Overview on Kind of GST Notice

Page Contents

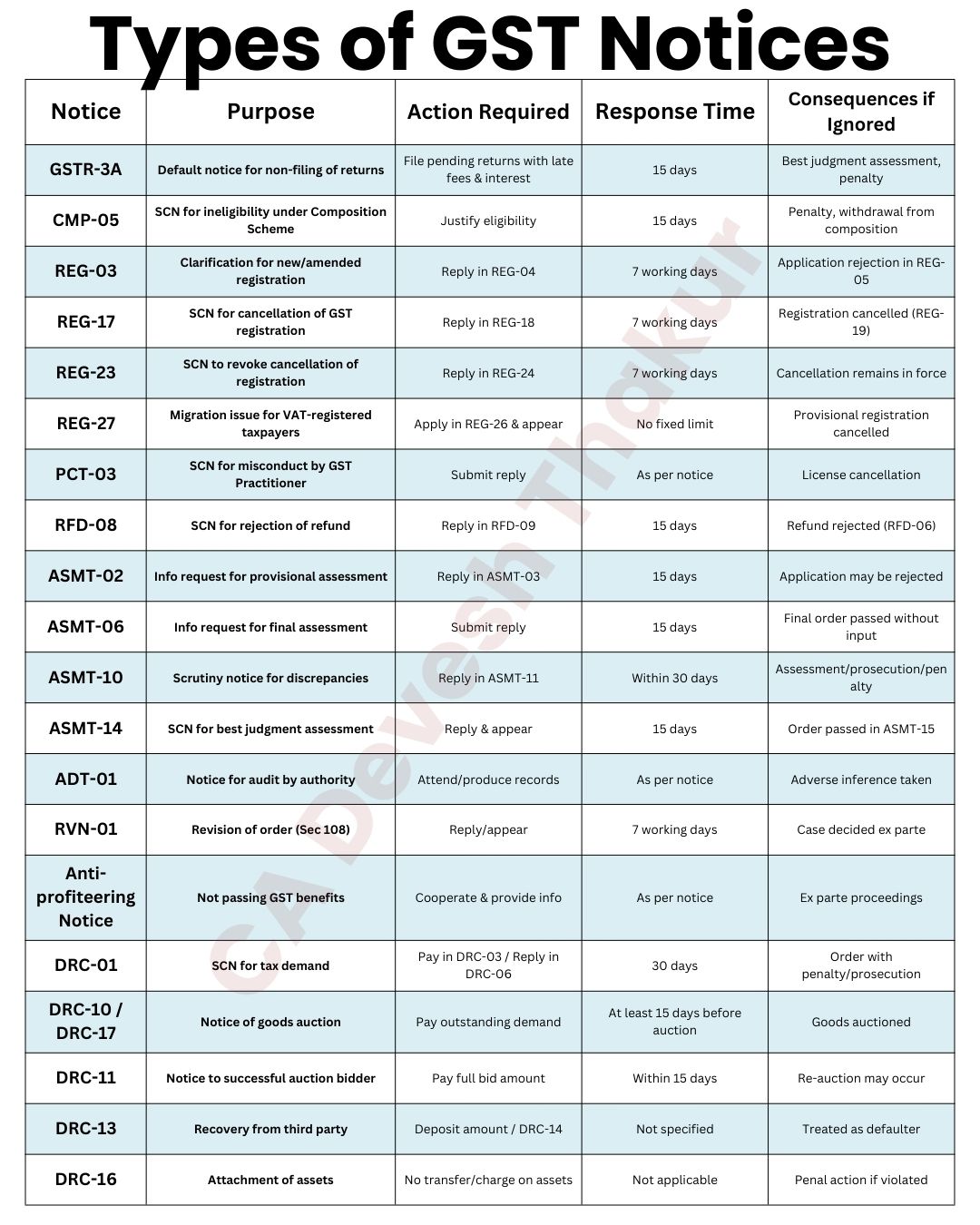

Types of GST Notices

GST notices are official communications from GST authorities in India, issued for reasons like discrepancies in returns, non-filing, or ITC mismatches. They come in various forms under the CGST Act, requiring timely responses to avoid penalties. Common types are categorized by purpose, such as scrutiny, demand, or registration-related.

