Analysis of definition of “Relative” under different Act

Page Contents

MEANING OF RELATIVE UNDER DIFFERENT ACT

As per section 2(41) of the income tax act

“Relative”, in relation to an individual, means the husband, wife, brother or sister or any lineal ascendant or descendant of that individual ;

As per sec 56

The definition is explained further in Section 56(2)(vii) under which, it is cleared that Gifts received from relatives are not chargeable under Income from Other Sources, further clarifying that they are not taxable.

This is valid for gifts received through any sum of money or property received by an individual or on or after 01-04-2017.

As per the Income-tax act, the term “relatives” is described in detail. A gift received in the form of cash, cheque or good from your relative is fully exempt from tax.

So if you receive a gift money from any of your relatives listed below, you are not liable to pay any tax on the same.

Gift received from a relative is not taxable in hands of recipient under section 56 of Income Tax Act.

The persons who are considered as relatives are

In the case of individual

- Spouse of the individual

- A Brother or sister of the individual

- Brother or sister of the spouse of the individual

- Sister or brother of either of the parents of the individual

- Any lineal ascendant or descendant of the individual

- lineal ascendant or descendant of the spouse of the individual

- Spouse of the person referred to in above points

In the case of HUF – Any member of the HUF

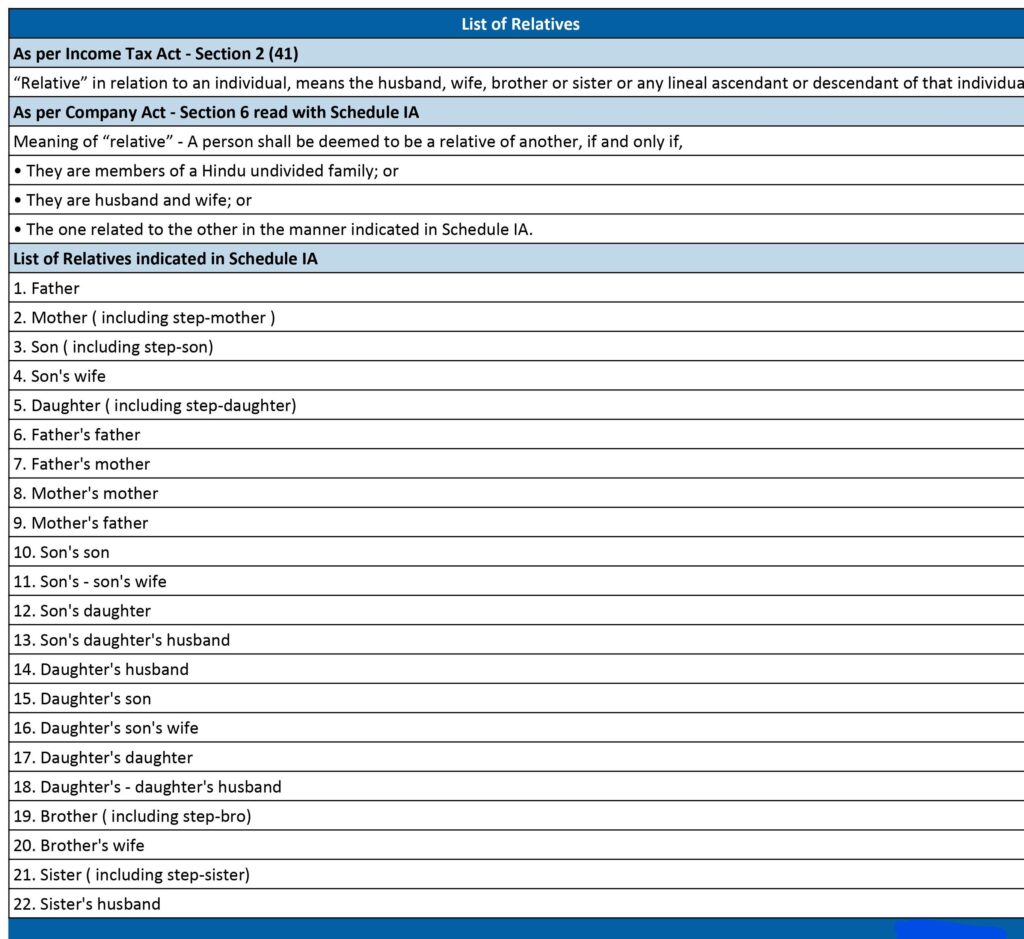

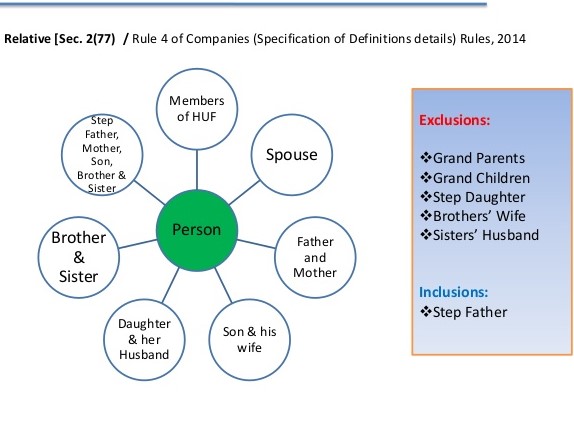

As per section 2(77) of the company Act

A person shall be deemed to be a relative of another if,-

(a) They are members of a Hindu undivided family; or

(b) They are husband and wife; or

(c) The one is related to the other in the manner indicated below

| Sr.no | Company`s act 2013 |

| 1 | Father(including stepfather) |

| 2 | Mother(including stepmother) |

| 3 | Son(including step-son) |

| 4 | Son`s wife |

| 5 | Daughter |

| 6 | Daughter`s husband |

| 7 | Brother(including step-brother) |

