overview of section 50c & its application

Page Contents

Section 50C – Taxability of Land or Building Sales

Due to the country’s massive population, there is always a high demand for real estate in India, which usually outnumbers supply.

This demand-supply relationship, as well as people’s desire to acquire more, causes real estate prices to rise, resulting in significant gains for the seller. Such gains are unlikely to fall outside of the tax rate.

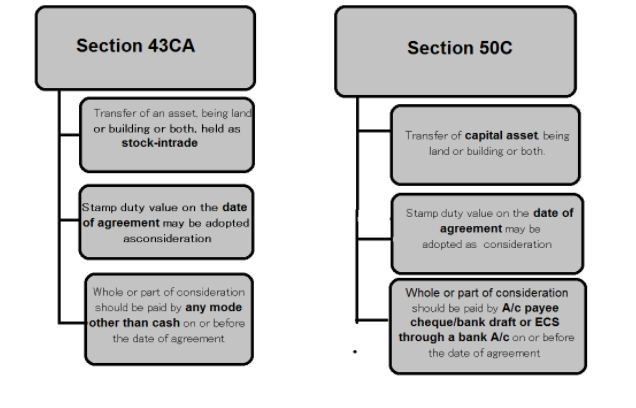

If the whole or part of the consideration was paid by an account payee cheque, account payee bank draught, or use of an electronic clearing system through a bank account on or before the date of the agreement for the transfer of such immovable property, the stamp duty value on the date of the agreement may be adopted as full value of consideration of immovable property, being land or building or both {Section 50C}

Recent Updates – November 2020:

The Finance Ministry increased the safe harbour rate under section 43CA of the Income Tax Act from 10% to 20%.

This means that the amount of fluctuation that can be allowed between the real selling consideration value and the stamp value of the property can now be increased.

What does Section 50C necessitate?

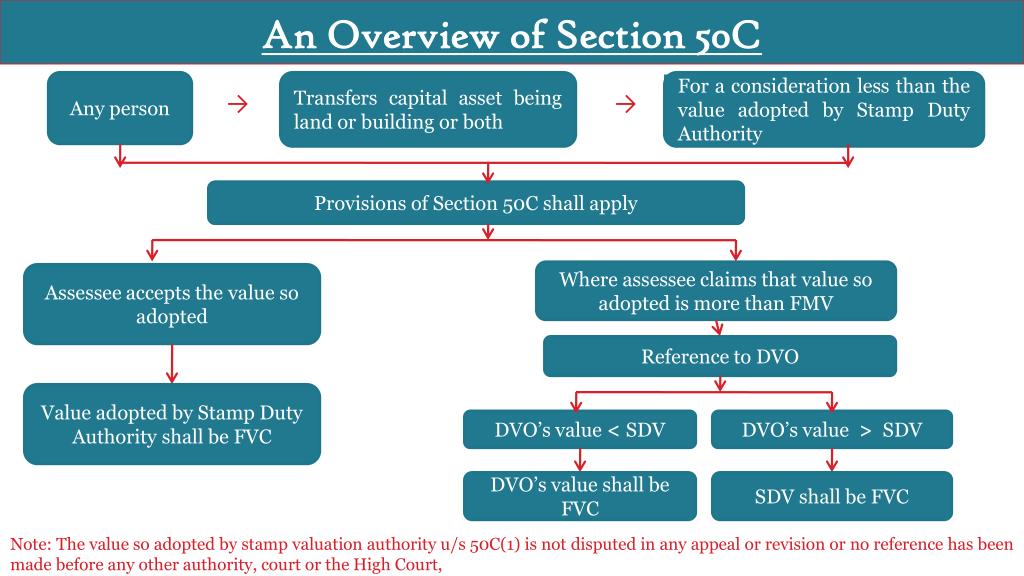

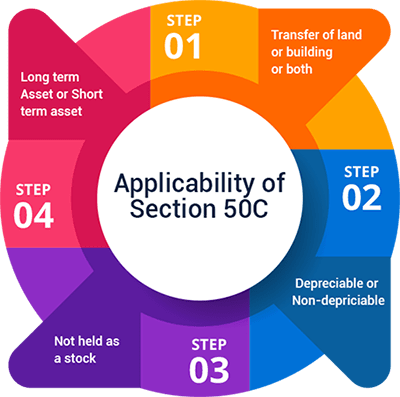

Section 50C only applies to land, buildings, or both. Section 50C uses the value approved by the Stamp Valuation Authority (SVA) for the purpose of levying stamp duty on property registration as a guideline value to determine whether the land or building in the sale agreement is undervalued.

