TDS Not Deposited? Can You Still Claim TDS Credit?

Page Contents

TDS Not Deposited? Can You Still Claim TDS Credit?

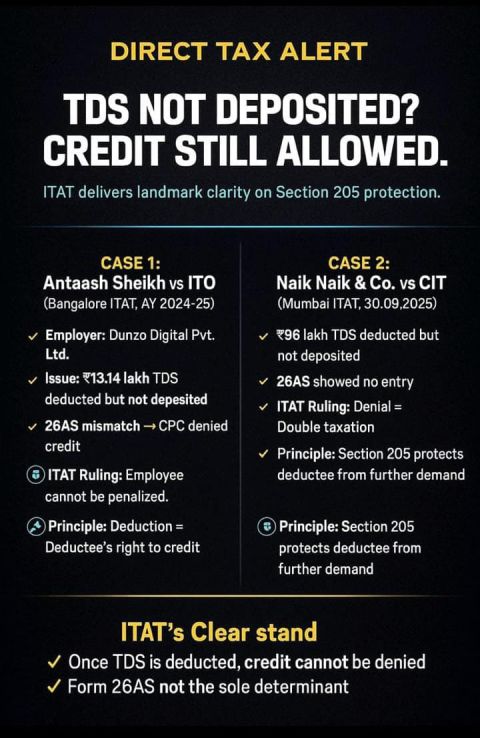

ITAT clarifies that if TDS is deducted but not deposited by the employer, the employee (deductee) cannot be penalized. Two Powerful ITAT Judgments Now Make the Answer Clear: Recent decisions from the Income Tax Appellate Tribunal have reinforced a major protection for taxpayers: TDS credit cannot be denied merely because of a mismatch in Form 26AS or the deductor’s failure to deposit tax. This brings long-awaited relief to thousands of taxpayers affected by CPC 143(1) adjustments.

Section 205 Protection Reaffirmed

Summarizing a landmark ruling by the Income Tax Appellate Tribunal on Section 205 protection regarding Tax Deducted at Source. Here’s a detailed breakdown: The ITAT has categorically held that once tax is deducted at source, the deductee cannot be asked to pay it again. Any failure to deposit TDS is the deductor’s default not the taxpayer’s.

1. Antaash Sheikh vs ITO, Circle 5(3)(5), Bangalore (AY 2024–25)

Employer Dunzo Digital Pvt. Ltd. deducted ₹13.14 lakh TDS from salary but did not deposit it. CPC and CIT(A) denied the credit. ITAT overturned the denial, emphasizing that an employee cannot be penalized for the employer’s non-compliance. Section 205 squarely protects the deductee once tax has been deducted.

2. Naik Naik & Co. vs CIT, ITA No. 2915/Mum/2025 (Order dated 30.09.2025)

Over INR 96 lakh was deducted from professional receipts but not deposited by the deductor. ITAT Mumbai allowed the TDS credit despite the absence of 26AS reflection. The tribunal held that denial of credit results in double taxation, violating Section 205. Proof of deduction was held sufficient to claim credit.

Why These Judgments Are Important

-

The right to TDS credit is created the moment tax is deducted.

-

Form 26AS is not the sole determinant of credit eligibility.

-

Taxpayers will no longer be penalized due to the deductor’s non-compliance, financial distress, or insolvency.

-

Reinforces the principle that TDS is held in trust by the deductor on behalf of the government.

Legal or Statutory Protection Under Section 205

Section 205 of the Income-tax Act, 1961, states that where tax has been deducted at source, the assessee cannot be called upon to pay that tax again. Section 205 of the Income Tax Act expressly prohibits the Income Tax Department from recovering tax from you if it has already been deducted from your income. The liability to deposit TDS rests entirely with the deductor—not with the taxpayer. The rationale is clear The deductor acts as an agent of the government. Failure to remit TDS is the deductor’s default, not the taxpayer’s fault, & the tax dept must recover from the deductor, not the deductee.

