What is compounding of contraventions under FEMA?

Page Contents

BRIEF INTRODUCTION

The Foreign Exchange Management Act, 1999 (FEMA) is an act of the Parliament of India to consolidate and amend the laws regarding exchange with the target of facilitating external trade & payments and promoting the orderly development and maintenance of exchange market in India.

Contravention may be a breach or non-compliance of the provisions of The Foreign Exchange Management Act, 1999 (FEMA), and therefore the rules, regulations, notifications, orders or circulars or directions made thereunder.

RBI has been vested with the power to compound offences under The Foreign Exchange Management Act, 1999 (FEMA) and in case a contravention arises under Section 13 of the Act, the same be compounded within 100 and eighty days (180) from the date on which the officer of RBI receives the application for compounding.

Anyone who contravenes the provisions of the touch on adjudication, is susceptible to pay –

- Thrice the sum involved in such contravention where the quantity is quantifiable, or;

- Rupees 2 Lakhs, where the quantity isn’t directly quantifiable;

and where the contravention is of an unbroken nature, an extra penalty of Rupees Five Thousand for each day after the primary day during which the contravention continues.

Furthermore, as per the Section 15 of the Act, it was provided under the Compounding of Contravention, that where the contravener voluntarily admits contravention, pleads guilty and seeks redressal, the same shall file an application for compounding.

Section 15 of Foreign Exchange Management Act (FEMA), 1999 empowers bank of India to compound any contravention made under Section 13 of FEMA, 1999 except the contraventions under section 3(a).

Compounding refers to the method of admitting voluntarily the breach of any of the provisions of The Foreign Exchange Management Act, 1999 (FEMA) or the rules/regulations/notifications/orders/directions or the circulars issued under the said Act.

The person, admitting the contravening the provisions, shall make a request for compounding his mistakes.

This would indeed provide and protect such person from legal proceedings and makes the method simple and fast. The offence shall be compounded within 180 days from the date on which the requisite officer receives the application for compounding.

COMPOUNDING POWER OF RBI

Any default/contravention in respect of any provision of The Foreign Exchange Management Act, 1999 (FEMA) shall be compounded by following officers, under the direction and supervision of the Governor of RBI.

| AMOUNT OF CONTRAVENTION FOR COMPOUNDING | COMPOUNDING AUTHORITY OF RBI |

| UPTO RS 10 LAKHS | ASSISTANT GENERAL MANAGER |

| MORE THAN RS 10 LAKHS, BUT LESS THAN RS 40 LAKHS | DEPUTY GENERAL MANAGER |

| RS 40 LAKHS AND ABOVE, BUT LESS THAN RS 100 LAKHS | GENERAL MANAGER |

| RS 100 LAKHS AND ABOVE | CHIEF GENERAL MANAGER |

It is to be noted that compounding provisions shall be applicable only in case of quantifiable contravention only.

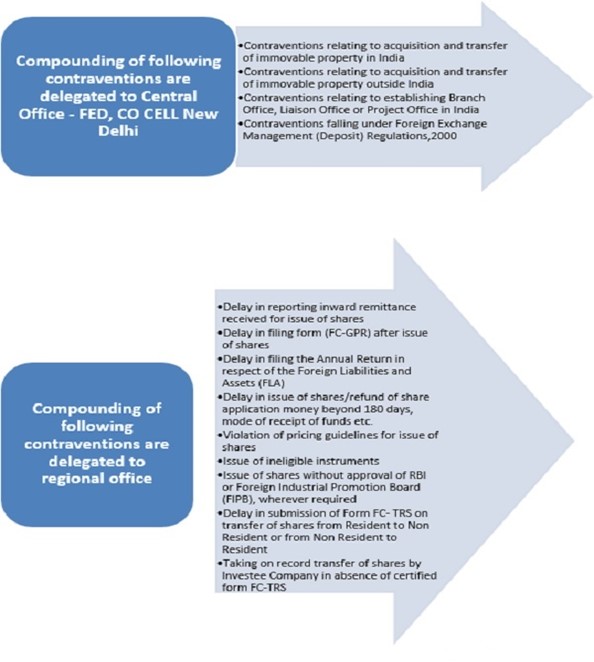

DELEGATION OF POWER TO REGIONAL AND HEADQUARTERS

With a view to relax and simplify the process of handling operational issues and customer service, RBI provided for segregation of compounding powers between Regional and Central level.

For Instance – Kochi and Panaji Regional offices are eligible to compound contraventions, where the amount involved is less than Rs 100 Lakhs.

However, where the said amount is RS 100 Lakhs and above in Panaji and Kochi, the compounding will be handled at Mumbai RO and Thiruvananthapuram RO respectively.

Apart from the contraventions laid out in particular, application for all other contraventions needs to be submitted to Foreign Exchange Department, RBI, Mumbai.

TYPES OF CONTRAVENTIONS

The type of contravention is decided to stay seeable the subsequent indicative points:

- Is the contravention being technical and/or minor in nature and desires only an administrative cautionary advice;

- Is the contravention being serious in nature and warrants compounding of the contravention; and

- Is the contravention, clear, involves concealing, national and security concerns involving serious infringement of the regulatory framework.

