Next-Gen GST Reform : Ease of Living & Aatmanirbhar Bharat

Page Contents

Next-Gen GST Reform : Ease of Living & Aatmanirbhar Bharat

The Government of India has rolled out the Simplified GST Registration Scheme, GST refund marking a next-generation reform to strengthen the vision of Ease of Living and Aatmanirbhar Bharat. GST 2.0 is designed not just for taxation ease, but as a nation-building reform that’s fueling growth, affordability, and self-reliance.

Hon’ble PM Shri Narendra Modi Ji’s Independence Day announcement on Next-Generation GST Reforms has now become a reality, with the GST Council unanimously endorsing the Union Government’s proposals. Hon’ble PM Narendra Modi’s Statement: “The next generation of GST reforms are a gift for every Indian this Diwali. Taxes will reduce substantially, benefiting MSMEs & small entrepreneurs. Everyday items will become cheaper, boosting the economy.”

These reforms are a landmark step which providing much-needed relief to farmers, MSMEs, small traders, women, youth, and the middle class, while furthering the vision of ease of doing business across India. This is not just a policy shift, but a transformative move towards citizen empowerment and economic strengthening.

The following key features of this Next-Gen GST Reform system are mentioned here under:

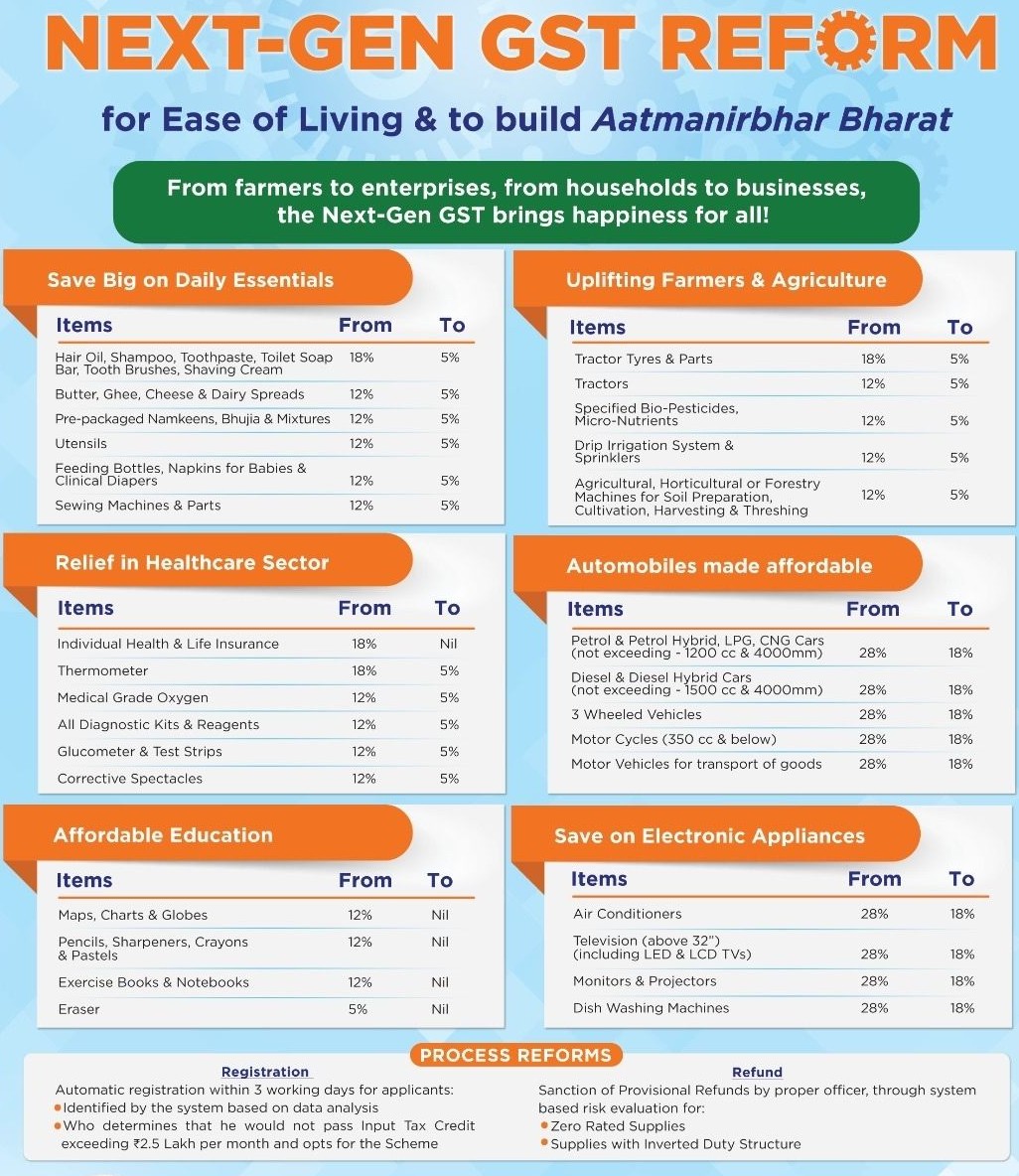

Save Big on Daily Essentials

- Hair oil, shampoo, soap, toothpaste, shaving cream – 18% → 5%

- Butter, ghee, cheese, dairy spreads – 12% → 5%

- Packaged namkeens, bhujia, mixtures – 12% → 5%

- Utensils – 12% → 5%

- Baby feeding bottles, napkins, diapers – 12% → 5%

- Sewing machines & parts – 12% → 5%

Uplifting Farmers & Agriculture

- Tractor tyres & parts – 18% → 5%

- Tractors – 12% → 5%

- Bio-pesticides, micro-nutrients – 12% → 5%

- Drip irrigation & sprinklers – 12% → 5%

- Agri/forestry machinery – 12% → 5%

Relief in Healthcare Sector

- Health & life insurance – 18% → Nil

- Thermometers – 12% → 5%

- Medical oxygen – 12% → 5%

- Diagnostic kits, reagents – 12% → 5%

- Glucometer & test strips – 12% → 5%

- Corrective spectacles – 12% → 5%

Affordable Education

- Maps, charts, globes – 12% → Nil

- Pencils, sharpeners, crayons, pastels – 12% → Nil

- Exercise books, notebooks – 12% → Nil

- Erasers – 5% → Nil

Automobiles Made Affordable

- Petrol/LPG/CNG hybrid cars (≤1200cc & ≤4000mm) – 28% → 18%

- Diesel hybrids (≤1500cc & ≤4000mm) – 28% → 18%

- 3-wheeled vehicles – 28% → 18%

- Motorcycles (≤350cc) – 28% → 18%

- Goods transport vehicles – 28% → 18%

Save on Electronic Appliances

- Air conditioners – 28% → 18%

- TVs (above 32″, incl. LED & LCD) – 28% → 18%

- Monitors & projectors – 28% → 18%

- Dishwashers – 28% → 18%

Heartfelt gratitude to Hon’ble PM Shri Narendra Modi Ji & FM Smt. Nirmala Sitharaman Ji for steering this historic and visionary reform.

GST Registration Process Reforms : Simplified GST Scheme: Faster Registration for Small & Low-Risk Businesses

