ITC reversal is not required when unsecured loan remain loan

Page Contents

No ITC reversal is required when unsecured loans remain loans (not considered supplies).

Under GST laws, Input Tax Credit reversal is mandated in cases where goods or services are used for non-business purposes or for making exempt supplies. Since unsecured loans are not considered as “supplies” under GST, the Input Tax Credit availed on inputs used for such loans is not eligible for reversal.

However, if the unsecured loans are later converted into taxable supplies, the Input Tax Credit related to the inputs used for making these supplies would need to be reversed in accordance with Section 17(2) of the THE CENTRAL GOODS AND SERVICES TAX ACT, 2017. This section governs the apportionment of credit and specifies instances where credit must be reversed.

In Summary:

- No Input Tax Credit reversal is required when unsecured loans remain loans (not considered supplies).

- If the loans are converted into taxable supplies, Input Tax Credit reversal would be required under Goods and Services Tax law as per Section 17(2) of the THE CENTRAL GOODS AND SERVICES TAX ACT, 2017.

Conditions for Input Tax Credit (ITC) reversal

When businesses pay taxes to the government, they can use the Input Tax Credit on Goods and Services Tax paid for their purchases, like raw materials or services used in the manufacturing or selling of products. But, if Input Tax Credit is wrongly claimed, it must be reversed by making the appropriate payment in the subsequent month.

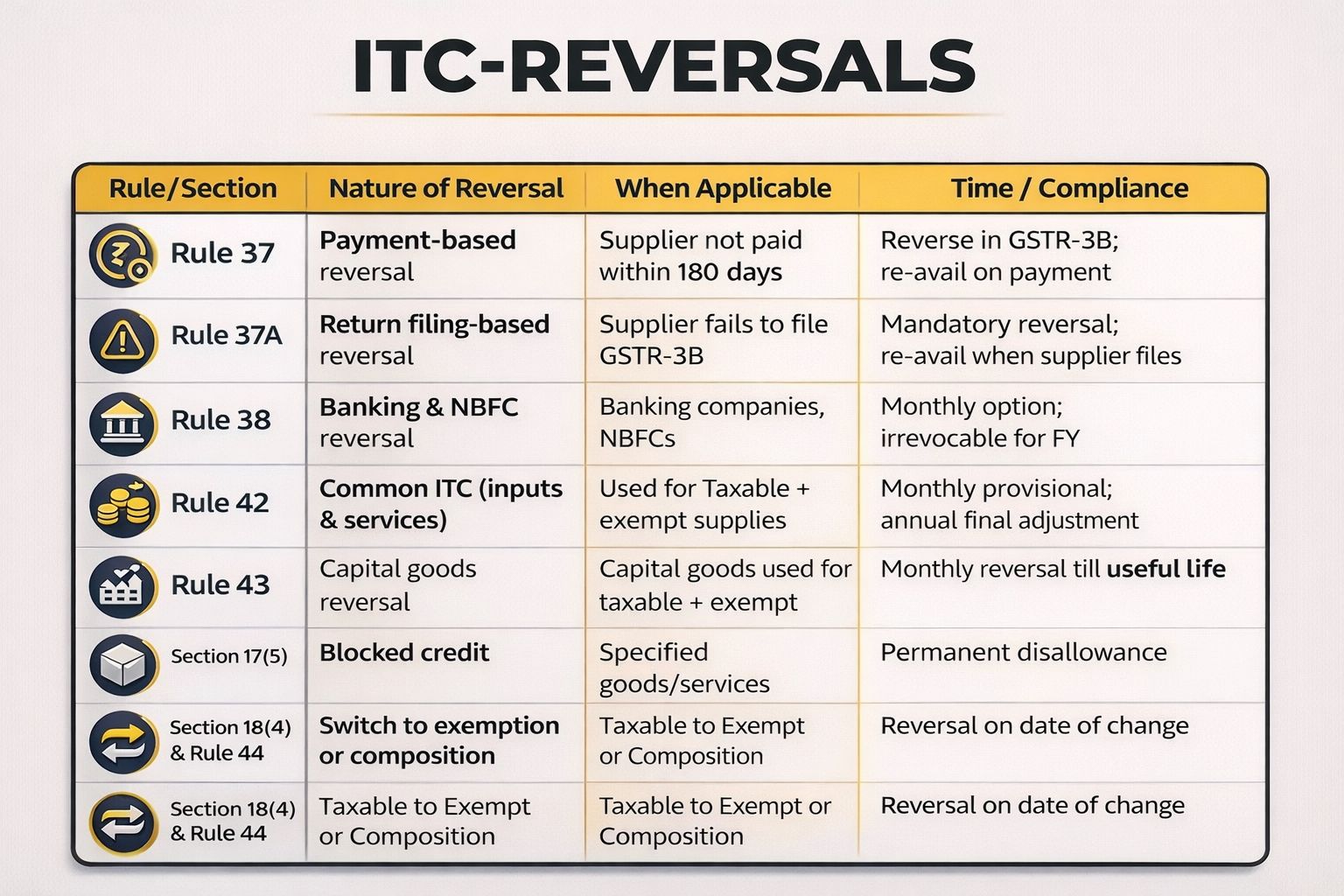

GST Deep Dive | ITC Reversals—Where Most Taxpayers Slip

Input Tax Credit (ITC) under GST is conditional, not absolute. A significant number of disputes arise not because credit is ineligible, but due to missed reversals, delayed compliance, or weak tracking mechanisms. Let’s decode the key ITC reversal provisions under GST and why they matter

Rule 37 – Payment-Based Reversal

If payment to the supplier (including GST) is not made within 180 days from the invoice date, ITC must be reversed in GSTR-3B. The credit can be re-availed once payment is made.

Rule 37A – Supplier Return Default

Introduced to strengthen compliance discipline in the GST chain. If the supplier fails to file GSTR-3B, the recipient is required to reverse ITC, even if Tax invoice is valid, and payment has been made to the supplier. ITC becomes available again once the supplier files the return.

Rule 38 – Banking & NBFC Reversal

Banks, NBFCs, and financial institutions may opt for a fixed percentage ITC reversal instead of invoice-level tracking. Once exercised, the option is irrevocable for the entire financial year.

Rule 42 – Common ITC (Inputs & Input Services)

Applicable where inputs or services are used for both taxable and exempt supplies.Requires: Monthly provisional reversal and annual final adjustment based on actual turnover.

Rule 43 – Capital Goods Reversal

Where capital goods are used for both taxable and exempt supplies: ITC must be reversed monthly over the useful life of 60 months.

Section 17(5) – Blocked Credits

Specified goods and services (e.g., certain motor vehicles, personal consumption, works contract for immovable property). Credit permanently disallowed — no re-availment under any circumstance.

Section 18(4) read with Rule 44 – Change in Tax Status

On: Switching to exempt supplies, or Opting for the composition scheme, ITC must be reversed on the effective date of changeMost ITC reversals are procedural and timing-based, not eligibility-based. Ignoring these provisions can result in Interest under Section 50, Penalties, Prolonged and avoidable litigation. Vendor reconciliation, payment tracking, and periodic ITC reviews are no longer optional — they are core GST controls.

Conditions for Input Tax Credit Reversal

Input Tax Credit reversals are required under several scenarios defined in the Goods and Services Act. Some of these are summarized as follows:

| Relevant GST Section/Rule | Circumstance | When ITC Reversal is Required |

|---|---|---|

| CGST Rule 37 | Recipient fails to pay the supplier for a supply | Within 180 days from the invoice date |

| CGST Rule 37A | Supplier fails to pay tax via GSTR-3B by 30th September | On or before 30th Nov of the following FY |

| CGST Rule 38 | 50% Input Tax Credit reversal by banking and financial companies | At the time of filing returns |

| CGST Rule 42 | Inputs used for exempt or non-business purposes | Monthly/yearly, using a specific formula |

| CGST Rule 43 | Capital goods used for exempt or non-business purposes | Monthly/yearly, using a specific formula |

| CGST Rule 44 | Cancellation of Goods and Services Tax registration or switching to composition scheme | During filing of Form REG-16 or ITC-03 |

| CGST Rule 44A | 5/6th Input Tax Credit reversal for gold dore bars stock as of 1st July 2017 | At the time of supply of gold dore bar/gold/gold jewellery |

| Section 16(3) | Depreciation claimed on Goods and Services Tax component of capital goods | At the time of closing accounts for that FY |

| CGST Section 17(5) | Input Tax Credit availed on blocked credits | During regular returns filing, up to annual return |

| CGST Section 17(5)(h) | Inputs used in goods lost, destroyed, or stolen | During regular returns for the month of the loss |

| CGST Section 17(5)(h) | Inputs used in goods given as free samples | During regular returns for the month of free sample issuance |