GST Returns to Become Time-Barred After 3 Years

Page Contents

GST Returns to Become Time-Barred After 3 Years

The upcoming change in the GST system, effective from early 2025, will significantly impact taxpayers by imposing a 3 year time limit for filing monthly and annual GST returns.

Under the Finance Act, 2023 (8 of 2023), effective from October 1, 2023, via Notification No. 28/2023 – Central Tax dated July 31, 2023, taxpayers will no longer be allowed to file certain GST returns after three years from their respective due dates. This restriction, introduced under the Finance Act 2023, applies to returns under Sections 37, 39, 44, and 52 of the GST Act. This significant amendment applies to returns under the following sections of the CGST Act:

- Section 37: Returns for outward supplies (e.g., GSTR-1).

- Section 39: Returns for payment of tax liability (e.g., GSTR-3B, GSTR-4, GSTR-5, GSTR-5A).

- Section 44: Annual returns (e.g., GSTR-9).

- Section 52: Returns for Tax Collected at Source (e.g., GSTR-7, GSTR-8).

Businesses should promptly file any overdue returns to avoid non-compliance. A thorough audit of filing history is recommended to ensure that any pending returns are addressed before the deadline.

The returns affected by this time bar include GSTR-1, GSTR-3B, GSTR-4, GSTR-5, GSTR-5A, GSTR-6, GSTR-7, GSTR-8, and GSTR-9. After 3 years from the original due date, taxpayers will no longer be able to file these returns.

This move aims to enhance timely compliance, improve data reliability, and reduce the backlog of pending returns within the GST system.

Key Points related to GST Returns Time-Barred After 3 Years

- Affected GST Returns: All major GST returns, such as GSTR-1, GSTR-3B, GSTR-9, and others, will fall under this new restriction.

- Time Limitation: GST returns can only be filed within three years from the due date of the original return. The GST portal will enforce this restriction starting early 2025, as mandated by the Finance Act, 2023.

- The system will be updated to enforce this rule starting early 2025.

- Consequences of Non-Compliance: GST Taxpayers failing to file within the time limit will be classified as defaulters. GST dept may conduct a best judgment assessment, determining tax liabilities based on available records. This could result in tax demand notices, penalties, and potential litigation.

Judicial Perspective on Delays

- Historically, courts have shown leniency in cases of delayed GST filings if the delay was due to genuine administrative challenges rather than intentional evasion. For instance, the Madhya Pradesh High Court recently held that delays arising from legitimate operational hurdles might warrant some flexibility.

- However, under the new rule, the courts’ ability to grant relief may be curtailed since the three-year filing restriction is a clearly stated legislative mandate. This reduces discretionary leeway, aligning compliance more strictly with statutory timelines.

- By setting a definitive timeline, the system aims to eliminate the accumulation of unfiled returns, making the GST ecosystem more efficient. Timely filings ensure the availability of reliable data for both taxpayers and authorities, reducing disputes and mismatches in credit claims.

Rajput Jain & Associates Expert Insights:

- Emphasizes the importance of reviewing and addressing historical records promptly to avoid compliance challenges. Rajput Jain & Associates Expert highlights potential difficulties for businesses dealing with administrative hurdles in reconciling old data.

- Recommends proactive reconciliation of GST credits, credit notes, and sales data with GSTR 2A/2B and financial records. Timely adjustments are essential to avoid last-minute issues.

- Notes that this change will particularly affect taxpayers with suspended registrations or overlooked filings.

- Reconcile financial statements, GSTR-2A/2B, and GST returns to identify discrepancies and ensure accuracy. Address any pending returns immediately to avoid being barred from future filing.

- Implement robust processes to ensure timely GST return filing going forward. Rajput Jain & Associates Expert advises compiling and reconciling necessary information now to comply with the 3 year deadline.

- Delaying action until closer to the three-year mark increases the risk of errors and missed deadlines. Filing pending returns now can prevent compliance hassles, avoid penalties, and ensure a clean tax record.

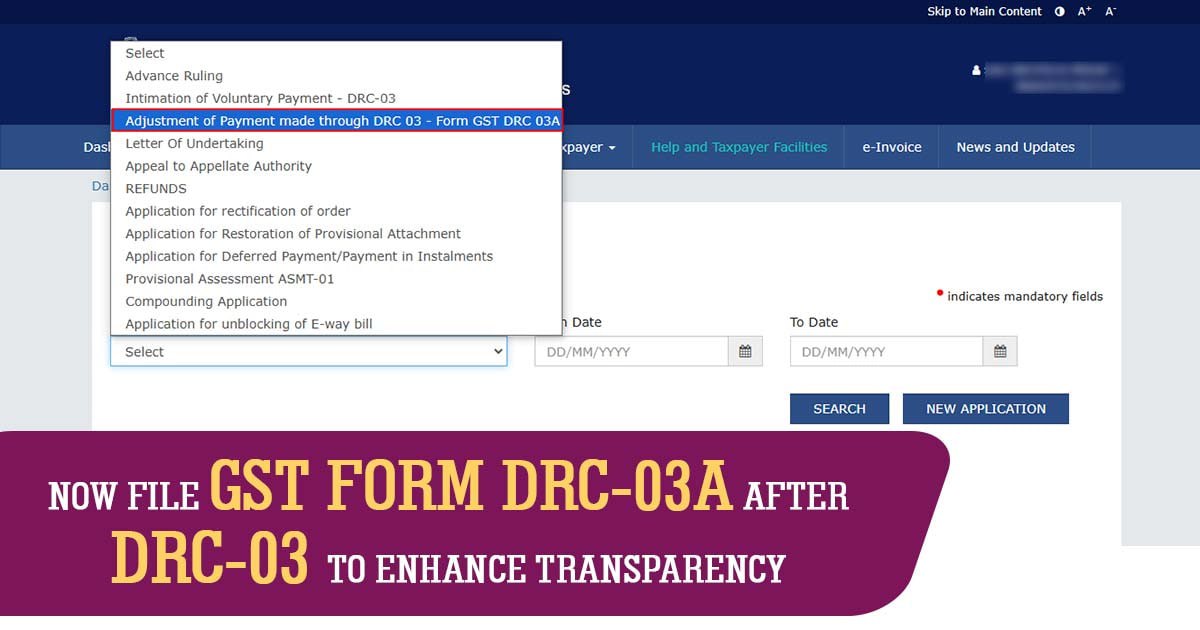

GST Portal Adds Form DRC-03A After Filing DRC-03 to Simplify the Voluntary Payment Process