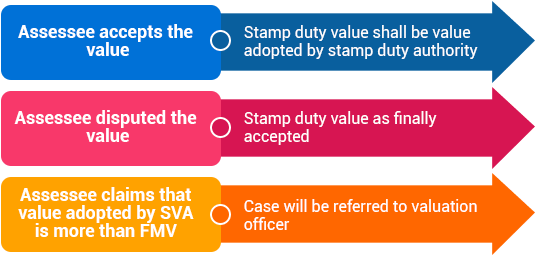

If the sale consideration obtained or claimed to be received by the seller on the sale of land, building, or both is less than the value accepted by the stamp valuation authority, the real sale consideration received or accruing to the seller will be the value adopted by the SVA.

As a result, capital gain would be determined by subtracting the stamp valuation authority’s valuation from the cost/indexed cost of acquisition.

Furthermore, Budget 2018 introduced a change to section 50C, stating that no adjustments will be made if the difference between the stamp duty value and the selling consideration is less than 5% of the sale consideration.

This was implemented in order to reduce the amount of suffering experienced by legitimate real estate transactions.

The Finance Ministry increased the safe harbour rate, which is the percentage difference between the actual selling consideration value and the stamp value of the property, from 10% to 20%.

What Happens If the Selling Price Is Less Than the SVA-Approved Value?

While there may be various genuine reasons for parties to have a transaction of sale of land or building for a consideration less than the value adopted by SVA, Section 50C only protects the value of property from fluctuations caused by a significant gap between different stages of the transaction of sale.

Further to illustrate, there have been occasions in the past when the value of the asset on the date of the agreement to sell and the actual transaction differed owing to economic factors like demand and supply.

In such circumstances, using SVA’s value as a sale consideration would put taxpayers through excessive hardship by forcing them to pay tax on something they never got.

Section 50C of the Finance Act of 2016 was revised to correct this legal problem. If the date of the agreement fixing the sale price and the actual date of registration of the sale of land or building are not the same, the value adopted by SVA on the date of the agreement can be used as the sale consideration, according to the modification.

To qualify for this benefit, at least a portion of the selling consideration must be received by account payee cheque, bank draught, or ECS on or before the agreed-upon transfer date.

This amendment provides relief to taxpayers who are involved in the sale of property or a structure, as talks typically take a long period.

What if the seller refuses to accept the SVA-adopted value?

There’s a chance that SVA’s worth doesn’t always reflect the Fair Market Value (FMV), or that the seller isn’t happy with SVA’s value based on elements he knows about.

Though stamp duty is normally incurred by the buyer, the buyer may be unconcerned about the SVA value because the amount he will pay in stamp duty is insignificant in comparison to the cost of the transaction.

However, it has a significant impact on the seller’s income tax, which can be significant depending on the value. If the seller does not pay stamp duty, he is not permitted to challenge or contest the value established by SVA before the valuation authority.

Because it is a subject of income tax for the seller, he is able to challenge SVA’s valuation and claim it is greater than FMV under Section 50C before the income tax authority, unless the value has already been challenged by another authority or court.

In such circumstances, the income tax officer is required to refer the case to a valuation officer, who will establish the market value. Officer in charge of valuation,

While determining market value, the assessor must request records/documents from the taxpayer if necessary, offer the taxpayer an opportunity to be heard, and issue a written order stating his valuation. Any value established by the valuation officer can be challenged in front of higher authorities.

What Happens If the Value of the Valuation Officer Exceeds the Value of the SVA?

A valuation officer is given a reference to assess the FVA in order to benefit the taxpayer and preserve him from excessive hardship.

The taxpayer is not harmed by such a reference submitted to the valuation officer. Even when a valuation officer is referred, the value assessed by the valuation officer or adopted by SVA, whichever is lower, is used will be taken as sale consideration while computing capital gains.

Section 56(2)(x): Tax treatment in the hands of the buyer

If a buyer pays less than the Circle Rate for a property and the difference between the “Price at which the property was purchased” and the “Circle Rate” is more than Rs. 50,000, the difference is considered the purchaser’s income and is taxed under the head Income from Other Sources under Section 56(2). (x).

If the circle rate changes between the date of agreement and the date of registration, the sale price will be based on the circle rate on the date of agreement.

