorporated in India/unincorporated entities formed in India] |

| 2. | FORM NO. 49AA | Application for Allotment of Permanent Account Number

[Individuals not being a Citizen of India/Entities incorporated outside India/Unincorporated entities formed outside India] |

| 3. | FORM NO. 49B | Form of application for allotment of tax deduction and collection account number under section 203A of the Income-tax Act, 1961 |

Part- 1A: Form for declaration for a person having transaction specified under rule 114B and does not have PAN

| Sr. No | Form Number | Description |

| 1. | FORM NO. 60 | Form for a declaration to be filed by an individual or a person (not being a company or firm) who does not have a permanent account number and who enters into any transaction specified in rule 114B |

2) In case mismatch in Date of Birth of the person

If in either of the two documents you entered an incorrect birth date, you are in for some trouble. Aadhaar cars won’t be linked to a PAN card if your date of birth is not matched. In situations where the Aadhaar card only contains the year of birth then the records in the PAN card should match.

3) In the case of gender Mismatch found

In the worst cases where either PAN or Aadhaar accidentally mentions gender, the linking is bound to fail. “Like that of Aadhaar, the I-T department must confirm your name, date of birth, and gender as per PAN,” says the income tax e-filing portal.

Popular blogs: