How to Track fake invoice or dealer’s rackets: GSTN

Page Contents

GSTN taken the measures to track the fake invoice/ dealers/rackets by press realize notified

- Ministry of Finance issue new Press Release issued on dated December 23, 2020, regarding measures recommended by GST Council to curb fake dealers/invoice rackets notified.

- The recommendations of the Law Committee as made aware are central to 4 main measures which include:

Tightening up the verification process for new registration:

– Initiatives suggested by the GST Council to curb counterfeit dealers/invoice rackets made aware

Suspension on the basis of data analytics and mismatches: – In-Person Confirmation must be performed for GST Registration, Identification of counterfeit dealers through data analysis, and suspension

Minimum cash payment to deter dummy businesses: –

Mandated by law 1 percent GST payment for all those risky dealers and fly-by-night operators who have uncommon large turnover and lack financial legitimacy

Ease of business in India and precise targeting in the interest of intelligently protected smaller firms.

- Law Committee of the GST Council’s main suggestion is to control the fresh or new registration of applicants without a commercial purpose and to remove existing counterfeit traders from the GST systems.

- These measures notified to the systemic tightening of new registrations by identifying counterfeit dealers, changes to the registration process.

- Use of Aadhaar during registration & Aadhaar as the capture of details during registration would have an impact on the threat of mushrooming fake firms and ITC fraud by fly-by-night operators.

Verification of the new registration:

- In Pursuant to such initiatives as set out in the notifications which specify there must now be in-person verification before registration is given to the applicant.

- Moreover, In the event that the applicant opts for Aadhaar authentication, Aadhaar Biometric Authentication will be submitted to one of the Information sharing Centers notified by the Commissioner.

- In the event that the applicant has not chosen for Aadhaar authentication, the request processing, the biometric data, and the verification of KYC must be carried out at the Verification Facilities.

- This verification process may also involve snapping pictures and verifying the applicant’s original documents uploaded to the database.

- which may impact that GST is going to move towards a better verifying regime for the registration of new business owners, with many of the steps taken in an automated environment.

- The timeline for the grant of registration to the Aadhaar Authenticated Applicant is now 7 days for the proper examination of the application.

- In order to overcome the cases of fake invoices, some extreme medical confirmation may be held out with the approval of an officer authorized by the Commissioner in a few risky cases where a person has successfully undergone Aadhaar authentication.

- Timeframe for granting registration in such cases would now be 30 days.

Cancelation and suspension:

- In the new GST regime notified suspension/cancellation would be based on the data analytics & mismatches.

- Registration shall also be liable for cancellation if the input tax credit is used in contravention of the law of the CGST Act or if the outward supply details in FORM GSTR-1 exceed the outward supply declared in FORM GSTR-3B for one or more tax periods.

- Some rather cases would result in ITC being passed or used without payment of tax and would therefore be liable for cancellation of registration.

- These taxpayers would remain in suspension during the cancellation hearings.

Minimum Cash Payment:

- In another considerable change in rules for Disposal of Dummy Businesses,

- as a framework for the implementation of the QRMP scheme with the facility’s existing eligibility limit for the use of 10 % input tax credit (ITC) by a registered person in respect of invoices where the details have not been provided by his suppliers would be reduced to 5 %.

- System & framework for the implementation of the QRMP scheme with the facility w.e.f. 1 January 2021.

- It could make sure that large taxpayers carry on making purchases from small taxpayers.

- To reduce false ITC use and transfer of such credit by unscrupulous persons who usually pay no tax in cash,

- In specific in those risky cases where GST turnover does not match tax returns where the value of taxable supply other than exempt supply and zero-rated supply exceeds Rs. 50 lakh,

- Such GST registration person will not be able to use the amount of ITC available in one month. At least 1% of the liability would have to be discharged in cash.

- This kind of new change will come into force on 1 January 2021.

