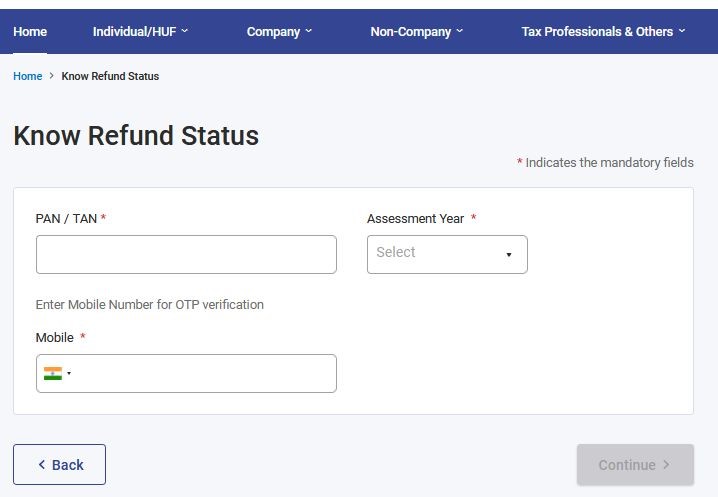

New Functionality “Know Your Income Tax Refund Status”

Page Contents

Income Tax New Functionality: “Know Your Income Tax Refund Status”

Which will helps in checking status of pending refund without login on income tax portal

CBDT: Income tax refunds of over INR 1,00,000/- Cr issued this FY

- Central Board of Direct Taxes announced on Wednesday that taxpayers have received refunds totaling Rs 1,02,952 crore in the current financial year. The Income Tax Department’s policy is set by the CBDT.

- According to an official Twitter post, this amount includes income tax refunds of Rs 27,965 crore in 76,21,956 cases and corporate tax refunds of Rs 74,987 crore in 1,70,424 cases. “From April 1, 2021, to October 25, 2021, the CBDT issued refunds of Rs 1,02,952 crore to over 77.92 lakh taxpayers.

- This includes Rs 6,657.40 crore in refunds for the assessment year 2021-22, which totaled 46.09 lakh “income tax department sent out a tweet.

Income Tax refund on valid bank account in india

Taxpayers should note that to be eligible for an income tax refund, their bank account must first be pre-validated. By pre-validating a bank account and using it for EVC, taxpayers can ensure a streamlined process for receiving income tax refunds and verifying their returns electronically

Important Points to Note for Pre-validated Bank Account

Ensure that the bank account details entered for pre-validation are accurate and up-to-date. The mobile number and email ID linked with the bank account should be active to receive OTPs for validation. Only one bank account can be used for receiving income tax refunds. Ensure the pre-validated account is the one you want the refund to be credited to. If there are any changes in the bank account details, update them promptly on the e-Filing Portal to avoid issues with refunds.

Use of Pre-validated Bank Account for Electronic Verification Code (EVC)

- Generate EVC: A pre-validated bank account can be used to generate an EVC for e-verification of your income tax return (ITR). This process ensures that refunds are processed smoothly and sent to the correct account.

- Steps to Generate EVC: After logging in to the Income Tax e-Filing Portal, go to the ‘e-Verify’ option under the ‘My Account’ tab. Select ‘Generate EVC’ through bank account, and an EVC will be sent to your registered mobile number.

- Verify ITR using EVC: Use the received EVC to verify your ITR by entering it in the designated field on the e-Filing Portal. This completes the e-verification process.

Significant Improvement in Income Tax Refund Processing by Central Board of Direct Taxes

- Central Board of Direct Taxes has been systematically working to enhance the efficiency of Income Tax Refund processing. Over the past three years, significant improvements have been achieved.

- The average time to process returns has been dramatically reduced from 93 days in 2013-14 to just 10 days in 2023-24. Significant Improvement in Income Tax Refund Reduced Processing Time in India.

Income Tax Refunds Decline by 16% Amid Enhanced Scrutiny October 2025

Income tax refunds have declined by 16% this year, dropping to INR 2 lakh crore from INR 2.4 lakh crore during the same period last year. The reduction is largely attributed to enhanced scrutiny and automated validation checks introduced by the Income Tax Department to curb fraudulent refund claims. Key Highlights Income Tax Refunds Decline

- Refund Amount: INR 2 lakh crore (down from INR 2.4 lakh crore)

- Net Direct Tax Collections: INR 11.9 lakh crore — up 6.3% year-on-year, supported by reduced refund payouts

- Non-Corporate Tax Refunds: Nearly halved to INR 62,359 crore from over INR 1.2 lakh crore in the previous period

Reasons Behind the Income Tax Refunds Decline

- Automated Validation & Risk-Assessment Checks: The Centralized Processing Centre has implemented additional automated systems to flag and review potentially incorrect refund claims before processing.

- Threshold-Based Checks: Income Tax Returns involving refunds above certain monetary limits are now subject to additional verification layers, ensuring only legitimate claims are cleared.

- Fraud Prevention Measures: The department is focusing on data-driven risk profiling to detect mismatches in income declarations and refund claims, reducing revenue leakages.

While taxpayers are experiencing delays in receiving refunds, these enhanced measures aim to improve accuracy, transparency, and integrity in the tax refund system. The tightening of refund processes has simultaneously contributed to higher net direct tax collections, reflecting the department’s emphasis on compliance and accountability.

The CBDT Notification given powers to correct certain mistakes in orders passed via AO or CPC – Income tax refund Mistakes That Can Be Corrected :

The Central Board of Direct Taxes under the Ministry of Finance issue Notification No. 155/2025 dated 27-10-2025. Central Board of Direct Taxes under the Ministry of Finance issue Notification Powers exercised under Section 120(1) & (2) of the Income-tax Act, 1961. & Rectification under Section 154 for apparent mistakes. Along with Issue of demand under Section 156. Key Highlights of Notification

Authority Empowered: Income Tax Officers at Centralized Processing Centre, Bengaluru have been given powers to correct certain mistakes in orders passed through the interface between the Assessing Officer and Centralized Processing Centre, Bengaluru. Mistakes That Can Be Corrected

- Any Refund issued earlier under the provisions of the Act.

- Non-consideration of any pre-paid tax credit (TDS, TCS & Advance Tax).

- Non-consideration of any relief eligible under the Act.

- Incorrect calculation of interest u/s 244A.

- Any error leading to wrong computation of Tax, Refund determined, or Demand.

Income tax jurisdiction: Applies to all cases where orders have been passed through the interface between AO and CPC.

Popular blog:-