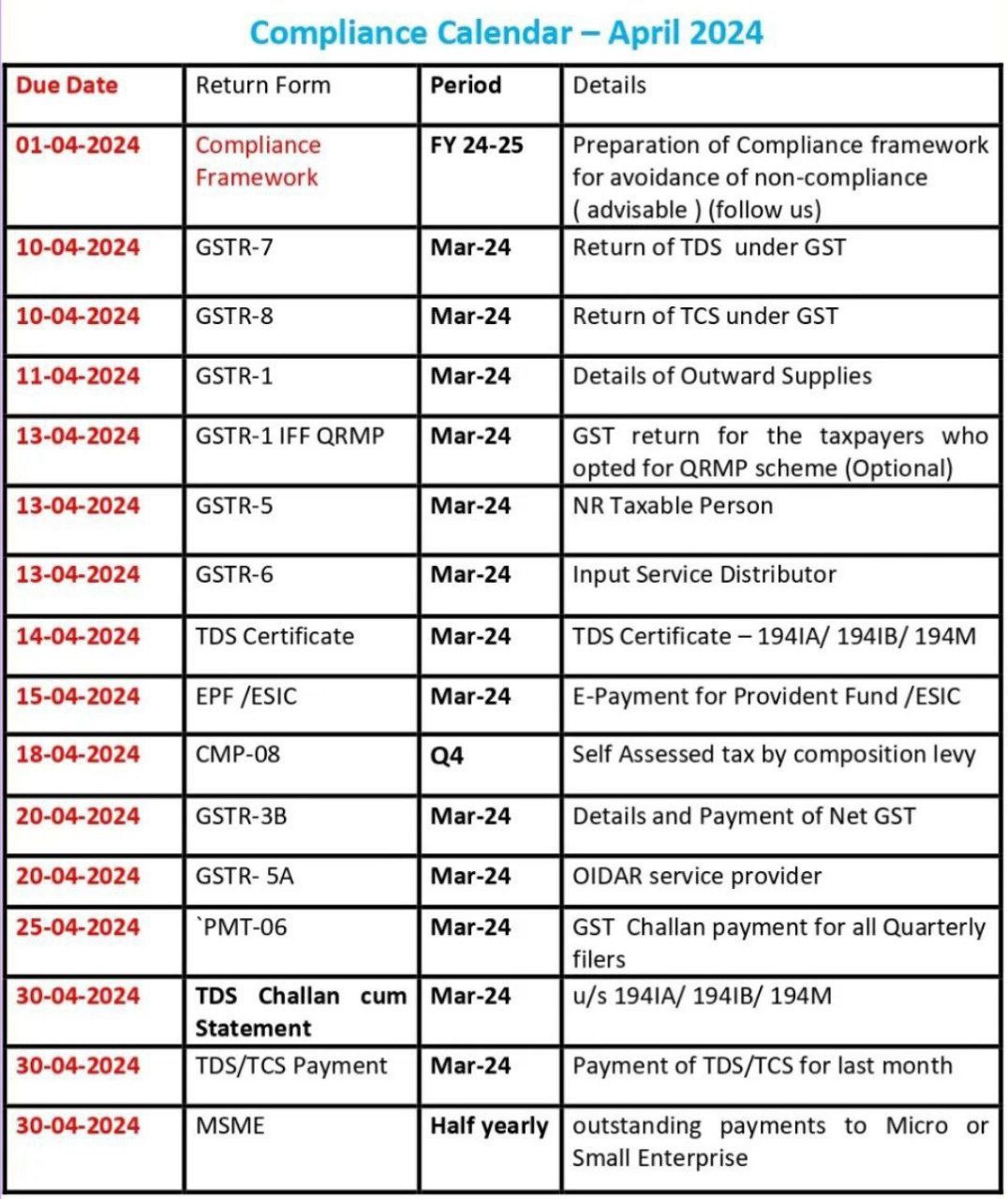

MSME -Buyer fails to make payment in 45 days ?

MSME -Buyer fails to make payment in 45 days MSME APPLICABILITY CRITERIA All manufacturing, service industries, wholesale, and retail traders that fulfil the revised MSME classification criteria of annual turnover and investment can apply for MSME registration. Thus, the MSME registration MSME registration: Individuals, startups, business owners, and entrepreneurs Private and Public limited companies Sole …