International Financial Services Centre in GIFT City

Page Contents

Overview on International Financial Services Centre in GIFT City

An International Financial Services Centre (IFSC) is a jurisdiction that caters to customers outside the domestic economy, dealing with the flow of finance, financial products, and services across borders. The Gujarat International Finance Tec-City (GIFT City) is India’s first IFSC, located in Gandhinagar, Gujarat.

NRIs and foreign investors enjoy favorable tax rates on investments made in the IFSC this is the basic Benefits for NRIs and Foreign Investors, Numerous AIFs have been established in GIFT City, specifically catering to NRIs, providing them with diversified investment opportunities.

Investing in AIFs in GIFT City offers several benefits, including access to diverse and sophisticated investment products, tax incentives, and the ability to invest in a jurisdiction designed to attract international finance.

NRIs and foreign investors can also engage in derivative trading within the IFSC, benefiting from the regulatory and tax advantages provided by the GIFT City framework.

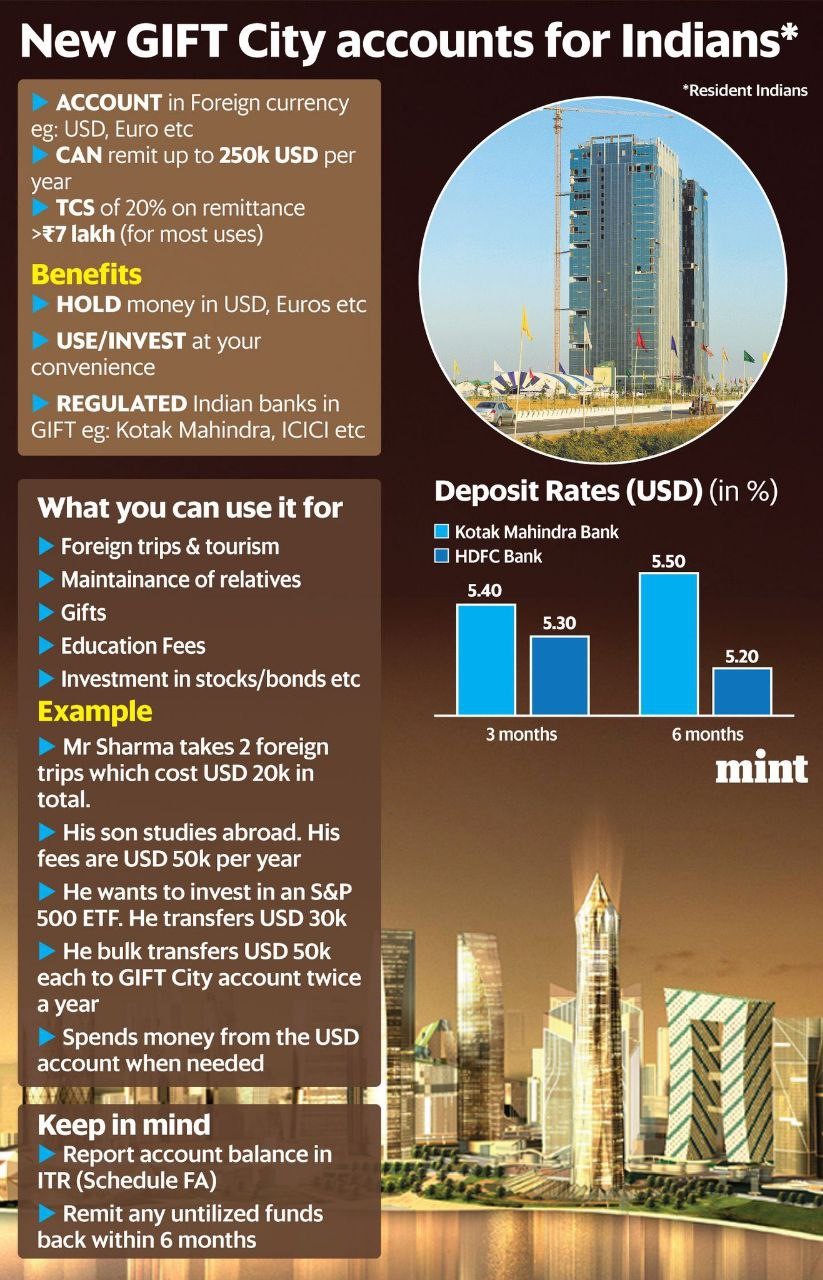

Resident Indians and the IFSC

Resident Indians do not receive tax breaks for investing through the IFSC. They can remit money to the IFSC through the RBI’s LRS, but investments can only be made in securities issued by entities outside India. Indian residents must report these holdings in the foreign assets schedule of their income tax return. Derivative trading is not permitted under LRS for resident Indians.

