Taxability of Dividend in the hands of Shareholder

Page Contents

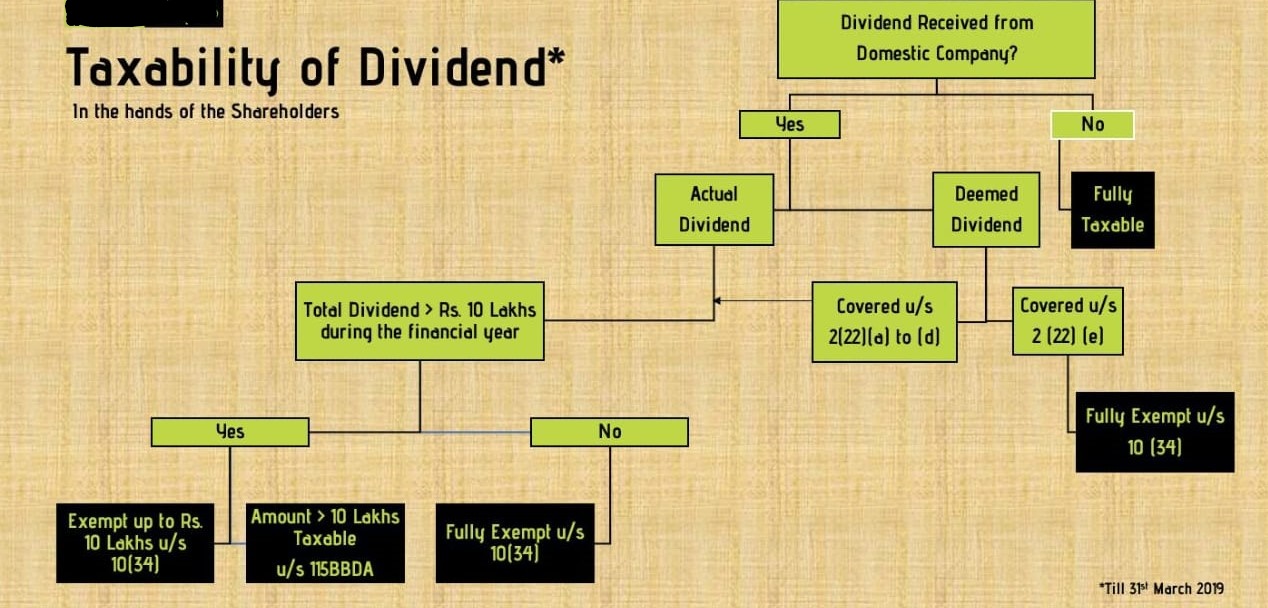

Taxability of Dividend in the hands of Shareholders- Union Budget 2016

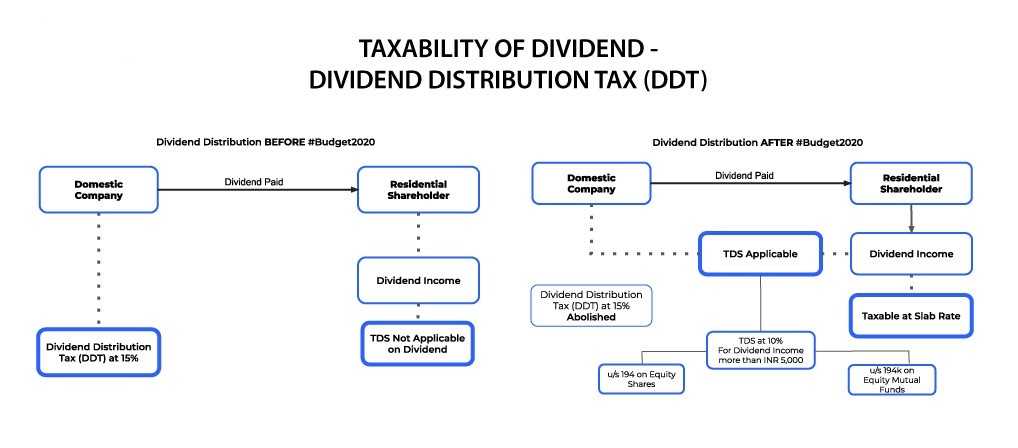

The taxation of dividends has seen several twists and turns over the years. In order to reduce the cost of collection and curb tax evasion through non-reporting of dividends by shareholders, the Government had introduced section 115-O in the Income-tax code through Finance Act, 1997. The section presently provides for a 15% tax on dividends distributed by a domestic company. After considering grossing up, surcharge, and cess, the effective rate of dividend distribution tax (‘DDT’) stands at approximately 20%.

Finance Bill, 2016 has introduced a concept of progressive taxation of dividends. Proposed section 115BBDA seeks to tax dividends in excess of INR 1 Million @ 10% (plus surcharge and cess) in the hands of individuals, HUFs, partnership firms, and LLPs resident in India.

However a indian company which has declared, & distributed dividend or paid as a dividend is needed to make the pay a dividend distribution tax (DDT) at 15%. Finance Act, 1997 has been introduced this DDT provision. Only a domestic company is liable for the dividend distribution tax (DDT) at 15%.

Foreign dividends have a different tax treatment than domestic dividends. Domestic dividend income was previously tax-free in the hands of shareholders.

Dividend income is now taxable in the hands of the shareholder, and is subject to TDS at 10% in excess of INR 5000 u/s 194 & 194K, following the introduction of Budget 2020. Slab rates apply on foreign dividends. Such dividends are exempt from TDS.

Update on Dividend Tax in Union Budgets 2020 & 2021

- Following the repeal of the Dividend Tax in Budget 2020, dividends that were previously exempt will now be taxed beginning in FY 2020-21.

- TDS under Section 194 and Section 194K were introduced in Budget 2020 to allow for the deduction of TDS on dividends received on equities shares and equity mutual funds. After Dividends paid to REITs and InvITs are now exempt from TDS under Budget 2021.

- Because it is impossible for shareholders to precisely forecast dividend income, advance tax liability on dividend income would arise only if the payout is declared or paid.

- The tax on dividend income from equities shares and equity mutual funds in India, as well as TDS application, is explained in full below.

- The Finance Minister abolished Section 115-O and the Dividend Tax in Budget 2020. As a consequence, a Domestic Company is exempt from paying tax on dividends distributed by Equity Mutual Funds.

- Because the corporation does not pay this tax, any income from Equity Mutual Funds is taxable in the hands of the investor at the applicable slab rates.

- TDS would be required because the income would be taxable in the investor’s hands. As a result, the Finance Minister added a new Section 194K to the tax code.

- A Domestic Company that distributes dividends on equity mutual funds to a domestic shareholder must deduct TDS at the rate of 10% if the sum exceeds INR 5000, as according Sec 194K. Such income should be reported in the ITR filed on the Official website under the heading IFOS.

For query or help, contact: singh@carajput.com or call at 9555555480