If GST notices primarily fall into scrutiny, assessment, demand, and registration types, each with specific forms like ASMT-10 for discrepancies or DRC-01 for short payments. Show Cause Notices u/s 73/74 demand explanations for potential violations, often without fraud allegations. Inspection notices under Section 67 allow authorities to verify records on-site.

Access notices via the GST portal under “View Additional Notices or Orders.” Reply online using prescribed forms (e.g., DRC-03, ASMT-11) and attach supporting documents. Respond within the stipulated deadline to prevent ex-parte orders or penalties u/s 122.

Key Categories of Important GST Notices Details

- GSTR-3A

- Purpose: Default notice for non-filing of returns.

- Action: File pending returns with late fees & interest.

- Response Time: 15 days.

- Consequence: Best judgment assessment, penalty.

- CMP-05

- Purpose: SCN for ineligibility under Composition Scheme.

- Action: Justify eligibility.

- Response Time: 15 days.

- Consequence: Penalty, withdrawal from scheme.

- REG-03

- Purpose: Clarification for new/amended registration.

- Action: Reply in REG-04.

- Response Time: 7 working days.

- Consequence: Application rejection.

- REG-17 / REG-23

- Purpose: SCN for cancellation/revocation of GST registration.

- Action: Reply in REG-18 or REG-24.

- Response Time: 7 working days.

- Consequence: Registration canceled or remains canceled.

- ASMT-10

- Purpose: Scrutiny notice for discrepancies.

- Action: Reply in ASMT-11.

- Response Time: Within 30 days.

- Consequence: Assessment/prosecution/penalty.

- ASMT-14

- Purpose: SCN for best judgment assessment.

- Action: Reply & appear.

- Response Time: 15 days.

- Consequence: Order passed in ASMT-15.

- ADT-01

- Purpose: Notice for audit by authority.

- Action: Attend/produce records.

- Response Time: As per notice.

- Consequence: Adverse inference taken.

- DRC-01

- Purpose: SCN for tax demand.

- Action: Pay in DRC-03 / Reply in DRC-06.

- Response Time: 30 days.

- Consequence: Order with penalty/prosecution.

- DRC-10 / DRC-17

- Purpose: Notice of goods auction / successful auction bidder.

- Action: Pay outstanding demand / full amount.

- Response Time: At least 15 days before auction / within 15 days.

- Consequence: Goods auctioned / re-auction.

- DRC-16

- Purpose: Attachment of assets.

- Action: No transfer/change on assets.

- Response Time: Not applicable.

- Consequence: Penal action if violated.

Common Notice Forms

| Form | Purpose | Response Timeline |

|---|---|---|

| GSTR-3A | Non-filing of returns | 15 days |

| ASMT-10 | Return discrepancies | As per SCN |

| DRC-01 | Tax short-pay or refunds (no fraud) | 30 days |

| REG-17 | Registration cancellation SCN | 7 days |

| CMP-05 | Composition scheme eligibility | 15 days |

The summaries table on GST notices are mentioned here under:

| Notice | Purpose | Action Required | Response Time | Consequences if Ignored |

|---|---|---|---|---|

| GSTR-3A | Default notice for non-filing of returns | File pending returns with late fees & interest | 15 days | Best judgment assessment, penalty |

| CMP-05 | SCN for ineligibility under Composition Scheme | Justify eligibility | 15 days | Penalty, withdrawal from scheme |

| REG-03 | Clarification for new/amended registration | Reply in REG-04 | 7 working days | Application rejection |

| REG-17 / REG-23 | SCN for cancellation/revocation of GST registration | Reply in REG-18 or REG-24 | 7 working days | Registration canceled or remains canceled |

