Overview of Practical Challenges in GST Filing

Page Contents

Overview of Practical Challenges in GST Filing

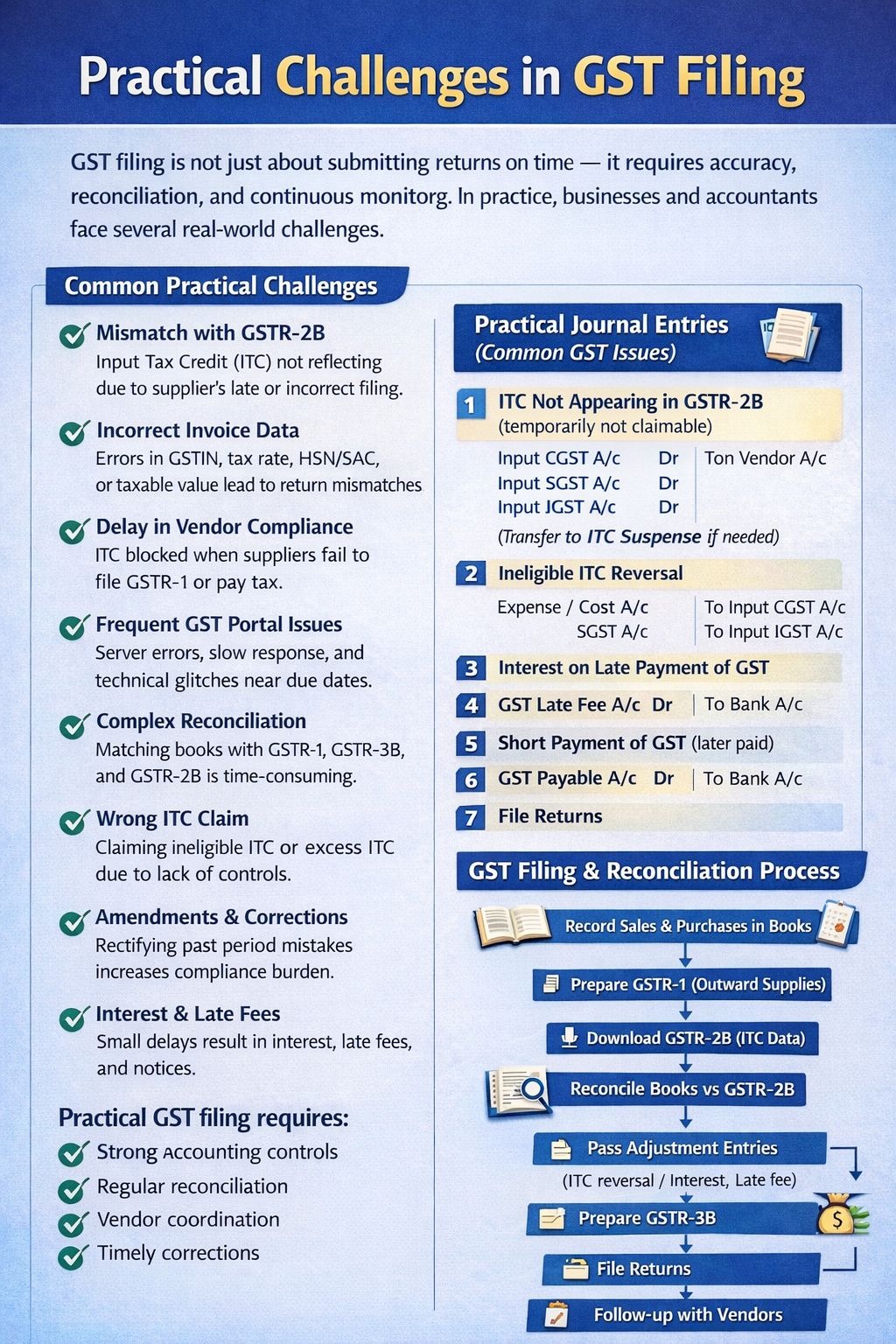

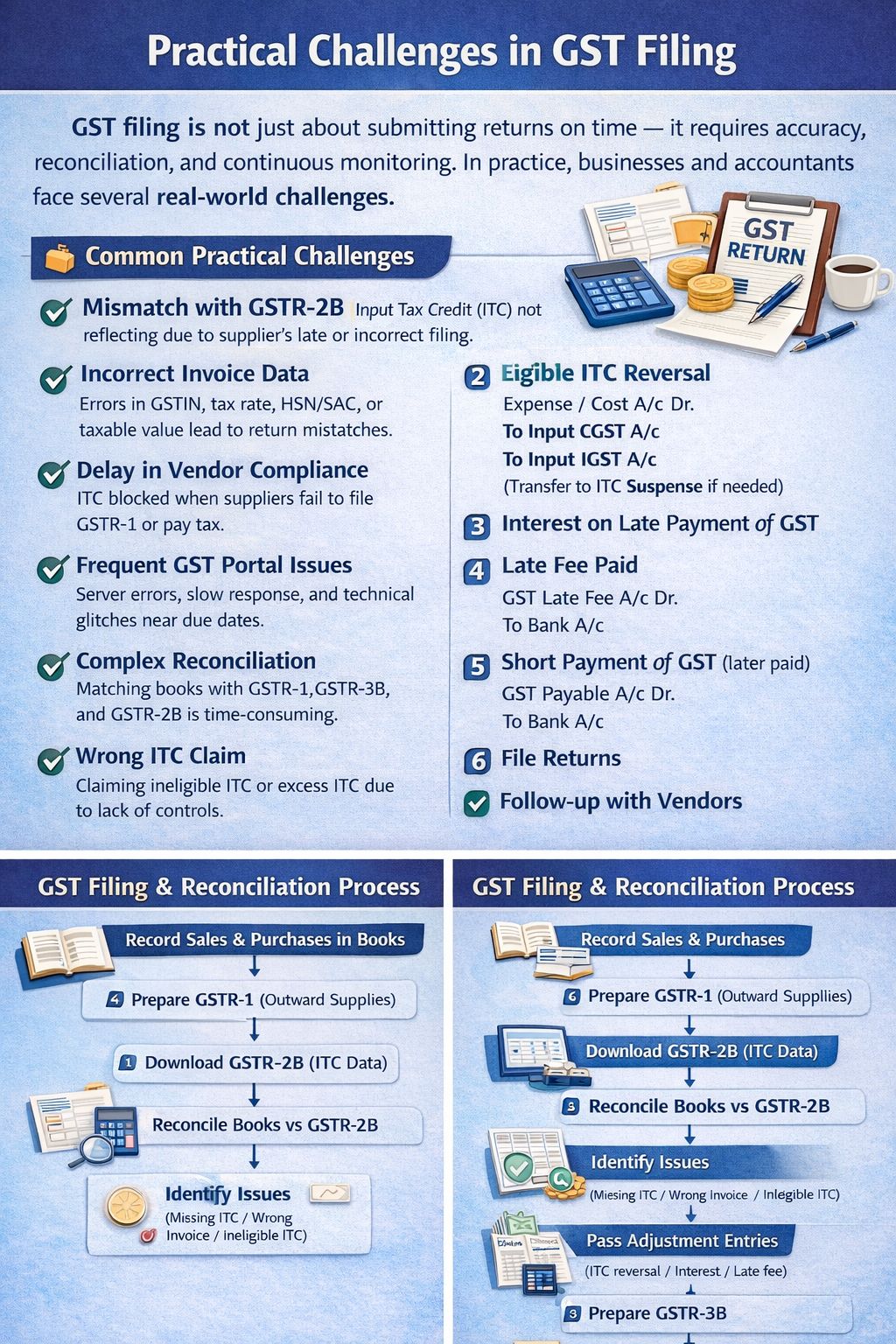

Goods and Services Tax filing is not merely a procedural exercise of uploading returns on the portal. In real-world practice, it demands data accuracy, continuous reconciliation, vendor coordination, and strict compliance discipline. Businesses and professionals routinely face operational challenges that complicate timely and correct Goods and Services Tax compliance.

Key Practical Challenges in GST Filing :

- Mismatch with GSTR-2B (ITC-Related Issues) : One of the most common challenges is Input Tax Credit mismatch due to supplier-side defaults such as delayed filing of GSTR-1, incorrect invoice details uploaded by suppliers, and wrong Goods and Services Tax Identification Number, taxable value, or tax amount reported. Since ITC eligibility is now linked strictly to GSTR-2B, these mismatches directly impact on monthly credit availability and cash flow.

- Incorrect Invoice Reporting: Errors in invoice reporting frequently arise due to incorrect Goods and Services Tax Identification Numbers, wrong tax rates or places of supply, HSN/SAC mismatches, and incorrect taxable values or tax computations. Such errors lead to discrepancies between books of accounts, GSTR-1, and GSTR-2B, increasing reconciliation workload and compliance risk.

- Vendor Non-Compliance: Input tax credit blockage often occurs due to supplier non-compliance, including non-filing of GSTR-1, non-payment of Goods and Services Tax, and incorrect or incomplete invoice uploads. In the case of GST filing despite genuine purchases, recipients are forced to defer input tax credit, creating working capital strain and follow-up pressure.

- GST Portal-Related Challenges: Near due dates, users commonly experience things like slow portal response, errors during return submission, OTP delays and session timeouts, and server issues. These kinds of technical glitches increase stress levels and elevate the risk of late fees and interest.

- Complex Reconciliation Requirements: Regular reconciliation is mandatory between books of accounts vs GSTR-1 (outward supplies), books of accounts vs. GSTR-2B (ITC), and GSTR-1 vs GSTR-3B. so needed to understand that without proper systems, controls, and periodic reviews, reconciliation becomes time-consuming, error-prone, and reactive.

