Key difference between Private company & LLP

Page Contents

\

DIFFERENCE BETWEEN PRIVATE COMPANY AND LLP

- Entrepreneur, Businessman, Investors have many choices in selecting the kind of business during which they need to take a position their hard money, like Private Company, Public Company, LLP, Partnership, etc.

- If one needs to make a choice between Private Company and LLP, they get confused, although there’s a large difference in both.

- As per Section 2(68), Private Company means a corporation having a minimum paid-up share capital as could also be prescribed, and which by its articles, —

· restricts the correct to transfer its shares;

· except within the case of 1 Person Company, limits the quantity of its members to 2 hundred.

- Whereas, as per Section 1(n) of the LLP Act, 2008 liability Partnership means a partnership formed and registered under this act.

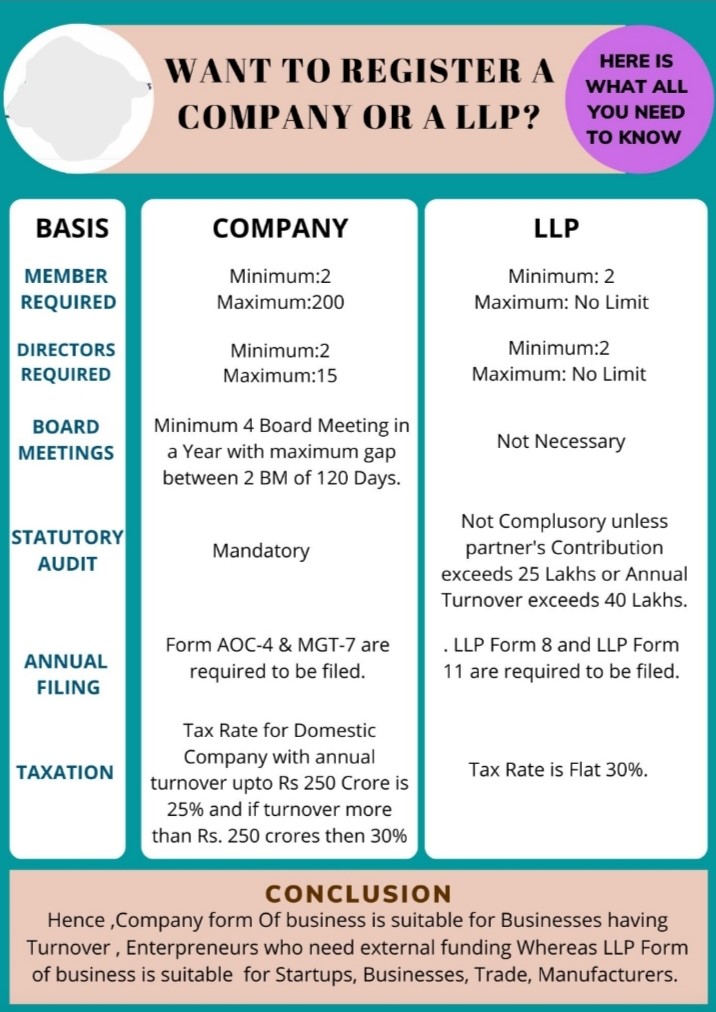

Basic Difference Between the Private Company and LLP : –

| S. NO. | BASIS | PRIVATE COMPANY | LIMITED LIABILITY PARTNERSHIP |

| 1. | REGULATORY AUTHORITY | IT IS REGULATED UNDER THE COMPANIES ACT, 2013 | IT IS REGULATED UNDER THE LIMITED LIABILITY PARTNERSHIP ACT, 2008 |

| 2. | INCORPORATION PROCESS | FORM SPICE + PART A AND B, FORM SPICE + MOA, FORM SPICE + AOA, AGILE PRO, FORM INC-9 ARE REQUIRED TO BE FILED FOR INCORPORATION OF PRIVATE COMP [ANY | WHEREAS, FORM RUN-LLP, FORM FILLIP, FORM 3 ARE REQUIRED TO INCORPORATE LLP. |

| 3. | END NAME | PRIVATE COMPANIES END THEIR NAME WITH “PRIVATE LIMITED.” | LLP’S END THEIR NAMES WITH “LLP.” |

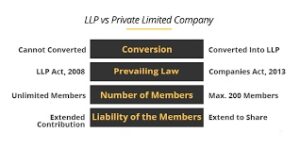

| 4. | NUMBER OF MEMBER | MAXIMUM 200 MEMBERS CAN BE THERE IN A PRIVATE COMPANY | THERE IS NO LIMIT ON A NUMBER OF MEMBERS. |

| 5. | MEETINGS | THEY NEED TO HOLD AND CONDUCT PROPER BOARD MEETINGS AND GENERAL MEETINGS | THERE IS NO SUCH REQUIREMENT TO HOLD A MINIMUM NUMBER OF MEETINGS. |

| 6. | AUDIT | IT IS MANDATORY FOR PRIVATE COMPANIES. | THE AUDIT IS MANDATORY IF THE CONTRIBUTION IS MORE THAN 25 LAKHS OR TURNOVER IS MORE THAN RS. 40 LAKHS |

| 7. | CONVERSION | A PRIVATE COMPANY CAN BE CONVERTED INTO LLP | BUT LLP CAN NOT BE CONVERTED INTO COMPANY |

| 8. | OWNERSHIP | ALTHOUGH, MEMBERS ARE THE OWNER OF COMPANY DIRECTORS HOLD THE POSITION OF MANAGER FOR DAY-TO-DAY WORKING. | NO SUCH CONFUSION BETWEEN MANAGEMENT AND OWNERSHIP, SINCE THE DESIGNATED PARTNERS WILL BE THE OWNER AS WELL AS MANAGERS OF THE LLP |

| 9. | TAX | THE COMPANY IS REQUIRED TO PAY DIVIDEND DISTRIBUTION TAX WHEN IT DECLARES ITS DIVIDEND. | ITR FILING IS REQUIRED TO BE PAID BY LLP. WHILE NO REQUIREMENT TO PAY DDT. |

CONCLUSION

So, while concluding, we are able to say that LLP is more beneficial to entrepreneurs than company incorporation. Although LLP and personal Company appear to be the identical, there are some differences that make LLP an improved choice.

- It goes without saying that LLP registration is an efficient mode of carrying business at the bottom risk. Besides, its name suggests, a limited liability partnership is that the most secure and cheapest business type.

- A business aspirant should step into the competitive market of the company world through LLP. Thus, if you would like any assistance within the LLP registration procedure, contact RJA.

Also read :

Key Highlights of RACP Bill, 2020 and Companies (Amendment) Bill,2020

Summary of New MCA official updates under the Company Act 2013