GSTN Introduce 2-Factor Authentication w.e.f. 1 Dec 2023

Page Contents

GSTN Introduce 2-Factor Authentication w.e.f. 1 Dec 2023

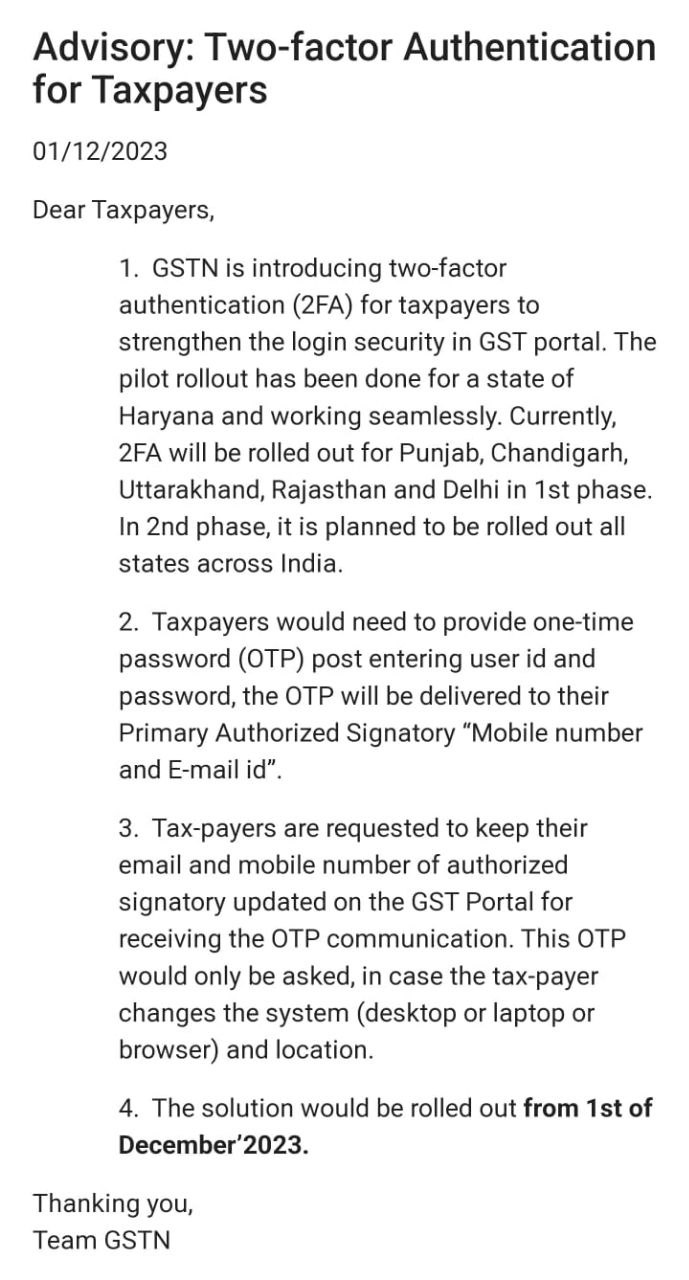

As per the GSTN issue an advisory Advisory No. 618 dated December 01, 2023, Goods and Services Tax Network will introduce 2- factor authentication (2FA) for taxpayers. GST Dept start the implementation process of 2-Factor Authentication to login security enhance or Security Enhancement security of the GST portal,

Rollout Stages in implementation of 2-Factor Authentication:

- – 1st Phase: Initially 2-Factor Authentication with Uttarakhand, Rajasthan, Punjab, Chandigarh, & New Delhi.

- – 2nd Phase: Next phase 2-Factor Authentication Gradual expansion to cover all india other states.

Keep GST Taxpayer information Updated:

- Ensure that GST Taxpayer authorized signatory’s contact information must be current on Goods & Services Tax Portal. In order to receive the OTP delivery, taxpayers are asked to maintain their authorised signatory’s email address and mobile number up to date on the GST Portal.