Ease of Doing Business & Precise Targeting:

- Even so, there are a few exceptions to the above requirement to limit the use of ITC to ensure Ease of Doing Business. example are

- Where a taxpayer has paid more than INR 1 lakh as income tax each of the last 2 FYs, or

- Received a refund of unused ITC on account of a zero-rated supply or inverted duty structure of more than INR 1 lakh in the previous FYs or

- Released its liability for output tax by electronic cash legs for an amount exceeding 1% of the total amount.

- Such taxpayers may use more than 99 % of ITC to discharge their tax liability.

- the Govt Dept, PSU, local & other statutory bodies are exempted from these limits on Input Tax credit utilization.

- Ease of Doing Business in India for Real Taxpaying citizens, Corporate Entities and Merchants, and Effective Trying to target in the Benefit of Small And medium enterprises would therefore not have an influence,

- As the Law Committee recommended initiatives for the precise identification of possibly riskier taxpayers based on very well-set limits in the automated environment.

- In the same spirit, moreover, to control the false invoice threat, now that a registered person has not filed Form GSTR-3B for the previous two months, his Form GSTR-1 will not be created.

- A comparable limitation has been positioned on QRMP taxpayers if the form GSTR-3B is not submitted for the prior one tax period of three months.

- Above such kinds of measures are able to monitor dummy registrations and fake ITC billing to move the GST procedure towards that cleaner and more robust regime.

- A recent case found on Fake invoices:

