How to file return under UAE VAT

Page Contents

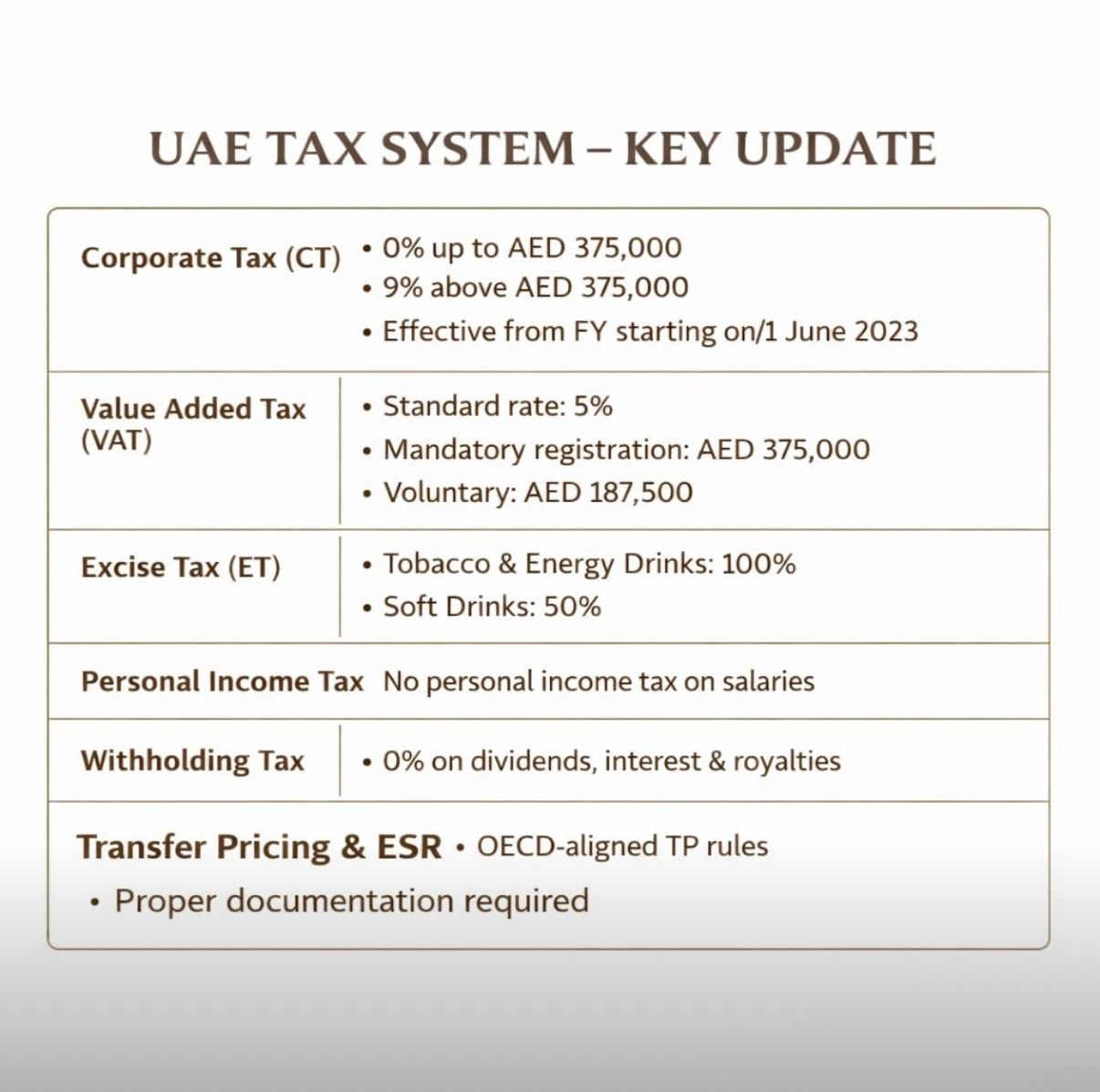

UAE Tax System – Detailed Overview (2026)

