Eligibility U/S 197 for Certificate for Lower TDS Deduction

Page Contents

Eligibility U/S 197 for a certificate for Nil or lower TDS deduction

Income Covered & Eligibility Condition of Apply U/s 197

- Applicants must demonstrate that their projected tax liability for the fiscal year is lower than the TDS amount deducted at standard rates as per eligibility u/s 197 for a certificate for Nil or lower TDS deduction. Detailed documentation, such as income computations and previous years’ tax returns, must be provided to support the application.

- Individuals and entities eligible to apply u/s 197 for a certificate for Nil or lower TDS deduction include:

- Individuals with Low Annual Income: Those whose estimated annual income is below the taxable threshold. Salaried individuals who anticipate lower tax liability after accounting for deductions and exemptions.

- Professionals and Contractors: Freelancers, consultants, and contractors receiving income subject to TDS (e.g., professional fees, commissions). Self-employed individuals and small businesses with incomes where TDS is typically deducted.

- Businesses and Entities: Companies and partnerships with incomes from interest, rentals, commissions, or professional charges. Entities covered under specific sections (e.g., Section 11, Section 12, Section 139(4C)) where income is exempt u/s 10.

- Taxpayers whose income falls under the following categories can file an application under Section 197 for Nil or lower deduction of Tax Deducted at Source (TDS) i.e Salary Income, Interest on Securities, Dividends, Interest Other than Interest on Securities, Contractors’ Income, Insurance Commission, Fee for Professional or Technical Services, Compensation on Acquisition of Immovable Property, Income with Respect to Units of Investment Fund, Commission/Remuneration/Prize on Lottery Tickets, Commission or Brokerage, Rent, Income of Non-Residents, Income in Respect of Investment in Securitization Trust.

Requirements for Eligibility u/s 197 for a certificate for Nil or lower TDS deduction:

- Applicant must provide the Proof of Lower Tax Liability: Demonstrate that the projected tax liability is lower than the TDS at standard rates.and that require to submit all the Required Documents i.e Upload supporting documents, including income computations, previous years’ tax returns, and relevant certificates.

What is the valid Time Limit of a Sec 197 Certificate for Nil or lower TDS deduction?

-

- A Section 197 certificate is valid from the date of issuance until March 31st of the financial year in which it is issued.

- It applies to the ongoing financial year and lapses at the end of the fiscal year (March 31st).

- Taxpayers must apply for a new certificate for each financial year if they wish to continue benefiting from reduced or Nil TDS.

- The application should be made promptly to ensure continuity of the reduced or Nil TDS benefit.

- Taxpayers should monitor their income and tax liability to ensure they continue to qualify for the reduced or Nil TDS deduction.

- Any changes in financial circumstances should be reported, and appropriate action should be taken to comply with the tax regulations.

By meeting these eligibility criteria and following the proper application process, taxpayers can benefit from reduced or Nil TDS deduction under Section 197 of the Income Tax Act.

How to Apply for Certificate u/s 197 Online?

Procedure for Making the Application for Nil or Lower Deduction of Tax (Form 13) : The Procedure for Making the Application for Nil or Lower Deduction of Tax (Form 13) process must be completed online. Application must ensure all required documents are accurately uploaded. Form 13 application for certificate is valid for a specified period and for diductors and services. Following Procedure of Application for Nil/ Lower Deduction of Tax via filling of Form 13.

Step 1: Registration on TRACES Portal :

For that Go to TRACES (TDS-CPC) website. Via Use your Permanent Account Number (PAN) to register on the portal.

Step 2: Login and Request Form 13 :

Log in to the TRACES portal using your credentials., then Go to the ‘Statements/Forms’ tab. Select ‘Request for Form 13’ from the dropdown menu.

Step 3: Filing the Application

- Applicant Choose Verification Method:

- Digital Signature Certificate (DSC)

- Electronic Verification Code (EVC)

- Form 13 for TCS: If you are a taxpayer whose payments are liable for tax collection at source (TCS) under section 206C, file the application in Form 13 for a certificate for Nil or lower tax collection.

Step 4: Upload Required Documents along with Form 13:

- Estimated Income Computation For the current financial year.

- Return of Income/Assessment Order For the previous four financial years.

- Computation of Estimated Total Income For the previous four financial years, if the return of income has not been filed.

- Registration/Exemption Certificate:

- For entities covered u/s 11 or 12 of the Income Tax Act.

- For entities covered u/s 139(4C) with income exempt u/s 10.

Step 5: Assessment by Assessing Officer

- The assessing officer reviews the application and documents to determine the estimated tax liability.

- The officer considers:

- Tax payable on the estimated income of the current financial year.

- Tax payable/paid on the assessed, returned, or estimated income of the previous four financial years.

- Advance tax payment, tax deducted at source, and tax collected at source for the current financial year until the date of application.

Step 6: Issuance of Certificate

By following these steps, taxpayers can apply for a certificate for Nil or lower deduction of tax under Form 13 effectively.

- If the officer is satisfied that the estimated tax is NIL or negligible and that generic rate deductions are unnecessary, they will issue the NIL or lower TDS/TCS certificate.

- The certificate will:

- Be specific to the deductor and the service (section).

- Be valid from the date of issue to the end of the financial year, unless canceled by the assessing officer.

Renewal Process of Lower Deduction Certificate of Tax Deducted at Source

A new application must be submitted each financial year to continue benefiting from the reduced or Nil TDS deduction. Apply promptly in the new financial year to avoid interruptions in the benefit.

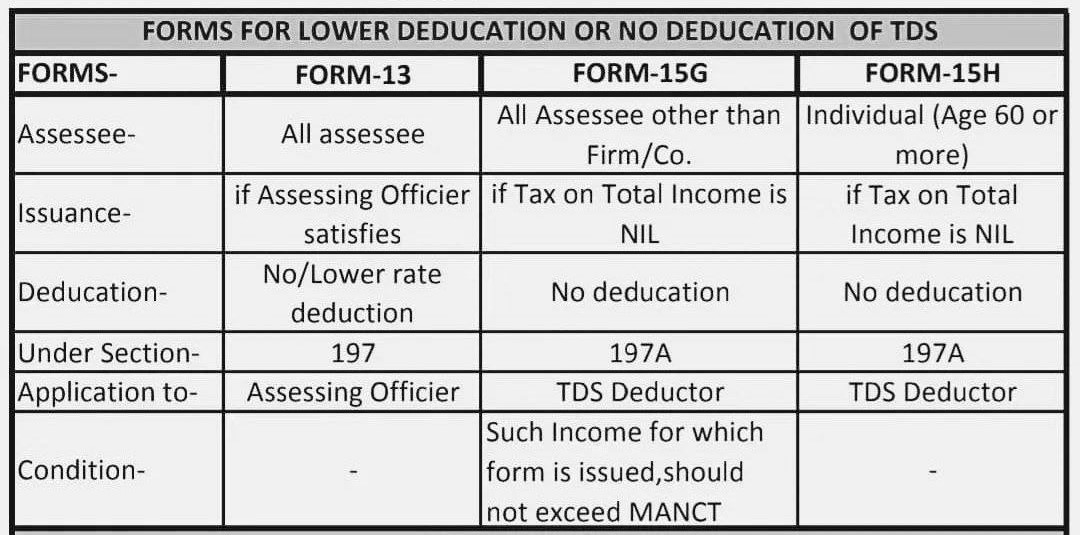

Forms for Lower Deduction and Non-Deduction of TDS

Lower Deduction of TDS

- Form Required: Form 13 – Objective of filling if form 13 is to apply for Nil/Lower deduction of Tax Deducted at Source (TDS). An application must be filed with the Income Tax Officer using Form 13. Upon satisfaction, the tax officer issues a certificate under Section 197 for lower deduction of TDS.

Non-Deduction of TDS

- Forms Required: Form 15G and Form 15H. Objective of filling if Form 15G and Form 15H is to declare that no TDS should be deducted since the individual’s total income is below the taxable limit. For filling Procedure of Form 15G and Form 15H, we required to submit the relevant form to the bank or financial institution where the fixed deposit or other income-generating account is held.

- Usage:

- Form 15G: For individuals below 60 years of age and Hindu Undivided Families (HUF).

- Form 15H: For individuals who are 60 years and above (senior citizens).

- In Summary we can say that Lower Deduction of TDS: Apply using Form 13 to the Income Tax Officer for a certificate under Section 197. Non-Deduction of TDS: Submit Form 15G (for individuals below 60 and HUFs) or Form 15H (for senior citizens) to the bank or financial institution.