| ASMT-10 | Scrutiny notice for discrepancies | Reply in ASMT-11 | Within 30 days | Assessment/prosecution/penalty |

| ASMT-14 | SCN for best judgment assessment | Reply & appear | 15 days | Order passed in ASMT-15 |

| ADT-01 | Notice for audit by authority | Attend/produce records | As per notice | Adverse inference taken |

| DRC-01 | SCN for tax demand | Pay in DRC-03 / Reply in DRC-06 | 30 days | Order with penalty/prosecution |

| DRC-10 / DRC-17 | Notice of goods auction / successful auction bidder | Pay outstanding demand / full amount | At least 15 days before auction / within 15 days | Goods auctioned / re-auction |

| DRC-16 | Attachment of assets | No transfer/change on assets | Not applicable | Penal action if violated |

GST Notice Compliance Checklist

1. Identify the Notice: Check the Form Number (e.g., GSTR-3A, ASMT-10, DRC-01, REG-17). Understand the purpose (non-filing, discrepancy, demand, registration issue). Note the response timeline mentioned in the notice.

2. Access the Notice: Log in to GST Portal → Services → User Services → View Additional Notices/Orders. & Download the notice and read it carefully.

3. Analyze the Issue: Verify the reason for the notice Non-filing of returns, ITC mismatch, Short payment of tax , Registration cancellation, Check relevant sections (e.g., Section 73/74 for demand, Section 67 for inspection).

4. Gather Supporting Documents: like GST returns (GSTR-1, GSTR-3B, etc.), Tax payment challans, Purchase/sales invoices, ITC reconciliation statements, Any other evidence requested in the notice

5. Prepare Response: Use the prescribed reply form ASMT-11 for ASMT-10, DRC-06 for DRC-01, and REG-18 for REG-17. Attach supporting documents and explanations. If payment is required, use DRC-03 for voluntary payment.

6. Submit Reply Online: Upload response and documents on GST portal. Ensure submission within the deadline (e.g., 7 days, 15 days, or 30 days as per notice).

7. Track Status: Check acknowledgment on the GST portal. Monitor for further communication or orders.

8. Escalate if Needed: If the notice involves complex issues or large demands, consult a chartered accountant or GST expert. Consider filing an appeal if an order is passed against you.

9. Avoid Future Notices: File returns on time. Reconcile ITC regularly & maintain proper records for audit.

Response Tips: Access notices via the GST portal under “View Additional Notices or Orders.” Reply online using forms like DRC-03 or ASMT-11, attaching proofs, within deadlines to prevent ex-parte orders or penalties under Section 122.