Thus, the RBI provides for segregation and categorization of the contraventions as provided above and thus, both the contravener and any other person will not have any right to classify the contravention as technical Suo moto.

- The banking company makes a scrutiny of the applying to verify whether the specified details and documents furnished by the applicant are prima-facie so as.

- Applications are returned to the applicant if it’s submitted with incomplete details or where the contravention isn’t admitted.

- On the receipt of applications, the RBI will examine and choose if the contravention is technical, material or sensitive in nature.

- The applicant is going to be issued a cautionary advice, if technical.

- If the contravention is material, it’ll be compounded by imposing a penalty after giving a chance to the contravener to look before the compounding authority for a private hearing.

- the identical would be named the Directorate of Enforcement (DoE) for further investigation/ action if the contravention is sensitive in nature requiring further investigations.

PROCEDURE FOR COMPOUNDING OF OFFENCES UNDER FEMA

ELIGIBLE PERSON MAKING APPLICATION FOR COMPOUNDING UNDER FEMA

- A person contravening any of the provision of the FEMA, 1999 [excluding section 3(a)] or any of the rule, regulation, notification, direction or contravenes any of the conditions associated with which a consent is issued by the banking concern, can apply for compounding to the depository financial institution.

- Applications searching for compounding of contraventions under section 3(a) of The Foreign Exchange Management Act, 1999 (FEMA) is also submitted to the Directorate of Enforcement.

TIME FOR MAKING APPLICATION FOR COMPOUNDING UNDER FEMA

- On receiving the Notice – When someone is created attentive to the contravention of the provisions of The Foreign Exchange Management Act, 1999 (FEMA) by the banking concern or the Foreign Investment Promotion Board (FIPB) or the other statutory authority.

- Suo Moto – A person may also file an application for compounding, in case of Suo moto, i.e., having become conscious about the contravention.

- Undertaking Due diligence and proactively filing for compounding under The Foreign Exchange Management Act, 1999 (FEMA)

PREREQUISITES COMPOUNDING OF CONTRAVENTIONS UNDER FEMA

- For a period of three years from the date of compounding of contravention, no contraventions of an analogous kind will be compounded. Post such duration, if a violation like the previous nature occurs, the identical shall be compounded as if it were the primary contravention.

- For the contraventions to be compounded for transactions where prior approval of statutory authorities/Government is required to be obtained, and such approval has not been obtained, then the compounding of such a contravention shall not be ordered till the applicant obtains the requisite approval(s) from the governing authority.

- In event the contravener has didn’t pay the sum of contravention for compounding within the desired limit or has serious contravention suspected of cash laundering, terror financing or affecting sovereignty and integrity of the state, the case is sufficiently required to be observed the Directorate of Enforcement for further investigation.

- Any necessary action under the Act or any authority under the Prevention of cash Laundering Act or other agencies also can take the requisite actions as is also deemed fit.

- In cases where the adjudication is completed by the Directorate of Enforcement and appeals are made under the Section 17 or Section 19 of FEMA, no compounding of contravention is allowed under Rule 11 of the Foreign Exchange (Compounding Proceedings) Rules, 2000 (‘Rules’).

- The contravener must specifically state within the manner prescribed in Annexure III together with the compounding application that he has not filed any such appeals

- Where any contravention that’s identified by the RBI or has been brought forward by the contravener itself, the Bank has got to confirm the subsequent –

-

- Whether it’s material and it’s required to be compounded and if the required procedure has been followed.

- Whether the contravention is of a sensitive nature and if the identical should learn to the Directorate of Enforcement

METHOD OF COMPOUNDING UNDER FEMA

The RBI is guided by the provisions of section 13 of FEMA, whereby it’s said that the number imposed will be up to 3 times the number involved within the contravention. However, the number imposed is calculated on the premise of guidance note and which is additionally available on the RBI’s website for information of the overall public.

However, the guidance note is barely for the aim of indicating the premise on which the quantity to be imposed comes by the compounding authorities.

the particular amount imposed may sometimes diverge, reckoning on the situations of the case taking into consideration the subsequent factors:

- The quantifiable amount of gain or unfair advantage, which the contravener has made, by contravening the provisions.

- Due to contravention the quantity of loss caused by any authority/ agency/ exchequer.

- The number of economic benefits that has accrued to the contravener, by delaying or avoiding the compliances.

- The repetitive nature of such contravention, along with the history of non-compliance by the contravener during the past years.

- Contravener’s conduct in undertaking the transaction and within the disclosure of full facts within the application and submissions made during the private hearing; and the other factor as considered relevant and appropriate.

LEGAL EFFECT OF COMPOUNDING

- No further penalty or proceedings on the problems compounded

- All the proceeding being pending against the applicant shall be taken on record.

- All contraventions compounded stands regularized

CONTRAVENTIONS ATTRACTING PENALTIES

- Contravention of the Act.

- Contravention of Rules, Regulations.

