Latest Update on GST Return Filling and Compliance

GST Returns –Due date for filing specified returns extended – Notification Nos. 59-63/2017–Central Tax, all dated 15-11-2017 have been issued for this purpose.

| Return | Month/Quarter | Revised due date | Additional comments |

| GSTR-4 | the quarter of July to September 2017 | 24-Dec-2017 | To be filed by Composition supplier. |

| GSTR-5 | For the month July, August, September & October 2017 | 11-Dec-2017 | Tobe filed by a non-resident taxable person. |

| GSTR-5A | Month July, August, September & October 2017 | 15-Dec-2017 | To be filed by the person supplying online information and database access or retrieval services from a place outside India to a non-taxable online recipient. |

| GSTR–6 | For the month of July | 31-Dec-2017 | Tobe filed by Input Service Distributor (ISD). |

| ITC-04 | Quarter of July to September 2017 | 31-Dec-2017 | In respect of goods dispatched to a job worker or received from a job worker or sent from one job worker to another. |

Late fees for delayed filing of GSTR-3B waived –

- Conditional Waiver of late fee for delayed furnishing of return in Form GSTR-3B for tax periods February 2020 to July 2020

- Late fee payable by any registered person for failure to furnish the return in FORM GSTR-3B for the month of February 2020 to July 2020 which is in excess of a number of twenty-five rupees for every day.

- Provided that where the total amount of central tax payable in the said return is nil, waived to the extent which is in excess of an amount of ten rupees for every day, Notification No. 64/2017-Central Tax, dated 15-11-2017.

Time limit for furnishing the details of outward supplies in FORM GSTR-1 by such class of registered persons, having aggregate turnover of more than 1.5 crore rupees in the preceding financial year or the current financial year

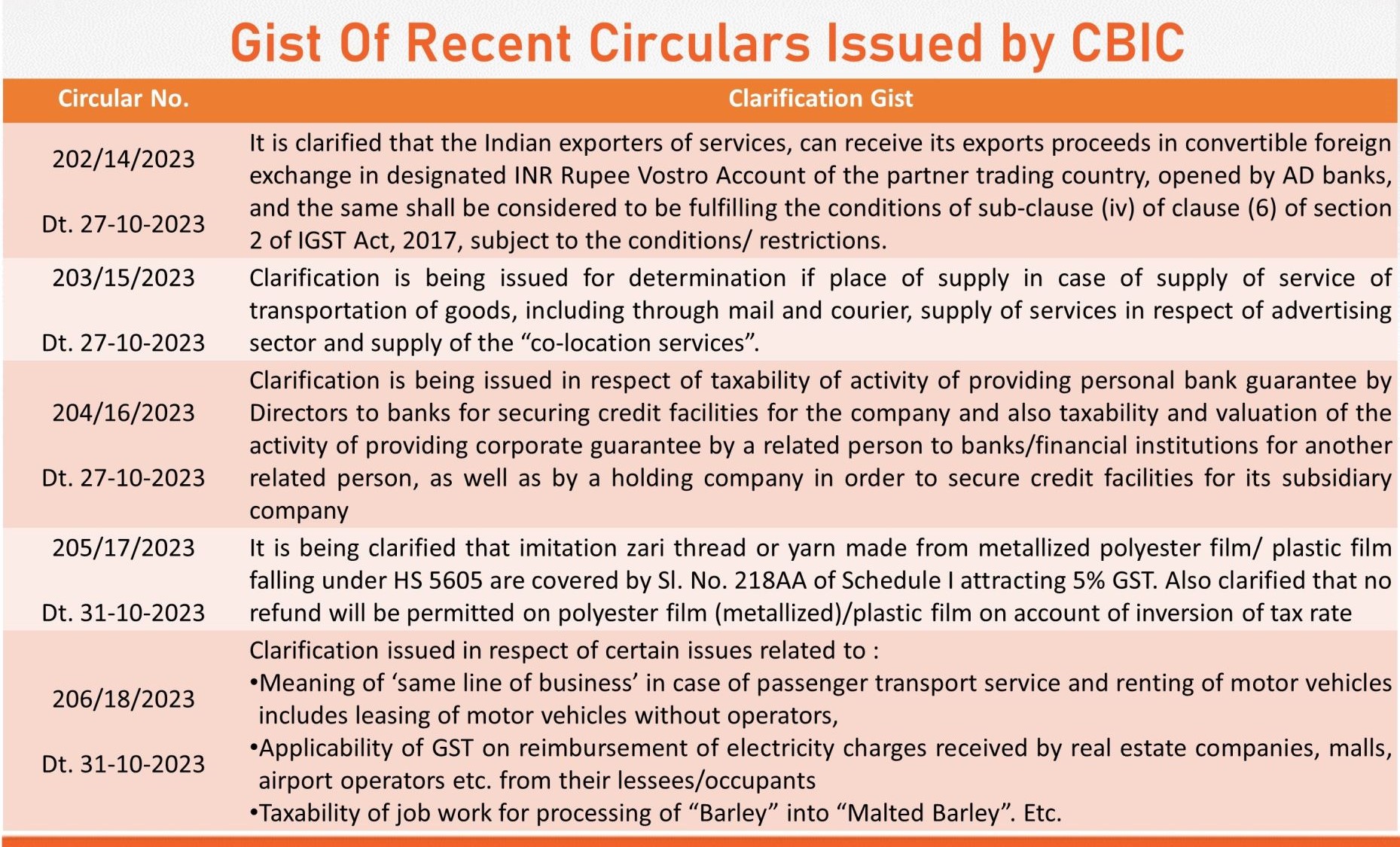

GST Update for Oct 2023 :

Popular Article on Update :

- GST Return compliances calendar- Nov 2020

- Key points of 42nd GST council Meeting headed By FM N. Sitharaman

- GSTN enable auto-populated in the E-invoice information into GST Return -1

- Delayed in payment of GST then Intt to be paid on net GST liability from Sep 1, 2020.

For query or help, contact: singh@carajput.com or call at 09811322785/4, 9555 555 480