Tax Implications on NRIs Receiving Gifts in India

Page Contents

Tax Implications on NRIs Receiving Gifts in India

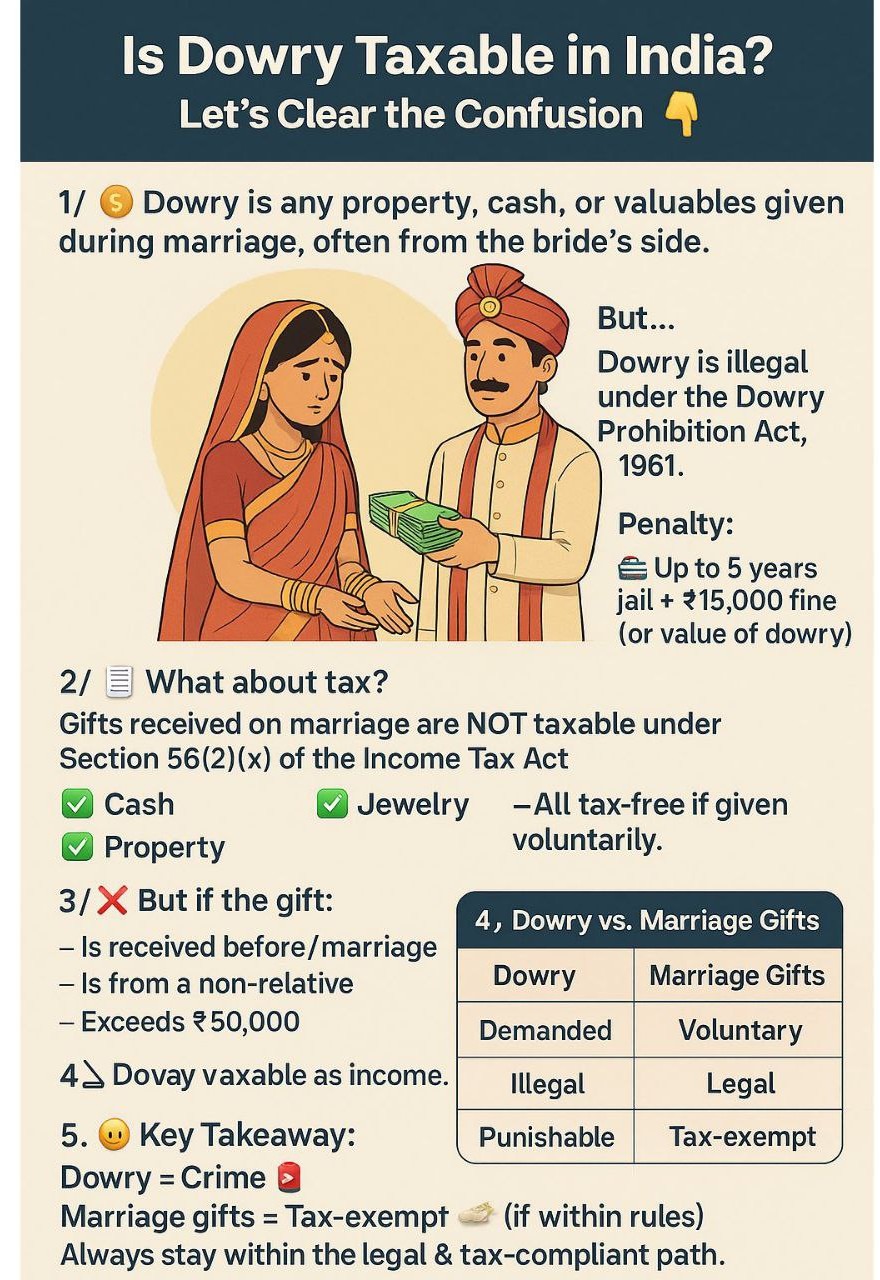

This article is for informational purposes only and does not constitute professional advice. Readers are advised to consult a tax expert before taking any decision. Gifts received by NRIs can be taxable in India in the hands of the recipient, mainly under section 56(2)(x), depending on (a) who gives the gift, (b) amount/value, and (c) residential status (especially RNOR vs full non‑resident). However a proper Professional advice is strongly recommended before accepting high-value gifts.

Basic rule – section 56(2)(x)

Definition of Gift under Section 56(2)(x) : A “gift” includes any receipt of cash, movable property (e.g., jewellery, shares), or immovable property (e.g., land, buildings) without adequate consideration—i.e., for free or much less than fair market value.

- Any sum of money or specified property received without consideration and whose aggregate value exceeds INR 50,000 in a year is taxed as “Income from Other Sources” in the recipient’s hands.