- Wrong or Ineligible Input tax credit Claims: Common Input tax credit related errors include claiming blocked credits (Section 17(5)), claiming input tax credit based on invoices instead of GSTR-2B and double-claiming input tax credit due to weak internal controls. These kinds of Such mistakes frequently result in departmental notices, reversals, interest, and penalties.

- Amendments & Corrections: A taxpayer rectifying past errors—such as incorrect B2B/B2C classification, wrong tax rates, or invoice details—adds to the compliance burden and requires constant monitoring and vigilance.

- Interest, Late Fees & Penalties: Even minor delays can trigger things like interest on delayed tax payments, Late fees for delayed return filing, and penalties for incorrect reporting. These costs are non-creditable and directly impact profitability.

Adjudication & Enforcement – Challenges

- Extremely short timelines for replying to DRC‑01A: Officers often allow only 1–2 days to respond, despite no prescribed limit.

- Virtual hearings denied despite CBIC instructions: Officers still insist on physical hearings.

- Notices are only uploaded on the GST portal: No simultaneous email/SMS alerts → leads to ex‑parte orders.

- Demand for physical documents: Even though data is available on the portal, officers still insist on hard copies.

- 5. Multiple Case IDs for the same matter: No unified case‑tracking system → taxpayers cannot view the case lifecycle.

- Penalties on Directors (Section 122(3)): No separate orders for individuals, portal lacks URP (Unregistered Person) login → appeals not possible.

- Non‑adherence to interception/detention SOPs: Circular‑prescribed procedures are not uniformly followed in the field.

Input Tax Credit (ITC)—Challenges

- ISD distribution problems for new units: Rule 39 offers no mechanism when no past turnover exists for distribution.

- GSTR‑2B issues: The rate column was removed → hinders reconciliation. and no quarterly consolidated view.

- ITC not restored after withdrawal of cancellation: If the cancellation application is withdrawn, ITC does not reappear automatically.

GST Registration – Challenges

- Difficulty selecting the correct jurisdiction: Portal lacks clarity → incorrect jurisdiction selection is common.

- Only one amendment is allowed at a time, causing delay in updating registration details.

- No preview or correction window in REG‑01: Applicants cannot review the full form → minor errors lead to rejection.

- Non‑speaking orders in cancellation: Automated generic cancellation orders issued without proper reasoning.

- Proceedings not migrated during merger/de‑merger : Old GSTIN receives notices even after closure → leads to missed deadlines.

- GST registration via SPICe+ / AGILE‑Pro‑S : TRN not generated, no status update → delays in GST registration.

- No online facility to cancel TDS registration: Manual requests remain unprocessed.

GST Refund – Challenges

- Refund delays & lack of faceless processing : Provisional refunds are rarely issued, many cases exceed the statutory 60 days, and there is no automated interest credit for delay.

- No refund mechanism for rejected CTP/NRTP registrations : Advance deposit gets blocked.

- Refund of ITC to SEZ via ISD unclear: No clear guidelines despite judicial backing.

Return Filing – Challenges

- Return dashboard defaults to current month : Taxpayers always have to switch back to the previous month.

- EVC cannot be generated in advance : OTP dependency causes problems near due dates.

- CMP‑08 lacks a separate field for exempt turnover: composition dealers cannot report correct tax liability.

E‑Way Bill – Challenges :

- No field for ‘Ultimate Recipient’ – In “Bill to – Ship to” transactions, absence of this field causes disputes and penalties.

Goods and services tax compliance may appear simple in concept, but it is operationally demanding. Effective goods and services tax filing requires robust internal controls, periodic and disciplined reconciliation, proactive vendor management, and timely corrections and compliance tracking. In practice, Goods and Services Tax compliance succeeds not merely through filing returns but through consistency, monitoring, and process discipline.

Practical Journal Entries for Common GST Issues

1️⃣ ITC Not Appearing in GSTR-2B (Temporarily Not Claimable)

Input CGST A/c Dr

Input SGST A/c Dr

Input IGST A/c Dr

To Vendor A/c

(Alternatively, transfer to ITC Suspense A/c where required)

2️⃣ Reversal of Ineligible ITC

Expense / Cost A/c Dr

To Input CGST A/c

To Input SGST A/c

To Input IGST A/c

3️⃣ Interest on Late Payment of GST

Interest on GST A/c Dr

To Bank A/c

4️⃣ Late Fee Paid

GST Late Fee A/c Dr

To Bank A/c

5️⃣ Short Payment of GST (Paid Later)

GST Payable A/c Dr

To Bank A/c

6️⃣ Excess ITC Claimed Earlier (Reversal)

Output GST A/c Dr

To Input GST A/c

GST Filing & Reconciliation Flow

First of all, record sales & purchases in books, then prepare and file GSTR-1 then download GSTR-2B. Thereafter, reconcile books with GSTR-2B after that, identify discrepancies like missing input tax credit, wrong/duplicate invoices, and ineligible input tax credit; then pass accounting adjustments like input tax credit reversals, interest & late fees, and vendor-related adjustments; then prepare GSTR-3B; then pay GST liability; then finally file GST returns and continuously follow up with vendors for pending input tax credit.