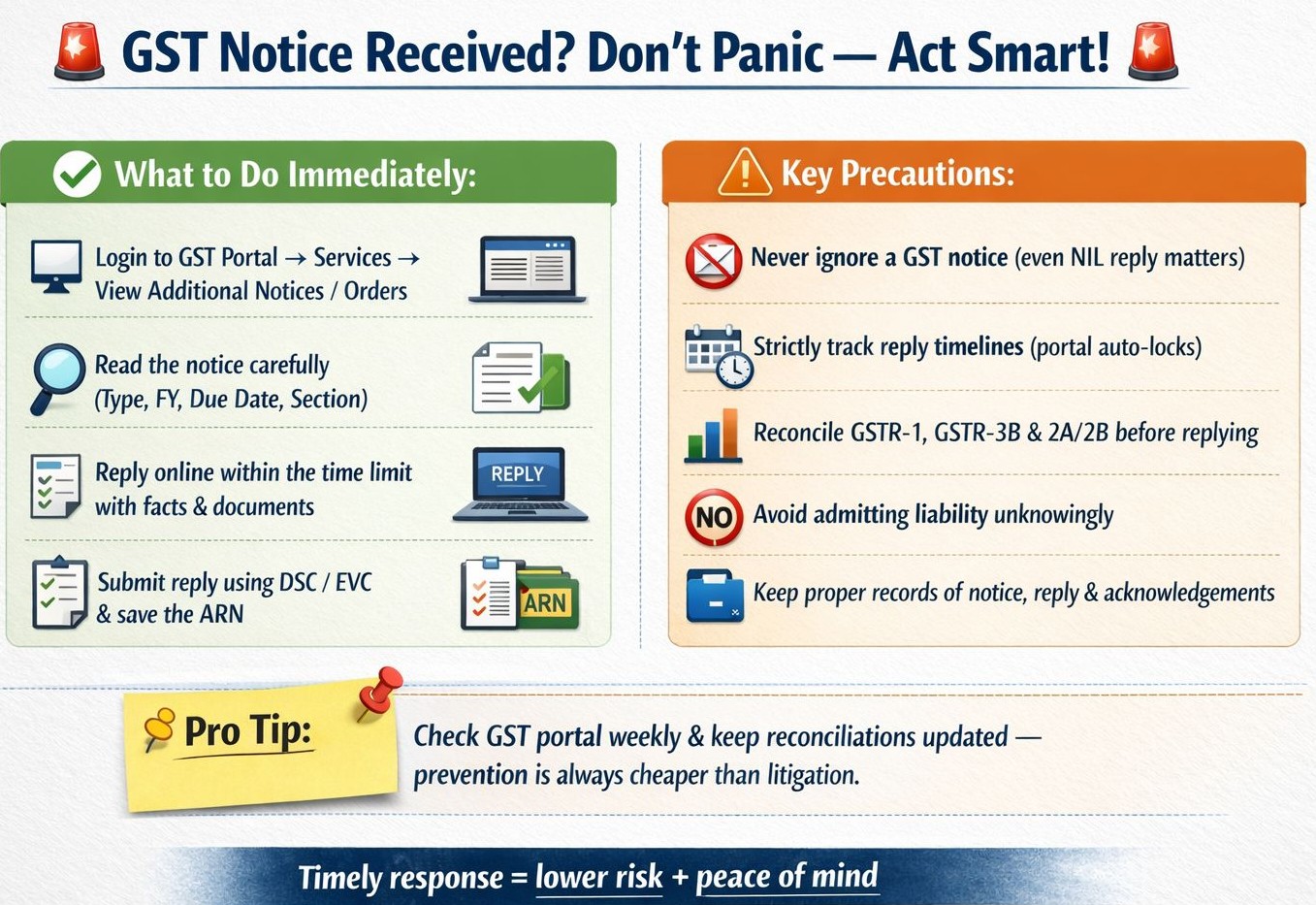

GST Notice Received? Don’t Panic; Act Smart!

Many taxpayers miss GST notices simply because they don’t check the GST portal regularly. Ignoring or delaying a response can quickly snowball into tax demand, interest, penalty, or even cancellation of GST registration. The good news is most GST notices are manageable if handled on time and correctly.

What to Do Immediately

- Log in to GST Portal → Services → View Additional Notices / Orders

- Read the notice carefully Type of notice, Relevant financial year, Section invoked & Reply due date

- Prepare a fact-based reply with supporting documents

- Submit the reply online within the prescribed time limit

- File using DSC/EVC and save the ARN & acknowledgement

Key Precautions to Remember

- Never ignore a GST notice (even a NIL reply must be filed where applicable)

- Strictly track reply timelines (The portal auto-locks after the due date)

- Reconcile data before replying GSTR-1, GSTR-3B and GSTR-2A / 2B

- Avoid admitting liability unintentionally (Incorrect wording can create future exposure)

- Maintain proper documentation like Notice copy, Reply filed and ARN & acknowledgements

- Take professional review for critical notices like DRC-01 (tax demand), ASMT-10 (scrutiny) and REG-17 (cancellation proceedings)

Pro Tip for Taxpayers & Businesses

- Check the GST portal at least once a week

- Keep reconciliations updated on a real-time basis.

- Prevention is always cheaper than litigation.

A timely, well-drafted GST reply can save tax, penalty, and years of dispute. Delay and silence are the biggest risks not the notice itself. Timely response = lower risk + peace of mind