- Gifts from “relatives” (as per the Act), on marriage, under will/inheritance, or in certain specified circumstances are fully exempt, irrespective of amount.

NRI vs RNOR vs Resident – key point

- For a person who is “resident and ordinarily resident” (ROR), section 56(2)(x) applies to gifts received from any person anywhere in the world, subject to the INR 50,000 and relative/marriage exemptions.

- For a person who is non‑resident, India can tax only income which is received/deemed to be received in India or accrues/deems to accrue in India; however, where the donor is a resident and the gift is deemed to arise in India, specific deeming provisions now pull certain gifts into the Indian tax net.

- Union Budget 2023‑24 introduced that monetary gifts above INR 50,000 received by a “not ordinarily resident” (RNOR) from a resident are deemed to accrue in India and taxable from 1‑4‑2024.

What Qualifies as a Gift?

Under Indian tax laws, a gift refers to any money or asset received without consideration—meaning the recipient has no obligation to repay or compensate the donor in any form. Gifts received by NRIs are governed by

- Foreign Exchange Management Act, 1999 (FEMA) – permissibility

- Income-tax Act, 1961 – taxability

Common Forms of Gifts is Cash / bank transfers, Immovable property, Shares and securities, LLP interest, Jewellery, paintings, sculptures, bullion, artefacts

FEMA Regulations: Who Can Gift What?

NRIs / PIOs / OCIs can receive gifts from residents or other NRIs, subject to FEMA rules. Monetary Limit (Resident to NRI). A resident Indian can gift up to USD 250,000 per financial year under the Liberalised Remittance Scheme (LRS)

Asset-wise FEMA Permissibility

| Asset Type | From Resident Indian | From NRI / PIO / OCI |

| Foreign currency | Subject to LRS limit of donor | No upper limit |

| Indian currency | Allowed only from relatives | Not permitted |

| Immovable property | Residential & commercial allowed (not agricultural land/farmhouse/plantation) | Allowed only from relatives |

| Shares & securities | RBI approval required | Up to 5% of company’s capital from relatives |

| Other movable assets | Within LRS limits | No restriction |

Rupee gifts cannot be credited to NRO accounts.

Repatriation of Gifted Assets via Sale proceeds of gifted assets must be credited to the NRO account, NRIs can repatriate up to USD 1 million per financial year, Requires Form 15CA / 15CB certification

Taxation of Gifts Under the Income-tax Act

Although the Gift Tax Act was abolished in 1998, gifts are taxable under Section 56(2)(x) of the Income-tax Act. Gifts Fully Exempt from Tax i.e Gifts from relatives. Gifts received On marriage, Gift Under a will or inheritance & Gift In contemplation of death of the donor

Taxability in India for an NRI Recipient :

Any taxable gift must be declared under “Income from Other Sources” in the recipient’s Indian ITR. The applicable tax rate will depend on the overall taxable income slab

Taxability of Gifts from Non-Relatives

(A) Cash Gifts : If aggregate cash gifts > INR 50,000 in a financial year then Entire amount becomes taxable

(B) Immovable Property

| Situation | Taxable Amount |

| Gifted without consideration & SDV > INR 50,000 | Stamp Duty Value |

| Gifted with consideration & (SDV – payment) > INR 50,000 and >10% of consideration | SDV – consideration |

(C) Movable Property (Shares, Jewellery, Art, etc.)

| Situation | Taxable Amount |

| Gifted without consideration & FMV > INR 50,000 | Fair Market Value |

| Gifted with consideration & FMV – payment > INR 50,000 | FMV – consideration |

Illustration : Ram as NRI receives: INR 30,000 and INR 25,000 cash from friends and Artwork worth INR 70,000 (FMV) Taxability are mentioned here under :

- Cash gifts aggregate to INR 55,000 → fully taxable

- Artwork FMV INR 70,000 → taxable

- Total taxable income = INR 1,25,000. Tax will be levied as per applicable slab rates and tax regime.

Income from Gifted Assets (Clubbing Provisions) :

If assets are gifted to Spouse, Minor child, Son’s wife. Income is taxable in the hands of the donor not the recipient.

Tax on Income Generated from Gifted Assets :

- Immovable Property Self-occupied then No tax (maximum two properties) & in case Let-out property then Rental income taxable after deductions

- For Other Assets like Dividends, interest, FD income, bonds, debentures is Taxed as Income from Other Sources at slab rates

Sale of Gifted Assets – Capital Gains

- Immovable Property: Holding period includes previous owner’s period and Generally results in long-term capital gains so Cost = cost to previous owner and If acquired before 01-04-2001 higher of actual cost or FMV as on 01-04-2001

Listed Shares & Securities

- LTCG if held > 12 months

- Gains above INR 1 lakh taxable under Section 112A

- STT must be paid

Other Assets (Including Unlisted Shares)

- LTCG if held > 36 months

- Cost and holding period of previous owner apply

NRIs must also evaluate tax implications in their country of residence. Relief may be available under applicable Double Taxation Avoidance Agreements.

