Essential Clauses & Stamp Duty of LLP Agreement

Page Contents

What is Limited Liability Partnership (LLP) :

- LLP is an abbreviation for Limited Liability Partnership. LLP is a hybrid of a traditional partnership & a company, since some of its features are comparable to those of a traditional partnership and others are similar to those of a corporation.

- For example, it combines the flexibility of a traditional partnership firm with the benefit of a company’s limited liability at a low compliance cost, which means that in an Limited Liability Partnership, members have the flexibility of organising their internal management on the basis of a mutually agreed-upon agreement,

- similar to a partnership firm, and also partners have limited liability, with each partner’s liability limited to the amount they put into business, which means no one can touch their personal property.

- Moreover, One partner in an LLP is not responsible or liable for the misconduct, negligence or wrongdoing of the other partners. As a result, it’s a cross between a corporation and a partnership. In some nations, however, an LLP must have at least one “General Partner” who bears unlimited liability.

ESSENTIAL CLAUSES OF LIMITED LIABILITY PARTNERSHIP AGREEMENT

-

Definitions:

This clause is that the spirit of any LLP agreement. An LLP Agreement must provide for various definitions like the definition of designated partners, the accounting period, business of LLP and therefore the name with which the LLP are known. The agreement must also provide with full address of the registered office of the LLP still because the address of all the partners.

-

Designated Partners:

LLP agreement shall mention the name, age, and address of every of the Designated Partners correctly.

-

Name of The LLP and Changes thereto:

This clause shall state that the business of the LLP shall be carried on within the name and magnificence of [Name of LLP]. Any change within the name of the LLP shall be notified to the Registrar by the Designated Partner(s) following the provisions of the LLP Act and therefore the Rules.

-

Registered Office of the LLP:

LLP agreement shall state that partnership business shall be carried on at the under mentioned address, which shall even be its registered office The business shall even be carried from such other places as could also be mutually decided by the partners from time to time.

-

The business of the LLP :

This clause must specify the character of the business that the LLP are going to be carrying on. The LLP may engage in any activities necessary, desirable or related to the accomplishment of the conduct of such business of the LLP including but not limited to such ancillary business. it should also include the other business conducted in such a fashion as is also decided by the bulk of Partners from time to time.

-

Capital Contribution:

The total contribution of the LLP and therefore the contribution by each partner together with the share of contribution to be mentioned during this clause. . If any partner is contributing in non-monetary form, that is, he/she goes to render services rather than a monetary contribution, add the identical. Manner of Additional capital contribution by a partner during the agreement to be included similarly. How contribution will be withdrawn by the partners shall even be stated during this clause.

-

Profit-Sharing Ratio:

An ideal LLP Agreement must also mention the ratio during which the profits and also the losses of the business are shared among the partners. The partners must clearly state the quantity of profit that every member receives, or the quantity of the loss that they’re responsible for are going to be come into being within the agreement.

-

Rights and Duties of Designated Partners:

The LLP Agreement must specify the assorted rights and duties of the Designated Partners as could also be mutually given by them. within the absence of such separate agreement between the partners about such rights and duties, etc., the provisions of Schedule I of the limited liability partnership Act, 2008 shall apply as provided under Section 23(4) of the said act.

-

Provisions regarding Admission, Retirement, Resignation and Expulsion of Partners:

LLP agreement must include the provisions regarding admission of recent partners, retirement in addition because the death of a partner, etc. The agreement must provide guidelines for the expulsion of partners moreover.

-

Remuneration & Interest to be Paid to Partners :

The LLP agreement shall contain a clause regarding the number of remunerations to the Designated Partner(s), for rendering the services per se. This clause shall contain the speed of interest to be paid to the partners on their capital contribution.

-

Bank Account :

This clause shall start the routine of the checking account transactions of the LLP

-

Books of Accounts and Accounting Year :

The LLP agreement shall contain a clause regarding the upkeep of books of accounts and other documents, method of accounting and also the details referring to the accounting year of the LLP.

-

Meetings:

LLP agreement shall clearly state how the choices of LLP shall be taken within the meeting of the partners and shall also provide on how the identical shall be recorded within the minutes and therefore the place of maintenance of such minute’s book etc.

-

Indemnity ;

The LLP agreement shall also contain the provision regarding indemnities. The clause of indemnity states that the LLP must protect its partners from any quite liability or claim incurred by them while carrying the business of the LLP. The partners should also comply with indemnify the LLP for the loss caused by it because of any breach committed by them.

-

Dispute Resolution:

A well-drafted LLP should contain a provision for resolving disputes between the members. during a normal course, every LLP prefers Arbitration as a mode of resolving disputes. Such an LLP shall be governed by the provisions of the Arbitration and Conciliation Act, 1996. Thus, every LLP agreement must incorporate a clause providing for a dispute resolution mechanism to avoid disputes that lead to lengthy and expensive litigation.

-

Term of LLP/Winding Up :

The partners must specify the term of validity of such an LLP agreement whether it’s a perpetual agreement or is valid for a set period. The agreement must also provide for the situations when the partners have agreed to aroused the affairs of the LLP either voluntarily or by an order of Tribunal for the particular violations as mentioned in Section 64 of the Act.

-

General Provisions :

The LLP agreement shall additionally to the above-mentioned clauses include general provisions on binding on heirs, successors, counterparts, serving of notices, waiver, Governing law, etc.