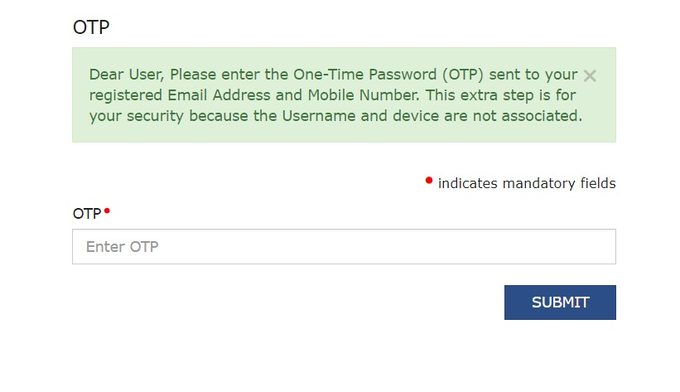

How 2-Factor Authentication Works in GST portal:

- After GST portal logging in, & One Time Passwords will be sent to the main authorized Signatory’s registered email & mobile.

One Time Passwords (OTP) needs:

- One Time Passwords will be required when taxpayer GST Logging in from a new location or device. This OTP would only be requested in the event that the taxpayer relocates or modifies their system (desktop, laptop, or browser). The remedy would go into effect on December 1st, 2023.

For Goods and services Tax portal Security Enhancement:

- Goods and services Tax portal is implementing 2-factor Authentication (2FA) to strengthen login security.

GST Taxpayer may access the details about GST advisory via reaching the following link

https://www.gst.gov.in/newsandupdates/read/618

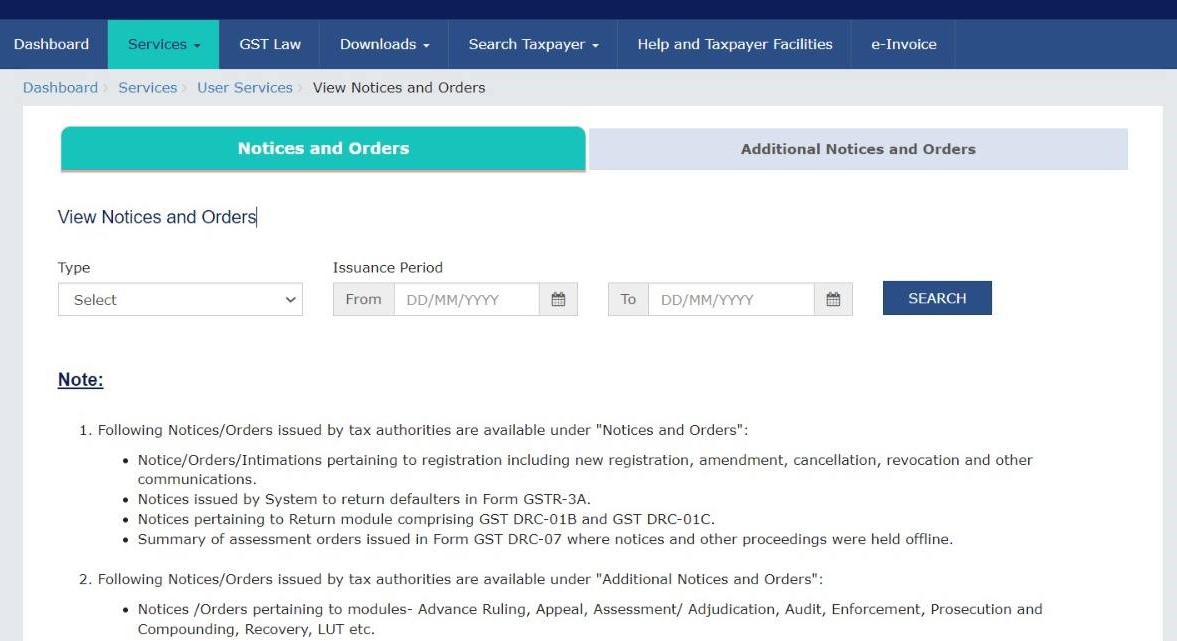

GSTN Portal enhanced design for access to ‘Notices and Orders’ Tab