This exception only applies if part or all of the consideration was paid in a method other than cash on or before the date of the agreement setting the consideration.

If a referral to the Valuation Officer has been made under Section 50C, the same applies to Section 56(2)(x) as well.

The Effects of the Amendment

Previously, if a property was sold for less than the Circle Rate, the tax was only imposed on the seller. However, as a result of this alteration, not only would the sale price be increased in the seller’s hands, but a tax would also be assessed in the buyer’s hands.

As a result, we have an instance of double taxation. The buyer’s sale price is increased first, and then the difference between the purchase price and the circle rate is added to the buyer’s income.

Section 50C: Tax Treatment in the Seller’s Hands

If a property is sold below the Circle Rate, the Circle Rate is presumed to be the rate at which the property was sold, and capital gains tax is levied as if the property had been sold at the Circle Rate, according to Section 50C.

Regardless of the consideration for which the property was sold, if it was sold for less than the Circle Rate, the Sale Price would be presumed to be the Circle Rate, and Capital Gains Tax would be imposed.

If the taxpayer contends before the AO that the property’s FMV is actually lower than the Circle Rate, the Assessing Officer may request that the property be valued by the Valuation Officer.

If the Valuation Officer conducts a valuation and the value determined by the Valuation Officer is less than the Circle Rate: If the Valuation Officer’s value is greater than the Circle Rate, the Circle Rate becomes the Sale Price.

As a result, if a Referral to the Valuation Officer is made, the sale price to be considered for Capital Gains purposes cannot be increased, but may only be decreased.

Section 50C- stamp duty value – The stamp duty value as of the date of the agreement to sell fixing the consideration is relevant for the purposes of applying section 50C, not the date of registration of the sale deed – the provision inserted in section 50C is clarifying in nature and has retrospective effect. (ITO VS. VANDANA SETHI) (ITA No.1614)

RELEVANT PROVISIONS OF SECTION 50C IT DOESN’T APPLY TO SALE OF ASSETS FORMING PART OF BLOCK OF ASSETS

Deeming provision under section 50C, adopting stamp duty value as sale consideration applies to compute capital gains and not to determine written down value of assets

[2015]ITAT MUMBAI – Bhaidas Cursondas & Company v. ACIT, MUMBAI

FACTS

During the relevant year, the Assessing Officer observed that the assessee had sold a part of the assets forming part of the block of assets ‘Building’ at Rs. 1.50 lakhs.

The Assessing Officer during the course of assessment proceedings observed that this transaction attracts section 50C and the value adopted by the stamp value authority was Rs. 2.30 lakhs. Accordingly, he recomputed the opening Written Down Value (WDV) of the relevant block of assets and allowed the depreciation for the current year accordingly, working the same at an amount less than that claimed by the assessee.

On appeal, the Commissioner (Appeals) ruled in favour of the assessee and held that section 50C only applies for computing ‘capital gains’ arising to the assessee on the transfer of capital assets specified therein and the same would have no implication towards computing the WDV of the relevant block of assets.On further appeal to Tribunal:

HELD

The revenue based its claim on the decision by the Special Bench of the Tribunal in the case of ITO v. United Marine Academy [2011] 130 ITD 113 (Mum).

However, as rightly noted by the Commissioner (Appeals), the said decision, in ratio, only holds that section 50C shall apply equally in respect of depreciable assets; it being the assessee’s claim in that case that immovable property, the asset class specified in section 50C, would yet not apply in such a case as the same is a depreciable asset being used for the purposes of its business by the assessee.

The deeming provisions of section 50C is for the restricted purpose for computing the capital gains under section 45 read with section 48 on the assets specified under the said section.

The only purport of section 50C is the extent of the matter specified therein, providing (to that extent) an alternate basis to that specified under section 48, for computing the capital gains chargeable under section 45.

The WDV would have to be necessarily computed in terms of section 43(6), and for which section 50C has no application.

The decision in the case of United Marine Academy (supra) shall, therefore, have no application in the facts of the case, even as clarified by the Commissioner (Appeals), whose decision is accordingly upheld.

In fact, the opening WDV could not be altered without first changing the depreciation for the immediately preceding year and, concomitantly, the WDV at the close of that year. The revenue’s case is wholly untenable in law.In the result, the revenue’s appeal is dismissed.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances; Hope the information will assist you in your Professional endeavors. For query or help, contact: singh@carajput.com or call at 9555555480