| 8 | Sister(including step sisters) |

-

AS Per IBC ACT 2016 –

The term “relative”, with reference to any person, means anyone who is related to another, in the following manner, namely:-

- members of a Hindu Undivided Family,

- husband,

- wife,

- father,

- mother,

- son,

- daughter,

- son’s daughter and son,

- daughter’s daughter and son,

- grandson’s daughter and son,

- granddaughter’s daughter and son,

- brother,

- sister,

- brother’s son and daughter,

- sister’s son and daughter,

- father’s father and mother,

- mother’s father and mother,

- father’s brother and sister,

- mother’s brother and sister; and

- whenever the relation is that of a son, daughter, sister, or brother, their spouses shall also be included.

4. As per FOREIGN EXCHANGE MANAGEMENT ACT (FEMA) :

FEMA relies on the definition in the Companies Act. As per section 2 (77) of the Companies Act 2013, “Anyone who is related to another if

- they are members of a Hindu Undivided Family (HUF); or

- they are husband and wife; or

- As may be prescribed. The Rule 4 of the Companies (Specification of definition details) Rules, 2014 lists the relatives as:

- Father, Mother

- Son, Daughter and their spouse

- Brother and Sister

- For easy understanding, the definitions of relative under all three regulations are summarized in the following table:

WHO IS YOUR RELATIVE

The comparison graph of the definition of a relative under the acts referred to above is as follows:

| S. No. | Relative | GST Act | IBC Act | Companies Act | Accounting Standard | Income Tax Act | ||

| 2(77) | AS -18 | Ind AS -24 | 2(41) | 56(2)(vii) | ||||

| 1 | Grandson | Not Covered | Covered (Lineal Descendant) | Not Covered | Not Covered | Not Covered | Covered (Lineal Descendant) | Covered (Lineal Descendant) |

| 2 | Grand Daughter | Not Covered | Covered (Lineal Descendant) | Not Covered | Not Covered | Not Covered | Covered (Lineal Descendant) | Covered (Lineal Descendant) |

| 3 | Grand Father | Not Covered | Covered (Lineal Ascendant) | Not Covered | Not Covered | Not Covered | Covered (Lineal Ascendant) | Covered (Lineal Ascendant) |

