Section 234F -Fee for delay in filing Income-tax return

Page Contents

Section 234F -Fee (Penalty) for delay in filing Income-tax return

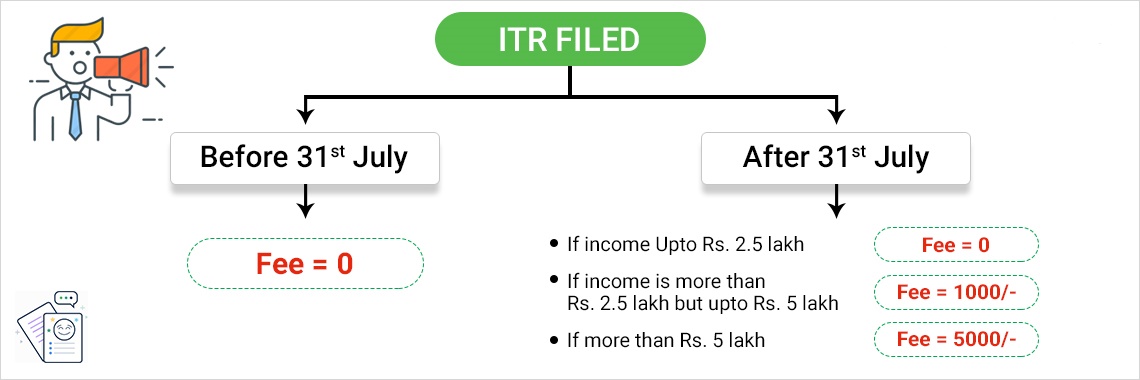

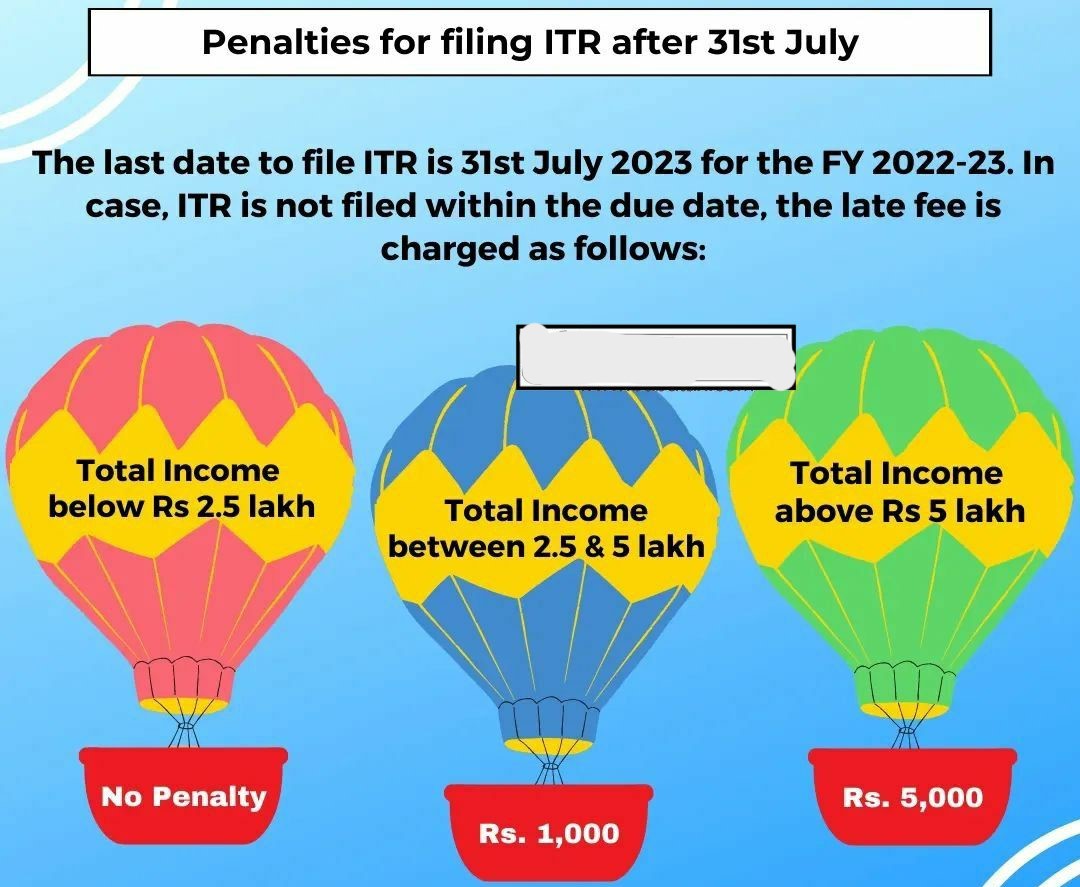

- Under this section, the fee (penalty) is levied if the Income-tax return is not filed within the due date.

- As per Section 234F of the Income Tax Act. Provisions of Section 234F of the Income Tax Act are as follows.

- Section 234F: New penalty for late filing of Income Tax Return under section 234F is introduced in Budget 2017. This penalty is applicable for the assessment year.

- If a person who is compulsorily required to file Income Tax Return (ITR) under section 139, doesn’t file a return on time then he is liable to a penalty as follows

| Total Income | Return filed | Fee (Penalty) |

| Exceeds Rs. 5 Lakh | On or before 31st December of Assessment Year but after the due date | Rs. 5,000/- |

| In any other case | Rs. 10,000/- | |

| Upto Rs. 5 Lakh | After the due date | Rs. 1,000/- |

Let us discuss the above provision below:-

AMOUNT OF PENALTY

For a person with a Total Income of more than Rs. 5,00,000. The penalty amount would be as follows:-