REGISTRATION OF LLP AGREEMENT

Section 23 of the Act provides for the execution and registration of LLP Agreement and the same be made within 30 days from the date of incorporation of LLP. Every LLP Agreement must be executed on stamp paper of appropriate amount depending upon the number of contribution and also the state where its registered office is found at. together with the stamp tax requirement, the agreement is required to be duly signed by all the parties and notarized by the authorities.

The liability isn’t just limited to the execution of the agreement, the said LLP Agreement is required to be filed with the registrar in Form 3 within the stated fundamental measure.

Know more about: Procedures for the conversion of partnership firm into Private limited company

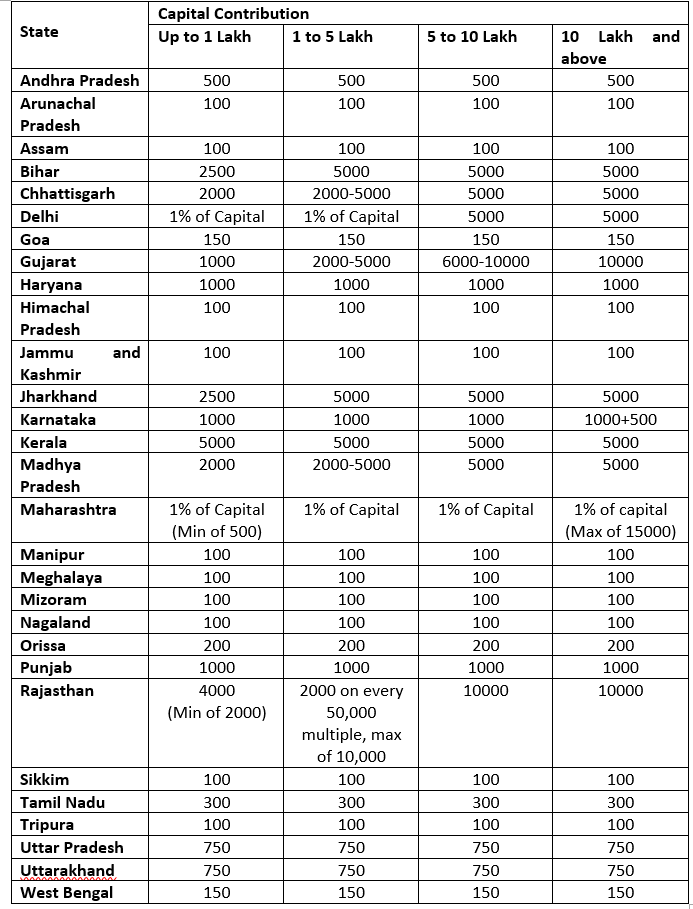

STAMP DUTY

An agreement must get on stamp paper and be notarized. taxation could be a state matter. Every state features a different tax act and there’s no fixed rate at which stamp tax is charged; rate of stamp tax differs from state to state. Further, the revenue enhancement also changes with the quantity of capital contributed within the LLP.

Stamp Duty leviable on the LLP Agreement differs/depends on state to state and is provided as per the State Stamp Act. The revenue enhancement payable on partnership agreement visible of the Finance Bill, 2009 is additionally payable for LLP.

Contents of an LLP Agreement

Following are the important components of a sound LLP Agreement:

- Name of the LLP: Name of the LLP is to be mentioned on the highest of the agreement. The name must be duly approved by the Registrar in after inspection of the applying filed in Form 1.

- Date and Place of Execution must be clearly mentioned at the start of the agreement.

- Details of Partners: Details including name, father’s name and address of all the partners must even be mentioned separately.

- Clearly mention the registered office address of the LLP. It should be the identical address mentioned at the time of incorporation of the LLP.

- Introductory provisions: This part will include the definition of the technical terms utilized in the agreement. together with that, the knowledge of initial partners etc. is

- Objects of the LLP including the mail yet as all the ancillary objects important for the furtherance of main objects must be clearly mentioned within the agreement.

- Capital contribution done by all the partner must be clearly mentioned within the agreement. together with the number of contributions, nature of such contribution must even be mentioned.

- All relevant information regarding appointment, removal, cessation etc. of partners including their remuneration, rights, and duties must be clearly mentioned within the agreement.

- Names of Designated Partners together with all relevant information regarding appointment, removal, cessation etc. including their remuneration, rights, and duties must be clearly mentioned within the agreement.

- Remuneration and percentage clause must even be included, during which all the relevant information must be mention clearly.

- There should be a clause mentioning the bookkeeping provisions for the LLP explaining the accounting furthermore as documenting provisions.

- Winding-up clause must even be mentioned specifying the provisions to be followed just in case the partners arrange to land up the organization.

- Along with all the above-mentioned information, the partners can enter the other clause that the partners agree on and are valid under the provisions of law.

Penalty for Non-Execution of LLP Agreement

In case, there’s any default a part of the partners in registering the agreement with the Registrar. Then they’re required to pay a penalty of rupees hundred for each day of such default.

FAQ ON LLP :

Query: Please tell us the form which is required to be filed for changing Registered office of LLP from one state to another.

Answer: You are required to file LLP Form 15 enclosing Consent letter of all DP’s, Consent letter of all Secured Creditors, Copy of Board Resolution, Copy of Advertisement & Proof of New Registered Office Address (If Rented then Rent Agreement, Utility Bill on the name of Owner & NOC) with the ROC.

Popular blog:-