- Contraventions of any of the conditions

NATURE OF PROCEEDINGS UNDER FEMA FOR COMPOUNDING

- Penalty Proceedings not criminal in nature.

- Penalty can’t be supported guesswork, conjecture or surmise

- The powers that have been vested with the enforcement officers have been classified as quasi-judicial.

- The doctrine of prosecution – Punishment by the imposition of a penalty also as imprisonment for non-payment of penalty wouldn’t amount to prosecution.

CEILING LIMIT ON PENALTY UNDER COMPOUNDING

- Sum involved is quantifiable- – -Up to 3 times of the sum involved within the contravention.

- Sum involved isn’t quantifiable- – – Up to ₹ 2 Lakhs only

- Apart from the above-mentioned penalty, the contravener shall be liable for a recurring penalty of ₹ 5,000 for every day of continuing default.

PROSECUTION

- The penalty has been paid – no prosecution is often initiated.

- The penalty isn’t paid – prosecution may be initiated.

- No specified cut-off date for the imposition of penalty.

DO’S AND DON’TS OF COMPOUNDING OF OFFENCES

- Spell out each contravention correctly

- Give the explanations of contravention

- Amount of penalty be applicable for each kind of contravention.

- The period for which such contravention continued.

- Where any default is identified after making application, the applicant is required to request for modification of application already submitted.

- All the supporting documents related to contravention be properly enclosed with the application.

- All the required papers be kept ready before the day of hearing, since no adjournments is provided under this Act.

- The language of the appliance should be polite and therefore the content should give the message of accepting the default

- No arguments at the time of hearing but informing about things and circumstances that cause contravention

- The applicant shall not cite any previous case laws.

- Also, the application shall not state any previous order be passed under any identical case.

- A Letter of Authority shall also be submitted on a plain paper.

- Not to irritate the authority

- Plead ignorance

APPLICATION FOR FEMA COMPOUNDING

An application for Compounding together with necessary documents and a requirement draft for Rs. 5000/- (Rupees five thousand only) drawn in favor of the “Reserve Bank of India” within the prescribed format shall be sent to the RBI.

the applying must contain pertinent details like, contact details, name of the applicant, the authorized official or representative of the applicant and email ID.

additionally to the appliance, the applicant must also furnish details within the format of Annex II of the foundations referring to Foreign Direct Investment, External Commercial Borrowings, Overseas Direct Investment and Branch Office / Liaison Office, as applicable, together with the Memorandum of Association of the corporate.

Also the most recent audited record together with an undertaking as per Annex-III of the principles must be attached stating that the applicant isn’t under any enquiry or investigation by any agency like the Directorate of Enforcement etc., as on the date of such application.

Where the applicant has not provided adequate details or where the desired approvals haven’t been obtained, the appliance so received by the RBI together with the applying fees of INR 5000 shall be returned and refunded by way of crediting the quantity to the applicant’s account through NEFT

As per the ECS mandate and details of their checking account per Annex-IV of the foundations furnished together with the applying.

Application must be made within the prescribed format containing the contact details i.e. the name of the applicant or his authorized official or representative of the applicant, telephone or mobile number together with the e-mail ID.

other than the applying in prescribed format, following documents must even be furnished:

- Details as per Annex II referring to Foreign Direct Investment, External Commercial Borrowings, Overseas Direct Investment and Branch Office/ Liaison Office

- Copy of Memorandum of Association

- Latest Audited record together with an undertaking as per Annex III that they’re not under any enquiry/ investigation/ adjudication by any agency like Directorate of Enforcement, CBI etc.

- as on the date of application. Also, the applicant should inform the compounding Authority / RBI if any such proceedings are initiated after filing the applying but on or before the date of issuance of the compounding order

If the applying for compounding isn’t filed within the prescribed format or the mandatory details, documents or declarations are missing or the applying is filed without the demand draft towards the applying fees, it’ll not be processed and can be returned to the applicant.

Once the appliance is completed altogether aspects within the given time then date of such submission is going to be considered because the date of receipt of application and shall be processed accordingly.

Serious contraventions i.e. contraventions involving concealment, terror financing or anything affecting sovereignty and integrity of the state or the cases

where applicant fails to pay the sum that compounding order was passed within the required fundamental quantity shall be directly stated Directorate of Enforcement for further investigation and necessary actions would be taken accordingly.

If the applicant again commits some contravention within the amount of three years which is comparable to the contravention that a compounding order has already been passed.

It shall not be compounded again and provisions of FEMA, 1999 shall prevail. Any contravention after the expiry of the amount of three years shall be considered for compounding.

Conclusion

Coordination with RBI is a difficult undertaking, but with the passage of time, RBI has made significant attempts to bridge this gap.

Today, RBI’s every move is in this direction. A good example is the consolidated Master Circular for each subject matter.

which is issued annually or half-yearly and compiles all of the alterations or circulars issued throughout the year into one document to give the concerned persons easy access and comfort while dealing with it, and which also served as the foundation for this article.

For query or help, contact: singh@carajput.com or call at 9555555480