- If ITR is filed on or before 31st December following the last date – Rs. 5,000

- If ITR is filed after 31st December – Rs. 10,000

For a person with a Total Income of up to Rs. 5,00,000 – Rs. 1,000

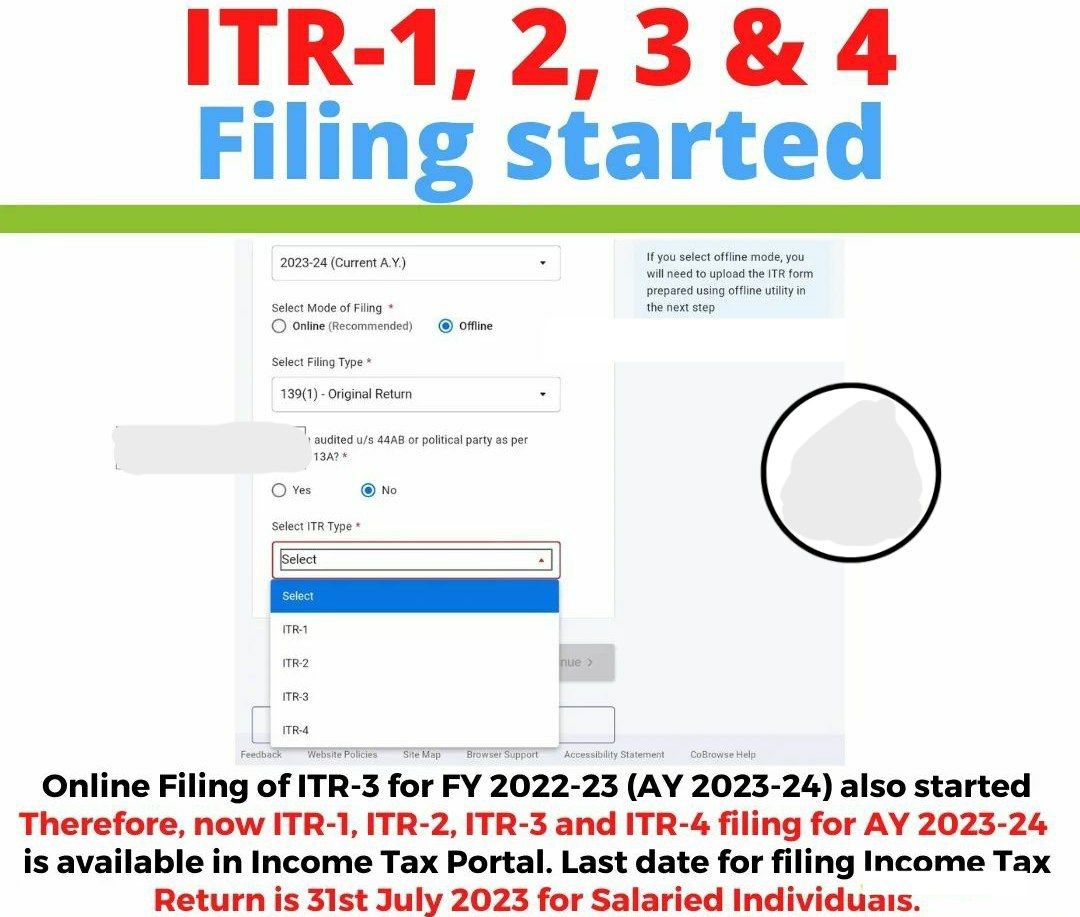

Online Income Tax Return Filing in India | INCOME TAX E-FILING

- E-Filing Income Tax return is a filling process via this Associations/ Individuals/HUF/Businesses provide details related to their income whole Financial year and accordingly Income tax if needed to filed.

- Income tax e-filing Process comes into existence when the final income of the assesse is computed from all the sources and Subsequent income tax is computed.

- Different Income Tax form is specified that is based on the Income sources earned by assesse.

We offer our service in all Taxation and Various Registration related services managed by professional,

our bouquets of services portfolio are:

| S.No. | COMPLIANCES | NATURE OF COMPLIANCES |

| 1 | INCOME TAX | Return Filing, Tax Deposit, TDS Returns, TAN, PAN, MAT, Tax Planning, NRI Taxation, Scrutiny, Assessments, Representing for Appeals etc. |

| 2 | GST | Registration, GST Tax Deposit, Monthly & Annually Return Filing, Input Credit, Department Notice, Assessment, And Other Compliance. |

| 3 | COMPANY PVT. LTD./LTD/LLP | Company Incorporation, Minutes, Annual Filing, Income Tax Return Filing, Routine Compliance, Section 8 Company, Nidhi Company, Inspection & Investigation for Mergers & Takeover. |

| 4 | SOCIETY/ TRUST (NGO) | Registration of Society/Trust, All India society, MOA, Income Tax Return Filing, Registration 80G & 12A, Utilization Certificates, Regs in NITI Aayog/NGO Darpan, etc. |

| 5 | PARTNERSHIP FIRM | Partnership Deed, Registration, Accounting, Income Tax Return Filing etc |

| 6 | PROPRIETOR FIRM | Registration, Accounting, Income Tax Return Filing, Refund etc. |