TDS Rate along with Nature of transaction, Threshold Limit (Rs), Applicability to NR/Residents

| Nature of transaction | Nature of transaction | Section | Threshold Limit (Rs) | TDS Rate | Applicability to NR | Applicability to Residents |

| Payment of salary | Salary | 192 | Basic exemption limit of employee | Normal Slab Rates | Applicable to NR | Applicable To Resident |

| Premature withdrawal from EPF | Withdrawal from EPF | 192A | Rs. 50,000 | 10% | Applicable to NR | Applicable To Resident |

| Interest on securities | Interest on Securities | 193 | a) Debentures- Rs. 5,000 b) 8% Savings (Taxable) Bonds 2003 or 7.75% Savings (Taxable) Bonds 2018- Rs. 10,000 c) Other securities- No limit |

10% | Not Applicable to Nr | Applicable To Resident |

| Payment of any dividend | Dividend payment | 194 | Rs. 5,000 | 10% | Not Applicable to Nr | Applicable To Resident |

| Interest from other than interest from securities (from deposits with banks/post office/co-operative society) | Interest other than Securities | 194A | a) Senior Citizens- Rs. 50,000 b) Others- Rs. 40,000 |

10% | Not Applicable to Nr | Applicable To Resident |

| Income from lottery winnings, card games, crossword puzzles, and other games of any type (Except Online Gaming) | Winnings from Lottery, Card Games, crossword puzzles | 194B | Aggregate income from lottery winnings, card games, crossword puzzles etc- Rs. 10,000 |

30% | Applicable to NR | Applicable To Resident |

| Income from online games | Income from online games | 194BA | No limit | 30% | Applicable to NR | Applicable To Resident |

| Income from horse race winnings | Income from horse race winnings | 194BB | Rs. 10,000 | 30% | Applicable to NR | Applicable To Resident |

| Payment to contractor/sub-contractor:- | Contractor – I/HUF | 194C | a) Single transaction- Rs. 30,000 b) Aggregate transactions- Rs. 1,00,000 |

1% | Not Applicable to Nr | Applicable To Resident |

| Payment to contractor/sub-contractor:- | Contractor – Others | 194C (Others) | a) Single transaction- Rs. 30,000 b) Aggregate transactions- Rs. 1,00,000 |

2% | Not Applicable to Nr | Applicable To Resident |

| Insurance commission to: a) Domestic Companies b) Other than companies |

Insurance Commission – Company | 194D | Rs. 15,000 | 10% | Not Applicable to Nr | Applicable To Resident |

| Insurance commission to: a) Domestic Companies b) Other than companies |

Insurance Commission – Others | 194D | Rs. 15,000 | 5% | Not Applicable to Nr | Applicable To Resident |

| Income from the insurance pay-out, while payment of any sum in respect of a life insurance policy. | Life Insurance Pay-out | 194DA | Rs. 1,00,000 | 2% | Not Applicable to Nr | Applicable To Resident |

| Payment to non-resident sportsmen/sports association | Payment to NR Sportsmen/Sports Association | 194E | No limit | 20% + Surcharge & Cess | Applicable to NR | Not Applicable to Resident |

| Payment of amount standing to the credit of a person under National Savings Scheme (NSS) | Payment from National Savings Scheme (NSS) | 194EE | Rs. 2,500 | 10% | Applicable to NR | Applicable To Resident |

| Payment for the repurchase of the unit by Unit Trust of India (UTI) or a Mutual Fund | Repurchase of Unit of UTI/MF | 194F | No limit | This section is omitted with effect from 1st October 2024 | Applicable to NR | Applicable To Resident |

| Payments, commission, etc., on the sale of lottery tickets | Payments, commission, etc., on the sale of lottery tickets | 194G | Rs. 15,000 | 2% | Applicable to NR | Applicable To Resident |

| Commission or brokerage | Commission/Brokerage | 194H | Rs. 15,000 | 2% | Not Applicable to Nr | Applicable To Resident |

| Rent on plant and machinery | Rent on Plant & Machinery | 194-I(a) | Rs. 2,40,000 | 2% | Not Applicable to Nr | Applicable To Resident |

| Rent on land/building/furniture/fitting | Rent on Land/Building/Furniture/Fitting | 194-I(b) | Rs. 2,40,000 | 10% | Not Applicable to Nr | Applicable To Resident |

| Payment in consideration of transfer of certain immovable property other than agricultural land. | Transfer of Immovable Property other than Agri Land | 194-IA | Rs. 50,00,000 | 1% | Not Applicable to Nr | Applicable To Resident |