Typical scenarios – NRI recipient

Resident → NRI (fully non‑resident, not RNOR)

- Monetary or property gifts from “relatives” (as defined: spouse, parents, siblings, lineal ascendants/descendants, etc.) are not taxable in India in the NRI’s hands, irrespective of amount.

- Monetary or property gifts from non‑relatives: if the amount is deemed to accrue in India (e.g., sums received in India and covered by specific deeming provisions), then if aggregate exceeds INR 50,000 and no exemption applies, taxed as “Income from Other Sources” in India; in practice, recent amendments focus more specifically on RNOR category for deemed accrual from resident donors.

Resident → NRI who is RNOR

- From 1‑4‑2024, any monetary gift exceeding INR 50,000 from a resident to an RNOR is deemed to accrue in India and taxable, unless covered by relative/marriage/will exemptions.

- If within INR 50,000 aggregate in the year, or received from specified relatives or on marriage, the gift is exempt.

NRI → NRI or NRI → Resident

- When an NRI receives gifts from another NRI, Indian taxation depends on whether the income is deemed to accrue in India (for example, if the subject matter is Indian immovable property or specified Indian assets), and the same INR 50,000 and exemption tests under section 56(2)(x) apply.

- When an NRI gifts to a resident, the resident recipient bears tax liability under section 56(2)(x) if the donor is not a relative and the INR 50,000 threshold is crossed; gifts from NRI relatives to residents are fully exempt.

FEMA / MODE / DOCUMENTATION- FEMA & RBI (FOREIGN EXCHANGE) RULES

- Under Liberalised Remittance Scheme (LRS), a resident can gift up to USD 250,000 per financial year to an NRI; this is an exchange control limit, not a tax exemption, and income‑tax rules still apply as above. Remittances from Indian residents to NRIs fall under the Liberalised Remittance Scheme (LRS), capped at USD 250,000/year. Immovable property gifted: Sale remittance capped at USD 1 million/year under FEMA.

- Large gifts should be routed through banking channels with a simple gift deed or declaration and identity/relationship proofs to substantiate exempt “relative” status and non‑commercial intent if questioned. Recipients must file Form 15CA/15CB for gifts exceeding INR 7 lakh sent abroad.

- Receiving cash from India requires credit to an NRO account, not in hand.

Quick comparative snapshot

| Scenario (recipient NRI) | Donor | Relationship | Value > INR 50k | Taxability in India (broadly) |

| Gift to NRI (non‑RNOR) from relative | Resident | Relative | Any | Generally exempt in India. |

| Gift to NRI (non‑RNOR) from non‑relative | Resident | Non‑relative | >INR 50k | Potentially taxable if deemed to accrue/receive in India; analyse facts and deeming provisions. |

| Gift to RNOR from resident | Resident | Non‑relative | >INR 50k | Deemed to accrue in India and taxable from 1‑4‑2024. |

| Gift to NRI from resident on marriage / via will | Resident | Any | Any | Exempt, irrespective of value. |

Conclusionon Gifts & Tax Treatment

| Gift Type | From Relative | From Non‑Relative |

| Cash / Bank Transfer | Always exempt | Tax if > INR 50k per year |

| Movable Property (jewellery, shares, etc.) |

Exempt | Taxable if FMV > INR 50k |

| Immovable Property (land/building) |

Exempt | If stamp duty value > INR 50k, taxable on full value |

- Modalities for movable property: Fair Market Value (FMV) is treated as gift value.

- Immovable: Stamp duty value is considered for the gift amount.

- Gifts from relatives or on special occasions (like marriage) are always exempt. Gifts from non-relatives over INR 50,000/year are fully taxable at FMV or stamp duty value. Compliance under FEMA/LRS is mandatory for cross-border transfers. Proper documentation (gift deeds, forms, bank proofs) is essential for lawful gifting and tax reporting. NRIs can receive gifts in India subject to FEMA and Income-tax laws. In summary we can say that :

- Gifts from relatives are largely tax-free

- Gifts from non-relatives may trigger tax liability

- Proper documentation, valuation, and compliance are crucial

- Cross-border tax implications should not be ignored

- If you share specific facts (residential status: NRI vs RNOR, donor’s status and relationship, nature of asset, where received), a precise tax position and disclosure/ITR treatment can be mapped.