Incorporation of Nidhi Company

Page Contents

Guideline for Nidhi Company

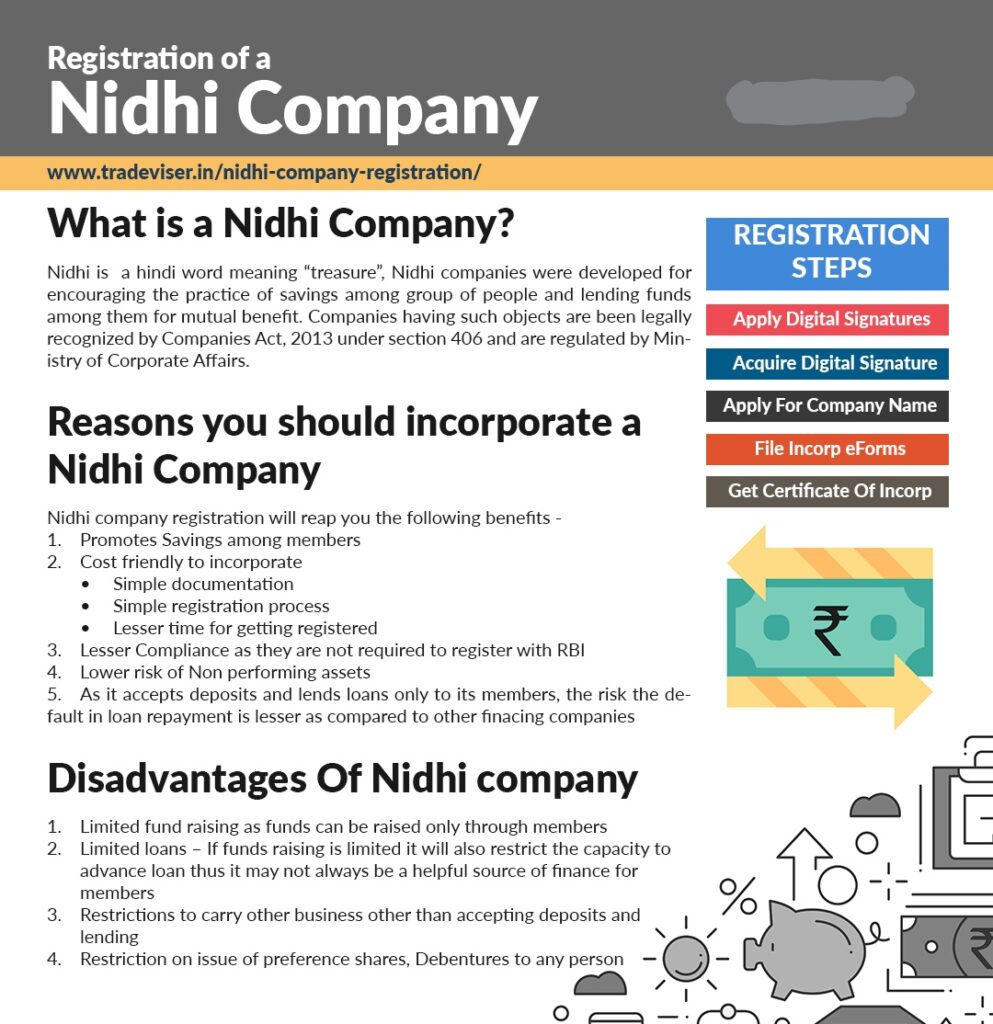

Nidhi company means which are incorporated as Nidhi to cultivate the habits of thrift, saving among its members, receive deposits or lending to its members only for mutual benefit and which comply with the rules made by the central government for regulation of such classes of the companies.

Incorporation of Nidhi Company

ADVANTAGE OF NIDHI COMPANY

INCORPORATION OF NIDHI COMPANY

- A Nidhi company shall be a public company and minimum paid-up equity share capital of Rs. 5 lakh.

- If any preference shares are issued before the commencement of the act then those preferences are redeemed by the terms of the issue.

- Nidhi company shall end its name by the words Nidhi limited.

- No object in its memorandum of association shall be cultivating the habits of thrift, saving among its members, receiving deposits, or lending to its members only for mutual benefit.

- Minimum 7 members are required before incorporation.

REQUIREMENT OF MINIMUM NUMBERS OF MEMBERS AND NET OWNED FUND IN CASE OF NIDHI COMPANY

what are the requirements for a Nidhi Company formation:

As per the company act 2013 Within a period of one year of the incorporation of the rules, the company must ensure that it has the below compliance –

Every Nidhi company shall within one year of incorporation ensure-

- It has not less than 200 as its members.

- Net owned fund of Rs. 10 lakh

- Unencumbered deposits were not less than 10 percent of outstanding deposits as specified in Rule 14.

- The ratio of net owned funds to the deposit shall not be more than 1:20.

Conditions while issuing of loan to members –

as per the company Act 2013, A Nidhi company provides loans only to its members. It is subject to the below-mentioned limits –

- In case Rs 2 lakhs where the total deposits from members are less than INR 2 Cr.

