Home loan interest exemption on under-construction property

Page Contents

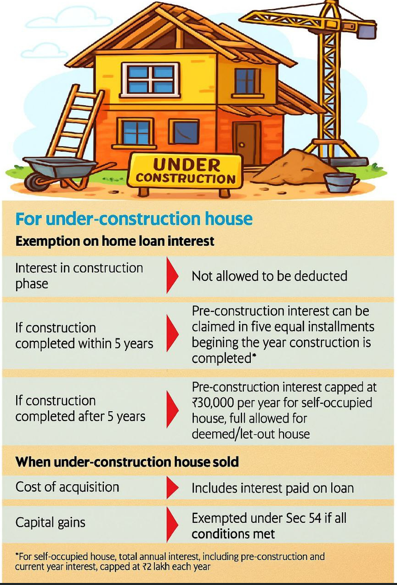

For an under-construction house, the tax treatment of home loan interest is a bit different from a ready-to-move property.

Interest During Construction (Pre-Construction Interest)

- Not deductible during construction. It’s Called Pre-construction Interest. You cannot claim interest deduction U/s 24(b) until the construction is complete.

- Once construction is completed (i.e., you get possession or the completion certificate), the total interest paid during the construction period can be claimed in five equal annual instalments.

- The first instalment is claimable in the year in which construction is completed/possession is taken.

- We can understand via example like Suppose you paid INR 4,00,000 interest during construction (Duration of 2019–2024). Construction completed in FY 2024-25. From FY 2024-25 onwards, you can claim INR 80,000 (i.e., 1/5th of INR 4,00,000) each year in addition to the regular interest of that year.

After Construction Completion – Regular Interest (Post-Construction Interest)

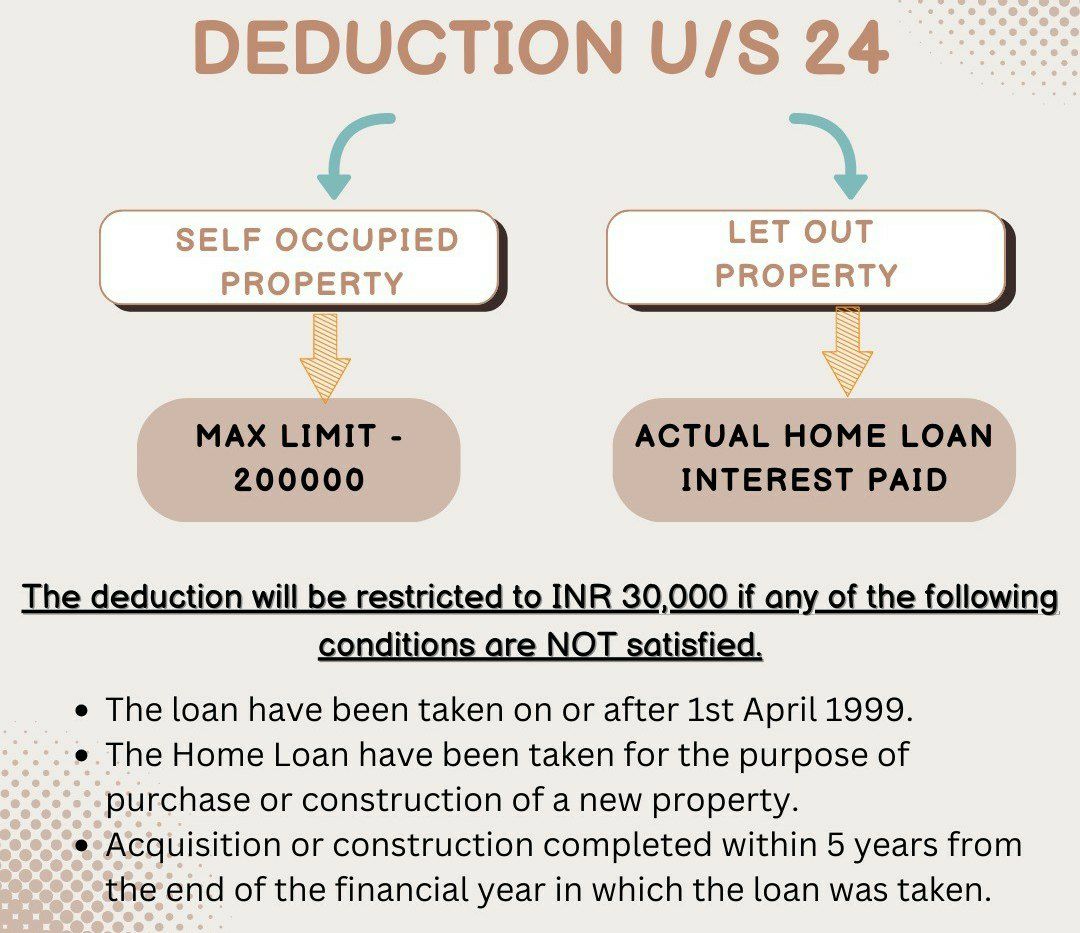

Once the house is completed, you can claim the regular annual interest on home loan (subject to limits):

-

If completed within 5 years (from end of the FY in which loan was taken):

- Pre-construction interest : claimable in 5 equal instalments starting from the year of completion/possession.

