Understanding Taxes Isn’t Optional It’s a Superpower

Page Contents

Understanding Taxes Isn’t Optional; It’s a Superpower

How Does the Government Spend Your Tax Contribution?

In India, taxes are one of the largest sources of government revenue. Each year, the spending plan is presented through the Union Budget by the Government of India, outlining how public funds will be allocated across sectors. Let’s break it down in a simple, visual way. Following are major Sources of Government Revenue.

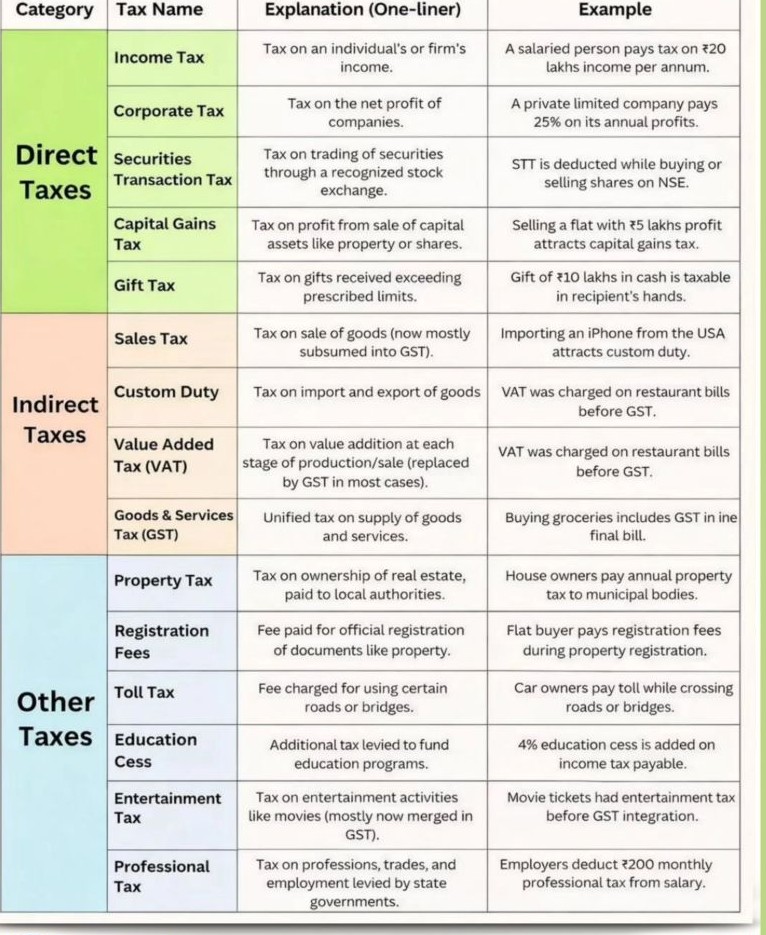

Sources of Government Revenue The major sources of revenue include Personal Income Tax, Corporate Tax, Goods and Services Tax (GST), excise duty, and customs duty. These funds are pooled into the Consolidated Fund of India and then allocated as per budgetary priorities. Financial literacy begins with clarity. Here’s a simple visual roadmap to India’s tax structure so you can understand how money flows from income and spending into the system.

Direct Taxes

These are taxes paid directly to the government by individuals or businesses.

- Income Tax : Paid by individuals on salary, business income, capital gains, etc.

- Corporate Tax : Paid by companies on profits.

- Capital Gains Tax : Tax on profit from sale of shares, property, mutual funds, etc.

- Securities Transaction Tax (STT) : Automatically deducted when trading shares on recognized stock exchanges. Direct taxes are linked to income or profit.

Common tax-saving avenues include Public Provident Fund (PPF), Employees’ Provident Fund (EPF), National Pension System (NPS), Tax-saving fixed deposits, Life insurance premiums, Health insurance premiums, and Medical expenses for dependents. Under Section 80C, eligible deductions can go up to ₹1.5 lakh annually (subject to conditions).

Indirect Taxes: These are embedded in the price of goods and services.

- GST (Goods and Services Tax) : Replaced VAT, service tax, excise duty, and several other indirect taxes.

- Customs Duty : Tax on imports and certain exports. You pay indirect taxes when you purchase goods or services.

Other Important Taxes & Charges

- Education & Health Cess : 4% added to your income tax liability.

- Professional Tax : State-level tax (varies by state, usually up to ₹200 per month).

- Gift Tax Rule : Tax applies if gifts received exceed ₹50,000 in a year (with specific exemptions for relatives and certain occasions).

What Most People Miss

- STT is automatically deducted when trading shares

- GST consolidated multiple earlier indirect taxes

- Cess increases final tax liability

- Professional Tax differs across states

- Tax rules vary depending on income source and classification

The Big Picture related to financial literacy begins with clarity

| Category | Based On | Paid By |

| Direct Tax | Income / Profit | Individuals & Businesses |

| Indirect Tax | Consumption | Consumers (collected by businesses) |

| Other Taxes | Specific Activity / Purpose | As applicable |

The tax system seems complex but once you understand the categories, everything starts to connect. Direct taxes reduce your income. Indirect taxes increase your purchase cost. Cess and surcharges adjust final liability. Financial freedom starts with financial awareness.

How the Government Spend Taxpayer Money?

- Interest Payments on Loans : A significant portion of tax revenue goes toward interest payments on past borrowings. Since the government borrows to manage fiscal deficits and capital expenditure, servicing this debt becomes a major expenditure head.

- Defense Expenditure: India allocates roughly 11–11.5% of the Union Budget to defense. This includes Salaries of armed forces, operational costs, Modernisation of weapons, import and development of defense equipment, and border security management.

- Government Welfare Schemes : Both Central and State Governments fund social welfare schemes such as Pradhan Mantri Jan Dhan Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana, Pradhan Mantri Mudra Yojana, Atal Pension Yojana and Kisan Vikas Patra. These schemes promote financial inclusion, insurance coverage, entrepreneurship, pensions, and rural savings.

- Subsidies : Subsidies are provided to farmers (fertilizer, crop support), consumers (food, LPG), specific industries. They are delivered as direct cash transfers, price support, tax concessions, and government procurement. Subsidies aim to support vulnerable groups and correct market imbalances.

- Salaries & Pensions : The government employs lakhs of individuals across ministries and departments. Salaries for serving employees, pensions for retired personnel (around 6.4% of revenue), and grants to states & union territories (around 8%). Citizens should understand applicable tax rates and available deductions under the Income-tax Act, 1961.

Taxes fund use in infrastructure (roads, railways, and airports), healthcare & vaccination programs, education & skilling initiatives, rural and urban development, and national security. Without tax revenue, these public goods cannot function efficiently.

The development of a country depends on sustainable public finances. Taxes are not just deductions from income they are contributions toward national growth. Understanding how taxes are collected and spent empowers you as a responsible citizen. Financial awareness is the first step toward financial freedom.