| 7 | IMPORT-EXPORT CODE | Registration

& Amendment |

| 8 | ACCOUNTING | Accounting of Prop. The firm, Partnership Firm, Company, Trust, Society, Proper Accounting in Tally, Ledger Management, Inventory Management, etc |

| 9 | OTHER REGISTRATION &COMPLIANCE | SSI/MSME REGS, ESI, EPF, GMP CERTIFICATION, CGMP, HACCP, SA 8000, UL MARKING, CE MARKING ETC. |

Why you required expert advices for ITR e-filling expert?

- As the deadline to submit income tax returns near, the pressure on paid individuals grows. Due to the large number of annual expense filers in recent times,

- It’s extremely difficult to find a CA or income tax filer who is ready to work for less money. Saving money on taxes is a major concern, particularly for people who get paid on a monthly basis.

- A re-visitation of getting back the allowance as TDS is required for some people.

- Few common mistakes which many persons or individuals do during the e-filing, Income tax return filling process like as:

- Placing in incorrect personal details

- Choosing an incorrect Income tax form

- Failure in Form 26AS & TDS information reconciliation

- Missing to reporting of source of Income

- Possible deductions that could be claimed

Income tax e-filing 2020-21 have so many different deductions, new ITR forms, income tax slab rates & income tax return due date extended etc.

So as to minimize your Income tax amount and maximise your Income effectively you should required to be in touch with our ITR e-filing experts.

Contract us to Know more about the consequences and penalties for late filing income tax returns. We also handle tax & registration services , We are always available with the best of our assistance and services for you.

Popular Article :

Delay in the deposit of Employer provident fund during the lockdown