- If Rs 7.5 lakhs where the total deposits from members are more than INR 2 Cr but less than INR 20 Cr.

- INR 12 lakhs where the total deposits from its members are more than INR 25 Cr but less than INR 50 Cr.

- Rs 15 lakhs where the total deposits from members are more than INR 50 Cr.

Nidhi Company Membership

- Each Nidhi Company will ensure that the membership is not reduced to less than 200 members at any time.

- A Nidhi company shall not admit a body corporate or trust as a member.

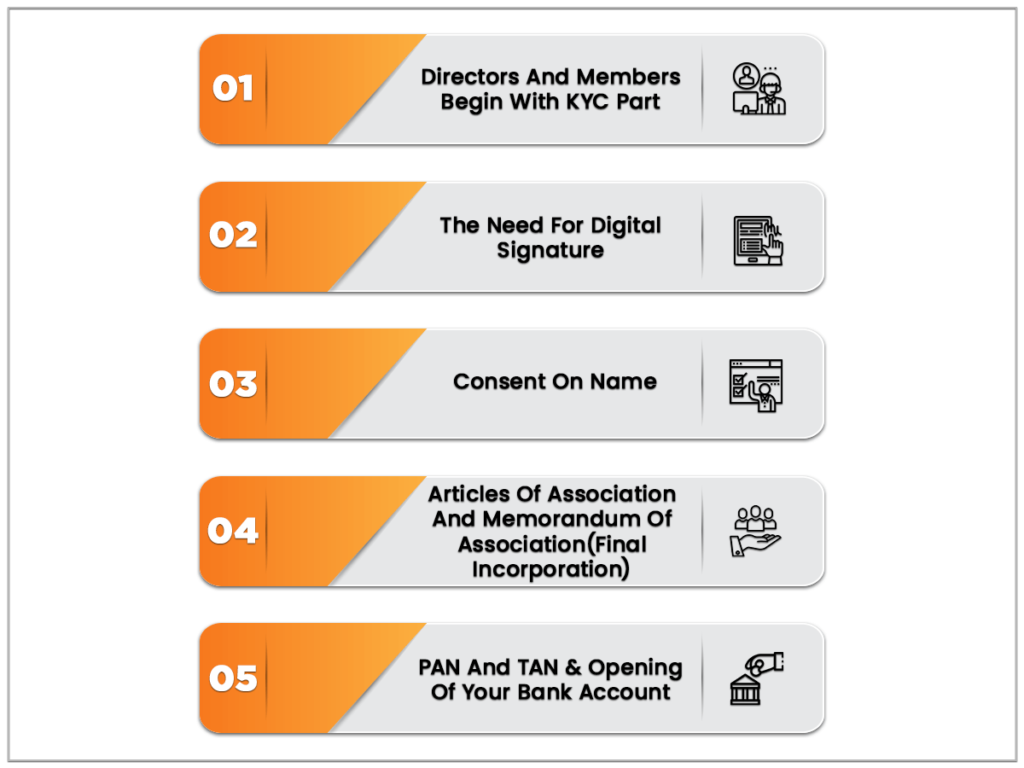

REGISTRATION PROCESS OF NIDHI COMPANY

Name approval

Every applicant who wants to incorporated Nidhi company is required to file name availability through the run facility of the ministry of corporate affairs.

Digital signature certificate

All the proposed directors need to obtain a digital signature certificate. The director can also promote the company.

Required documents in the case of Nidhi company incorporation.

- Pan card of directors and shareholders.

- Id proof of shareholders of the director.

- Address proof of shareholders or directors.

- Passport size photograph

- Property ownership document of registered office

- Digital signature certificate

- Aadhar card or voter if the card

- Rent agreement or sale deed of place being used as the registered office.

- Address proof registered office

- No objection certificate of the owner of the property.

- memorandum of association of the company drafted by the chartered accountant or company secretary.

- Article of association of the company prepared by the chartered accountant or company secretary.

Approval

After submitting all the documents company will get within 20 days incorporation certificate.

AFTER INCORPORATION REQUIREMENT of IN CASE OF NIDHI COMPANY

- Within 90 days of the closing of the first financial year of the incorporation of Nidhi company, then in the second financial year, Nidhi shall file a return of statutory compliances in FORM NDH -1 along with the fee provided in (registration office and fees ) Rules, 2014 with the registrar duly certified by the company secretary in practice or chartered accountant in practice or cost accountant in practice.

- If Nidhi company do not comply with the above within 30 days of the close of financial year then it shall apply to the regional director for extension of time in FORM NDH -2 along with fee provided in (registration office and fees ) Rules, 2014 and regional director pass the order within 30 days after considering the application.

- Every Nidhi company shall file FORM NDH -4 within 60 days of the expiry of-

- One year from the date of incorporation.

- The period up to which extension has been granted by the regional director.

If a company does not company this requirement of filing the FORM NDH -4 then the company is not allowed to file FORM no. SH-7 ( notice to a registrar for the alteration of share capital ) and FORM PAS – 3 ( return of allotment )