- Self-occupied property: Maximum deduction of INR 2,00,000 per year U/s 24(b). For a self-occupied house, the total deduction (current year + pre-construction portion) is capped at INR 2 lakh per year.

- Let-out property: No maximum cap; you can claim the entire interest (but set-off of loss under “House Property” is limited to INR 2,00,000 against other heads in a year, balance carried forward for 8 years). For a let-out house, the entire interest is allowed (no cap, but set-off limited to INR 2 lakh per year; balance carried forward).

-

If completed after 5 years:

- For self-occupied house : deduction restricted to INR 30,000 per year (including pre-construction interest).

- For let-out house : full interest allowed (same set-off rule as above).

Principal Repayment

- Deduction for principal repayment U/s 80C (up to INR 1.5 lakh) is available only after construction is completed and possession is taken.

- Construction should be completed within 5 years from the end of the financial year in which the loan was taken.

- If not completed within this period, the maximum deduction for self-occupied property reduces from INR 2,00,000 to INR 30,000 per year.

When Under-Construction House is Sold

- Cost of acquisition: Can include the interest paid on the home loan (if not already claimed as deduction).

- Capital gains: Exemption possible U/s 54 if reinvested in another house property, subject to conditions.

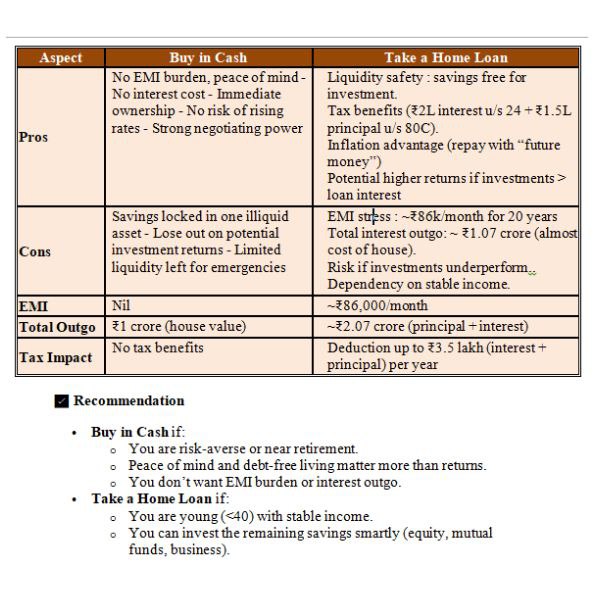

Home Purchase: Buy in Cash vs Take a Home Loan

| Aspect | Buy in Cash | Take a Home Loan |

|---|---|---|

| Pros | – No EMI burden – Peace of mind – No interest cost – Immediate ownership – No rate hike risk – Strong negotiating power |

– Liquidity safety – Tax benefits (₹2L interest u/s 24 + ₹1.5L principal u/s 80C) – Inflation advantage – Potential higher returns |

| Cons | – Savings locked in one asset – Missed investment returns – Limited emergency liquidity |

– EMI stress (~₹86k/month) – Interest outgo ~₹1.07 crore – Risk if investments underperform – Income dependency |

| EMI | Nil | ~₹86,000/month |

| Total Outgo | ₹1 crore (house value) | ~₹2.07 crore (principal + interest) |

| Tax Impact | No tax benefits | Deduction up to ₹3.5 lakh/year |

Recommendation Guide on Buy in Cash vs Take a Home Loan

Buy in Cash If:

- Person are risk-averse or nearing retirement

- In case Person value peace of mind and debt-free living

- Person want to avoid EMI burden and interest costs

Take a Home Loan

If person are young (<40) with stable income & person can invest remaining savings smartly (e.g., equity, mutual funds, business)

In Summary:

You get tax benefit on interest only after possession, not during construction. No deduction allowed during construction. After completion:

-

- Pre-construction interest: Claim in 5 equal instalments.

- Regular interest: INR 2 lakh max (self-occupied), full amount (let-out).

- The 5-year rule is crucial: finish construction within 5 years to enjoy the INR 2 lakh benefit (instead of just INR 30,000).

- Principal: Section 80C benefit available