NRI remittance taxation & compliance rule for 2025

Page Contents

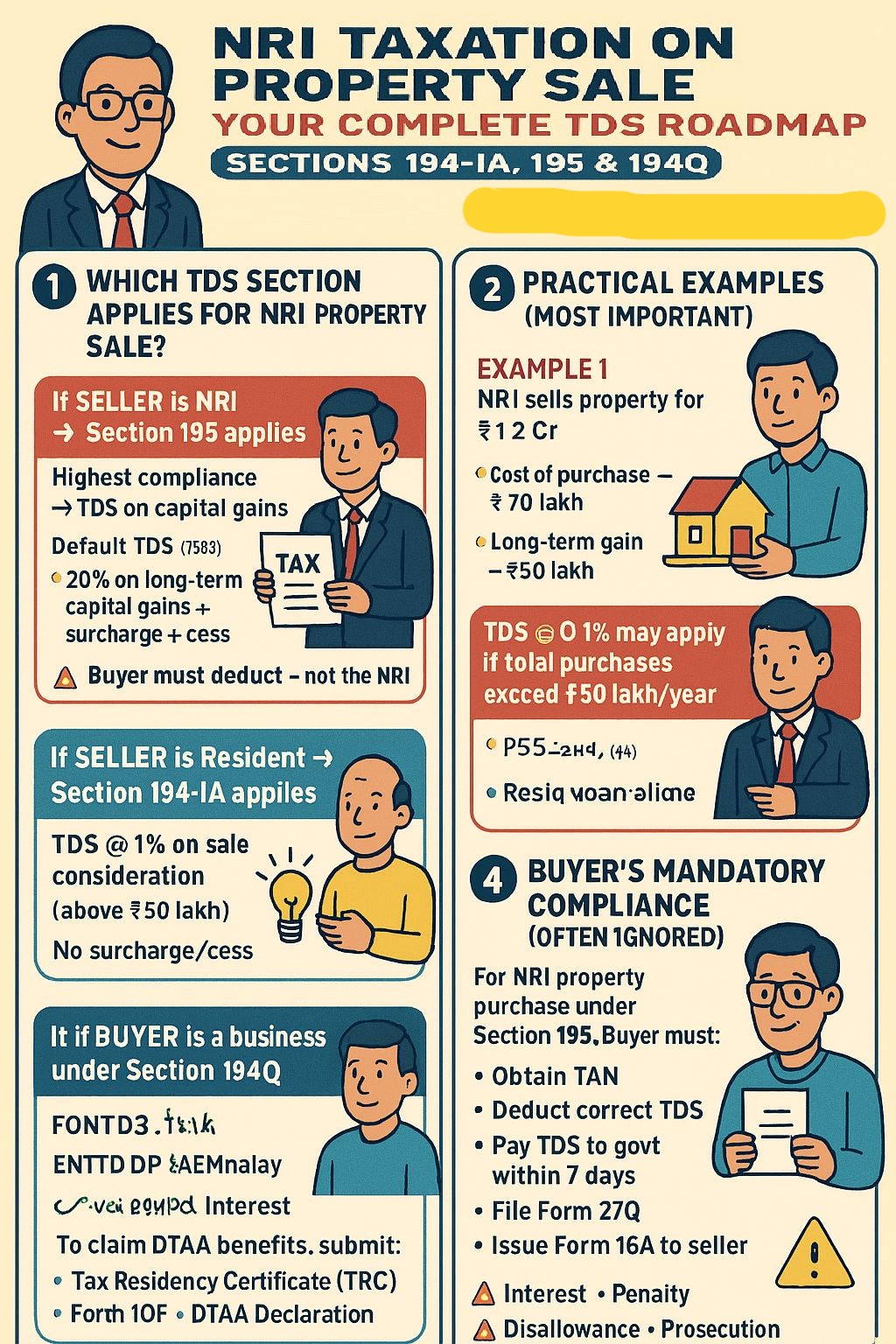

NRI Taxation on Property Sale

TDS compliance when property transactions involve NRIs, highlighting correct section applicability, buyer responsibility, Form 13 planning, & DTAA benefits.

Which TDS Section Applies?

Seller is NRI : Section 195 applies: Highest compliance requirement & the buyer is responsible for TDS (not the NRI)

TDS Applicability: TDS is required on the amount payable to the NRI. In the case of default TDS on gross consideration, the correct tax is on capital gains. In case of default TDS rates:

-

Long-term Capital Gain (LTCG): 20%

-

Short-term Capital Gain (STCG): slab rate

-

Surcharge & Health & Education Cess

-

Without Form 13, TDS is deducted on the entire sale value

Seller is Resident → Section 194-IA applies

-

TDS @ 1% of sale consideration

-

Applicable only if property value exceeds ₹50 lakh

-

No surcharge or cess

-

Buyer does not need TAN (PAN is sufficient)

-

Section 194-IA is never applicable to NRI sellers

Buyer is a Business Entity → Section 194Q

-

Applicable where the buyer’s turnover is greater than INR 10 crore and the purchase of goods exceeds INR 50 lakh. However, in the case of an NRI seller, Section 195 overrides Section 194Q; TDS must be deducted only u/s 195. The following is a practical example:

-

NRI Property Sale, Sale Value: INR 12 crore, Purchase Cost: INR 70 lakh, Long-Term Capital Gain: INR 11.3 crore.