| 4 | Grand Mother | Not Covered | Covered (Lineal Ascendant) | Not Covered | Not Covered | Not Covered | Covered (Lineal Ascendant) | Covered (Lineal Ascendant) |

| 5 | Father | Covered (If dependent) | Covered (Lineal Ascendant) | Covered | Covered | Not Covered | Covered (Lineal Ascendant) | Covered (Lineal Ascendant) |

| 6 | Step Father | Not Covered | Not Covered | Covered | Not Covered | Not Covered | Not Covered | Not Covered |

| 7 | Mother | Covered (If dependent) | Covered (Lineal Ascendant) | Covered | Covered | Not Covered | Covered (Lineal Ascendant) | Covered (Lineal Ascendant) |

| 8 | Son | Covered | Covered (Lineal Descendant) | Covered | Covered | Not Covered | Covered (Lineal Descendant) | Covered (Lineal Descendant) |

| 9 | Daughter | Covered | Covered (Lineal Descendant) | Covered | Covered | Not Covered | Covered (Lineal Descendant) | Covered (Lineal Descendant) |

| 10 | Step Son | Not Covered | Not Covered | Covered | Not Covered | Not Covered | Not Covered | Not Covered |

| 11 | Brother | Covered (If dependent) | Covered | Covered | Covered | Not Covered | Covered | Covered |

| 12 | Step Daughter | Not Covered | Not Covered | Not Covered | Not Covered | Not Covered | Not Covered | Not Covered |

| 13 | Step Mother | Not Covered | Not Covered | Covered | Not Covered | Not Covered | Not Covered | Not Covered |

| 14 | Step Sister | Not Covered | Not Covered | Covered | Not Covered | Not Covered | Not Covered | Not Covered |

| 15 | Son’s Wife | Not Covered | Not Covered | Covered | Not Covered | Not Covered | Not Covered | Not Covered |

| 16 | Sister | Covered (If dependent) | Covered | Covered | Covered | Not Covered | Covered | Covered |

| 17 | Step Brother | Not Covered | Not Covered | Covered | Not Covered | Not Covered | Not Covered | Not Covered |

| 18 | Husband/ Wife/ Spouse | Covered | Covered | Covered | Covered | Covered | Covered | Covered |

| 19 | Daughter’s Husband | Not Covered | Not Covered | Covered | Not Covered | Not Covered | Not Covered | Not Covered |

| 21 | Member of a HUF | Not Covered | Not Covered | Covered | Not Covered | Not Covered | Not Covered | Not Covered |

| 22 | Spouse’s Brother/Sister | Not Covered | Covered | Not Covered | Not Covered | Not Covered | Not Covered | Covered |

| 23 | Liner Ascendant/ Descendant of Spouse (Including their Spouse) | Not Covered | Covered | Not Covered | Not Covered | Not Covered | Not Covered | Covered |

| 24 | Spouse of Liner Descendant | Not Covered | Covered | Not Covered | Not Covered | Not Covered | Not Covered | Covered |

| 25 | Spouse of Liner Ascendant | Not Covered | Covered | Not Covered | Not Covered | Not Covered | Not Covered | Covered |

| 26 | Spouse of Brother/ Sister of the Individual | Not Covered | Covered | Not Covered | Not Covered | Not Covered | Not Covered | Covered |

| 27 | Spouse of Spouse’s Brother/ Sister | Not Covered | Covered | Not Covered | Not Covered | Not Covered | Not Covered | Covered |

| 28 | Spouse of parent’s Brother Sister | Not Covered | Covered | Not Covered | Not Covered | Not Covered | Not Covered | Covered |

| 29 | Parent’s Brother Sister | Not Covered | Covered | Not Covered | Not Covered | Not Covered | Not Covered | Covered |

| 30 | Dependent of Individual/ Spouse | Not Covered | Not Covered | Not Covered | Not Covered | Covered | Not Covered | Not Covered |