However, the automated system may temporarily disallow the claim during ITR processing if the TDS does not reflect in Form 26AS/AIS, which may trigger a demand notice. In such cases, you must follow the process below to ensure the credit is allowed.

Steps to Claim TDS Credit When the Deductor Has Not Deposited TDS

- Verify the Discrepancy: Regularly check Form 26AS, Annual Information Statement, on the income-tax portal to confirm whether your TDS is reflecting.

- Contact the Deductor : Inform your employer, bank, tenant, or any person who deducted TDS. Request them to deposit the pending TDS with interest/penalty and File a revised TDS return. Often, the issue gets resolved once the deductor corrects the error.

- Gather Evidence of TDS Deduction : Collect documents proving that TDS was actually deducted from your income, like salary slips showing TDS, bank statements showing net income credited, and Form 16 / Form 16A (if issued). These documents are crucial if the case is escalated.

- File a Complaint With the Deductor’s Assessing Officer: If the deductor does not act, file a written complaint with the Assessing Officer (AO) of the deductor. You can find AO details by entering the deductor’s PAN on the income tax website.

- Respond to Any Demand Notice : If CPC issues a demand under Section 143(1) File a response online, Attach supporting evidence (salary slips, bank statements, etc.) then request the AO to allow credit in accordance with Section 205 and established judicial precedents. Courts and CBDT instructions generally require the AO to grant credit if evidence supports your claim.

- File an Appeal (If Needed) : If the AO still denies TDS credit, you may file an appeal before the Commissioner of Income Tax (Appeals). Recent ITAT rulings strongly support the taxpayer in such cases.

If Employer Has Not Deposited TDS

If entries are missing despite proof of salary deduction, Inform the employer and request immediate remedial action. Provide supporting evidence such as pay slips or bank statements. If the employer does not act, file a written complaint with your jurisdictional Assessing Officer (AO). AO details can be found on the Income Tax e-filing portal using the employer’s PAN.

Interest for Not Deducting or Not Depositing TDS on Time

The Income Tax Act imposes strict interest and penalties when a deductor (employer, company, or any payer) either fails to deduct TDS or deducts but does not deposit TDS on time. Interest Under Section 201A

| Default Under Section | Nature of Default | Interest Rate | Period of Levy |

|---|---|---|---|

| 201A | Failure to deduct TDS (fully or partly) | 1% per month | From the date the tax was deductible till the date of actual deduction |

| 201A | Failure to deposit TDS after deduction | 1.5% per month | From the date of deduction till the date of actual payment |

Interest must be paid before filing TDS returns or before settling any TRACES demand. & Interest paid for delayed TDS deposit is not allowable as a business expense under income tax laws.

Penalty for Delay in Filing TDS Returns

Companies, whether government or private must also comply with quarterly TDS return filing deadlines.

- The late filing fee under Section 234E is INR 200 per day for delay. & Capped at the amount of TDS that is reportable in the return.

- Penalty Under Section 271H: A penalty between INR 10,000 and INR 100,000 may be levied if a TDS return is filed late beyond one year or incorrect information is furnished. This penalty is in addition to the Section 234E fee.

- No Penalty Under Section 271H If all conditions below are met, like The TDS/TCS amount has been fully deposited with the government, all interest and late filing fees have been paid, & the TDS/TCS return is filed within one year from the original due date.

Implication for taxpayers:

As the deductee (the taxpayer from whose income tax has been deducted), you are fully entitled to claim TDS credit even if the employer or deductor fails to deposit it with the government. If your employer deducted TDS but failed to deposit it, you still have the right to claim credit under Section 205. The mismatch in Form 26AS cannot be the sole reason for denial. following important points to remember in this regard:

- You are not liable for the deductor’s default: recovery of unpaid TDS, interest, and penalties is done from the deductor, not the taxpayer.

- Must still file your ITR on time : To preserve your right to credit and refund, file your return within the applicable due date.

- New Relief: Form 71 : CBDT introduced Form 71, allowing taxpayers to claim TDS credit in cases where:

- The income was reported in an earlier year,

-

But the deductor deposited TDS in a later year, leading to mismatch issues.