GST Registration will be Auto within 3 working days (data-analysis based). The Government of India has unveiled a Simplified GST Registration Scheme aimed at easing compliance and promoting entrepreneurship. Key Features of this Simplified GST Registration Scheme are mentioned here under :

- Quick Registration: Eligible applicants can now receive GST registration within 3 working days.

- Low-Risk Businesses: Identification through data analysis and risk parameters.

- Eligibility: Businesses not availing Input Tax Credit (ITC) exceeding ₹2.5 lakh per month can opt for this scheme.

- Benefits: Reduced paperwork, faster onboarding, and smoother compliance, particularly for MSMEs, startups, and small traders.

- Impact on Middle Class & Businesses : The Simplified GST Registration Scheme is a step towards making GST faster, smarter, and entrepreneur-friendly, while providing direct relief to the middle class. This reform, coupled with the recently revised GST rate cuts on essentials (food, healthcare, insurance, automobiles, and daily-use products), ensures:

-

- Greater affordability for households.

- Ease of doing business for small enterprises.

- A boost to entrepreneurship and job creation.

GST Refund Process Reforms will be Implementation of 90% Provisional Refunds under Inverted Duty Structure

GST Process Reforms: GST Refunds will be Faster provisional refunds for zero-rated supplies & inverted duty structure. As per the provisions of the GST Act, 2017, and in line with the recent Next-Gen GST Reforms, the CBIC has been directed to begin administrative implementation of a revised refund system. Details are mentioned below

- 90% Provisional Refunds: GST Refunds under the Inverted Duty Structure (IDS) will now be processed provisionally up to 90% of the claimed amount. This aligns with the current practice for zero-rated supplies (exports, SEZs), where provisional refunds are already granted.

- Risk-Based Evaluation: GST Refunds will be sanctioned using data analytics and risk evaluation tools. & High-risk claims may undergo further scrutiny before release. This ensures faster liquidity for genuine taxpayers while preventing fraudulent claims.

- Ease of Doing Business: Faster provisional refunds will provide significant relief to manufacturers, exporters, and MSMEs, where working capital gets blocked due to IDS. & Enhances cash flow and reduces compliance burden.

- GST Administrative Mechanism: The process will be automated and system-driven on the GSTN portal. & Provisional refund orders will be generated seamlessly, reducing manual intervention.

CBIC will now operationalize 90% provisional refunds for inverted duty structure claims, mirroring the system already in place for zero-rated supplies. This marks a major reform in GST compliance, strengthening both ease of doing business and taxpayer confidence. Impact of this GST Process Reforms to MSMEs & Exporters Sector Immediate working capital relief. & Government sector : Stronger fraud-prevention with AI-driven risk analytics. Final Overall Boost to manufacturing, competitiveness, and economic growth.