The UAE continues to offer one of the world’s most competitive and business-friendly tax regimes, while steadily strengthening its compliance, transparency, and substance requirements. Below is a practical overview of the key tax components every business operating in the UAE should understand in 2026:

Corporate Tax (CT) : Federal Decree-Law on Taxation of Corporations and Businesses

• 0% on taxable income up to AED 375,000

• 9% on taxable income exceeding AED 375,000

• Applicable to mainland entities and qualifying Free Zone persons (subject to conditions)

• Mandatory Corporate tax registration, annual CT return filing, maintenance of proper accounting records, & Free Zone benefits apply only where qualifying income and substance conditions are met.

Value Added Tax (VAT)

UAE VAT Law

• Standard VAT rate: 5%

• Mandatory registration: AED 375,000 turnover

• Voluntary registration: AED 187,500 turnover

• Requirements include periodic VAT return filing, VAT-compliant invoicing, accurate input tax credit (ITC) management & reconciliations between VAT returns and financials are now a key audit focus.

Excise Tax

Excise Tax Law: applies to 100% of tobacco products and energy drinks and 50% on Carbonated and sweetened soft drinks. Applicable to manufacturers, importers, and stockpilers. Strong record-keeping and excise registration controls are critical.

Personal Income Tax

• No personal income tax on salaries or wages

• No filing obligation for employees

• Social security applies only to UAE nationals (subject to Emirate rules)

Withholding Tax

0% withholding tax on Dividends, Interest, Royalties & Relevant primarily for cross-border transactions, treaty planning, and transfer pricing evaluation

Economic Substance & Transfer Pricing

Integrated into the corporate tax framework: Economic substance requirements now operate through corporate tax substance tests, transfer pricing aligned with OECD BEPS guidelines, mandatory arm’s-length pricing, transfer pricing documentation (where thresholds apply), and disclosure of related-party transactions. Substance and pricing are now core risk areas for assessments.

The UAE tax regime remains low-tax and pro-business, but it is no longer light-touch. Registration accuracy, timely filings, proper documentation, and substance-driven structuring are now non-negotiable for sustainable compliance. Strategic tax planning and professional advisory support are essential to manage risks, avoid penalties, and protect long-term business continuity.

UAE VAT RETURN

As per the official site of the Ministry of Finance, UAE, majority of the business entities will be required to file the VAT returns on a quarterly basis, within one month/28 days from the end of the respective quarter.

USE OF ACCOUNTING SOFTWARE

The business in UAE are required to generate the VAT return File from their accounting software, login to the FTA’s e-tax portal and upload the return file.

UPLOAD RETURN

On the basis of the uploaded return file, the e-tax portal will validate the file and accordingly the details from the file will be auto-populated in the online return form.

After generating the VAT return file, you need to login to the FTA’s e-tax portal using the credentials. Using the e-tax portal upload option, you need to browse and select your return file.

VAT RETURN FORMAT

The VAT return file should be in XML or MS Excel format.

Auto Fill VAT Return Details.

Once the file is uploaded, you need to click ‘Auto Fill UAE VAT Return’ which will auto-populate the details from the VAT return file to the VAT return form in the FTA’s e-tax portal.

VALIDATE OR AUTHENTICATE

Once this button is clicked, the FTA portal will validate or authenticate whether the uploaded file has been created by a certified tax accounting software. If the file is authenticated, only then the details will be auto-populated into the VAT return form. If the file is not authenticated, it will be rejected and an appropriate error message will be displayed.

Once the VAT return file is authenticated, you are required to fill the other details required by FTA and submit.

CORRECTION IN RETURN

Correction of errors made in previous return period can be carried out. The taxable person must disclose this error to the FTA within 30 days of becoming aware of this error and include in the Tax Return to be submitted immediately after noticing and correcting the error.

PENALTY FOR LATE FILLING OF VAT RETURNS

Late filing of return may attract penalty. The administrative penalty will not be less than 500 Dirhams but not exceeding three times the amount of tax in respect of which the administrative penalty was levied.