| Rent payment by an individual or HUF not covered u/s. 194-I | Rent payment by I/HUF other than 194I | 194-IB | Rs. 50,000 per month | 2% | Not Applicable to Nr | Applicable To Resident |

| Payment under Joint Development Agreements (JDA) to Individual/HUF | Payment under JDA to I/HUF | 194-IC | No limit | 10% | Not Applicable to Nr | Applicable To Resident |

| Any sum paid by way of fee for professional services | Professional Fees | 194J | Rs. 30,000 | 10% | Not Applicable to Nr | Applicable To Resident |

| Any sum paid by way of remuneration/fee/commission to a director | Remuneration/Fees/ Commission to Director | 194J | Rs. 30,000 | 10% | Not Applicable to Nr | Applicable To Resident |

| Any sum paid as a fee for technical services | Payment as a Fee for Technical Services | 194J | Rs. 30,000 | 2% | Not Applicable to Nr | Applicable To Resident |

| Any sum paid by way of royalty towards the sale or distribution, or exhibition of cinematographic films | Royalty paid towards Sale or Distribution/Exhibition of Cinematographic Films | 194J | Rs. 30,000 | 2% | Not Applicable to Nr | Applicable To Resident |

| Any sum paid as fees for technical services, but the payee is engaged in the business of operation of the call centre. | Fees for Technical Services | 194J | Rs. 30,000 | 2% | Not Applicable to Nr | Applicable To Resident |

| Payment of any income for units of a mutual fund, for example, dividend | Dividend/Income from Units of MF | 194K | No limit | 10% | Not Applicable to Nr | Applicable To Resident |

| Payment in respect of compensation on acquiring certain immovable property | Compensation on acquiring certain immovable property | 194LA | Rs. 2,50,000 | 10% | Not Applicable to Nr | Applicable To Resident |

| Payment of interest on infrastructure debt fund to Non-Resident | Interest on Infrastructure Debt Fund to NR | 194LB | No limit | 5% | Applicable to NR | Not Applicable to Resident |

| Payment of interest for the loan borrowed in foreign currency by an Indian company or business trust against loan agreement or the issue of long-term bonds | Interest for the loan borrowed in foreign currency by an Indian company | 194LC | No limit | 5% | Applicable to NR | Not Applicable to Resident |

| Payment of interest on bond (rupee- denominated) to FII or a QFI | Payment of interest on bond to FII | 194LD | No limit | 5% | Applicable to NR | Not Applicable to Resident |

| Certain income distributed by a business trust to its unitholder | Certain income distributed by a business trust to its unitholder | 194LBA(1) | No limit | 10% | Not Applicable to Nr | Applicable To Resident |

| TDS on the transfer of virtual digital assets Specified persons: Individual or a HUF not having income from business or profession OR Individual or a HUF having sales from business or profession less than |

Transfer of virtual Digital asset | 194S | Specified Persons- Rs. 50,000 Others- Rs 10,000 |

1% | Not Applicable to Nr | Applicable To Resident |

| TDS on certain payment to partner | Certain payment to partner | 194T | Rs. 20,000 | 10% | Not Applicable to Nr | Applicable To Resident |

| Income on investments made by NRI citizen | Income on investments made by NRI citizen | 195 | No limit | 20% | Applicable to NR | Not Applicable to Resident |

| Income (including LTCG) from units of an offshore fund | Income (including LTCG) from units of an offshore fund | 196B | No limit | 10% | Applicable to NR | Not Applicable to Resident |

| Income (including LTCG) from foreign currency bonds or GDR of an Indian company | Income (including LTCG) from foreign currency bonds or GDR of an Indian company | 196C | No limit | 10% | Applicable to NR | Not Applicable to Resident |

| Income (excluding dividend and capital gain) from Foreign Institutional Investors. | Income (excluding dividend and capital gain) from Foreign Institutional Investors. | 196D | No limit | 20% | Applicable to NR | Not Applicable to Resident |

CA Professional Assistance with Lower Deduction Certificate Application

At India Financial Consultancy Corporation Pvt LTD, we recognize the challenges faced by taxpayers who are subject to TDS despite having minimal or no taxable income for the year. To alleviate this burden, the Income Tax Act provides for the issuance of a Lower TDS Deduction Certificate u/s 197. This certificate allows eligible taxpayers to benefit from reduced or nil TDS rates, ensuring that their tax deductions are aligned with their actual tax liability.

By leveraging our expertise, you can ensure that you only pay what is necessary, preserving your cash flow and simplifying your tax affairs.