Services Provided by an International Financial Services Centre in GIFT City

- Global Tax Management and Cross-Border Tax Liability Optimization Services i.e A business opportunity for financial intermediaries, accountants, and law firms.

- Merger and Acquisition Activities services For trans-national corporations.

- Fund-Raising Services to For individuals, corporations, and governments.

- Asset Management and Global Portfolio Diversification Services for pension funds, insurance companies, and mutual funds.

- Risk Management Operations services Including insurance and reinsurance.

- Wealth Management & Comprehensive wealth management solutions.

- Corporate Treasury Management Operations services Involving fund-raising, liquidity investment and management, and asset-liability matching.

GIFT City’s IFSC provides a conducive environment for international financial activities, benefiting both NRIs and foreign investors with its regulatory and tax incentives. However, resident Indians face limitations and reporting requirements when investing through the IFSC.

What Changed related to CAs in GIFT City

The Institute of Chartered Accountants of India has relaxed its exclusivity norms to allow CAs to set up “mirror firms” in the GIFT IFSC without jeopardizing their exclusivity rights in domestic India. A “mirror firm” means a firm in GIFT International Financial Services Centre that mirrors (or replicates) a CA’s existing firm in India, with similar partner composition, but functioning under IFSC rules.

ICAI clearing the way for CAs to work in GIFT City

Relaxation of Exclusivity Rule : Earlier, a CA who was a partner in one firm could not join another firm, due to rules ensuring exclusivity (especially for RBI and CAG empanelment). ICAI has clarified that setting up a mirror firm in GIFT IFSC (International Financial Services Centre) will not violate exclusivity in India.

- CA firms across India can now establish mirror firms in GIFT City to provide bookkeeping, accounting, taxation, and financial crime compliance services (BATF). This enables firms to operate internationally without losing domestic opportunities.

- ICAI has allowed CAs to obtain COP in other countries as well, so they can work globally.

- ICAI also announced that Indian Chartered Accountants can now hold dual Certificates of Practice (COPs), which allows them to operate not only in India but also in certain foreign jurisdictions (e.g. UK, Australia, Canada, New Zealand) without losing their Indian COP or affecting their domestic engagements.

- With GIFT IFSC introducing BATF regulations, GIFT City aims to emerge as a global financial hub. This will create significant job opportunities for CAs.

- ICAI is aligning with international practices, as many countries like the UK, Australia, Canada, and New Zealand allow similar global practice rights.

- India has about 4.30 lakh CA members and 3.0 lakh CA firms, expected to grow rapidly. CAs with multiple COPs will be able to serve clients both domestically and globally.

These steps are intended to boost GIFT City as a global financial hub and attract CA firms nationwide to establish operations there.

Implications & Considerations- CAs in GIFT City

| Positive Outcomes / Opportunities | Potential Concerns / Things to Watch Out |

| CA firms can expand operations into GIFT IFSC without losing domestic practice rights. | Regulatory clarity will be needed on handling cross-jurisdictional compliance, tax, and oversight. |

| Greater flexibility and global reach (dual COPs) for Indian CAs. | Need to ensure that domestic exclusivity rules for RBI / CAG empanelments remain safeguarded. |

| May encourage more CAs / firms to locate parts of their operations in IFSC, aiding the vision of GIFT City as a financial hub. | Mirror firms must adhere to IFSC/BATF regulations, which may differ from domestic norms. |

| Boosts competitive positioning of Indian CA firms in the global market. | Transition and implementation logistics (technical, licensing, regulatory) need to be ironed out. |

Impact for Chartered Accountants:

- More flexibility to operate globally.

- Opportunity to serve international clients via GIFT City.

- Boost in employment and firm growth.

- Indian CAs can now compete with global firms without restrictions of exclusivity.

Finance Minister Launches Foreign Currency Settlement System (FCSS) at GIFT IFSC, Gujarat

Finance Minister has officially launched the Foreign Currency Settlement System at the GIFT International Financial Services Centre in Gujarat. Previously, all foreign currency transactions at IFSC were routed through correspondent banks located abroad, which typically required 36–48 hours for settlement.

The newly introduced FCSS will now enable seamless, real-time settlement of foreign currency transactions within GIFT IFSC itself, eliminating dependency on overseas correspondent banking networks. With this development, GIFT IFSC joins a select group of global financial centres that offer local foreign currency settlement, enhancing India’s competitiveness as an international financial hub. This initiative is expected to:

-

Significantly reduce transaction costs and settlement time,

-

Boost liquidity and efficiency in financial operations at GIFT IFSC, and

-

Strengthen India’s position in the global financial ecosystem.