We specialize in delivering comprehensive financial and corporate services in the UAE, helping entrepreneurs and businesses confidently navigate every stage of their journey. Built on a strong foundation of integrity, innovation, and excellence,

we support clients in setting up, managing, and scaling their companies in a dynamic regulatory environment. Our expert team provides tailored, end-to-end solutions from business registration and licensing to strategic financial and corporate advisory ensuring a seamless, compliant, and efficient process.

Whether you are launching a startup or expanding an established enterprise, we are committed to guiding you at every step, making business success in the UAE simple, structured, and stress-free.

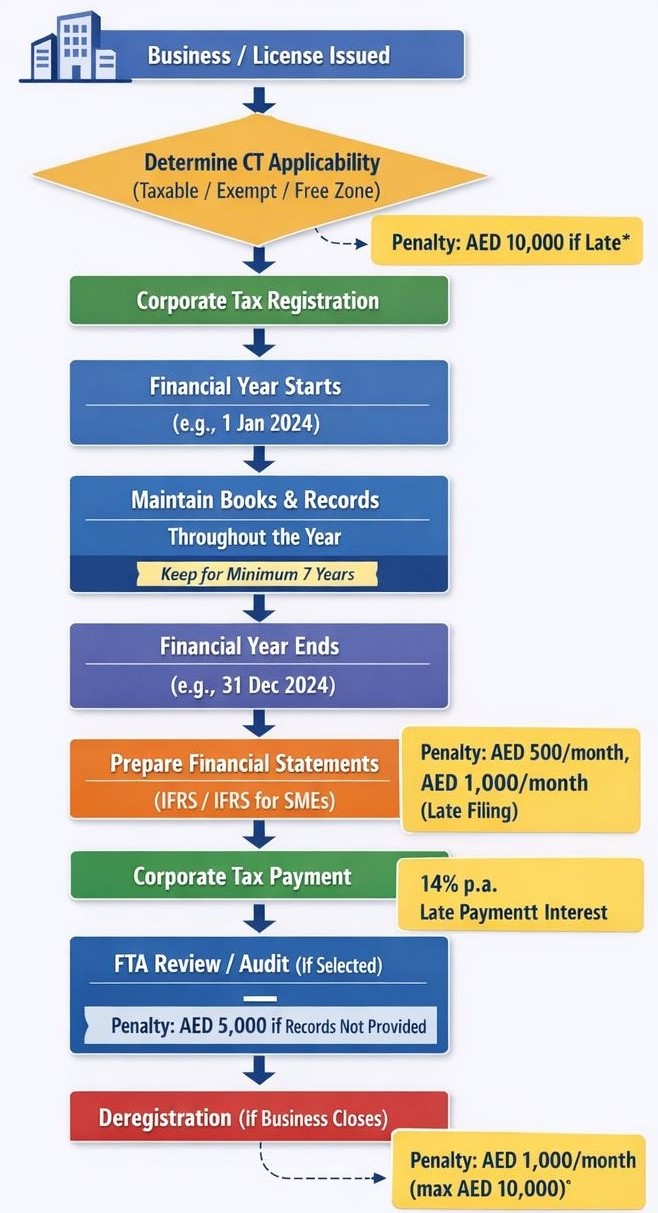

UAE Corporate Tax (CT) Deadlines

Understanding corporate tax deadlines is critical to stay compliant with the UAE Federal Tax Authority (FTA) and avoid unnecessary penalties. This flow chart clearly explains:

- when Corporate Tax registration is required

- CT return filing & tax payment deadline: Within 9 months from the end of the financial year

- record-keeping obligations: Books and documents to be maintained for 7 years

- Common penalties for Late registration, Delayed return filing, Late tax payment

If you’re operating a business in the UAE—mainland or free zone—this is a must-know compliance roadmap. Key takeaway: Corporate Tax in the UAE is low-rate, but non-compliance is high-cost. Staying proactive today helps you, Avoid penalties, Reduce audit risk & Ensure smooth long-term compliance