- Without Form 13: TDS deducted on entire INR 12 crore, Approx. TDS outflow: INR 2.6–2.8 crore, Massive cash-flow blockage for NRI

With Form 13 (Lower TDS Certificate):

- TDS restricted to actual capital gains, Significant reduction in TDS, Faster settlement & minimal refund dependency

- Form 13 is the most critical tax-planning tool in NRI property sales

DTAA Benefits for NRIs

NRIs may claim Double Taxation Avoidance Agreement benefits on capital gains, rental income, and interest income. Following are mandatory documents like the Tax Residency Certificate, Form 10F, and DTAA Self-Declaration. DTAA does not automatically reduce TDS unless supported by Form 13 / AO approval

Buyer’s Mandatory Compliance

For property purchase from an NRI under Section 195, the buyer must obtain a TAN, deduct the correct TDS under Section 195, deposit the TDS within 7 days from the end of the month, file the TDS return in Form 27Q, and issue Form 16A to the NRI seller.

Consequences of Non-Compliance:

-

Interest at 1%/1.5%

-

Late fee & penalties (Sections 234E & 271H)

-

Disallowance of expenditure (where applicable)

-

Prosecution in extreme cases

-

Buyer treated as “assessee in default”

-

Buyer ignorance of law is NOT a valid defense under the Income-tax Act, 1961.

-

NRI property transactions are compliance-sensitive and high-value—professional handling is essential.

NRI remittance taxation & compliance rules for 2025

- Taxability of Remittances: Money sent to India by a non-resident Indian is not taxable if the income originates outside India. Example: A foreign salary is transferred to India, then there is no additional tax in India. Outgoing remittances from the US: No direct tax, but gift reporting applies.

- Gift Tax Rules (US): Gifts above USD 19,000 per person annually (2025 limit) must be reported via Form 709. No immediate tax due to lifetime exemption of USD 13.99 million.

- Indian Gift Tax Rules: Gifts to blood relatives (spouse, children, parents, siblings, in-laws) → Fully exempt. And Gifts to non-relatives > INR 50,000/year → Taxable as recipient’s income.

- Reporting Obligations (US Residents): FBAR (FinCEN Form 114): Required if foreign accounts (including NRE) exceed USD 10,000 anytime during the year. FATCA (Form 8938): Applies at higher thresholds.

Proposed Remittance Tax—Non-Resident Indian remittance taxation and compliance rules for 2025

Originally 5%, now revised to 1%, likely effective after Dec 31, 2025. Exemptions: Transfers from US bank accounts and US-issued debit/credit cards.

FEMA & Repatriation:

- Non-resident Indians can freely remit foreign currency to India. Repatriation limit: Up to USD 1 million per FY for inherited property or post-retirement assets. India has DTAAs with many countries → Prevents double taxation on the same income.

- Plan remittances with awareness of gift reporting, Indian tax exemptions, and the upcoming 1% remittance tax. Maintain compliance with FBAR/FATCA and leverage DTAA benefits.

Frequently Asked Questions related to NRI :

Q1. What is the maximum amount an NRI can transfer from India?

Ans.: NRIs can repatriate up to USD 1 million per FY from their NRO account, subject to applicable taxes and submission of Form 15CA/15CB, where required. There is no upper limit on repatriation from NRE or FCNR (B) accounts, as these accounts are fully repatriable.

Q2. Are there tax implications for NRIs sending money to India?

Ans. Money remitted to India by an NRI is generally not taxable in India if the source of income is outside India. However, gifts to non-relatives in India exceeding INR 50,000 in a FY may be taxable in the hands of the recipient. US residents may need to report large gifts under US tax laws, even if no tax is payable. Proper disclosure and documentation are essential to avoid compliance issues.

Q3. What documentation is required for NRIs to send money to India?

Ans. Typically required documents include a valid passport and overseas address proof, bank account details (NRE/NRO), and purpose-specific documents, such as admission letters (education), medical bills (medical treatment), gift declarations (for gifts), transaction records, and remittance advice. NRI must maintain proper records; it is strongly recommended for future tax and regulatory compliance.

Q4. What are the most efficient methods for NRIs to transfer money to India?

Ans.: The commonly used methods include:

- Online money transfer platforms—competitive exchange rates and quick processing

- Bank wire transfers—secure and suitable for large amounts

- Cross-border UPI (where available)—instant transfers with prescribed daily limits

The ideal method depends on transfer amount, speed, exchange rate, and transaction costs.

Q5. Are there any reporting requirements for NRIs transferring money to India?

Ans.: Yes, especially for US tax residents, FBAR (FinCEN Form 114) must be filed if foreign account balances exceed USD 10,000 at any time during the year. FATCA (Form 8938) is required if specified foreign financial assets exceed prescribed thresholds. Failure to comply may result in significant penalties, so professional advice is advisable.