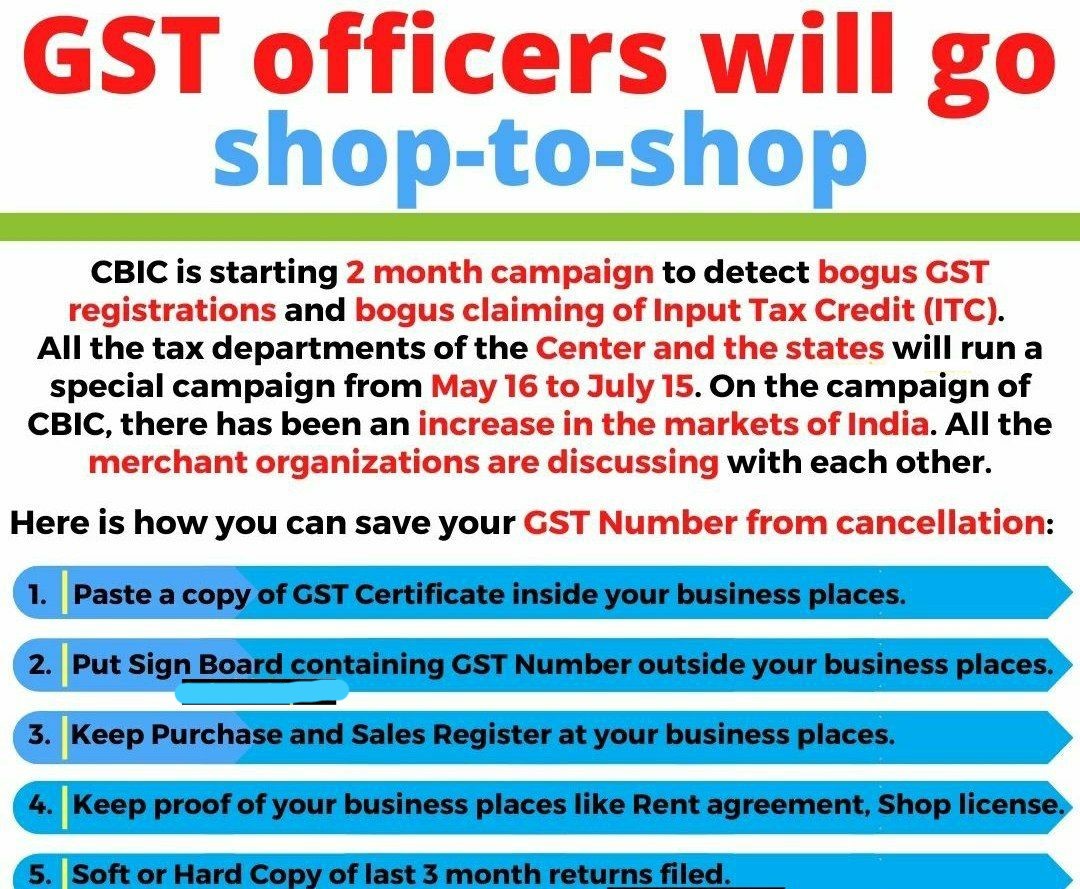

A special All India Drive of GST Instructions by CGST & SGST

ITC Fraud- INR 2 lakh crore worth of fake ITC Claims

The recent Group of Ministers meeting on revenue analysis raised a serious red flag — states reported over INR 2 lakh crore worth of fake Input Tax Credit claims. This massive tax evasion not only dents government revenue but could also lead to tighter compliance norms, impacting even honest businesses. With the government estimating INR 2 lakh crore Input Tax Credit fraud, Goods and services Tax enforcement is only going to get stricter. Honest taxpayers, especially SMEs, may see increased scrutiny. The safest strategy is strong internal controls, supplier due diligence, and proactive reconciliation.

What Triggered the Alarm?

- Fake firms availing Input Tax Credit via bogus invoices

- Inter-state Input Tax Credit rackets using mule accounts

- Goods and services Tax registration abuse (Aadhaar–PAN mismatch)

- Lack of coordination between GSTN, DGGI, and State GST departments

Estimated fraud size: INR 2 lakh crore – Understanding ITC Fraud: How It Works

| Modus Operandi | Description |

| Bogus Invoices | No actual supply; only invoices raised to claim ITC |

| Circular Trading | Goods shown as moving in a loop only on paper |

| Layering of Entities | Shell firms created to route fake invoices |

| Aadhaar-linked Registrations | Fraudulent GSTINs obtained using fake credentials |

Legal Reference:

- Section 132 of CGST Act – Offences & penalties,

- Rule 86A – Power to block Input Tax Credit if fraud is suspected

- Section 16(2) – Input Tax Credit eligibility only on actual receipt of goods/services

GST Enforcement: What’s Changing?

In response to these frauds, enforcement agencies are tightening compliance norms:

- Mandatory Aadhaar authentication for all new registrations

- Real-time invoice verification through Invoice Registration Portal

- Risk-based scrutiny of Goods and services Tax returns

- More frequent DGGI raids and investigation-led assessments

- CBIC reviewing Rule 9 of CGST Rules (registration verification & biometric checks)

Practical Tips for Businesses :

- Verify supplier Goods and Services Tax Identification Number’s on Goods and services Tax Portal

- Use e-invoice compliance tools to cross-check invoice authenticity

- Avoid vendors showing sudden Input Tax Credit spikes

- Reconcile GSTR-2B vs books monthly

- Respond promptly to Input Tax Credit mismatch notices

Legal Penalties for ITC Fraud

| Offence | Punishment (CGST Act) |

| Fake ITC > INR 5 crore | Non-bailable offence + Jail up to 5 years |

| Fake registration | GSTIN cancelled + Input Tax Credit reversed |

| Non-filing of returns | Late fee + interest + Input Tax Credit ineligible |

Relevant Provisions: Section 132, Section 122, Rule 86A, Rule 9 of CGST Rules

Impact on Small Businesses – Even genuine taxpayers may face hurdles:

- More queries on GSTR-3B vs GSTR-2B reconciliation

- Input Tax Credit delay if supplier is flagged by DGGI

- Input Tax Credit blocked under Rule 86A, even if later restored

And Always keep a document trail – e-way bills, proof of delivery, payment receipts, and transport records.

FAQs on ITC Fraud & GST Enforcement

Q1. Will ITC be blocked if my supplier is fake?

Yes. Under Rule 86A, the department can block your Input Tax Credit even if the fraud was committed by the supplier.

Q2. How can I prove I received the goods?

Maintain delivery challans, e-way bills, payment proofs, and transport receipts.

Q3. Can I face jail time if my accountant claimed wrong Input Tax Credit ?

Yes. U/s 132, proprietors, partners, and directors can face personal liability.

Popular Article :

Key points of 42nd GST council Meeting headed By FM N. Sitharaman