CBDT Raised exemption limit for undisclosed foreign assets

Page Contents

Central Board of Direct Taxes have indeed raised the exemption threshold for undisclosed foreign assets

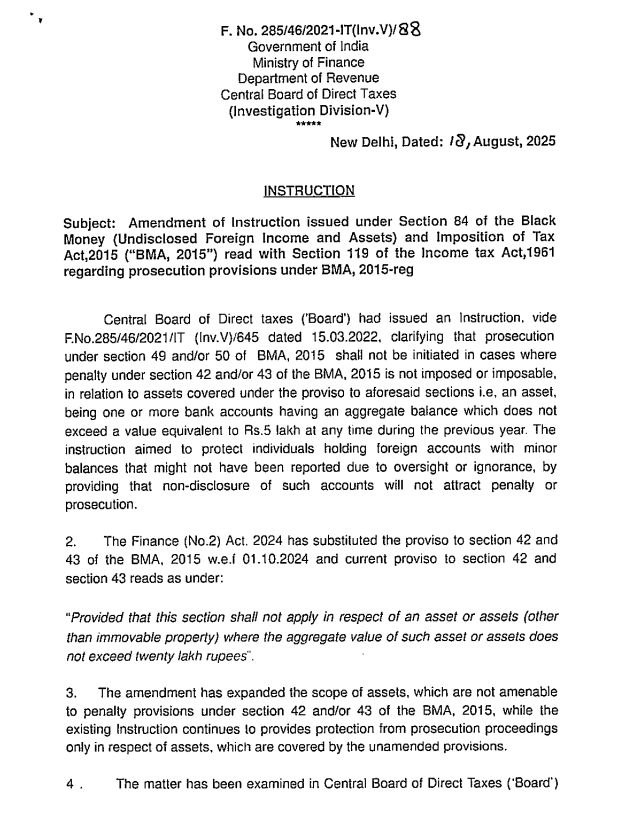

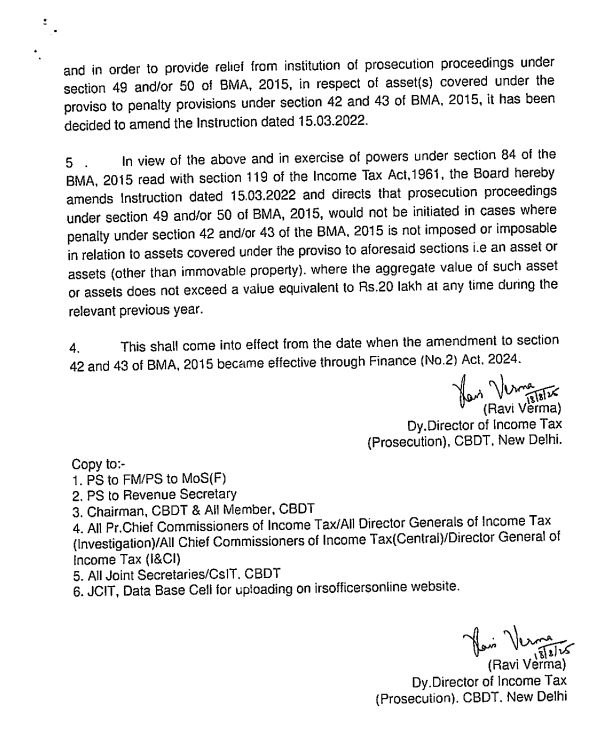

Following this legislative change, the Central Board of Direct Taxes has amended its internal instruction (dated August 18, 2025) to align prosecution thresholds with the revised penalty limits. Now, prosecution u/s 49 and 50 will not be initiated where penalties u/s 42 or 43 are not warranted—specifically for undisclosed foreign assets (excluding immovable property) valued up to INR 20 lakh during the relevant year

What is earlier Position (15.03.2022 Instruction): Prosecution u/s 49 and 50 of the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 was not initiated if the undisclosed foreign asset(s) (other than immovable property) had an aggregate value up to INR 5 lakh during the previous year.

As per recent media reports, the Finance (No. 2) Act, 2024 increased the exemption limit u/s 42 & 43 of the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 (BMA) from INR 5 lakh to INR 20 lakh, applicable to all types of foreign assets except immovable property. This change took effect from October 1, 2024.

Amendment via Finance (No. 2) Act, 2024:

W.e.f. 01.10.2024, the proviso to Sections 42 and 43 of the the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 was amended. & New limit: INR 20 lakh (aggregate value of foreign asset(s), other than immovable property). This comes into effect from 01.10.2024, when the Finance (No. 2) Act, 2024 amended Sections 42 and 43.

Prosecution u/s 49 and 50 will not be initiated if the penalty u/s 42/43 is not leviable. This relief applies where the aggregate value of foreign assets (excluding immovable property) does not exceed INR 20 lakh at any time during the relevant year.The basic objective of this CBDT Instruction (18.08.2025 for taxpayers holding small-value foreign assets/accounts, which might be missed due to oversight or ignorance.

Practical Impact on Taxpayers

Threshold Raised: From INR 5 lakh to INR 20 lakh, which covered all foreign assets (bank accounts, shares, etc.) except immovable property. So impactful is the relief available for taxpayers that there is no penalty or prosecution for non-disclosure of such small-value assets. This disclosure is still mandatory in ITR, and this exemption is only from penalty/prosecution, not from reporting obligations.

What does this mean for taxpayers?

| Scenario | Pre-Amendment (Before Oct 1, 2024) | Post-Amendment (Effective Oct 1, 2024) |

| Foreign assets ≤ INR 5 lakh | Protected from penalties under Sections 42/43; internal Central Board of Direct Taxes instruction also protected from prosecution | Still protected—but threshold raised |

| Foreign assets between INR 5—INR 20 lakh | Previously exposed to penalties and prosecution | Now protected from both penalties and prosecution (if other conditions met) |

| Foreign immovable property (e.g. real estate abroad) | Always excluded from this exemption | Still excluded |

So effectively, individuals with small-value foreign assets (up to INR 20 lakh), excluding property, are now shielded from both penalty and prosecution under the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 for non-disclosure—provided the assets are disclosed in the ITR and no other irregularities exist

Important caveats

- Disclosure is still mandatory. Even though the protection threshold has been expanded, all foreign assets must still be declared in the Income Tax Return—this is not a waiver

- Immovable property is excluded. Any immovable foreign asset, such as land or property, continues to fall outside the exemption.

- Aggregate value matters. The INR 20 lakh limit is based on the total combined value of all eligible foreign assets, not assessed separately

- Deliberate concealment is still punishable. The relief applies only to unintentional non-disclosures. Intentional attempts to evade tax, artificial splitting of assets, or manipulation of values remain subject to penalties and prosecution

- You may also review the following blogs:

In Summary:

CBDT has raised the exemption limit for undisclosed foreign assets (excluding immovable property) from INR 5 lakh to INR 20 lakh, aligning prosecution relief with the revised penalty threshold. This brings much-needed clarity and relief to taxpayers with minor foreign holdings, while ensuring strict enforcement for serious cases. Enforcement will now target significant or deliberate cases of black money rather than minor omissions.

Comparison: Pre vs Post Amendment

| Scenario | Before Oct 1, 2024 | After Oct 1, 2024 |

| Foreign assets ≤ INR 5 lakh | No penalty or prosecution | Still exempt |

| Foreign assets between INR 5–20 lakh | Penalty and prosecution applicable | Now exempt |

| Foreign immovable property | Always excluded | Still excluded |